The NSE Nifty 50 opened higher but struggled to withstand the selling pressure at elevated levels on Tuesday, according to Rupak De, senior technical analyst at LKP Securities. On the hourly chart, the RSI (14) indicates bearish divergence, signalling a potential shift in price momentum towards the downside, he said.

Immediate support is observed at 22,600 and a decisive drop below this level could drive the index towards 22,400, De said. "Conversely, resistance is evident at 22,770 on the higher end."

The Bank Nifty will face hurdle around 48,900–48,950 and if the index sustains above it, the rally could extend towards 49,500–50,000 levels, according to Asit C Mehta Investment Intermediates Ltd. "Short-term support levels for Bank Nifty are seen at 48,500 and 48,200, with resistance levels at 48950 and 49,500."

The GIFT Nifty was trading 5 points or 0.02% lower at 22,826.50 as of 06:36 a.m.

FII And DII Activity

Overseas investors remained net sellers of Indian equities on Tuesday.

Foreign portfolio investors offloaded stocks worth Rs 593.2 crore and domestic institutional investors remained net buyers and mopped up equities worth Rs 2,257.2 crore, according to provisional data from the NSE.

Markets On Tuesday

India's benchmark indices gave up all early gains to end lower, tracking losses in heavyweights Reliance Industries Ltd., Titan Co., and Larsen and Toubro Ltd.

The NSE Nifty 50 ended 23.55 points, or 0.1%, lower at 22,642.75, and the S&P BSE Sensex closed 58.80 points, or 0.08%, down at 74,683.70. The NSE Nifty 50 rose to a fresh high of 22,768.40, and the S&P BSE Sensex gained to a record 75,124.28.

The NSE Nifty Bank index also scaled to a fresh high of 48,960.75, led by gains in ICICI Bank Ltd. and Axis Bank Ltd.

On the NSE, seven stocks ended lower and five ended higher. The NSE Nifty Metal rose the most among its peers, and the NSE Nifty Media index fell the most among sectoral indices. Broader markets were mixed. The BSE MidCap ended 0.47% lower and the SmallCap index also ended 0.15% down.

Major Stocks In News

One 97 Communications: Surinder Chawla, managing director and chief executive officer of Paytm Payments Bank Ltd., has resigned, effective June 26.

Paisalo Digital: The company's assets under management grew 32% year-on-year to Rs 4,622 crore in the fourth quarter, while disbursements jumped 38% to Rs 3,588 crore.

Lupin: The company launched the first generic version of Oracea in the U.S.

Top Brokerage Calls

Citi On India Autos And Auto Parts

Margins and profits will be determined by operating leverage.

Commodity costs are expected to remain steady.

Quarterly trends are positive for personal vehicles and consumer vehicles, and negative for two-wheeler and tractors.

Watching out for plans in the current financial year, new launches in personal vehicles and electric vehicles along with rural/urban trends.

Awaiting EV plans with commentary on Production Linked Incentive and FAME 2 ending.

Top picks include Maruti Suzuki India Ltd. and Endurance Technologies Ltd. among parts makers.

Motilal Oswal On Kolte-Patil Developers

The brokerage initiates coverage with a 'buy' and a target price of Rs 700 per share, implying a potential upside of 35% from the previous close.

The company delivered 26 million sq ft of space in the last three decades and now has 43 million sq ft under development.

Balance sheet strengthened to net cash in December 2023.

Strong pipeline and balance-sheet strength to push growth.

Risks include the inability to add new projects and slowing demand.

Global Cues

Most markets in the Asia-Pacific region declined as traders await fresh cues from the release of the US consumer-price-index print for March and the Federal Reserve's rate outlook moving.

The Nikkei 225 was trading 124.87 points or 0.31% lower at 39,648.26, and the KOSPI index was trading 12.49 points or 0.46% lower at 2,705.16 as of 06:30 a.m. The Australian benchmark was trading 35.70 points or 0.46% up at 7,859.90 as of 06:31 a.m.

Wall Street traders making their final bets on Wednesday's key inflation report sent stocks lower as bonds rebounded after a recent slide, Bloomberg said.

The S&P 500 index and the Nasdaq Composite fell 0.14% and 0.32%, respectively as of Tuesday. The Dow Jones Industrial Average declined 0.02%.

