Rupee closes 32 paise weaker at 87.52 against US Dollar

Intraday, the rupee fell 35 paise weaker at 87.54 against US Dollar

It closed at 87.20 a dollar on Thursday.

Source: Bloomberg

Over 450 of Nifty 500 stocks decline in February.

Nifty records longest monthly losing streak in 28 years.

Nifty falls 5th month in a row, longest losing streak since Nov. 1996.

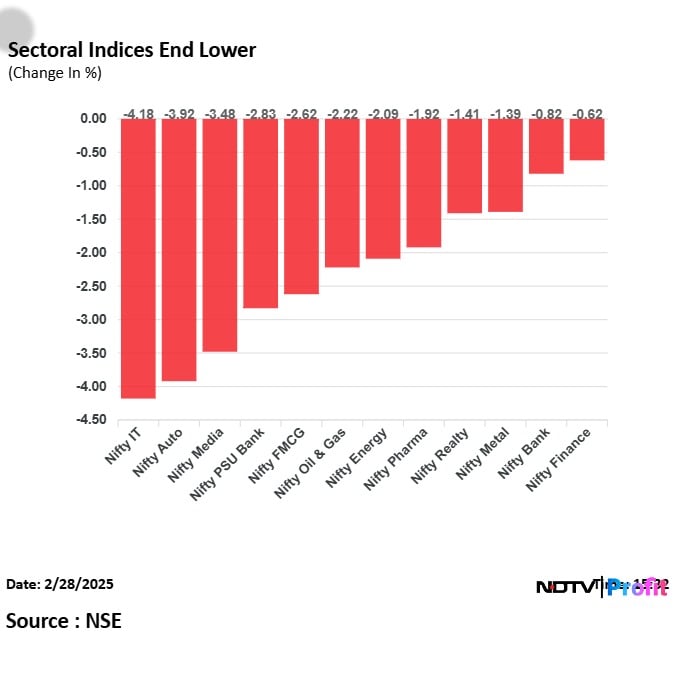

All sectoral indices record losses in February; Realty, IT fall the most.

Nifty Realty records worst month since March 2020.

Nifty IT records worst month since April 2022.

Nifty FMCG records longest monthly losing streak since inception, falls fifth month in a row.

"Nifty 50 is not portraying correct picture of pain in the market," Manish Sonthalia, Emkay Investments told NDTV Profit. He further added that the correction in large caps suggest we are close to the bottom.

According to Sonthalia, consumption is next big theme in Indian markets over medium term.

Tata Technologies Ltd. shares fell over 6%, as the stock entered the Futures & Options segment with the commencement of the March series. This move marks a notable shift for the company, which now joins the ranks of other prominent stocks trading in the F&O segment.

Read full story here.

Over 1.8 million shares of Tata Steel were traded via a block deal on Friday. The share of Tata Steel fell as much as 2.47% to Rs 135.25 apiece.

Adani Green Energy Ltd. has achieved a significant milestone by surpassing 12,000 megawatts of operational portfolio, reaching 12,258.1 MW. The milestone establishes AGEL as the first and only renewable energy company in India to attain this level of operational capacity.

