Rolex Rings Q3 Earnings Highlights (Consolidated, YoY)

Revenue down 4.9% at Rs 260 crore versus Rs 273 crore.

Ebitda down 2.9% at Rs 51.2 crore versus Rs 52.7 crore.

Margin at 19.7% versus 19.3%.

Net Profit down 45.4% at Rs 20.2 crore versus Rs 37 crore.

Foreign institutional investors' selling in the cash market topped Rs 1.1 lakh crore in 2025, according to the data from NSE, taking the selloff to worst in any year.

US President Donald Trump ordered his administration to consider imposing reciprocal tariffs on numerous trading partners, which could take effect from April this year. Reciprocal tariffs could affect nearly every country, with India, Japan, and the European Union being hit the most.

Bank of America expects Indian companies' earnings growth to slow down going ahead, after the earnings tracked by the brokerage were largely in line in the third quarter, led by healthcare.

Read full story here.

India is expected to face a relatively muted impact from the ongoing US-China tariff battle, as the country’s economy remains comparatively localised, according to analysts.

Maneesh Dangi, founder of Macro Mosaic Investing, said that both the US and China are large, independent economies, with less interdependence compared to East Asian nations. While the US is actively targeting China with tariffs to assert its hegemony, the overall impact on India will be minimal.

Read full story here.

Uncertainties related to US President Donald Trump's new reciprocal tariffs

Foreign institutional investors' selling in the cash market topped Rs 1.1 lakh crore in 2025

Bank of America expects Indian companies' earnings growth to slow down going ahead, after the earnings tracked by the brokerage were largely in line in the third quarter, led by healthcare.

Nifty Smallcap 250 Index down over 22% from life high.

Nifty Smallcap 250 Index enters a technical bear market.

Nifty Midcap 150 Index down over 19% from life high.

Nifty Midcap 150 Index nears technical bear market.

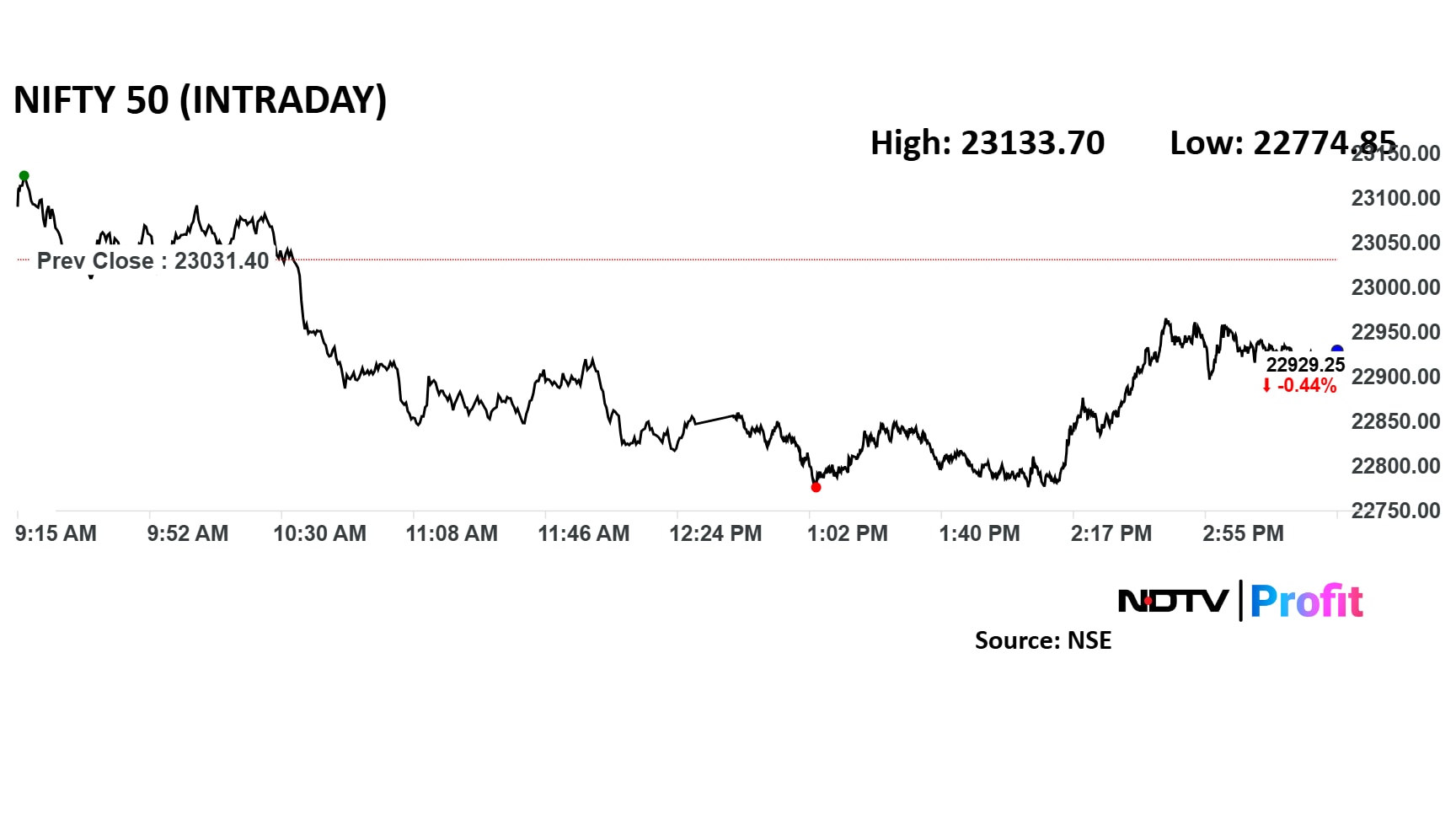

Nifty down over 13% from (intra-day) life high (26,277) made on Sept. 27, 2024.

IPO Fully Subscribed On Day 3

Overall subscription at 1.22 times as of 1:12 p.m.

NII subscription at 8%

Retail subscription at 8%

QIB Subscription at 4.11 times.

