-The local currency strengthened by 2 paise to close 83.38 against the U.S. Dollar.

-It closed at 83.40 a dollar on Thursday.

Source: Bloomberg

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

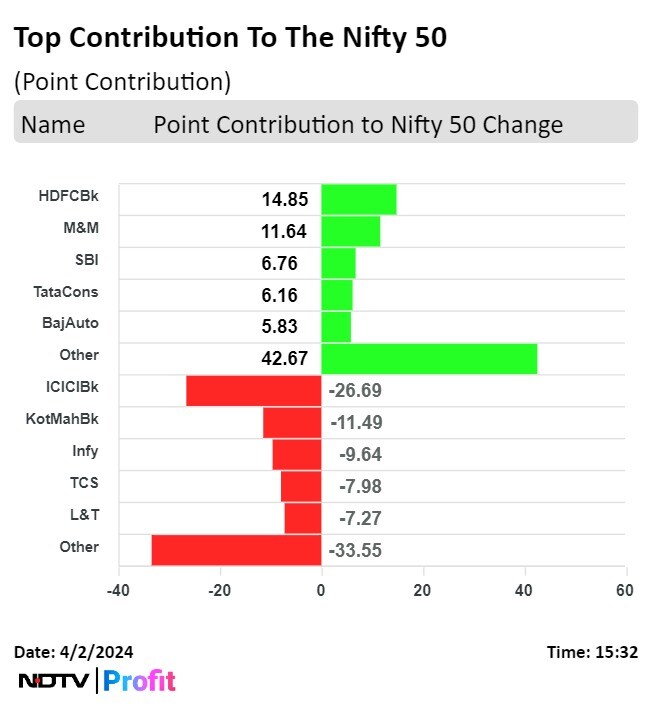

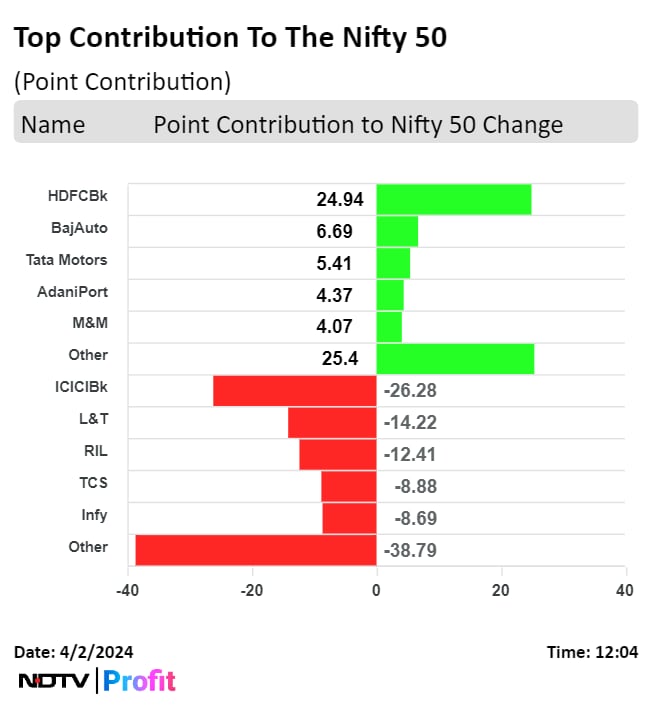

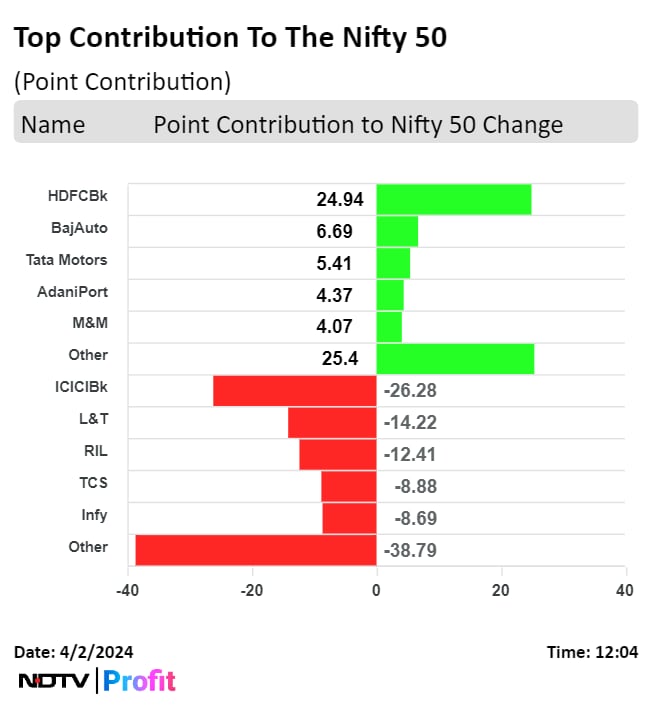

Shares of Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and ICICI Bank Ltd. weighed on the Nifty 50.

Meanwhile, those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., State Bank Of India, Tata Consumer Products Ltd., and Bajaj Auto Ltd. minimised the losses.

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Shares of Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and ICICI Bank Ltd. weighed on the Nifty 50.

Meanwhile, those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., State Bank Of India, Tata Consumer Products Ltd., and Bajaj Auto Ltd. minimised the losses.