Ireda Share Price Tumbles After Entering F&O Segment

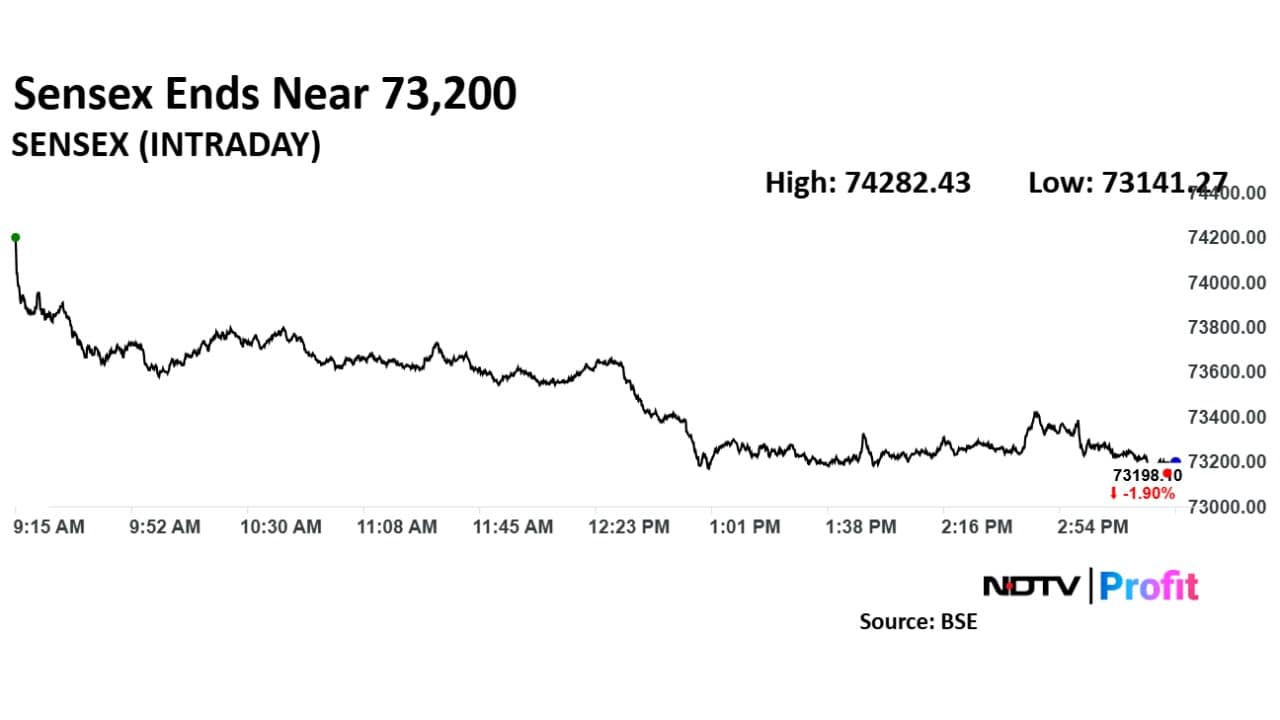

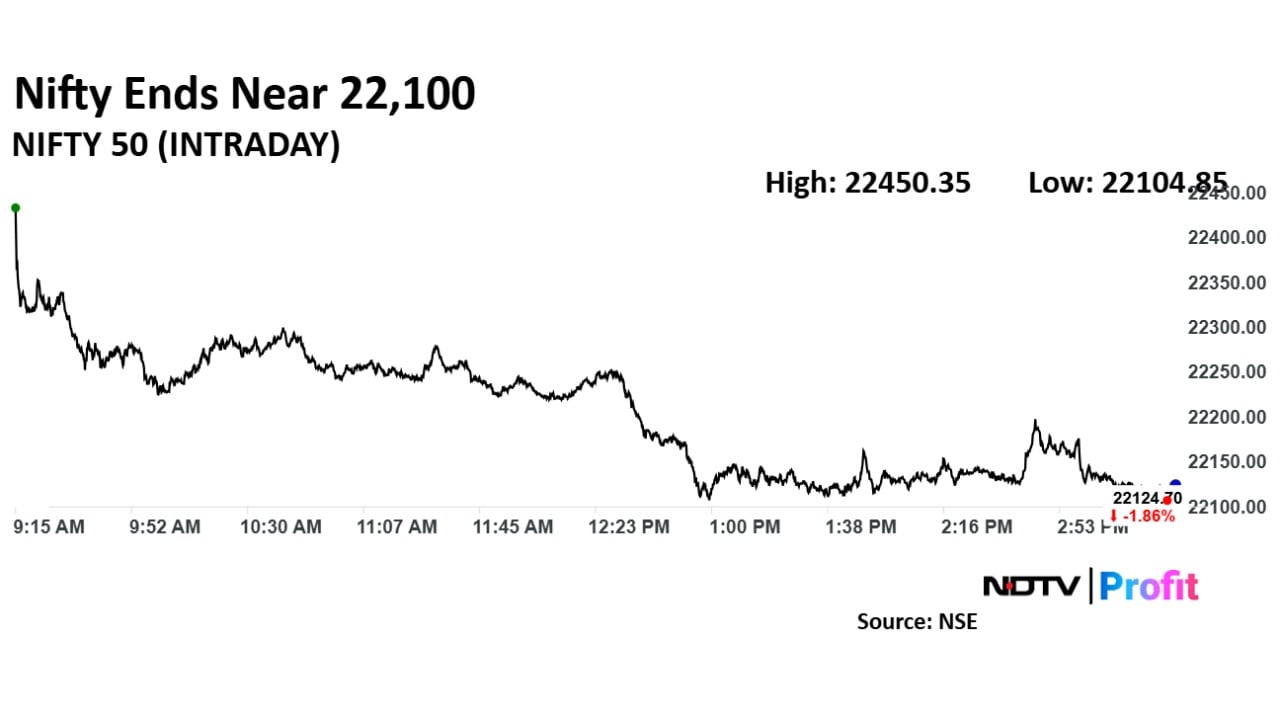

Indian equities were trading lowerer with Nifty falling nearly 2% at 22,147.75 and Sensex was trading 1,200 points lower at 73,319.71.

Intraday, both Nifty and Sensex fell over 1.75%.

Nifty fell 1.78% to 22,143.65.

Sensex fell 1.79% to 73,275.39.

Broader indices were trading lower. Nifty Midcap fell 3.13%; Nifty Smallcap was trading 3.29% lower.

Most sectoral indices fell, led by Nifty IT.