Source: BSE

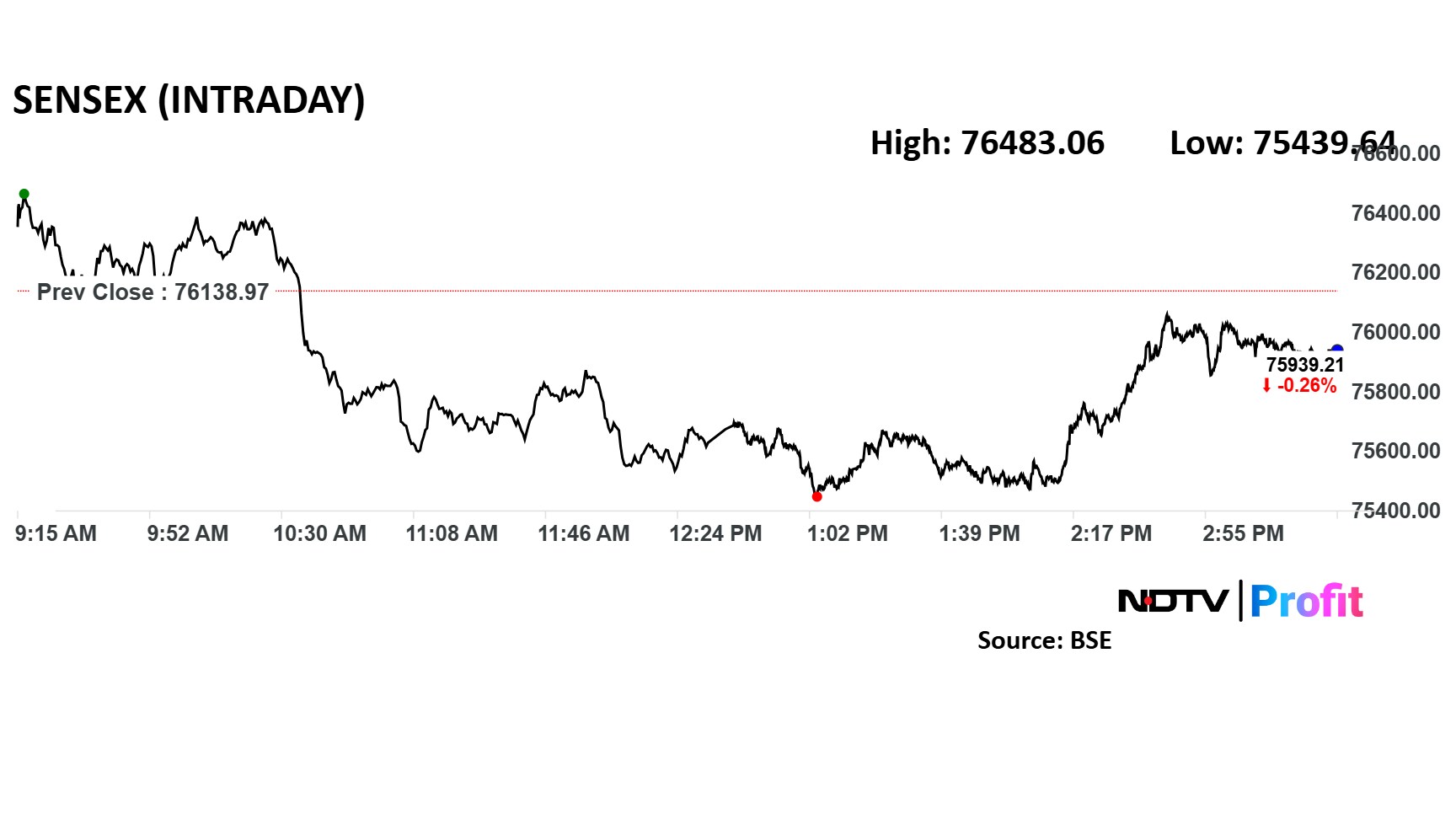

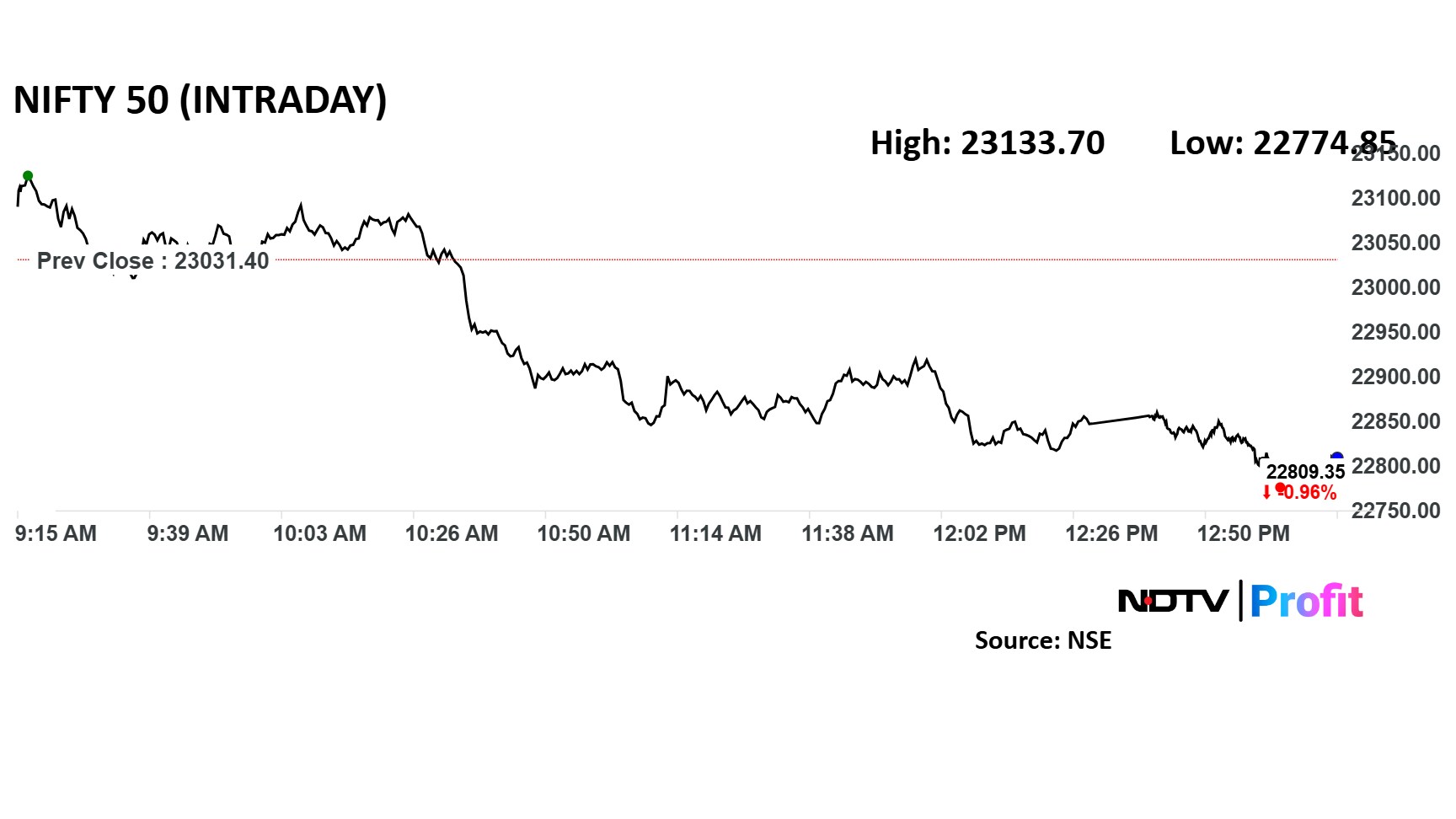

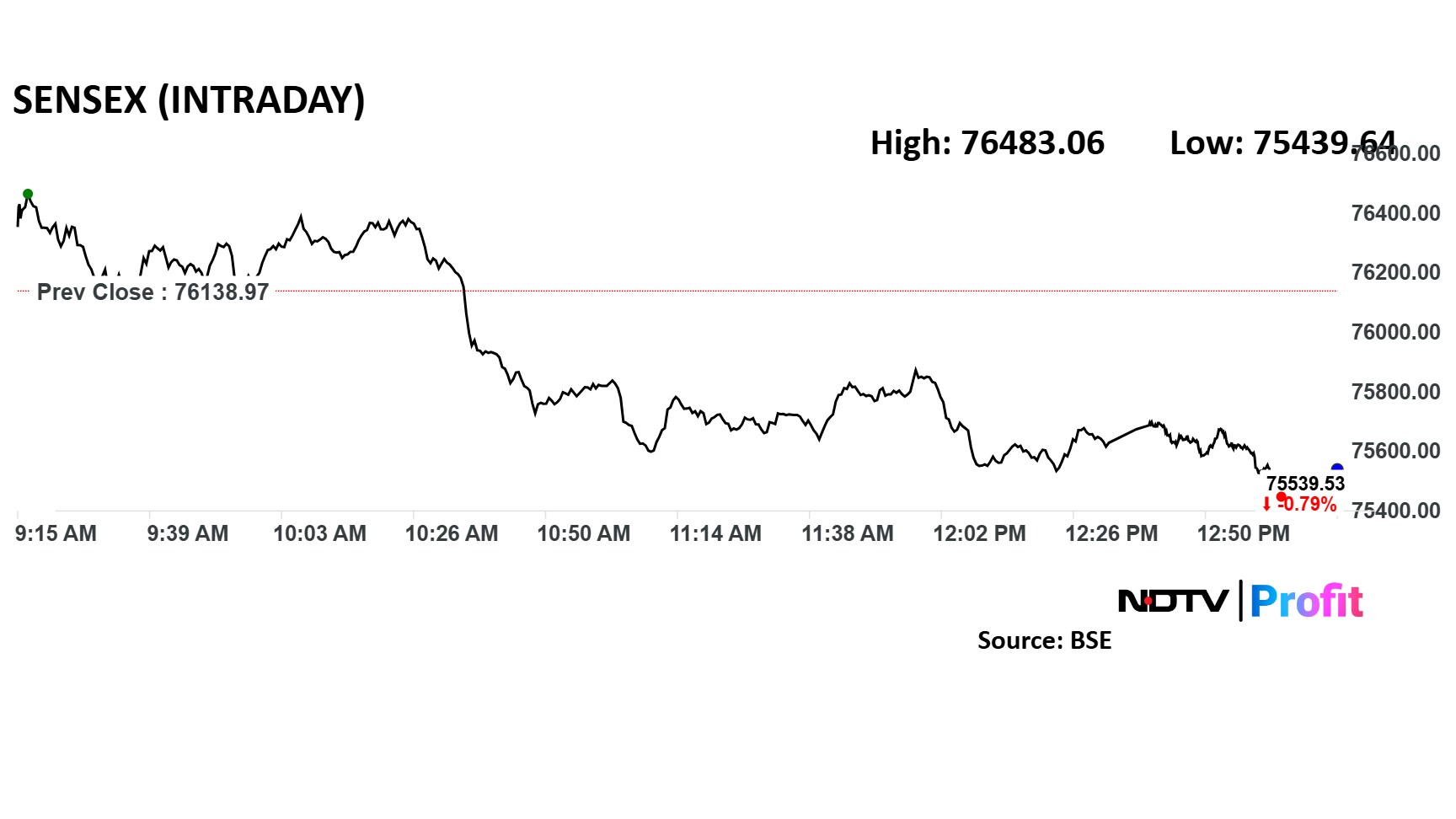

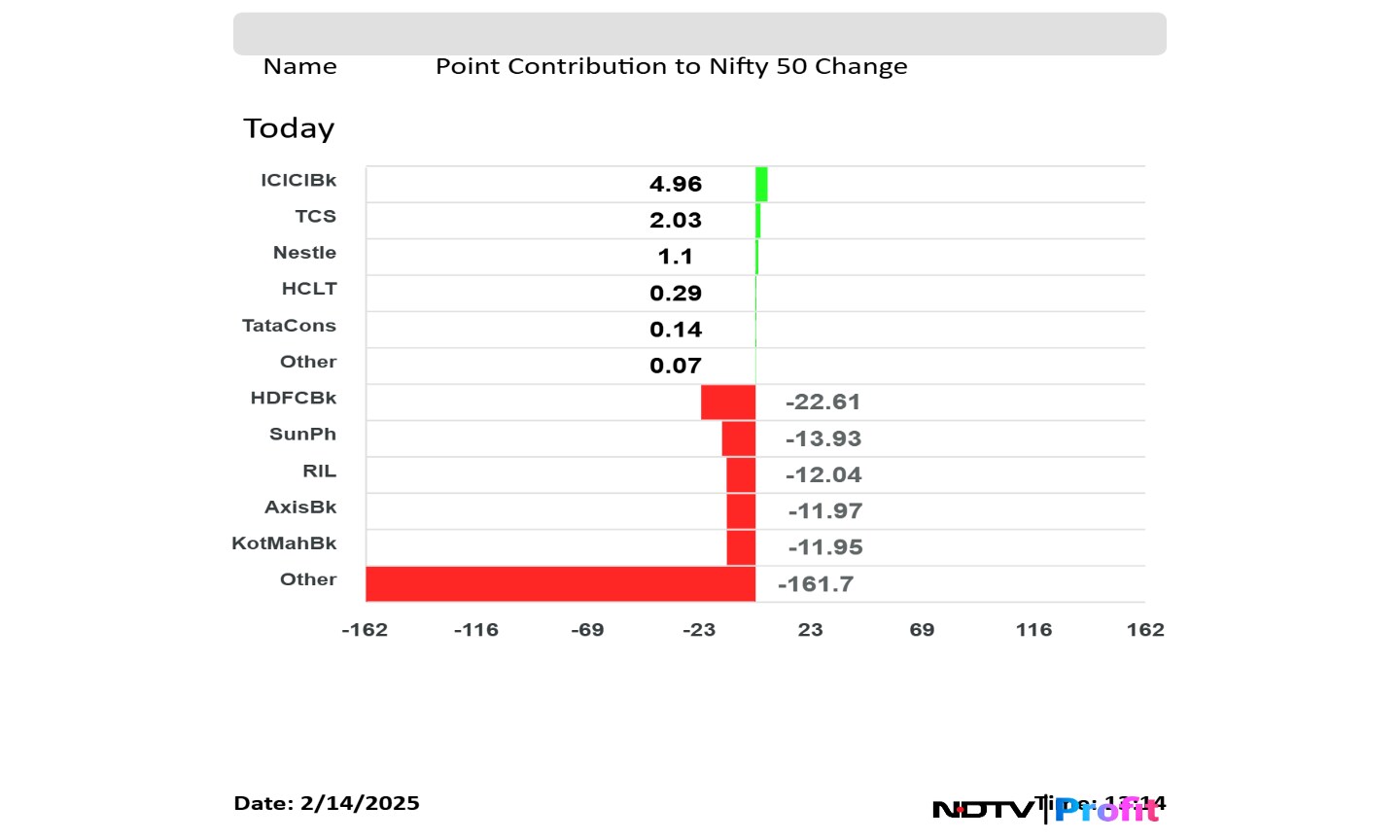

