Rupee weakened by 4 paise to close at 83.96 against the US dollar.

It closed at 83.92 on Tuesday.

Source: Bloomberg

Nifty ends higher in the tenth consecutive session to record highest close

Nifty's best winning streak since 10 sessions ended Oct 14, 2020.

Sensex ends higher for seventh consecutive session

Nifty also recorded its fresh intraday high of 25,129.60

Nifty ends 0.14% or 34.6 points higher at 25052.35

Sensex ends 0.09% or 73.80 points higher at 81785.56

Broader indices underperformed; Nifty Midcap 100 ended 0.12% down and Nifty Smallcap 250 fell 0.22

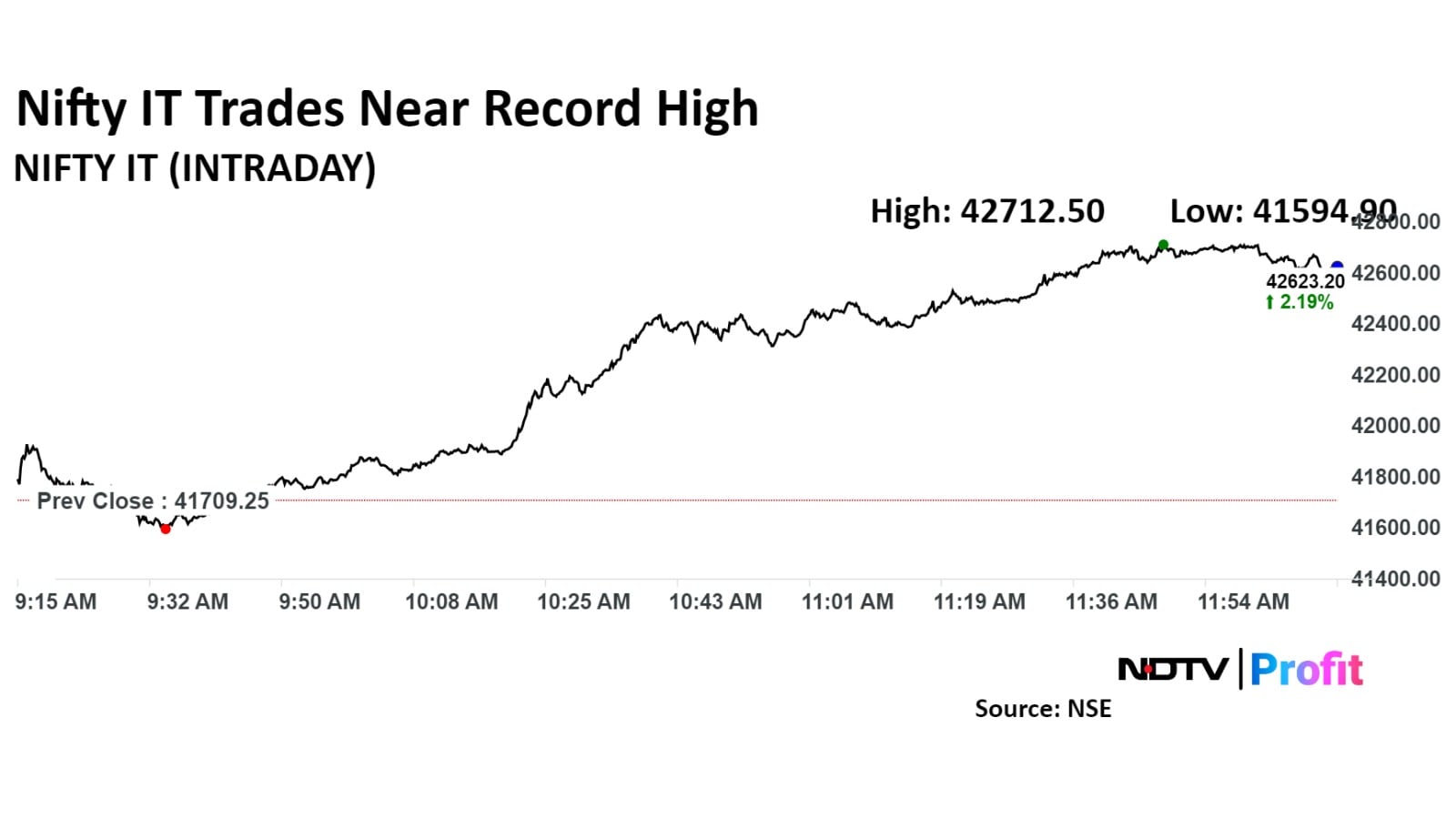

Most sectoral indices ended lower; Nifty IT was the top gainer and Nifty Media fell the most

LTIMindtree and Wipro were top Nifty gainers

Adani Enterprises and Asian Paints were top losers among Nifty stocks

Source: Ashwini Vaishnav at cabinet briefing

Signs term sheet to lease to DEE the pipe automation equipment for the performance of automated pipework fabrication along with a non-exclusive license to utilize.