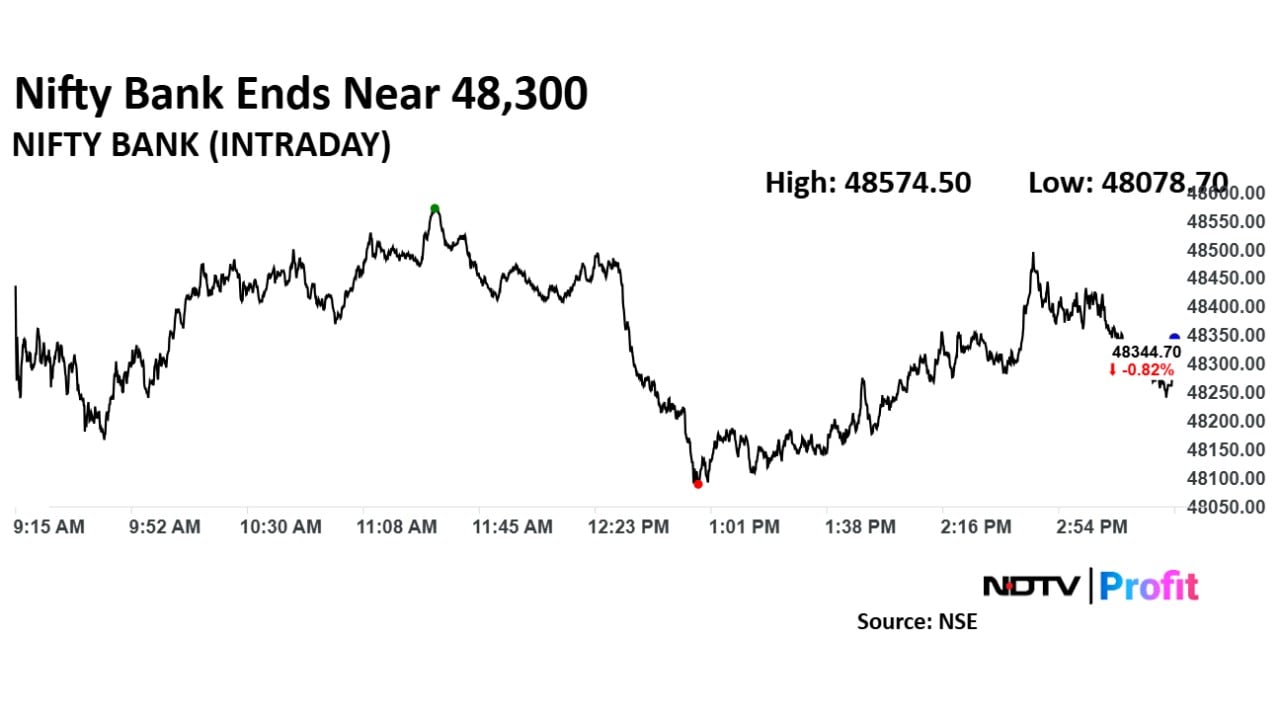

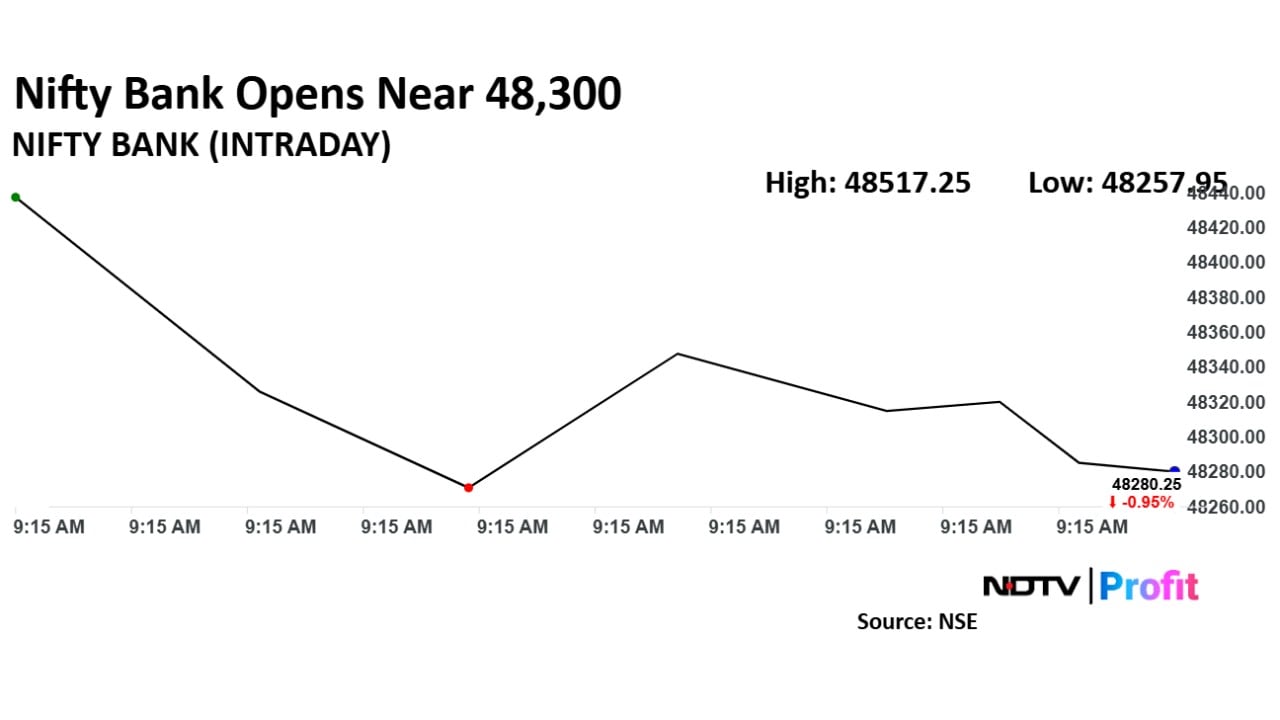

Nifty Bank fell 1.28%, Nifty IT was down 4.03%.

