In a year characterised by a record surge in Indian equities and turnover on the world's largest derivatives exchange, colocation emerged as the most popular trading method across multiple markets.

Colocation trading has steadily gained popularity since FY11, becoming the dominant mode of trading in equity derivatives and capital markets. This practice involves positioning computers as close as possible to the exchange to minimize latency or execution delays for trade orders.

According to an NSE report, the share of turnover through colocation in the capital market segment moderated last year from its peak of 34.8% in FY22, before recovering marginally in FY24. Meanwhile, in the equity derivatives segment, colocation reached a record high share of 61.6%, marking a 241-basis-point increase from the previous year.

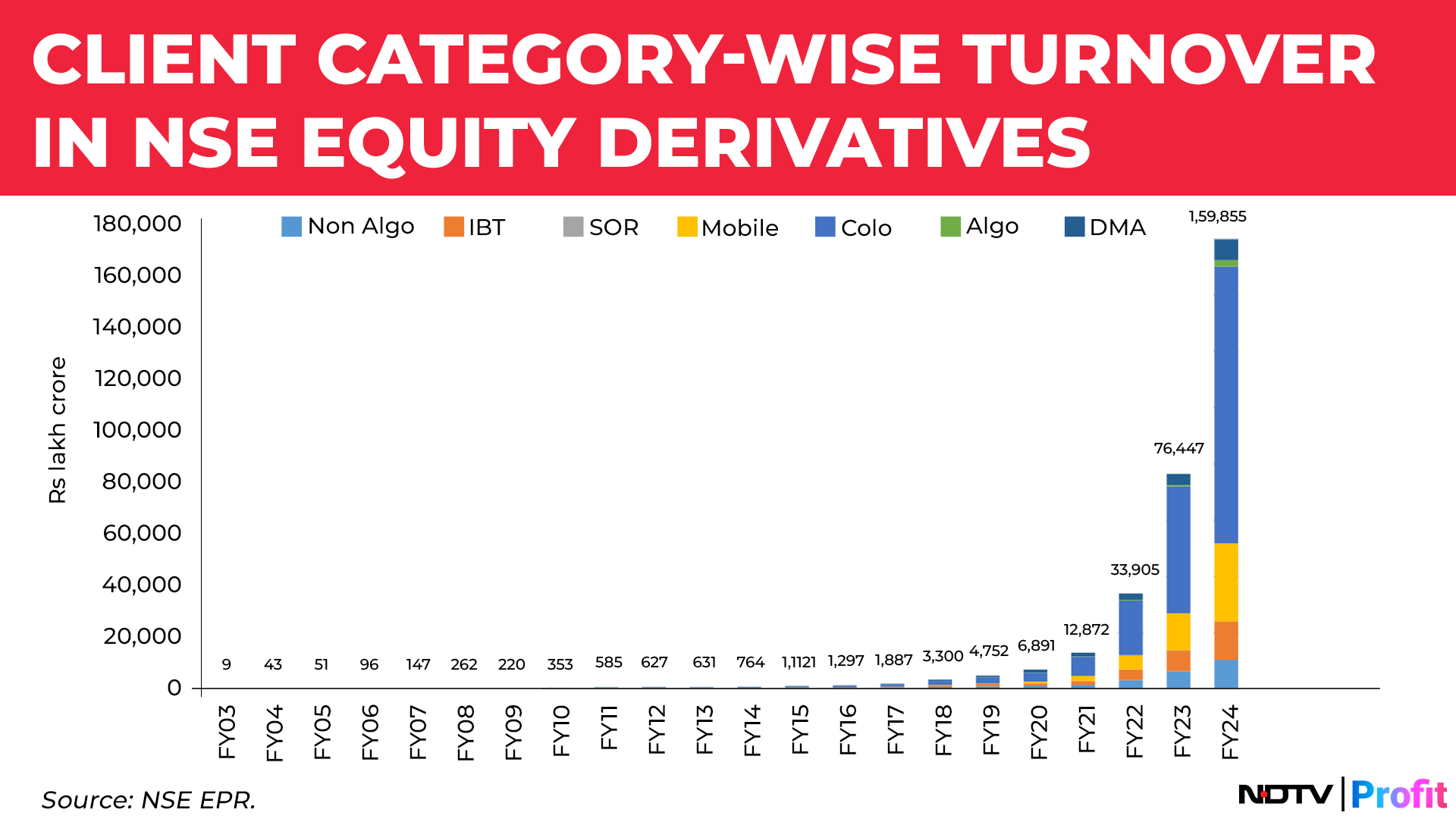

The report highlights a significant shift in trading modes across various segments of the NSE over the last two decades.

NSE's equity derivatives' turnover by mode.(Source: NSE)

Colocation is predominantly used by proprietary traders, as indicated in the report, who continue to dominate participation across multiple market segments, including equity derivatives, currency derivatives, and the cash market.

Proprietary traders, often referred to as prop traders, are professional traders who leverage the firm's capital to trade across asset classes such as stocks, currencies, and commodities, aiming to generate profits that are then shared with the firm.

In an emerging trend, Direct Market Access (DMA) mode has seen growth over the past two fiscal years, reaching its highest level in 23 years at 5.8% in the cash market segment. However, its share in the equity derivatives segment has marginally decreased each year since FY20.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.