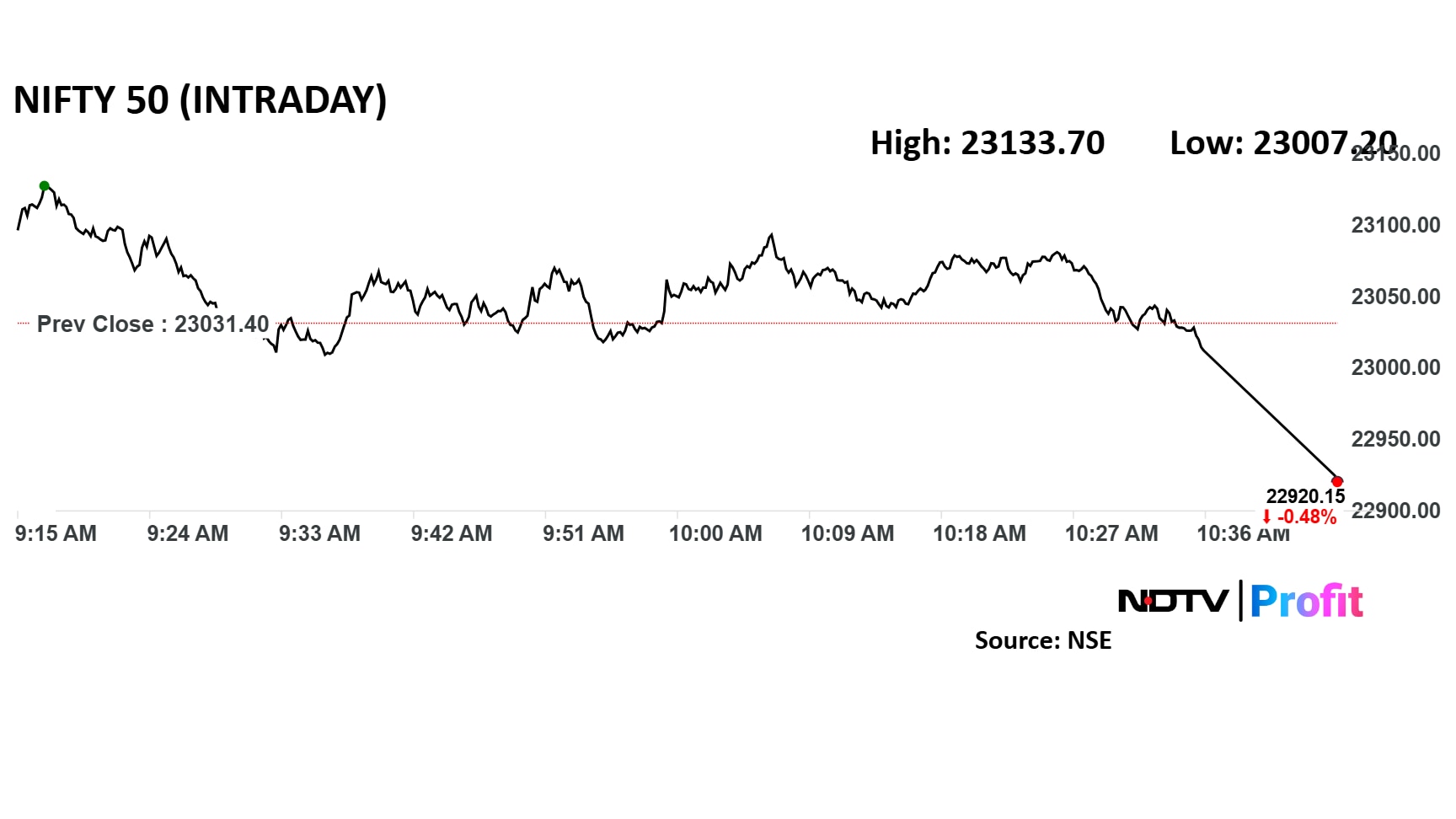

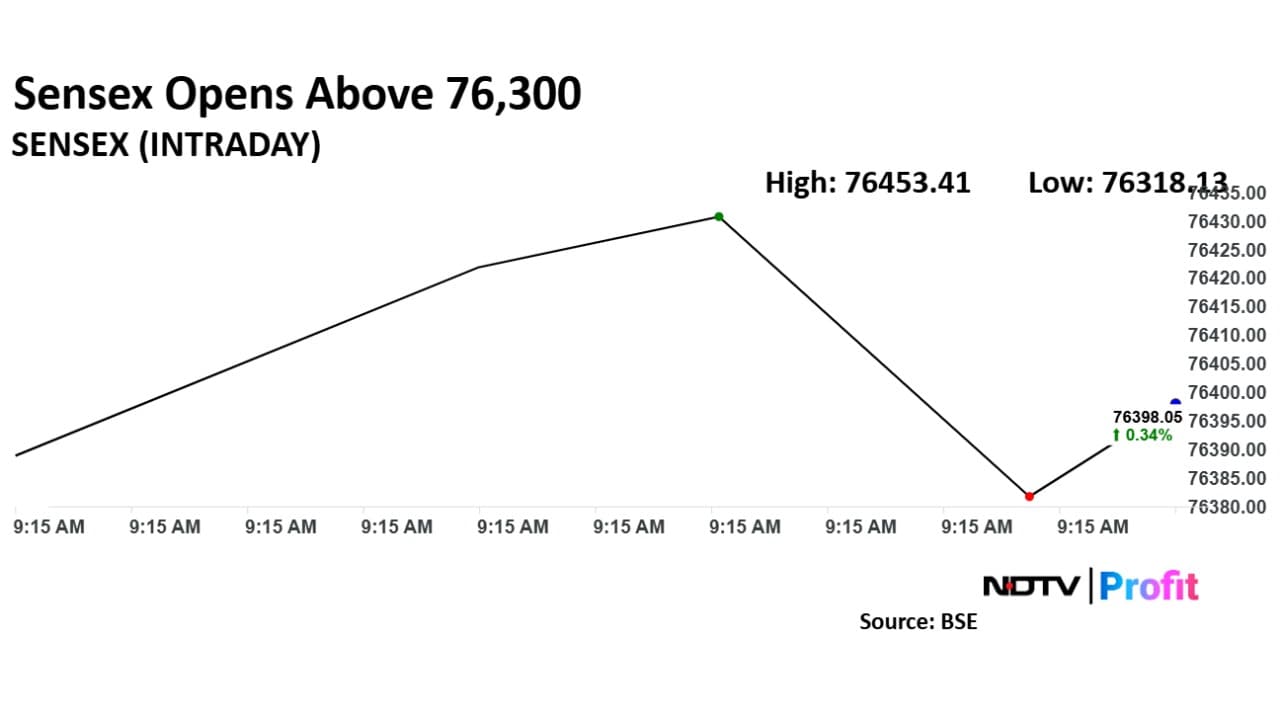

Nifty 50 down 0.54%; intraday low 0.8%

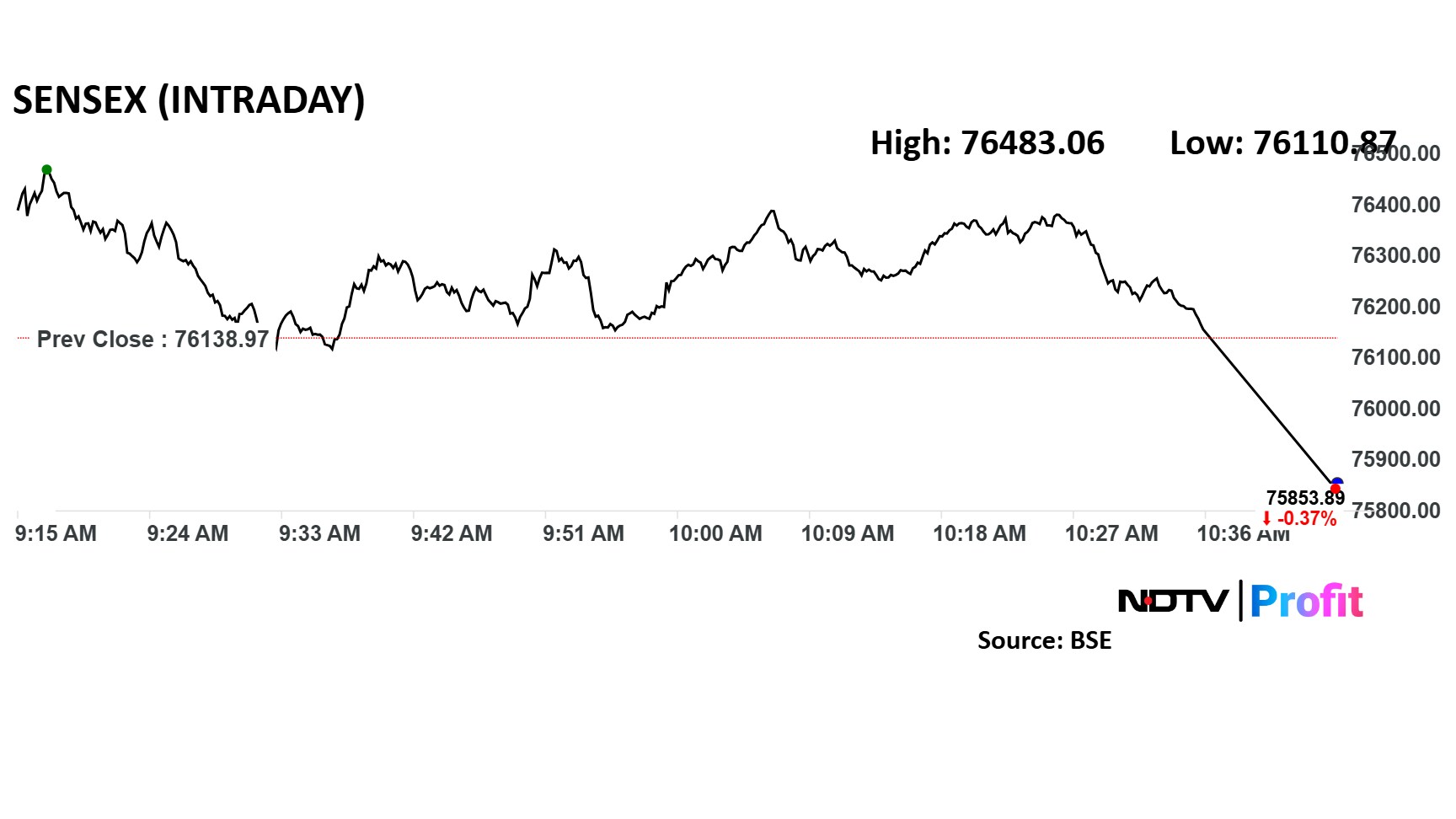

Sensex down 0.43%; intraday low 0.72%