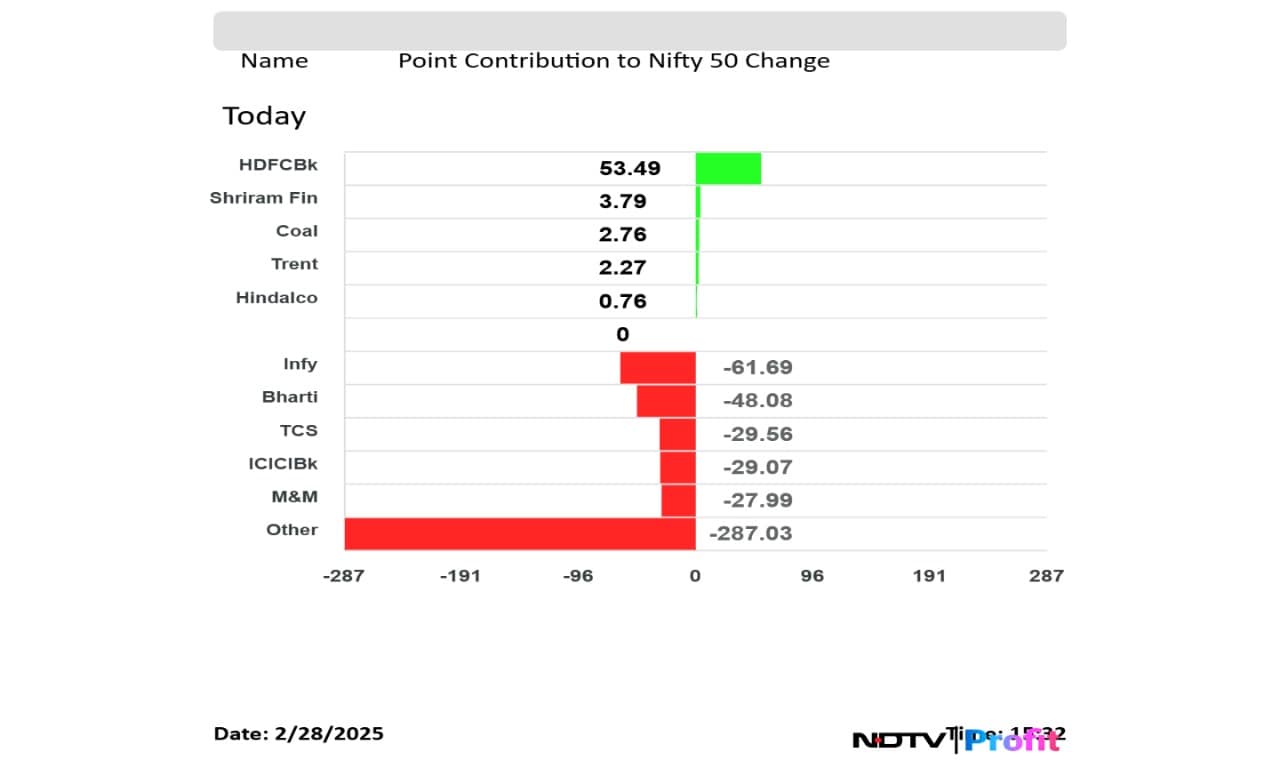

HDFC Bank, Coal India and Shriram Finance were top Nifty gainers.

Infosys, Bharti Airtel, TCS, Mahindra & Mahindra and ICICI Bank were top Nifty losers.

Market Loses Rs 38.6 Lakh Crore In Investor Wealth In February

Large-Cap stocks lose Rs 19.5 lakh crore in investors wealth in February.

Small-Cap stocks lose Rs 5.8 lakh crore in investors wealth in February.

