(Bloomberg) -- The world's biggest bond market extended this year's selloff and stocks dropped from a record on speculation that the Federal Reserve will be in no rush to cut interest rates.

Another report signaling inflation is showing signs of being “stickier” than expected weighed on Wall Street's sentiment, with the producer price index rising on a sizable jump in costs of services. Traders found little encouragement to bid up the market at a time when the Fed bumps into what's being referred to as a tough “last mile” toward its goals.

“It's been a wild week,” said Chris Zaccarelli at Independent Advisor Alliance. “While we understand the market's knee-jerk behavior when it sees too too-hot or too-cold data, we think it will take another couple data releases to establish a new trend (if the pattern continues) or to show that this week's data was just a bump in the road.”

Treasuries fell, with two-year yields up seven basis points to 4.65%. Swaps are pricing less than 90 basis points of rate cuts in 2024 — from around 150 basis points at the start of February. The S&P 500 halted a streak of five weeks of gains. The Nasdaq 100 underperformed amid losses in big names like Meta Platforms Inc. and Apple Inc. US markets will close Monday for Presidents' Day.

To Ian Lyngen at BMO Capital Markets, the PPI was a “troubling print” that reinforces the tone set by the core-consumer price index.

It's another data point that suggests the Fed has “very little reason” to cut interest rates anytime soon, said Clark Bellin at Bellwether Wealth.

“The disinflation is not so immaculate,” noted Peter Boockvar, author of the Boock Report. “As for the Fed, I'm beginning to believe that the ONLY reason they might cut rates this year is if the unemployment rate notably gets above 4% and for no other reason.”

The latest data has driven traders to roll back their once-aggressive rate-cut bets so much that their expectations are now approaching the Fed's own forecast. At the time of the last quarterly update in December, policymakers' median projection was for cuts totaling 75 basis points this year.

Fed Chair Jerome Powell and his colleagues have been signaling they're on a wait-and-see mode before deciding to embark on policy easing. Two officials who vote on policy in 2024 indicated an openness to three interest-rate cuts this year should inflation progress continue.

San Francisco Fed President Mary Daly said Friday that's a “reasonable baseline” expectation, and Atlanta's Raphael Bostic said he could “for sure” see three cuts — rather than his current preference for two — should inflation data come in better.

“This PPI print further highlights that getting inflation back to the Fed's 2% target isn't just a walk in the park,” said Ken Tjonasam at Global X. “It's the last mile that's the toughest. For Chair Powell and the Fed, this means recalibrating their lens on the economic landscape. The narrative of easing into a rate cut has just hit a snag.”

Former Treasury Secretary Lawrence Summers said that persistent inflationary pressures evident in the latest data suggest that there's potential for the next Fed policy move to be to raise interest rates, not lower them.

“There's a meaningful chance — maybe it's 15% — that the next move is going to be upwards in rates, not downwards,” Summers said on Bloomberg Television's with David Westin. “The Fed is going to have to be very careful.”

Separate data on Friday showed US consumer sentiment improved for a third month in February as Americans grew more optimistic about the outlook for the economy and inflation. Meantime, new-home construction sank at the start of the year by the most since the onset of the pandemic.

Despite signs that rates will possibly be higher for longer than the market had envisioned, US equities saw only a mild loss this week.

To Fawad Razaqzada at City Index and Forex.com, investors have chosen to concentrate on stronger earnings and the artificial-intelligence optimism, taking advantage of the bullish momentum.

“But with some of the ‘Magnificent Seven' stocks reaching extremely expensive levels, there is always the danger of a correction soon,” he noted. “Nvidia will be the last from this group to report its results in the week ahead. With most of the optimism now in the price, a correction of some sort, should not come as major surprise in the tech sector.”

