The short-term texture of the market is still on the weak side, with the volatility set to remain on the higher end in the near term, according to market analysts.

The market slipped below the 20 and 50-day simple moving average last week, and consistently faced selling pressure at higher levels. Technically, on daily and weekly charts, it has formed double top formation, which indicates the upward trend has slowed down, according to Amol Athawale, vice president of technical research at Kotak Securities.

"We are of the view that the short-term texture of the market is still on the weak side but due to temporary oversold conditions, we could see one pullback rally from the current levels."

The volatility index is expected to remain elevated in the near term due to the elections and foreign investor sell-offs, which have impacted market sentiment, according to Shrey Jain, chief executive officer of SAS Online. "It's advisable to maintain lighter positions and reduce exposure to mid and small-cap companies."

The Nifty Bank indicates weakness with the index forming a shooting-star candlestick pattern on a weekly scale, according to Neeraj Sharma, assistant vice president of technical and derivatives research at Asit C Mehta Investment Interrmediates Ltd. "As long as the index remains below 48,000, ongoing weakness will continue."

The GIFT Nifty was trading 25.5 points or 0.12% higher at 22,082.50 as of 06:47 a.m.

F&O Action

The Nifty May futures were up by 1.43% to 22,140 at a premium of 84.8 points, with its open interest down by 3.7%. The Nifty Bank May futures were down by 1.05% to a premium of 186.15 points, while its open interest was down by 1.02%.

Open interest distribution for the Nifty May 16 series indicates that the 21,000 level is seeing the most put strikes, and call strikes of 23,000 have the maximum open interest.

For the Bank Nifty options' May 15 expiry, the maximum call open interest was at 48,000 and the maximum put open interest was at 45,000.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the seventh consecutive session on Friday.

Foreign portfolio investors offloaded stocks worth Rs 2,117.5 crore and domestic institutional investors stayed net buyers for the 14th straight session and mopped up equities worth Rs 2,709.8 crore, according to provisional data from the National Stock Exchange.

Markets On Friday

Benchmark equity indices logged their worst week in nearly two months as they declined around 2% last week. On Friday, the indices ended higher after five sessions, led by gains in Bharat Petroleum Corp. and Hero MotoCorp.

The Nifty ended 0.44%, or 97.10 points, higher at 22,054.60 and the Sensex rose 248.45 points, or 0.34%, to close at 72,652.62.

On a weekly basis, the Nifty lost 1.87% and the Sensex declined 1.64%, marking the worst close since the week-ended March 15.

Broader markets outperformed the benchmark indices. The S&P BSE Midcap ended 0.81% higher and the S&P BSE Smallcap settled 0.80% up.

On BSE Ltd., 16 sectoral indices advanced and four declined, out of 20. The S&P BSE Utilities was the top performing sectoral index, while the S&P BSE IT index emerged as the worst performing among peers on Friday.

The market breadth was skewed in favour of buyers. Around 2,216 stocks advanced, 1,590 stocks fell, and 125 stocks remained unchanged on the BSE.

Major Stocks In News

Vedanta: The company's unit, CIHL, acquired an additional 46.57% stake in AvanStrate for JPY 12.2 billion.

Wipro: The company appointed Vinay Firake as CEO for the Asia Pacific, India, Middle East, and Africa strategic market unit.

Lupin: The US Court has lifted a temporary restraining order for Mirabegron ER Tablets. The shipment of the product has now resumed.

Tata Motors (Consolidated, YoY)

Revenue up 13.26% at Rs 1.19 lakh crore vs Rs 1.05 crore (Bloomberg estimate Rs 1.21 lakh crore).

Ebitda up 32.81% at Rs 16,995 crore vs Rs 12,795 crore, (Bloomberg estimate Rs 17,407 crore).

Margin up 208 bps at 14.16% vs 12.07%, (Bloomberg estimate 14.4%).

Net profit up 218.93% at Rs 17,529 crore vs Rs 5,496 crore, (Bloomberg estimate 6,967 crore).

Note: Deferred tax write-back of Rs 9,478 crore vs Rs 1,737 crore.

Kalyan Jewellers (Consolidated, YOY)

Revenue up 34.09% at Rs 4535 crore vs Rs 3388 crore, (Bloomberg estimate Rs 4506 crore).

Ebitda up 19.27% at Rs 306 crore vs Rs 257 crore, (Bloomberg estimate Rs 315 crore).

Margin down 83 bps at 6.75% vs 7.59%, (Bloomberg estimate 7%).

Net profit up 97% at Rs 137 crore vs Rs 69.79 crore, (Bloomberg estimate Rs 140 crore).