Mid-Cap Stocks lose Rs 8.7 lakh crore in investors wealth in February.

A net passive inflow of up to $1 billion is expected on account of MSCI Inc.'s February rejig set to come into effect from close of the market hours on Friday. Stocks covered in the review are likely to see heightened volatility in the last trading session of the week.

Read full story here.

Indian IT stocks sunk to a seven-month low on Friday and are set to register the worst monthly fall in nearly three years. The selloff came after tech stocks in the US took a beating following Nvidia Inc.'s fourth-quarter earnings and commentary that failed to enthuse investors accustomed to sporadic AI-fuelled gains. The Jensen Huang-led chipmaker sank 8.5%.

Read full story here.

Transrail Lighting Snaps Five-Day Losing Streak After Bagging Orders Worth Over Rs 2,700 Crore

1. Weak US markets & macro

2. Relentless FII selling

3. Weak domestic macro

4. Cut in earnings estimates

5. Punchy broader market valuations

Read full story here.

While the shares of Patanjali Foods hit lower circuit on Friday on first day of F&O inclusion, the shares of Tata Technology and IREDA were also trading lower.

If the bruising correction in small- and mid-cap stocks was not enough; there may be some more pain coming their way. The risk of outflows will grow when dedicated funds start to show a year-on-year loss, which on present trends is likely to be in about three months, according to Jefferies' Greed and Fear report.

Read full story here.

Coal India, Shriram Finance, Reliance Industries and Grasim are the only stocks in green today.

Nifty 50 Hits Nearly 9-Month Low.

Nifty 50 Slips Into Negative Territory For FY24-25.

Nifty Declines For 8 Consecutive Sessions.

Nifty Gains Only Twice In February.

Nifty Declines 5.3% In Feb, Biggest Monthly Fall Since Oct. 2024.

Nifty Falls Back To June 2024 Levels.

Only 4 Nifty Stocks Trade In Green.

Nifty 14-Day RSI Goes Back Below 30 After 4 Months.

Nifty 14-day RSI At Lowest Level Since COVID.

Nifty 14-day RSI goes back below 30 after 3 months and falls to the lowest since Covid-19. This comes as Nifty 50 has gone into negative territory for financial year 2024-25.

(Note: Conventionally, RSI below 30 indicates Nifty as oversold in the near-term)

Nifty companies' wipe-out Rs 2.3 lakh crore in investor wealth

Nifty 500 companies' wipe-out Rs 5.6 lakh crore in investor wealth

IT, Financial lead drag Nifty 50 by 150 points.