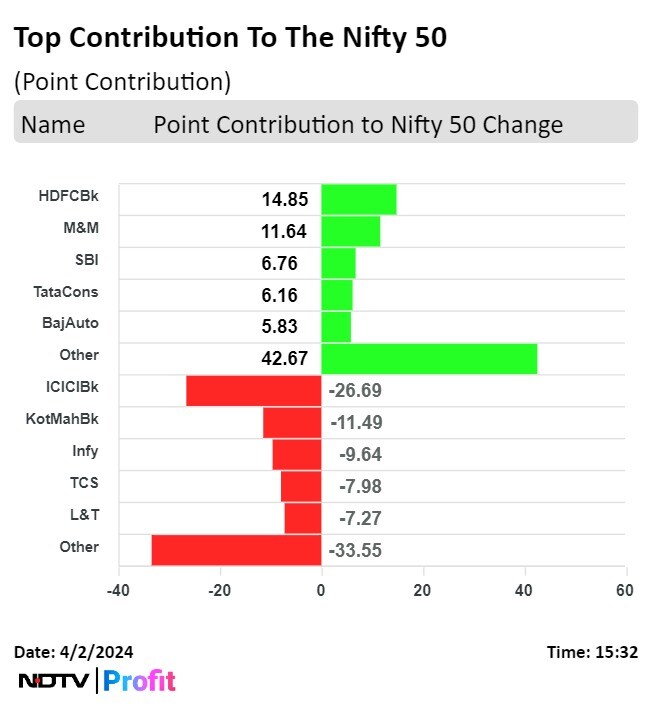

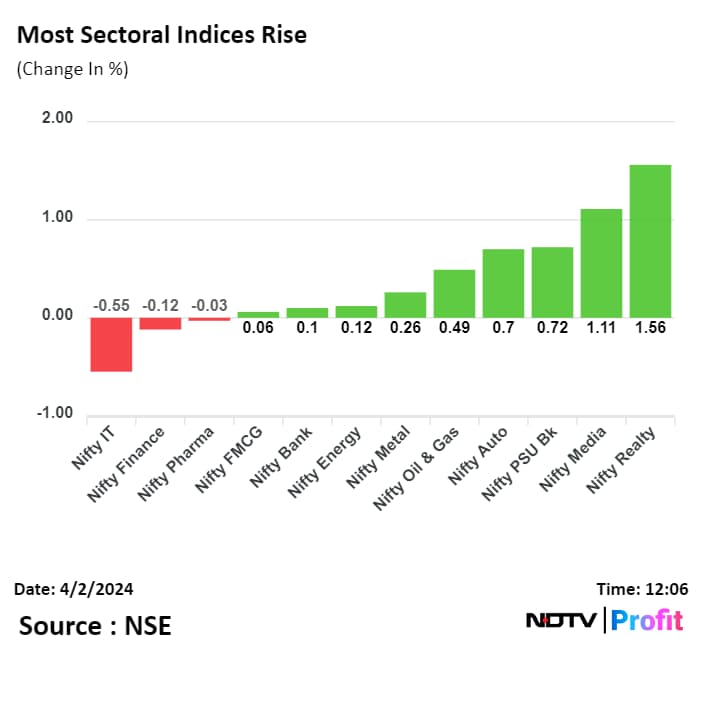

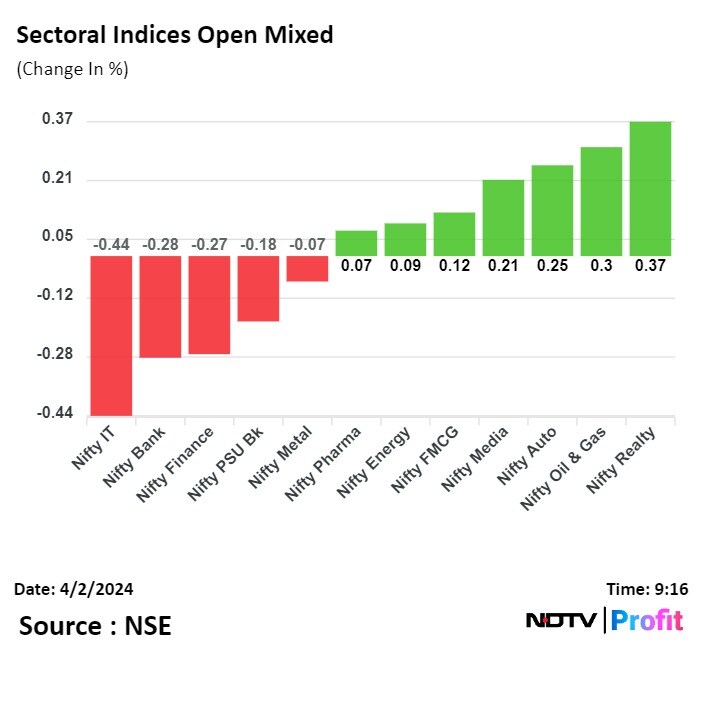

Nifty Media led the gains as most sectoral indices ended higher. On the other hand, Nifty IT fell the most.

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Shares of Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and ICICI Bank Ltd. weighed on the Nifty 50.

Meanwhile, those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., State Bank Of India, Tata Consumer Products Ltd., and Bajaj Auto Ltd. minimised the losses.

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Benchmark indices snapped their three-day rally as losses in IT stocks put pressure on them but mid and small cap banks led the outperformance in the broader indices.

The Nifty 50 ended at 22,453.30, down 8.70 points or 0.04% while the Sensex closed 110.64 points or 0.15% lower at 73,903.91.

From last two days the market witnessing range bound activity, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"For the traders now, 22350/73700 and 22500/74100 would act as key levels to watch out. On the higher side, above 22500/74100 the market could rally till 22600-22650/74500-74600," he said. "On the flip side, dismissal of 22350/73700 could accelerate the selling pressure. "

Shares of Larsen & Toubro Ltd., Tata Consultancy Services Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., and ICICI Bank Ltd. weighed on the Nifty 50.

Meanwhile, those of HDFC Bank Ltd., Mahindra & Mahindra Ltd., State Bank Of India, Tata Consumer Products Ltd., and Bajaj Auto Ltd. minimised the losses.

Nifty Media led the gains as most sectoral indices ended higher. On the other hand, Nifty IT fell the most.

