Asian stocks slumped following Wall Street lower as investors contemplate a protracted period of higher interest rates. Benchmarks across the region declined, with stocks in Japan, Australia and South Korea all falling.

The S&P 500 Index lost 1.5% and the Nasdaq 100 slumped 1.6% Tuesday as Wall Street's fear gauge — the Cboe Volatility Index or VIX — hit the highest since late May after U.S. consumer confidence fell to a four-month low. Contracts for U.S. equities edged higher in early Asian trading.

Tech giants, namely Apple Inc., Microsoft Corp., Amazon.com Inc. and Google-parent Alphabet Inc. dragged on the U.S. stock gauges, pushing the tech sector down more than 10% from a July peak from the threat of tight policy.

Meanwhile, Brent Crude prices were trading above $93 a barrel, and WTI Crude was above $90-mark. The yield on the 10-year U.S. bond was trading at 4.52% and Bitcoin was below 27,000-level.

At 7:40 a.m., the GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India was down 1 point or 0.01% at 19,731.5.

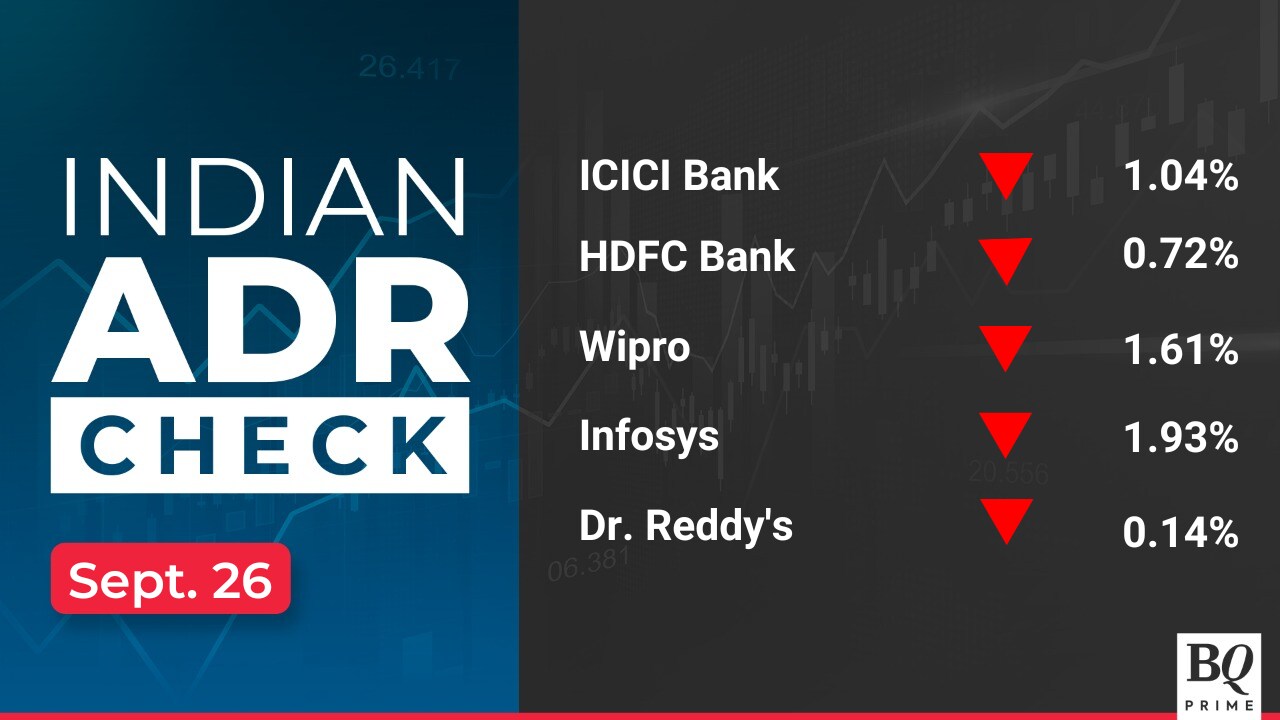

India's benchmark stock indices closed lower on Tuesday after opening marginally higher. The telecommunications and industrial sectors advanced, while shares of information and technology and banks were under pressure.

The S&P BSE Sensex closed 78.22 points, or 0.12%, lower at 65,945.47, while the NSE Nifty 50 was 9.85 points, or 0.05%, lower at 19,664.70.

Overseas investors remained net sellers of Indian equities for the sixth consecutive session. Foreign portfolio investors offloaded stocks worth Rs 693 crore, according to provisional data from the NSE. Domestic institutional investors remained net buyers and mopped up equities worth Rs 715 crore.

The Indian rupee weakened 9 paise to close at 83.24 against the U.S. dollar on Tuesday.

India's benchmark stock indices closed lower on Tuesday after opening marginally higher. The telecommunications and industrial sectors advanced, while shares of information and technology and banks were under pressure.