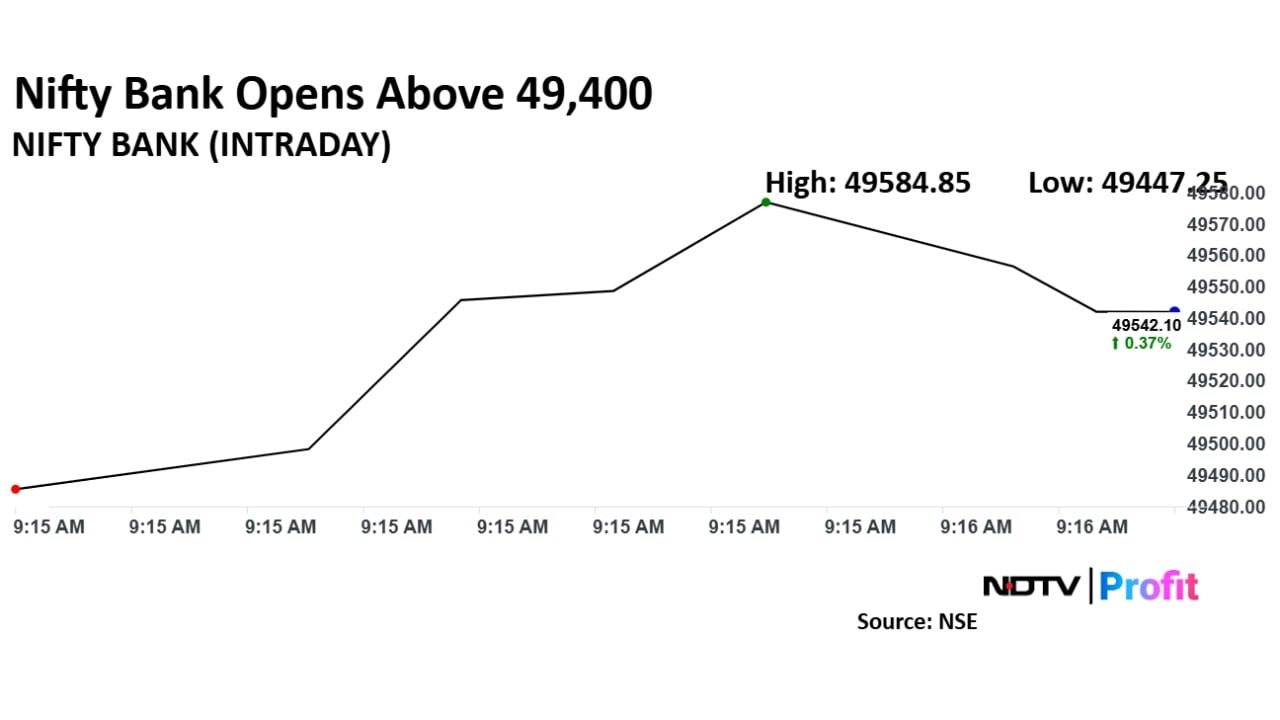

Nifty Bank down 0.7%; intraday low 0.9%

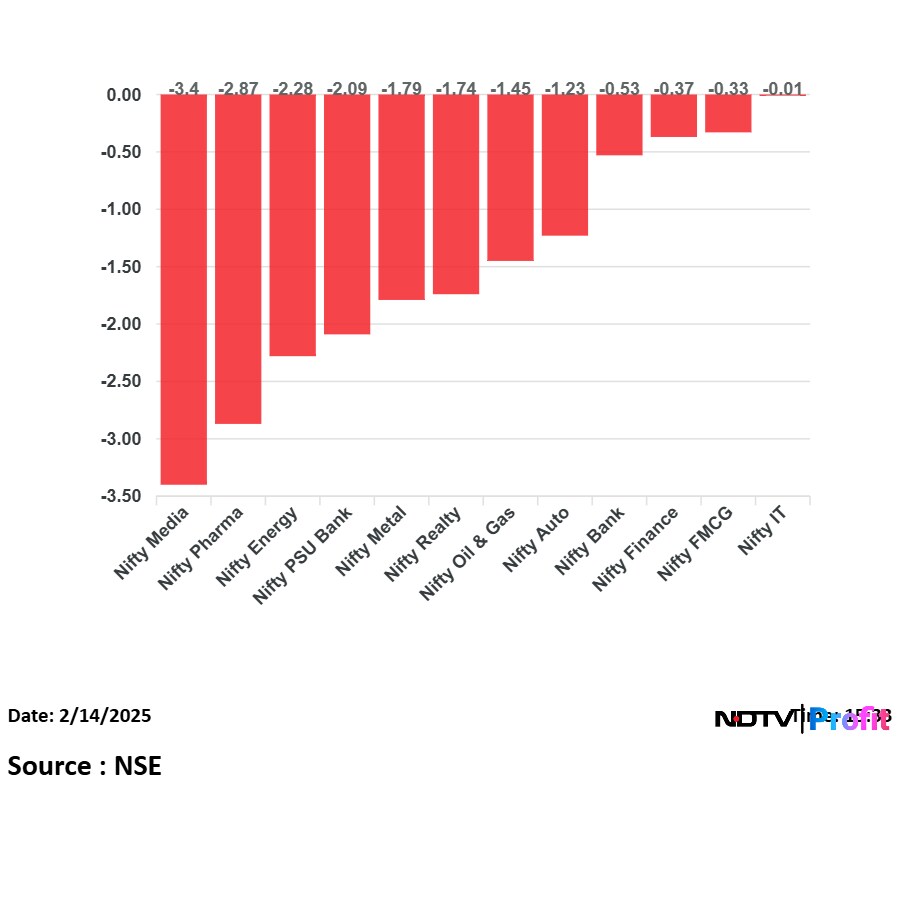

Nifty Midcap 150 down 2%; intraday low 1.4%