Global Cues

Most markets in the Asia-Pacific countries fell in early trade on Monday as investors awaited inflation data from China and Japan.

The Nikkei 225 was trading 59.53 points or 0.16% lower at 38,169.58, and the S&P ASX 200 was 9.90 points or 0.13% down at 7,739.10 as of 06:46 a.m.

The US stock market lost traction and bond yields rose after data pointed to an economy that is slowing amid stubborn inflationary pressures, posing a challenge to the outlook of Federal Reserve rate cuts, Bloomberg said.

The S&P 500 and the Dow Jones Industrial settled 0.16% and 0.32% higher respectively on Friday. The Nasdaq Composite ended 0.03% lower.

Brent crude was trading 0.34% lower at $82.45 a barrel. Gold fell 0.04% to $2,359.61 an ounce.

Key Levels

U.S. Dollar Index at 105.34

U.S. 10-year bond yield at 4.49%

Brent crude down 0.33% at $82.52 per barrel

Nymex crude down 0.29% at $78.03 per barrel

Bitcoin was up 0.58% at $61,627.61

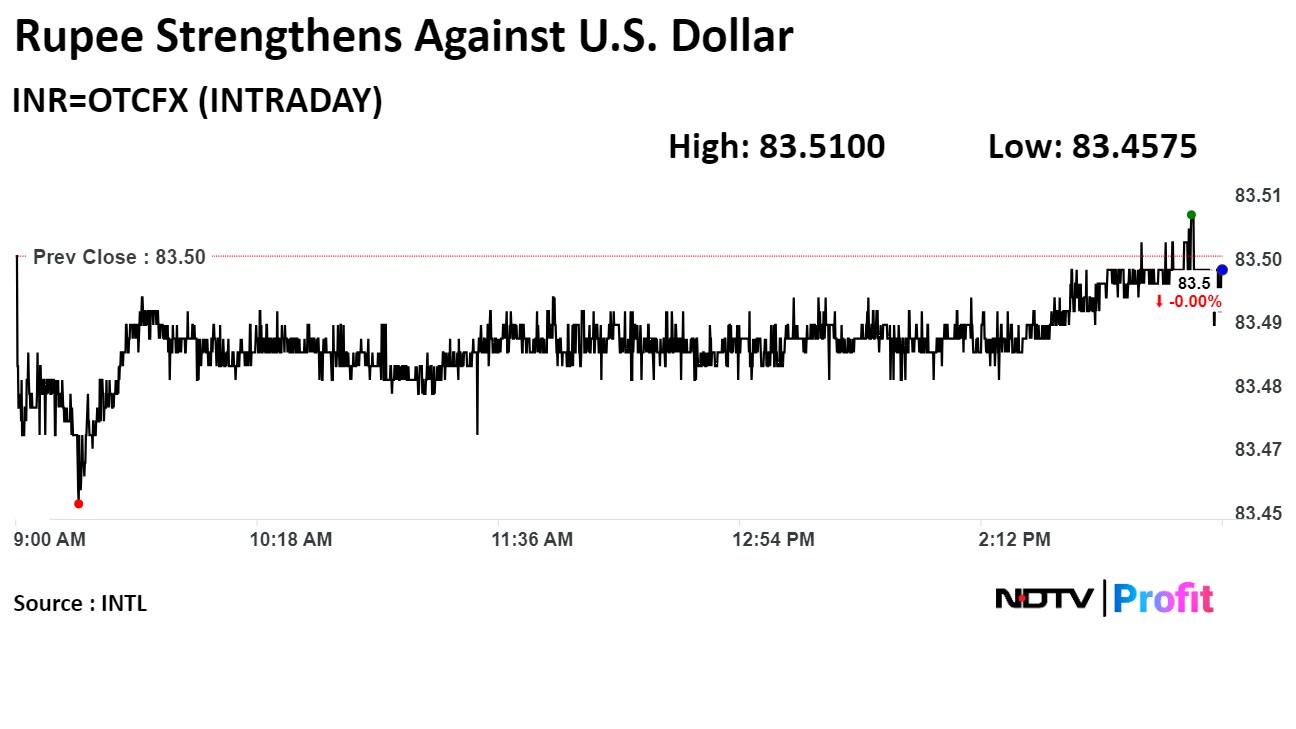

Rupee Update

The Indian rupee closed stronger on Friday amid a flat US dollar index.

The local currency appreciated two paise to close at Rs 83.49 against the greenback, according to Bloomberg data. It had closed at Rs 83.51 on Thursday.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.