The S&P BSE Sensex closed 78.22 points, or 0.12%, lower at 65,945.47, while the NSE Nifty 50 was 9.85 points, or 0.05%, lower at 19,664.70.

Overseas investors remained net sellers of Indian equities for the sixth consecutive session. Foreign portfolio investors offloaded stocks worth Rs 693 crore, according to provisional data from the NSE. Domestic institutional investors remained net buyers and mopped up equities worth Rs 715 crore.

The Indian rupee weakened 9 paise to close at 83.24 against the U.S. dollar on Tuesday.

Stocks To Watch

Infosys: The IT major has partnered with Microsoft for a generative AI solution. Infosys Topaz will use Microsoft's Azure OpenAI Service and Azure Cognitive Services to augment AI capabilities.

IndusInd Bank: The lender announced a multi-year global partnership with the International Cricket Council to provide a premium experience to customers, employees, and cricket fans. The bank will have access to a suite of branding and content assets.

Vedanta: Moody's downgraded Vedanta Resources' corporate family rating to Caa2 and maintained a negative outlook.

REC, Punjab National Bank: The two inked an agreement to co-finance projects in power, infrastructure, and logistics worth Rs 55,000 crore.

Container Corp: The company has appointed Sanjay Swarup as chairman and MD from Oct. 1, 2023, to July 31, 2026.

Suzlon Energy: Investor group Dilip Shanghvi and Associates terminated the 2020 shareholder pact. The investor group's nominee director on Suzlon's board, Hiten Timbadia, has also resigned with effect from Sept. 26.

Century Textiles: Unit Birla Estates sold out phase 1 of Birla Trimaya in Bengaluru within 36 hours of its launch. With 556 units booked, accounting for Rs 500 crore in booking value, the company said it has solidified its position as a leader in the luxury residential real estate market of Bengaluru.

DCM Shriram: Unit Fenesta underwent a significant capacity expansion of uPVC extrusion at Kota, which will increase the annual production capacity of Fenesta uPVC profiles from 8,600 metric tonnes to 12,284 metric tonnes.

Shree Renuka Sugars: The company will acquire Anamika Sugar Mills for Rs 235.5 crore to establish a presence in Uttar Pradesh and cater to the markets of North and East India.

Shyam Metalics And Energy: The company has entered the energy storage sector with battery-grade aluminium foil, a critical component in lithium-ion cells. The customised battery aluminium foil has been tested and validated by third-party laboratories.

Prataap Snacks: The GST Authority conducted search and seizure operations at the company's Bengaluru manufacturing unit.

NDTV: The broadcaster has received the government's nod for three news and current affairs HD channels: NDTV 24x7 HD, NDTV India HD, and NDTV Profit HD.

Rajnandini Metal: The company has received orders worth Rs 206.91 crore from 12 clients.

3i Infotech: The company received a Rs 39.55 crore contract from Ujjivan Small Finance Bank for end-user support services (workplace services). The contract is for a period of five years.

IPOs

Updater Services: The IPO was subscribed to 0.16 times, or 16% on its second day. The bids were led by retail investors (0.68 times or 68%) and non-institutional investors (0.12 times or 12%). The issue got zero bids from institutional investors.

JSW Infrastructure: The IPO was subscribed 2.13 times on its second day. The bids were led by by retail investors (4.52 times), non-institutional investors (3.7 times) and institutional investors (0.55 times, or 55%).

Valiant Laboratories: The IPO will open for bids on Wednesday. The pharmaceutical ingredient manufacturing company plans to raise Rs 152 crore through fresh issuance and no offer for sale. The price band is fixed at Rs 133-140 apiece.

Listings

Signatureglobal (India): The company's shares will debut on the stock exchanges on Wednesday with an issue price of Rs 385 apiece. The Rs 730 crore IPO was subscribed to 11.88 times on its final day. The bids were led by non-institutional investors (13.54 times), institutional investors (12.71 times), and retail investors (6.82 times).

Sai Silks (Kalamandir): The company's shares will debut on the stock exchanges on Wednesday with an issue price of Rs 222 apiece. The Rs 1,201-crore IPO was subscribed 4.40 times on its final day. The bids were led by institutional investors (12.35 times), non-institutional investors (2.47 times), and retail investors (0.88 times).

Bulk Deals

Voltamp Transformers: Kunjal Lalitkumar Patel sold 12.14 lakh shares (12%) at Rs 4,633.09 apiece. Kotak Mahindra Mutual Fund, NORDEA 1 SICAV, Manulife Global Fund India Equity Fund, Oxbow Master Fund, Vittoria Fund-OC, and Societe Generale bought 1.3 lakh shares (1.28%), 56,405 shares (0.55%), 61,076 shares (0.6%), 2.88 lakh shares (2.85%), 76,701 shares (0.75%), and 90,763 shares (0.9%), respectively, for Rs 4,632 apiece.