Nifty Smallcap 250 up 0.8%; intraday low 1.1%

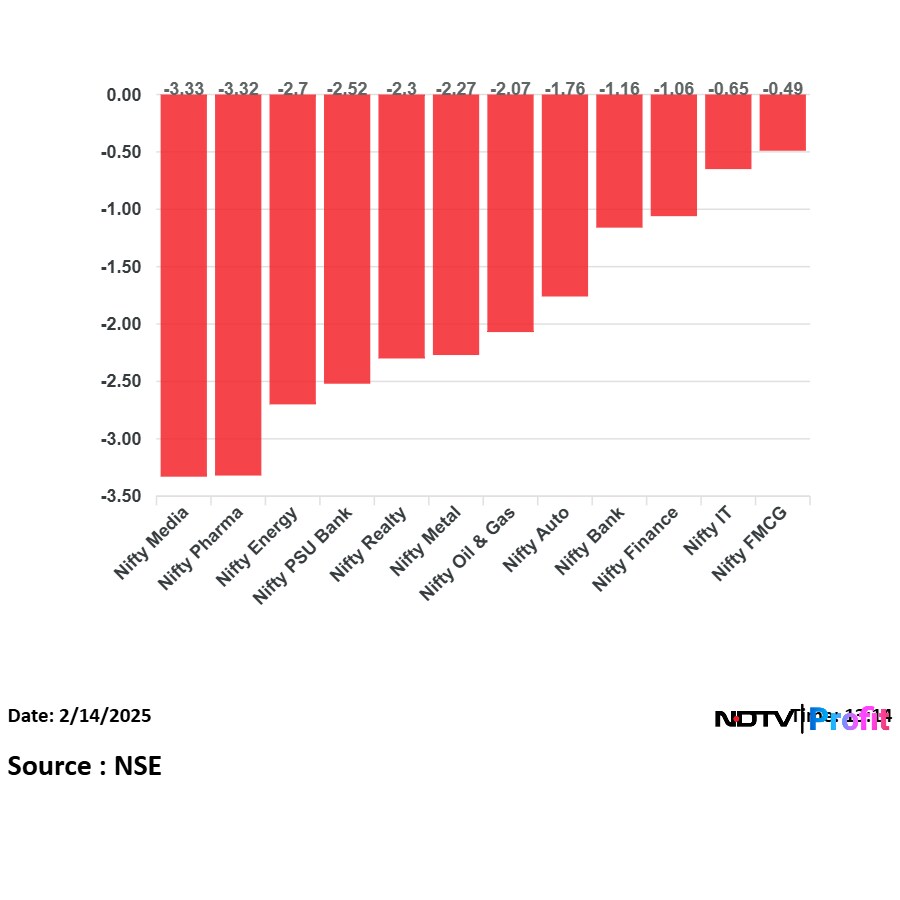

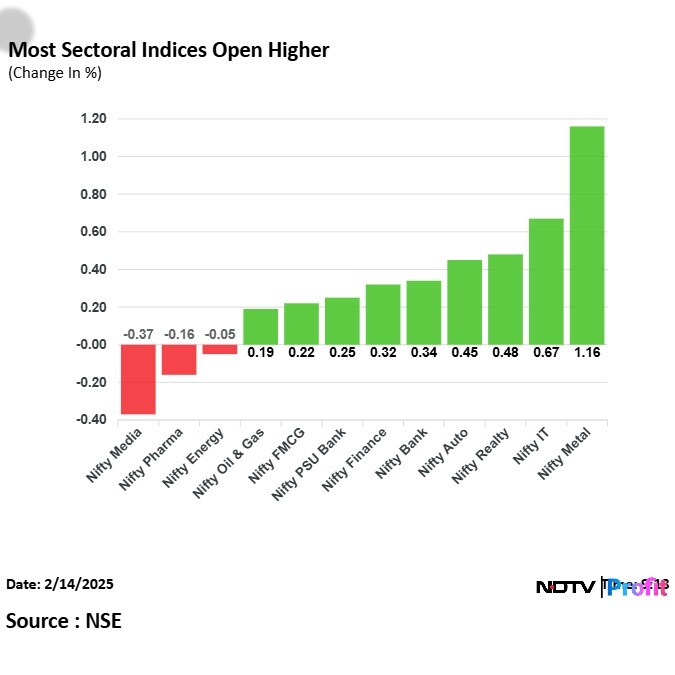

Nifty Pharma, Nifty Energy lead sectoral losses

