The prevailing market sentiment is likely to remain pessimistic, with a possibility of consolidation until the benchmarks break out of a strong resistance level, analysts have said. With support hovering around the 22,150 mark in the Nifty, and global markets maintaining stability, there is a possibility of some consolidation, according to Ajit Mishra, senior vice president of research at Religare Broking Ltd.

Nonetheless, the prevailing sentiment is likely to remain pessimistic until the Nifty convincingly surpasses the 22,500 threshold, Mishra said. "Traders are advised to exercise caution and maintain hedged positions."

For the day traders now, the 50-day simple moving average or the level for the 22,350 for the Nifty would act as a key level to watch, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "Above the same, the pullback formation is likely to continue till 22,400–22,425."

For the Bank Nifty, the intermediate swing support is near 47,740, while the 50-day double exponential moving average is near 47,720, according to Neeraj Sharma, assistant vice president of technical and derivatives research at Asit C Mehta Investment Interrmediates Ltd. The 47,700–47,750 zone will serve as a strong support zone for the Bank Nifty, Sharma said. "If Bank Nifty maintains its support level, a relief rally to 48,400–48,600 is possible.”

The GIFT Nifty was trading 6 points or 0.03% higher at 22,388.50 as of 06:36 a.m.

F&O Action

The Nifty May futures were up 0.05% to 22,392.85 at a premium of 90.35 points, while its open interest was up 5.64%. The Nifty Bank May futures were down 0.26% to 48,221 at a premium of 200 points, with its open interest up 5.73%.

Open interest distribution for the Nifty May series indicates that the 22,000 level is seeing the most put strikes, and call strikes of 22,800 have the maximum open interest.

During the previous session, open interest at 22,300 saw the most change in put strikes, and call strikes at 22,500 saw the maximum open interest change.

For the Bank Nifty options May expiry, the maximum call and put open interest was at 48,000.

FII/DII Activity

Overseas investors in Indian equities remained net sellers on Wednesday for the fifth consecutive session as the selloff hit the highest in nearly a month.

Foreign portfolio investors offloaded stocks worth Rs 6,669 crore—the highest since April 12—and domestic institutional investors remained net buyers for the 12th straight session and mopped up equities worth Rs 5,929 crore, according to provisional data from the National Stock Exchange.

Markets On Wednesday

In yet another range-bound trade, India's benchmark stock indices ended flat as voting trends in the ongoing general election made traders cautious.

The NSE Nifty 50 settled flat at 22,302.5 and the S&P BSE Sensex declined 45.46 points, or 0.06%, to end at 73,466.39.

The Nifty hit an intraday low of 22,185.2, and the Sensex touched 73,073.9 levels earlier in the session. The volatility gauge, India VIX, ended 0.46% higher during the session.

Nine sectors on the NSE ended higher, with the Nifty Oil & Gas and Nifty Auto advancing the most. Nifty Bank and Nifty Finance fell the most by 0.55% and 0.53%, respectively. The S&P BSE Midcap ended 1.52% higher and the S&P BSE Smallcap closed up 0.78%.

Six out of 20 sectoral indices on the BSE ended lower, while 14 advanced. S&P BSE Capital Goods was the top gainer.

The market breadth was skewed in favour of buyers as 2,133 stocks rose, 1,661 fell and 132 remained unchanged on the BSE.

Major Stocks In News

Bank of Baroda: The Reserve Bank of India lifts restrictions on the bank's mobile app, Bob World. The company resumed onboarding customers in the Bob World app.

Reliance: The company acquired a 100% stake in Reliance Chemicals for Rs 314.5 crore.

Nucleus Software: The company approved the appointment of Surya Prakash Kanodia as CFO.

Tata Power (Consolidated, YoY)

Revenue up 27.24% at Rs 15,846 crore vs Rs 12,454 crore (Bloomberg estimate Rs 16,009.31 crore).

Ebitda up 20.96% at Rs 2,332 crore vs Rs 1,928 crore, (Bloomberg estimate Rs 2,787 crore).

Margin at 14.71% vs 15.47%, (Bloomberg estimate 17.4%).

Net profit up 11.37% at Rs 1,045 crore vs Rs 938.81 crore (Bloomberg estimate Rs 950 crore).

Board recommends final dividend of Rs 2 per share.

Larsen & Toubro (Consolidated, YoY)

Revenue up 15% at Rs 67,079 crore vs Rs 58,335 crore (Bloomberg estimate Rs 65,868 crore).

Ebitda up 5.9% at Rs 7,234 crore vs Rs 6,833 crore, (Bloomberg estimate Rs 7,157 crore).

Margin at 10.8% vs 11.7% (Bloomberg estimate 10.9%).

Net profit up 12.4% at Rs 5,013 crore vs Rs 4,459 crore (Bloomberg estimate Rs 4018 crore).

Global Cues

Asia-Pacific markets were trading on a mixed note early Thursday as market participants await the release of April's trade data from China later on Tuesday. The Nikkei 225 was 0.16% up, while the S&P ASX 200 was 0.58% down. The Kospi was trading 0.09% higher as of 6:33 a.m.