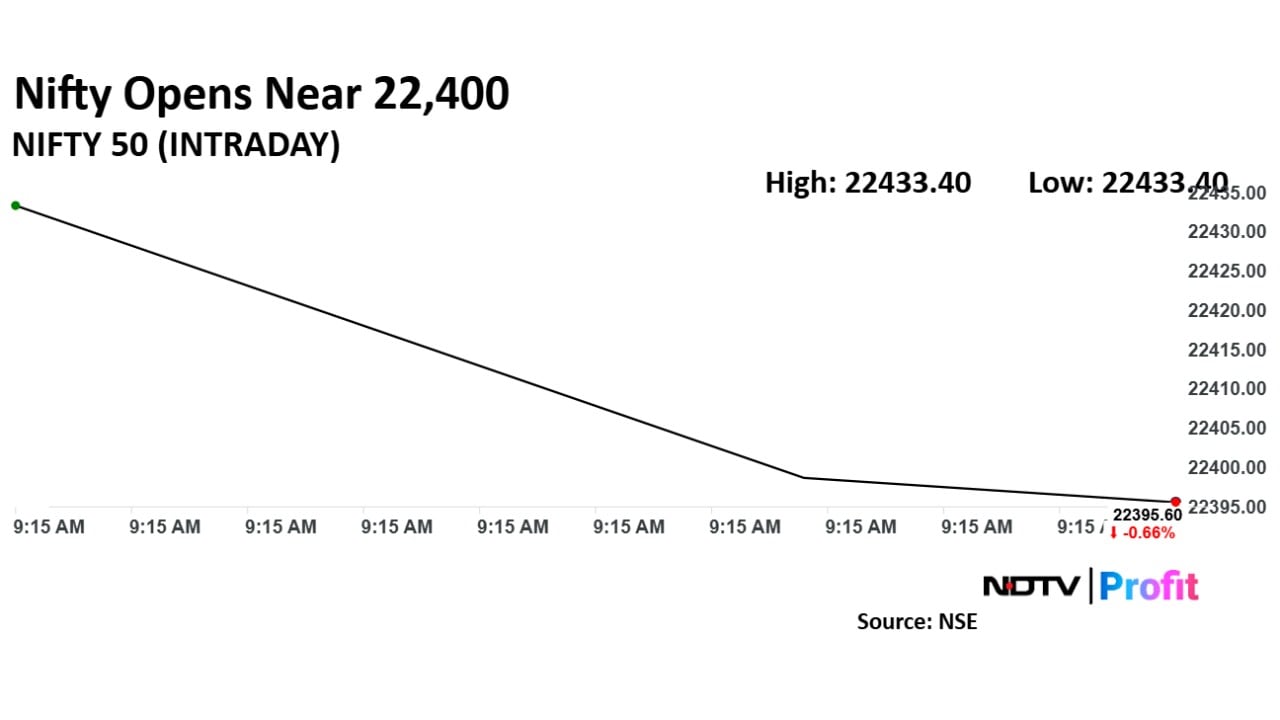

Infosys, M&M top contributors to Nifty's decline.