Brent crude was trading 0.01% higher at $89.43 a barrel. Gold fell 0.12% to $2,349.88 an ounce.

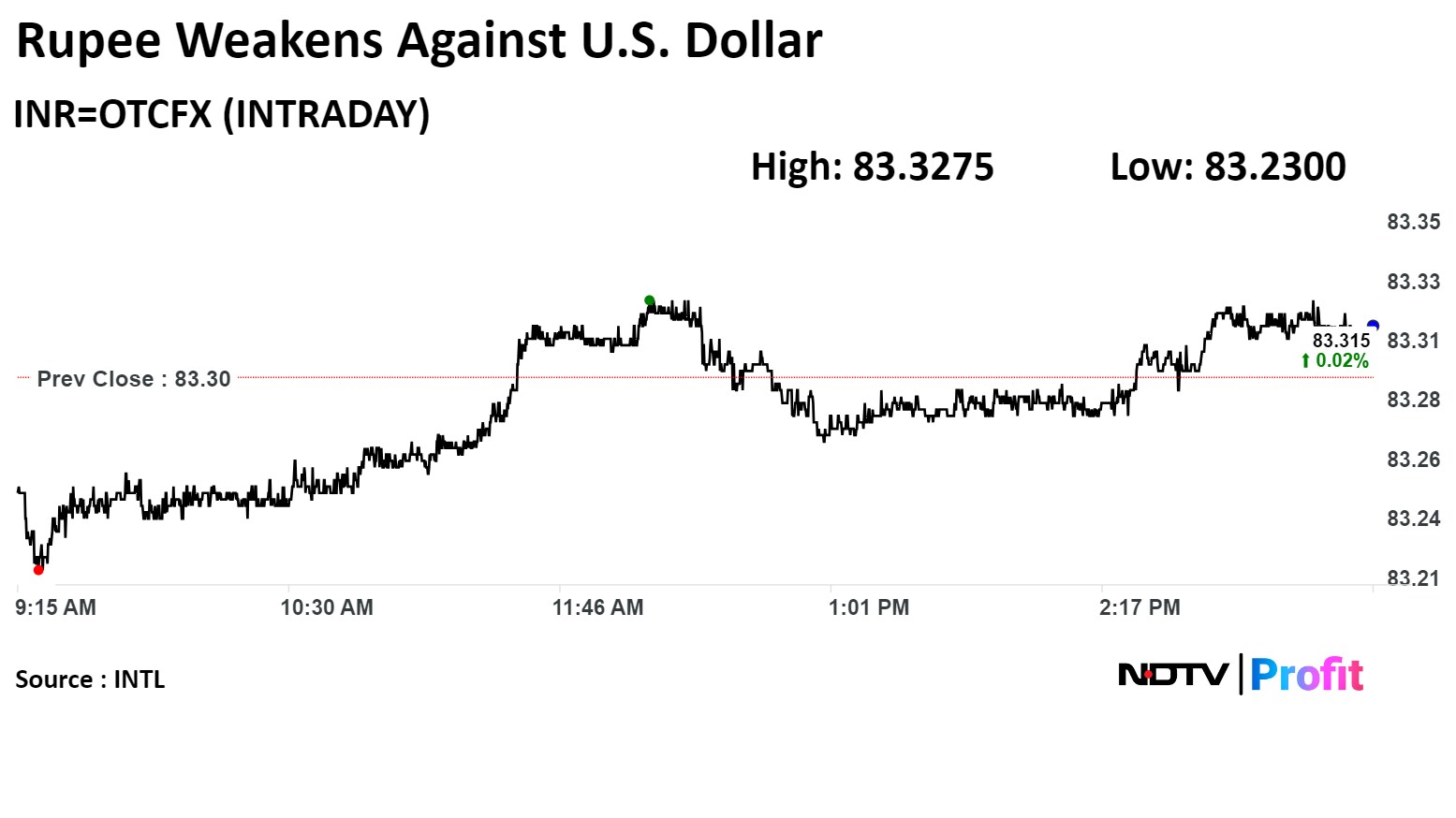

Rupee Update

Money markets were closed on Tuesday on account on Gudi Padwa.

The Indian rupee had closed weaker against the US dollar on Monday, days after the Reserve Bank of India kept its benchmark repo rate unchanged for the seventh time in a row.

The local currency weakened 3 paise to close at Rs 83.32 against the greenback.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.