Boarder markets outperformed benchmark indices. The S&P BSE Midcap rose 1.14%, and the S&P BSE Smallcap settled 1.28% higher.

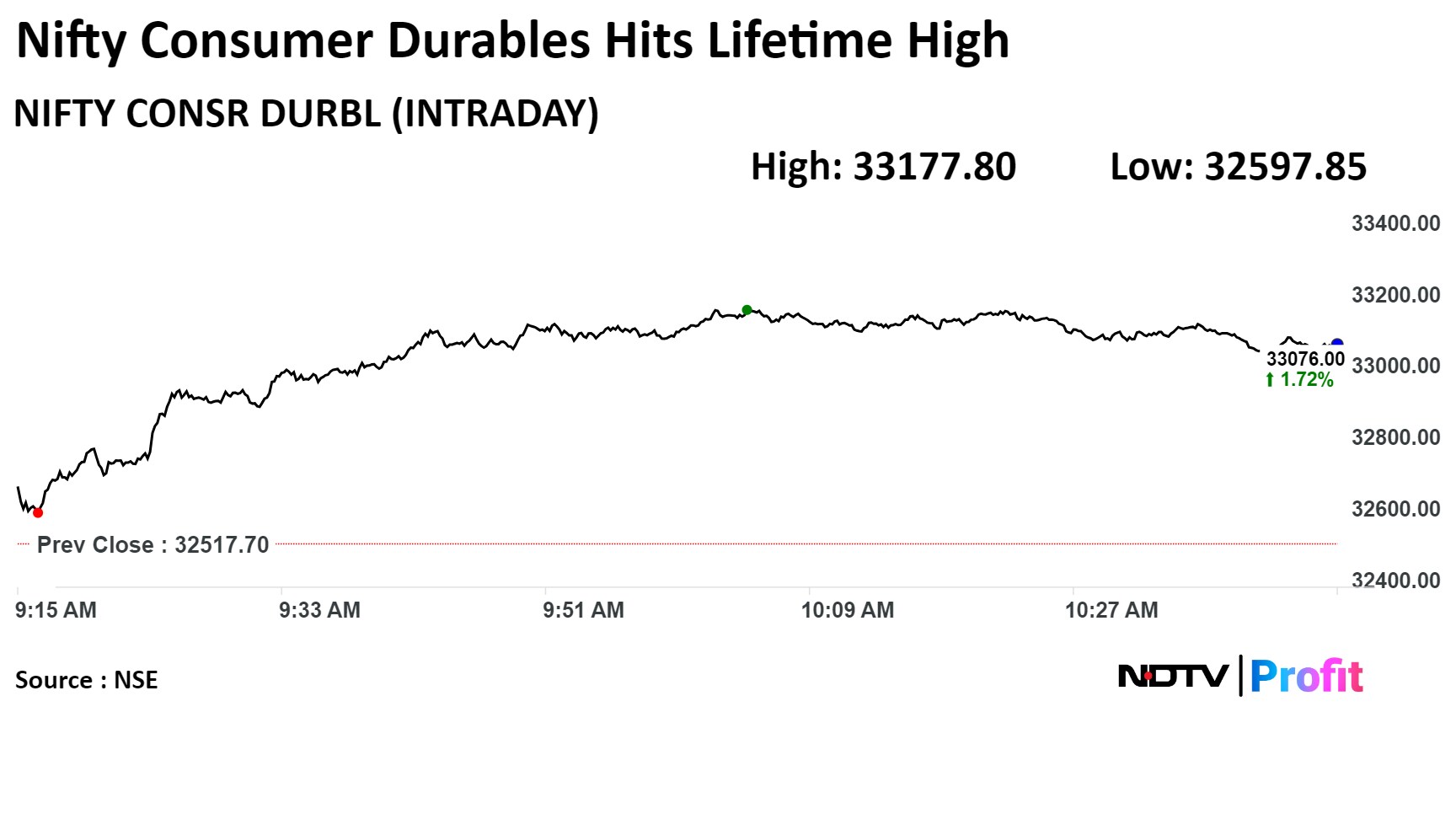

On BSE, 16 sectors advanced, and four declined. The S&P BSE Consumer Durable index was the top performing sector with over 1.82% gain. The S&P BSE TECK index fell the most among sectoral indices.