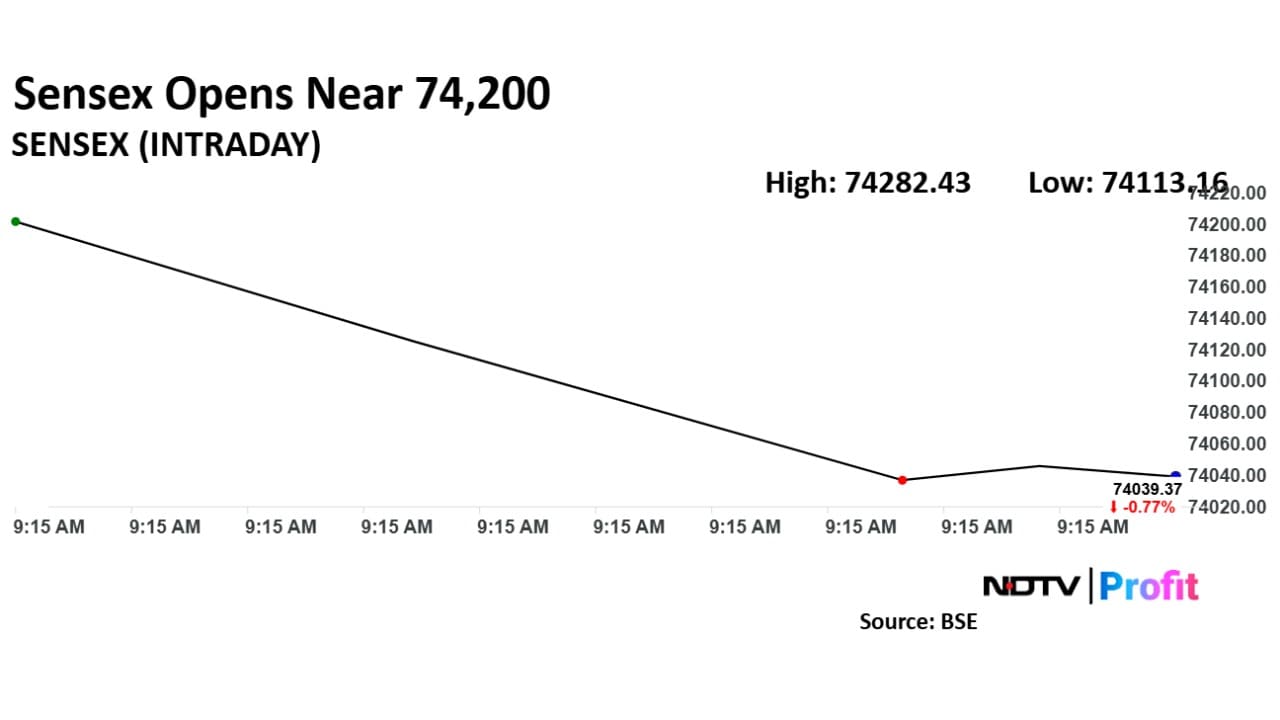

At pre-open, the NSE Nifty 50 was trading 111.65 points or 0.50% lower at 22,433.40. The BSE Sensex was 0.55% lower at 74,201.90.

Rupee opened 12 paise lower at 87.32 against the US Dollar. It closed at 87.20 on Thursday.

Source: Bloomberg

The dollar index is 0.06% lower at 107.35. Brent crude is down 0.49% to $73.68.

Over 2.66 million shares of ITC were traded via a block deal on Friday.

JPMorgan

Maintained 'neutral' rating and raised target price to Rs 420 apiece from earlier Rs 395.

Fuel supply agreement price hike announcement is a positive surprise.

Anticipate the flow-through to the fiscal years ending March 2026 through March 2027 estimated Ebitda could be 8-9%.

Northern Coalfields is the third largest subsidiary of Coal India (18% sales mix).

Morgan Stanley

Maintained 'overweight' rating with a target price of Rs 525 apiece.

Sees price hike as a positive development.

The levy is 2.5% of the fiscal year ending March 2026 revenue and implies 8% upside risk to the fiscal 2026 earnings estimates.

Key to watch would be if the company is able to take price hikes over and above this.

Currently forecasting 2% growth in fuel supply agreement realisations.

Maintains outperform with a target price of Rs 850

“Boldly going where no one has”

Store expansion guidance.

Strong focus on operation and tech.

Platform innovation and value focus.

Profitability and cash management.

Popeyes guidance

Comments on dine-in vs delivery.

What they liked:

What was missing:

Nifty March futures down by 0.25% at a premium of 138.6 points.

Nifty March futures open interest up by 37.38%.

Nifty Options March 06 Expiry: Maximum Call open interest at 25500 and Maximum Put open interest at 22500

Securities in ban period: Nil

The US Dollar index is up 0.06% at 107.35.

Euro was up 0.11% at 0.9626.

Pound was up 0.10%% at 0.7944.

Yen was down 0.27% at 149.49.

Stocks in the Asia Pacific region continued to decline on Friday after heavy selling in US markets as investors digested underwhelming Nvidia Corp. results, mixed economic data and further details on US tariffs.

South Korea's Kospi fell 2.47%, or 64.64 points, to 2,557.11 while Australia's S&P / ASX 200 was down 0.81% at 8,201.50 as of 7:28 a.m. Markets in Japan fell on Friday, while the benchmark index in China and Hong Kong also saw a lower open. This comes after S&P 500 fell 1.6% on Thursday erasing the gains it made this year.

Among important events today Japan Tokyo CPI, industrial production and retail sales data will be released today. US PCE inflation in addition to income and spending data will also be released on Friday.

The US dollar rose on Thursday following US President Donald Trump's announcement on starting tariffs on Canada and Mexico from March 4 and adding another 10% tax on Chinese imports. The S&P 500 fell 1.6% while the Nasdaq 100 slipped over 2.8%, pulled down by the Magnificent Seven that saw the biggest decline since December. The Dow Jones Industrial Average declined by 0.45% on Friday.

Stock Market Today: All You Need To Know Going Into Trade On Feb. 28