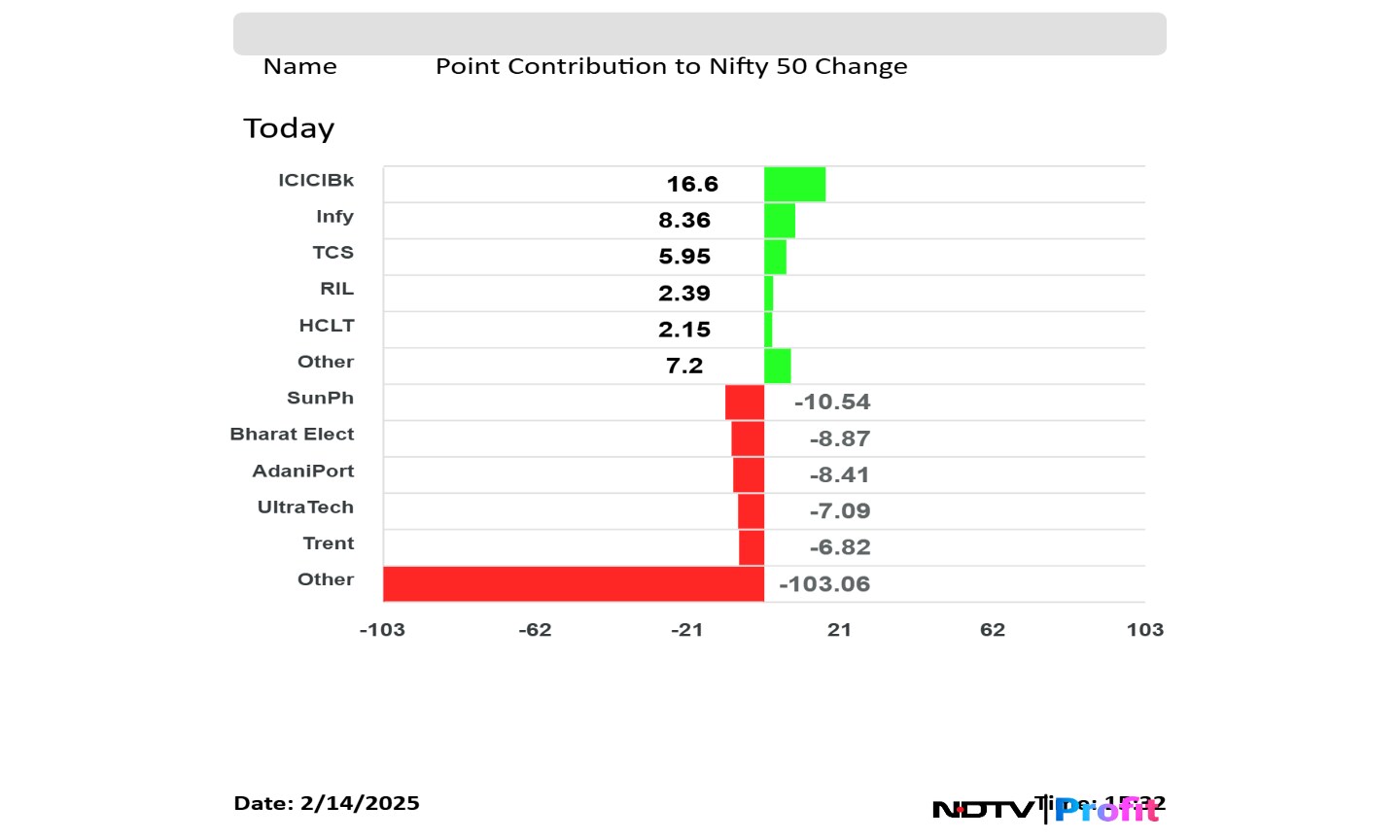

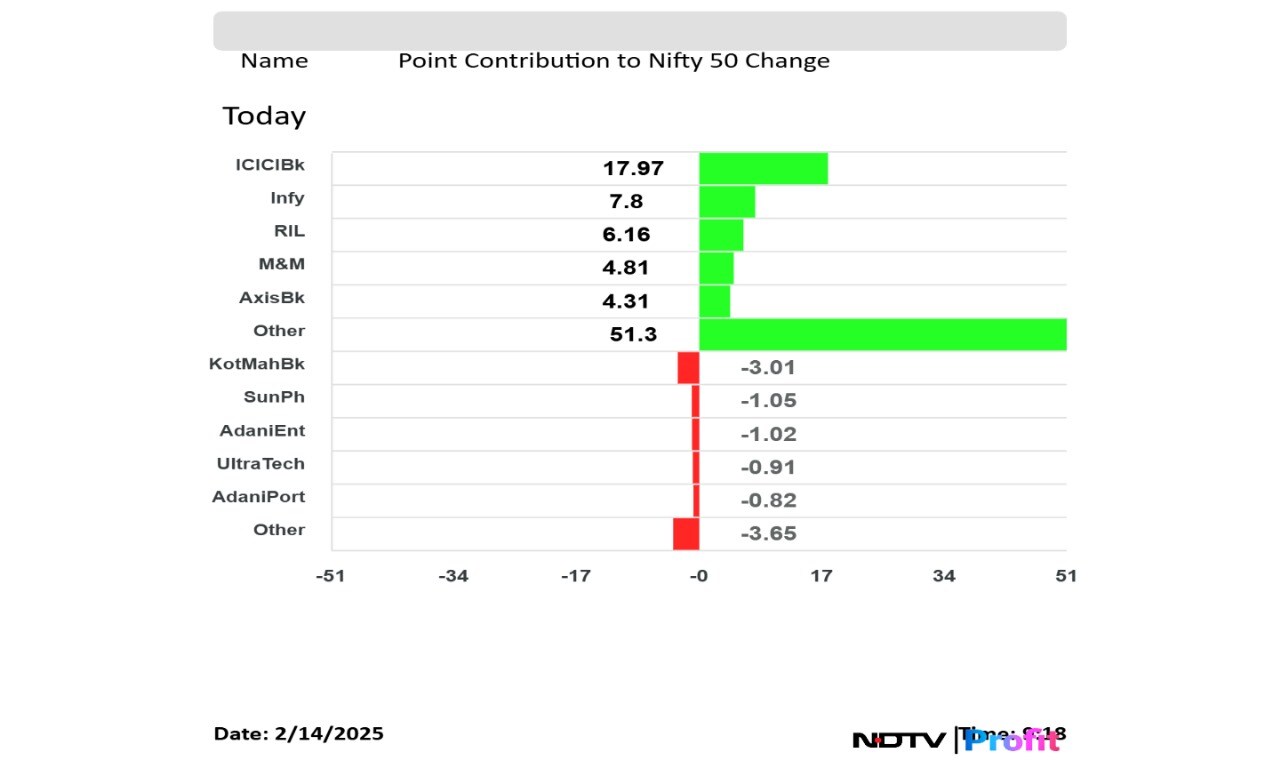

Top Nifty Gainers: Nestle India, Tata Consumer, JSW Steel

Top Nifty losers: Bharat Electronics, Adani Enterprises, Adani Ports

Q3 Results Live: RVNL, Glenmark Pharma, Samvardhana Motherson And Zen Tech

BPCL, HPCL, IOC Keep HSBC's 'Buy' As Low Crude Prices, Less Intervention In Petrol Prices To Support Margins