HLE Glascoat: Himanshu Khushalbhai Patel sold 10 lakh shares (1.46%) at Rs 505.84 apiece. Nilesh Khushalbhai Patel and Harsh Himanshubhai Patel sold 10.09 lakh shares (1.48%) and 4.65 lakh shares (0.68%) for Rs 505 apiece. DSP Mutual Fund bought 24.01 lakh shares (3.52%) for Rs 505 apiece.

Manappuram Finance: Elizabeth Mathew bought 4.35 lakh shares (0.51%) of Rs 141.29 apiece.

Rama Steel Tubes: Aditya Kumar Halwasiya bought 25 lakh shares (0.49%) at Rs 36.05 apiece. Jainam Broking bought and sold 63.76 lakh shares (1.26%) and 10.76 lakh shares (0.21%) at Rs 36.01 and Rs 36.07 apiece. Naresh Kumar Bansal sold 1.4 crore shares (2.76%) at Rs 36.01 apiece.

Insider Trades

Venus Pipes & Tubes: Promoter Jayantiram Motiram Choudhary bought 5,000 shares on Sept. 26.

SJVN: The Promoter Government of India sold 19.33 lakh shares between Sept. 21 and 22.

ADF Foods: Promoter Krish Bhavesh Thakkar sold 10,304 between Sept. 21 and 22.

Usha Martin: Promoter Neutral Publishing House bought 96,156 shares on Sept. 15.

Maharashtra Seamless: Promoter Global Jindal Fin-Invest bought 51,696 shares between Sept. 21 and 25.

Star Cement: Promoters Kamakhya Chamaria sold 22,099 shares, Vinay and Company sold 1.376 shares on Sept. 21, and Laxmi Chamaria sold 68,304 shares between Sept. 22 and 25.

Pledge Share Details

Chambal Fertilisers & Chemicals: Promoter Zuari Industries created a pledge of five lakh shares on Sept. 21.

AGMs Today

63 Moons Technologies, Authum Investment & Infrastructure, Balmer Lawrie, Balu Forge Industries, BEML, Best Agrolife, BF Utilities, CarTrade Tech, Century Plyboards, Dishman Carbogen Amcis, Delhivery, Dhani Services, Dredging Corporation of India, FDC, Filatex India, Goldiam International, Garware Hi-Tech Films, Heidelbergcement India, Hemisphere Properties India, Hinduja Global Solutions, Hindustan Oil Exploration, Hindware Home Innovation, Indraprastha Gas, IRB Infrastructure Developers, India Tourism Development Corp, Kmc Speciality Hospitals, Lemon Tree Hotels, Likhitha Infrastructure, Marathon Nextgen, Max Healthcare Institute, Mazagon Dock Shipbuilders, NIIT Learning Systems, NIIT, Parag Milk Foods, PTC India, Religare Enterprises, Rail Vikas Nigam, SAIL, Som Distilleries & Breweries, Shalimar Paints, Southern Petrochemicals, Sunteck Realty, Suzlon Energy, Tanfac Industries, Technocraft Industries, Vardhman Special Steels.

Who's Meeting Whom

Shankara Building Products: To meet investors and analysts on Sept. 29.

Nuvama Wealth Management: To meet investors and analysts on Sept. 28.

Meghmani Organics: To meet investors and analysts on Sept. 29.

Globus Spirits: To meet investors and analysts on Sept. 29.

Parag Milk Foods: To meet investors on Sept. 29.

Tega Industries: To meet investors and analysts on Sept. 29.

PI Industries: To meet investors on Sept. 27.

Safari Industries: To meet investors and analysts on Sept. 29.

Quick Heal Technologies: To meet investors and analysts on Sept. 29.

Shyam Metalics: To meet investors and analysts on Sept. 29.

Century Textiles: To meet investors on Sept. 29.

Grasim Industries: To meet investors on Sept. 27 and 29.

Torrent Power: To meet investors and analysts on Sept. 29.

Trading Tweaks

Ex-date AGM: Jaiprakash Associates.

F&O Cues

Nifty September futures ended at 19,666, a discount of 34.50 points.

Nifty September futures fell 0.18%, with 12,236 shares in open interest.

Nifty Bank September futures ended at 44,656, a discount of 156.65 points.

Nifty Bank September futures fell 0.35%, with 8,448 shares in open interest.

Securities in the ban period: Balrampur Chini, Canara Bank, Delta Corp., Hindustan Copper, Indiabulls Housing Finance, and India Cements

Research Reports

Aavas Financiers, Aptus Value, Home First Finance Gets A 'Buy' As Centrum Broking Initiates Coverage

HDFC Bank - Execution At The Core; Aims To Deliver Unchanged RoE: Motilal Oswal

Brigade Enterprises - Building A War Chest For Growth: ICICI Securities

Linc - Riding The Twin Engines Of Premiumisation, Distribution Expansion: Systematix

Steel Strips Wheels - Steady Core And Expanding Opportunities: Prabhudas Lilladher

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.