Source: Exchange Filing

Gets Rs 350 crore order from Bharat Aluminium for building housing complex in Chhattisgarh

Source: Exchange filing

CS Setty assumed charge as State Bank of India chairman.

Source: Exchange filing

Zapperfresh filed draft papers for IPO having fresh issue of 59.06 lakh shares.

Source: DRHP

Titan Co. Ltd.'s Tanishq partners with De Beers to promote natural diamonds across India

Tanishq is to educate Indian customers about natural diamonds at retail stores

Tanishq-De Beers collaboration is to increase emotional significance of natural diamonds among consumers amid growing demand for lab-grown diamonds.

Source: Press release shared by Tanishq

Life Insurance Corp of India submitted views to IRDAI regarding implementation of its insurance products regulations

Alert: The company clarified on media reports of it seeking changes to surrender value norms.

Source: Exchange filing

Acquires single largest stake in Virat Kohli-backed digital first brand 'Rage Coffee'

Source: Exchange Filing

UK-based step-down subsidiary Ohm International Mobility voluntarily liquidated

Source: Exchange Filing

Max Factor in pact with company to build brick & mortar presence in India

Max Factor to be at 70 outlets of company by year-end

Source: Exchange Filing

Gets order worth Rs 296 crore for manufacturing alkaline electrolysers with 200 MW capacity

Source: Exchange Filing

Rashtriya Ispat Nigam, Indian Oil in accord for supply of hydraulic & lubricating oils

Indian Oil to supply hydraulic & lubricating oils to RINL for 5 years

Source: PIB

Institutional buyers: nil.

Non-institutional investors: 1.59 times.

Retail investors: 1.39 times.

Total: 1.02 times

Only 150-160 of govt outlined 5000 CBG plants by FY24 have started production

Challenges include hinterland pipeline connectivity, raw material availability

Farming community acceptance of disposable of waste has been limited

Viability gap funding met with limited success

Current internal rate of return of CBG plants at only 7-9%

Special allocation in 2024 budget, mandatory blending expected to give some impetus to sector

Source: Prashant Vasisht, VP & Co-Head, Corporate Ratings, ICRA Gas Utilities Webinar

Outlook remains stable amid rising gas production

Natural gas supply expected to increase from domestic fields

Long term contracts to provide stable LNG supplies

Gas consumption to grow 6-8% in FY25 supported by benign prices, healthy offtake by city gas distributors

Expect FY25 capex outlay of Rs 20000 crore in next 3 years

Source: Prashant Vasisht, VP & Co-Head, Corporate Ratings, ICRA Gas Utilities Webinar

Pradeep Sharma resigns from the post of CFO effective October 30

Source: Exchange Filing

GQG increases stake in company to 5.17% vs 4.74% earlier

Source: Exchange Filing

Board approves investment in Swmabhan Commerce

To acquire 44% stake in Swmabhan Commerce via primary infusion & secondary buyouts

Source: Exchange Filing

Indus Towers Becomes Bharti Airtel Subsidiary After Buyback

MICL Estates LLP ceases to be subsidiary of company on account of disposal of entire partnership interest.

Source: Exchange filing

NBCC Shares Surge — Board Set To Consider Bonus Issue, Multiple Large Trades

Orient Technologies Shares List At 40% Premium Over Issue Price

Hindustan Zinc, down over 3.8%

Asahi India Glass, down over 1%

Bajaj Steel Industries, up over 1.5%

Force Motors, down 1%

GE T&D India, up 1.2%

Sigachi Industries, up 1%

GMR Airports 14.14 lakh shares changed hands at Rs 95.04

Zee Entertainment 12.93 lakh shares changed hands at Rs 152.89

Reliance Power 36.87 lakh shares changed hands in ten large trades at Rs 30.55- Rs 32.01

Source: Cogencis

Turns zero net debt on standalone basis

Standalone net debt as of FY24: Rs Rs 762.22 crore

FY24 Standalone finance cost: Rs 76.39

Consolidated net debt as of FY24: Rs 777.47 crore

FY24 Consolidated finance cost: Rs 86.06

SEBI Bars Rana Sugars, Top Executives From Securities Markets For Two Years

At pre-open, the Nifty was at 25030.80, up 0.05% or 13.05 points and the Sensex was at 81780.27, up 0.08% or 68.51 points.

The yield on the 10-year bond opened flat at 6.86%.

It closed at 6.86% on Tuesday.

Source: Bloomberg

Rupee weakened by 3 paise to open at 83.95 against the US dollar.

It closed at 83.92 on Tuesday.

