Vedanta Ltd. is well-placed to benefit from the commodity upcycle due to its diversified exposure, while the margin expansion and capital expenditure will drive earnings, according to CLSA. The research firm upgraded the mining company to 'buy' from 'underperform' and raised the target price to Rs 390 apiece from Rs 260, implying a potential upside of 15.32% from the previous close.

With 38% of its Ebitda sourced from aluminum, 41% from zinc and 14% from oil, Vedanta stands out as the most-diversified investment opportunity in upcycle in base metals. In addition to macro tailwinds, it also benefits from ongoing margin expansion and its growth projects, according to an April 9 note.

Vedanta has provided guidance, indicating a significant increase in group Ebitda from $5 billion to a range of $6 billion to $7.5 billion by financial year 2025–27. This growth trajectory is attributed to strategic endeavours, including capacity expansion, backward integration and value-addition projects.

Leverage And Corporate Structure To Remain In Focus

Over the past two years, Vedanta's parent company, Vedanta Resources Ltd., has seen a reduction in debt by $3.5 billion. Vedanta has experienced an increase in debt by $4.7 billion, reaching a total of $7.5 billion.

However, there is a strategic plan in place for the group debt (combining Vedanta and VRL) to be maintained at less than $10 billion within the next three years. This suggests a slight reduction in debt for Vedanta, even as its Ebitda profile is anticipated to improve significantly.

By fiscal 2025–27, with projected Ebitda of $6 billion to $7.5 billion, Vedanta expects to generate free cash flow before growth capex ranging from $3.5 billion to $5 billion.

The split into six distinct entities is scheduled to be completed by December, with particular attention on the transfer of the Konkola mine to Vedanta, which will be a pivotal corporate action to monitor.

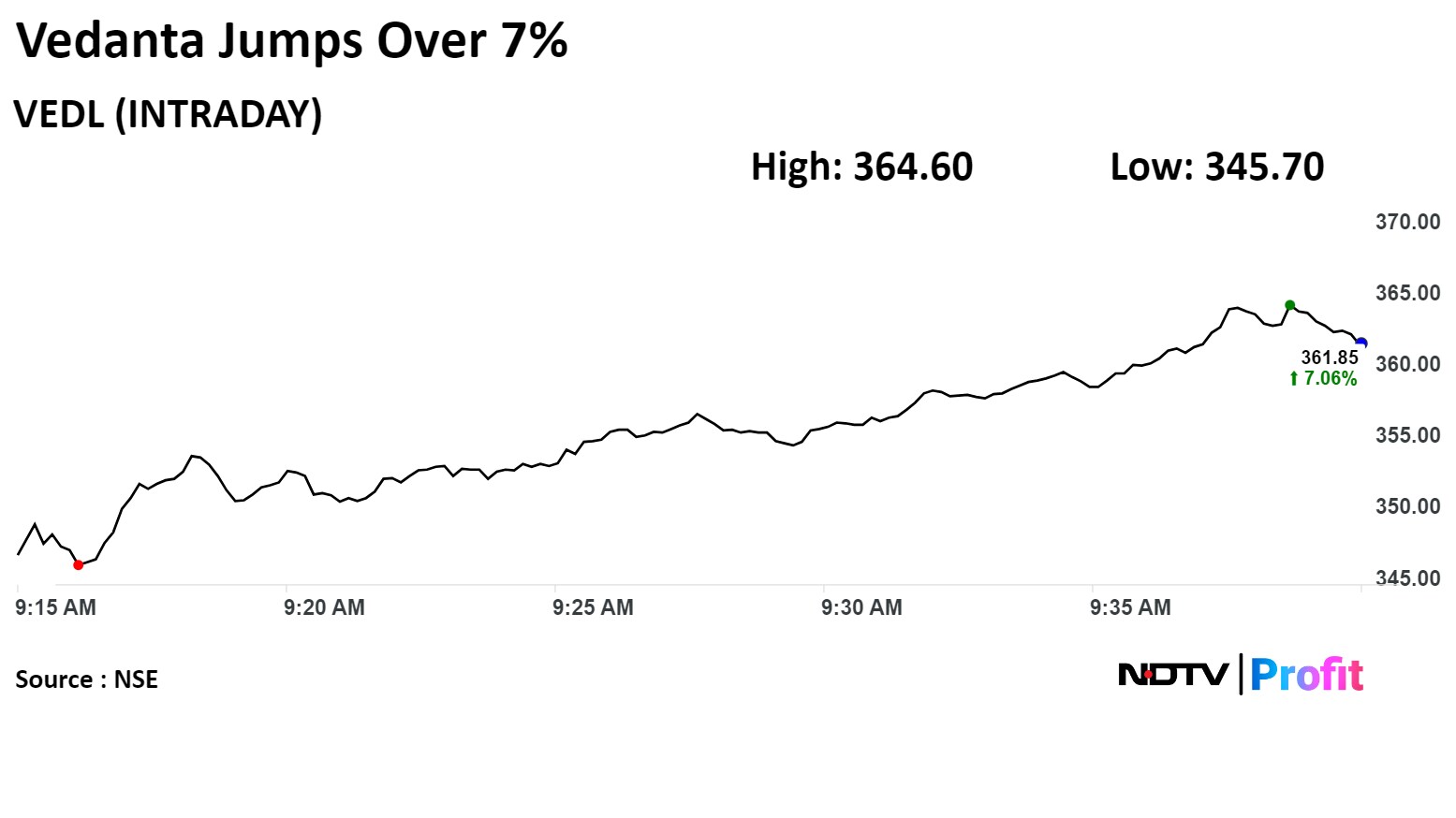

Vedanta's stock rose as much as 7.06% — the highest jump since Sept. 29. — during the day to Rs 361.85 apiece on the NSE. It was trading 6.94% higher at Rs 361.45 per share, compared to a 0.33% advance in the benchmark Nifty as of 9:40 a.m.

The share price has risen 32.94% in the last 12 months. The total traded volume so far in the day stood at 9.4 times its 30-day average. The relative strength index was at 82, indicating the stock may be overbought.

Eight out of the 13 analysts tracking the company have a 'buy' rating on the stock, three recommend 'hold' and two suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.