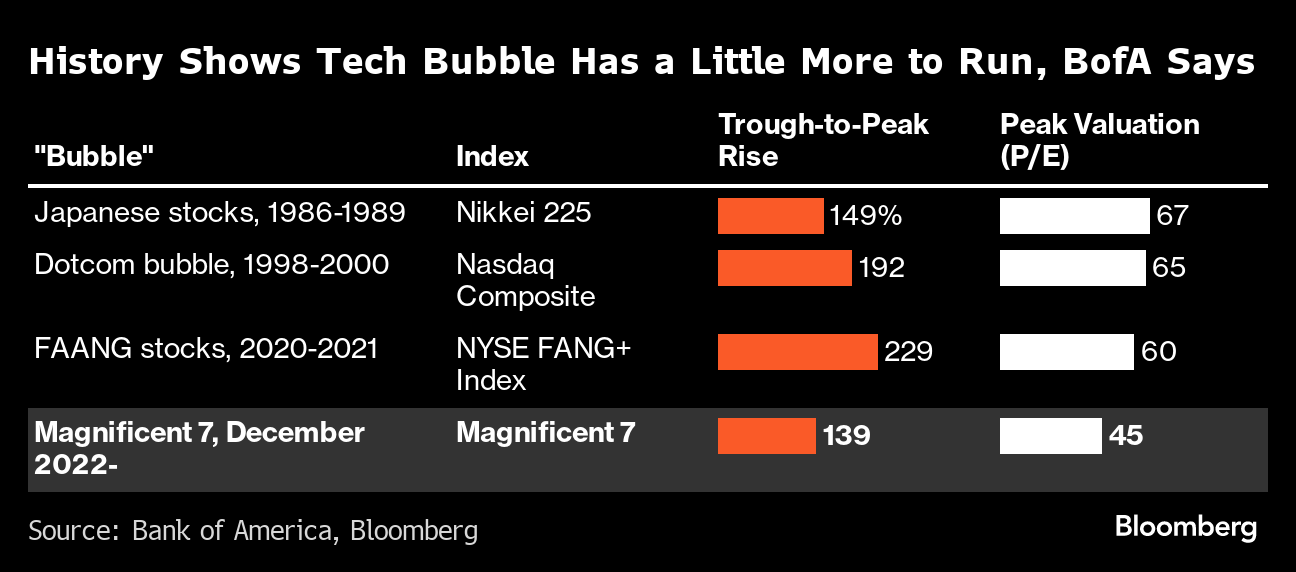

A host of similarities between tech stocks now and previous bubbles suggest the “Magnificent Seven” is nearing — but not yet at — levels that may lead it to pop, according to Bank of America Corp. strategists.

They cite a handful of indicators, such as bond yields, valuations and price action, that suggest there are further gains ahead of the group that includes Apple Inc. and Amazon.com Inc.

“It ain't cheap,” said the team led by Michael Hartnett, “but true that bubble highs have seen dafter valuations.”

Corporate Highlights:

- Applied Materials Inc., the largest US maker of chipmaking machinery, gave a bullish revenue forecast for the current period, signaling that some of the largest semiconductor companies are increasing their investments in new production.

- OpenAI Chief Executive Officer Sam Altman is working to secure US government approval for a massive venture to boost global manufacturing of artificial intelligence chips, an effort that risks raising national security and antitrust concerns in Washington, according to people familiar with the matter.

- Coinbase Global Inc. posted a profit for the first time in two years after a fourth-quarter rebound in digital-asset markets lifted trading revenue.

- DoorDash Inc. beat analysts' estimates for delivery orders in the fourth quarter, as an expansion into new categories is luring a record number of monthly users who order more frequently.

- DraftKings Inc. reported fourth-quarter sales and profit that missed analysts' projections and announced it would buy the lottery app Jackpocket for $750 million in cash and stock.

- Eli Lilly & Co.'s relentless stock records have Morgan Stanley analysts musing whether it will become the first US company outside of the Magnificent Seven to reach a market value of $1 trillion.

- Novartis AG Chief Executive Officer Vas Narasimhan says the drugmaker aims to compete in the growing obesity market by designing next-generation treatments.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5% as of 4 p.m. New York time

- The Nasdaq 100 fell 0.9%

- The Dow Jones Industrial Average fell 0.4%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0776

- The British pound was unchanged at $1.2600

- The Japanese yen fell 0.2% to 150.22 per dollar

Cryptocurrencies

- Bitcoin rose 1% to $51,869.05

- Ether fell 0.5% to $2,781.26

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.28%

- Germany's 10-year yield advanced four basis points to 2.40%

- Britain's 10-year yield advanced five basis points to 4.11%

Commodities

- West Texas Intermediate crude rose 1.3% to $79.08 a barrel

- Spot gold rose 0.4% to $2,012.50 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Edward Bolingbroke and Henry Ren.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.