Wall Street's enthusiasm for stocks faded after a four-day advance that drove the market to its longest winning run since March, Bloomberg said.

The S&P 500 settled flat, while the Nasdaq Composite ended 0.18% down. The Dow Jones Industrial Average ended 0.44% higher on Wednesday.

Brent crude was trading 0.28% higher at $83.86 a barrel. Gold rose 0.03% to $2,309.58 an ounce.

Key Levels

U.S. Dollar Index at 105.55

U.S. 10-year bond yield at 4.50%

Brent crude up 0.28% at $83.81 per barrel

Nymex crude up 0.35% at $79.27 per barrel

Bitcoin was down 0.39% at $61,325.9

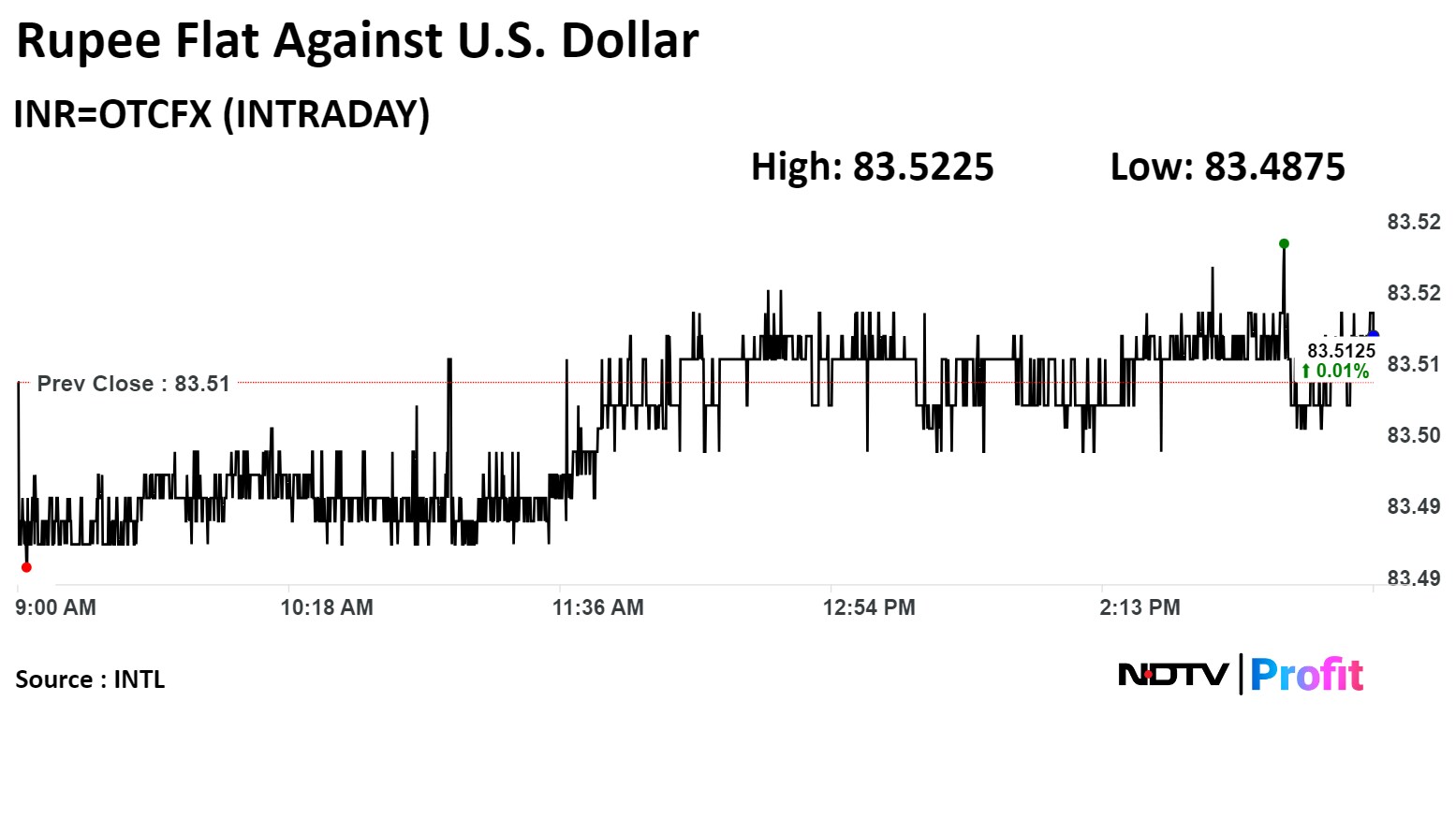

Rupee Update

The Indian rupee closed flat on Wednesday as the impact of the rising dollar index was offset by a key Fed official comment stating that interest rates in the US may stay steady for a longer period.

The local currency closed at Rs 83.51 against the greenback, unchanged from Tuesday's close of Rs 83.51, according to Bloomberg.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.