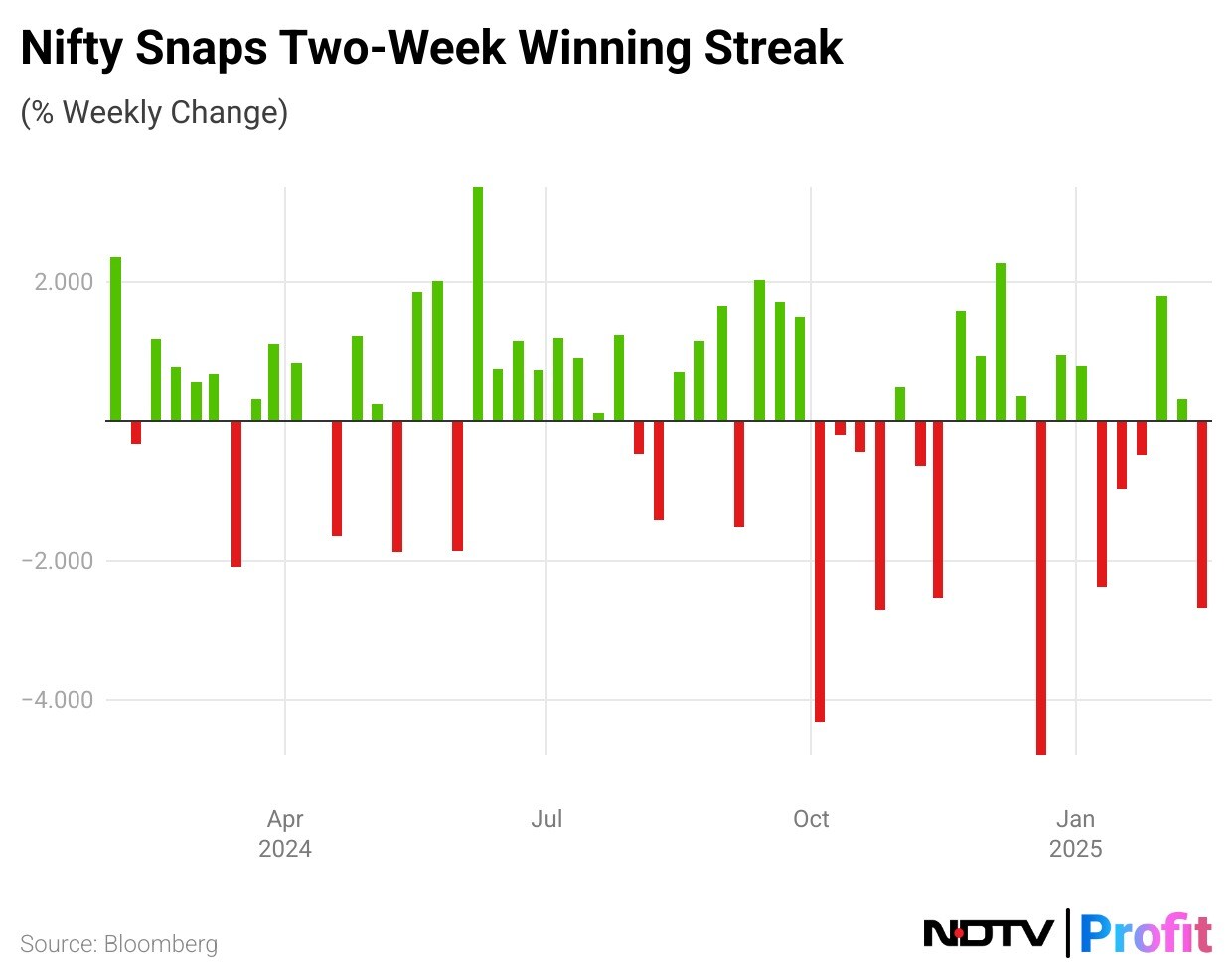

Nifty 50 headed towards its highest weekly loss for the year.

The last highest weekly loss was of 4.8% in December 2024.

The Nifty and Sensex enroute to post longest losing streak in nearly two years.

Last eight consecutive session loss was in February 2023.

Despite multiple reliefs, the Indian equity market has not seen a rally yet.

The Reserve Bank of India’s pro-growth commentary and the postponement of the LCR implementation have been positive.

The new income tax bill has not introduced any negatives.

The results season has been broadly inline, and there has been strong mutual fund inflow.

However, these factors have not been sufficient to drive equity market growth.

Potential positive developments may come from the Modi-Trump meetings, and improvements in high-frequency indicators.

Trump Tariff Impact On India Auto Sector

Views of Nirmal Bang’s Varun Baxi

OEMs seen largely insulated due to heavy localisation, minimal US exports

Royal Enfield only Indian automaker that may see some impact due to US exports

Auto ancillaries like Sansera, Suprajit, BKT, Sona Comstar, Motherson Sumi seen impacted

Most auto component makers are working on ways to sidestep Trump tariffs

Some Indian auto component makers already have manufacturing plants in the US

Views of S&P Global Mobility’s Puneet Gupta

India is the only alternative to China for US carmakers

India’s auto component makers supply to all American carmakers

Any hike in tariffs will make American cars more expensive amid sales slump

India is a preferred partner of the US

Unrelated Fallout: Future Of India EV Policy

Trump’s Make in America stance is in direct conflict with Modi’s Make in India policy

Expect further relaxation of India EV policy in terms of local sourcing

For Tesla, this may just be the last opportunity to set up shop in India

Trump Tariffs Hit Indian Stocks — Waaree Energies, Torrent Pharma, Dr. Reddy's Decline

The Nifty Smallcap 250 lost 0.7% and the Nifty Midcap 150 declined 0.22%.

The Nifty and Sensex are up 0.3% in the pre-open session.

Hindalco Industries retained positive stock ratings from brokerages after it delivered better-than-expected results in the third quarter. JPMorgan, CLSA and Investec maintained their rating and target prices on the stock.

The company reported 4% higher operating profit in its India business than JPMorgan's estimates. Its aluminum business and copper segment also beat the estimates. JPMorgan anticipates positive stock movement on Friday.

Read full story here.

The yield on the 10-year bond opened flat at 6.70%. It closed at 6.71% on Thursday.

Source: Bloomberg

Rupee strengthened by 5 paise to open at 86.84 against the US Dollar. It closed at 86.89 on Thursday.

Source: Bloomberg

Premier Energies Photovoltaic Pvt., a subsidiary of Premier Energies Ltd., have received and accepted orders aggregating to Rs 1,234 crore from existing customers for supply of solar modules. The supply of these modules is scheduled to commences from April 2025.

Source: Exchange filing

India Among Worst Hit From Trump's Reciprocal Tariffs Even As Talks Set To Continue

The Nifty 50 has formed a red candle on the daily scale, which indicates selling pressure at higher levels, according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

"The 21-Days Simple Moving Average is placed at 23,270, making the 23,270–23,300 zone a strong hurdle," Yedve said.

On the downside, Yedve said that 22,780 will act as a key support level. He advised traders to adopt a buy-on-dips strategy as long as the index holds 22,780.

Read Friday's Trade Setup here.

Hexaware Technologies: The public issue was subscribed to 0.15 times on day 2. The bids were led by qualified institutional investors (0.39 times), non-institutional investors (0.03 times), retail investors (0.06 times), Employee reserved (0.17 times).

Quality Power Electrical Equipments: The company will offer shares for bidding on Friday. The price band is set from Rs 401 to Rs 425 per share. The Rs 858.7-crore IPO is a combination of fresh issue of Rs 225 crore and rest offer for sale. The company raised Rs 386 crore from anchor investors.

The US Federal Reserve will stay on hold about interest rate cutes for first six months of 2025 as it will wait for to see the effects of Trump's trade actions, Peter Cardillo, chief market economist at Spartan Capital Securities told NDTV Profit.

The Fed will wait and see how import tariffs impact US inflation. The US will mostly see only one rate cut in the second half of 2025. The dollar will continue to remain strong," he said.

Stocks To Watch: Mahindra Lifespace, Bank Of Baroda, TCS, Piramal Enterprises, UltraTech

Your Guide To FII Positions For Feb. 14 Trade

Trump-Modi Meet: India, US Set $500 Billion Trade Target By 2030

Nifty 50 Top Gainers And Losers On Feb. 13: Sun Pharma, Bajaj Finance To HDFC Bank, Infosys