Source: Bloomberg

Hikes target to Rs 1725, implying 21% upside and upgrades to buy

Triggers: Excise duty slab cuts in Karnataka, resumption of sales in Andhra, India UK FTA

Demand outlook for alcobev remains strong

Inflationary fears not panning out, outlook better than guidance

Category premiumisation trend playing out well with pricing power

Value the co at 60 times Sept 26E EPS

Citi Research

Maintains 'sell', target at Rs 137, downside 8.7%

Remains concerned on the potential impact of the cost saving measures

Management has been implementing strategic initiatives around reducing costs

Has guided to recovering to 18-20% EBITDA margin by FY26E

Elara Securities

Maintains 'buy', target at Rs 210, upside 40%

Expects better growth rates in the festive season

Further profitability too will continue to improve helped by cost cutting initiative

Improved efficiencies, lower losses, will drive valuation re-rating

Maintains BUY at Rs 9,500 target, implying 15% upside

Expects express logistics segment demand to pick up after slow FY24, Q1FY25

Infra and network expansion to drive growth in surface express

Improves utilization of new aircrafts to boost margins

Higher volumes on new aircrafts, routes and network expansion

Expect revenue/Ebitda/net profit to grow at 17%/32%/36% CAGR over FY24-26

Commences operations of captive solar power plant established at cost of Rs 41 crore

Source: Exchange Filing

Promoter Bharti Airtel's stake in company will increase to 50% post completion of buyback

Source: Exchange Filing

Transfer of events ticketing business to arm Wasteland Entertainment completed

Transfer of movies ticketing business to arm Orbgen Technologies completed

Subscription by Zomato in share capital of both subsidiaries of company completed

100% stake of company in subsidiaries transferred to Zomato

Source: Exchange Filing

Tata Technologies: TPG Rise Climate sold 1.21 crore shares (2.98%) at Rs 1,014 apiece, while Copthall Mauritius Investment bought 40.1 lakh shares (0.98%) and Ghisallo Master Fund bought 31.22 lakh shares (0.76%) at Rs 1,013 apiece.

Aavas Financiers: Amansa Holdings sold 17.5 lakh shares (2.21%) at Rs 1,690 apiece, while Nippon India Mutual Fund A/C - Nippon India Multi Cap Fund bought 10 lakh shares (1.26%) at Rs 1,690 apiece.

Rolex Rings: ICICI Prudential Mutual Fund sold 3.19 lakh shares (1.17%) at Rs 2,425 apiece, Ashokkumar Dayashankar Madeka sold 2.72 lakh shares (0.99%) at Rs 2,419 apiece and Sanjaykumar Bhagvanji Bole sold 1.74 lakh shares (0.64%) at Rs 2419 apiece. On the other hand, SBI Mutual Fund bought 2.8 lakh shares (1.02%) at Rs 2421.66 apiece, India Acorn Icav bought 2.03 lakh shares (0.74%) at Rs 2421.63 apiece and Kotak Mahindra Mutual Fund bought 1.7 lakh shares (0.62%) at Rs 2,425 apiece. Franklin Templeton Mutual Fund also bought 1.56 lakh shares (0.57%) at Rs 2421.08 apiece.

FedBank Financial Services: Anil Kothuri sold 20 lakh shares (0.54%) at Rs 121 apiece.

Price Band change from 20% to 10%: Goldiam International, NIIT.

Ex/record dividend: GE T&D, Hindustan Zinc, Force Motors, Sigachi Industries.

Ex/record AGM: Gandhar Oil Refinery, Force Motors, Sigachi Industries.

Moved in short term ASM Framework: Hinduja Global Solutions, NIIT.

Godrej Agrovet Fully Acquires Its Subsidiary Godrej Tyson Foods

Orient Technologies: The company's shares will debut on the stock exchanges on Wednesday at an issue price of Rs 206 apiece. The Rs 214.76-crore IPO was subscribed 151.71 times on its third and final day. Bids were led by institutional investors (189.9 times), retail investors (66.87 times), and non-institutional investors (300.6 times).

Premier Energies: The public issue was subscribed to 16.96 times on day one. The bids were led by retail investors (24.49 times), non-institutional investors (20.97 times), and qualified institutional investors (0.16 times).

ECOS (India) Mobility & Hospitality: The company will offer its shares for bidding on Wednesday. The price band is set from Rs 318 to Rs 334 per share. The Rs 601.2-crore IPO issue is entirely an offer for sale. The company raised 180.3 crore from anchor investors.

Tata Technologies Shareholder Offloads Stake Worth Rs 1,230 Crore

ICICI Prudential Gets Rs 420.8 Crore GST Demand And Penalty

Nifty, Sensex Close Lacklustre Session Flat; RIL, HUL Drag: Market Wrap

.png)

.png)

.png)