Market breadth was skewed in favour of buyers. Around 2,839 stocks rose, 1,009 stocks declined, and 112 stocks remained unchanged on BSE.

Q4 disbursements at Rs 15,300 crore, up 11% YoY

Q4 collection efficiency at 98%

Stage-3 as of March 31 at around 3.3% vs 4% as of Dec 31, 2023

Balance sheet liquidity at over Rs 7,650 crore

March disbursements at Rs 6,100 crore, up 9% YoY

March collection efficiency at 101%

Source: Exchange Filing

Board approves increasing borrowing limit to Rs 12,000 crore from Rs 7,500 crore

Source: Exchange Filing

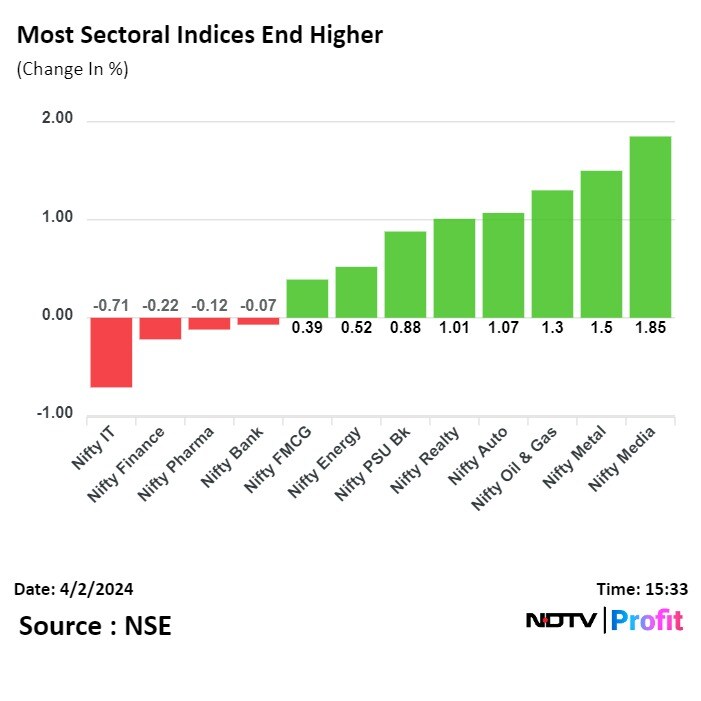

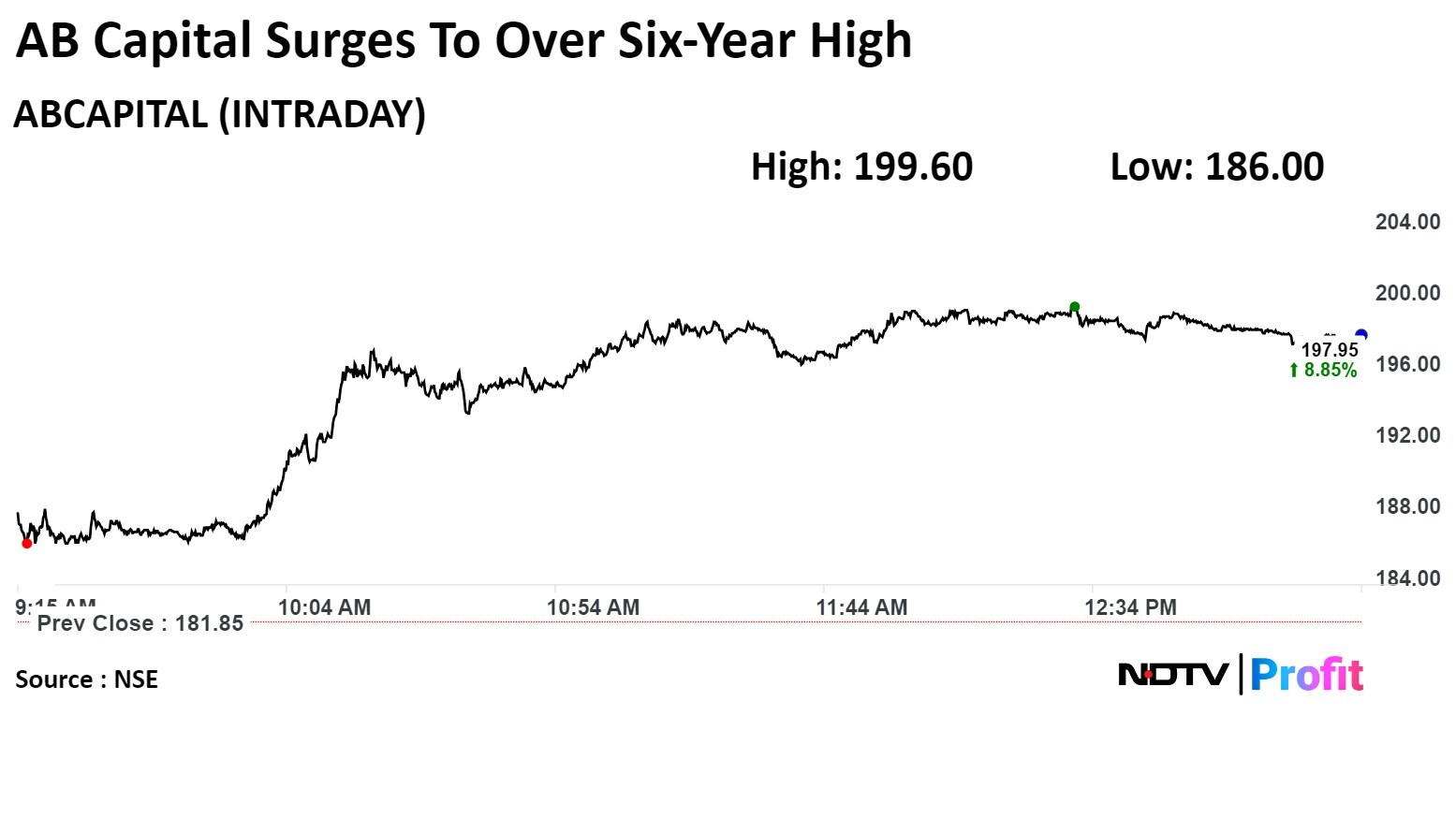

Macquarie has chosen Aditya Birla Capital as its top pick in the non-banking financial companies segment as it's on path to post strong growth in upcoming years.

Initiating coverage on the NBFC, Macquarie has rated the stock 'Outperform' with a target price at Rs 230, which implies upside of 26.48% from Monday's close.

Macquarie has chosen Aditya Birla Capital as its top pick in the non-banking financial companies segment as it's on path to post strong growth in upcoming years.

Initiating coverage on the NBFC, Macquarie has rated the stock 'Outperform' with a target price at Rs 230, which implies upside of 26.48% from Monday's close.

Aditya Birla Capital Ltd. rose as much as 9.76% to Rs 199.60, the highest level since Nov 29, 2017. It was trading 8.72% higher at Rs 197.70 as of 1:25 p.m., as compared to 0.24% decline in the NSE Nifty 50 index.

The scrip has risen 28.51% in 12 months. Total traded volume so far in the day stood at 7.9 times its 30-day average. The relative strength index was at 68.28.

Out of 10 analysts tracking the company, nine maintain a 'buy' rating, one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.1%.

Mining & export operations in Guinea impacted for the month of March

To impact company's consolidated Q4 results

Source: Exchange filing

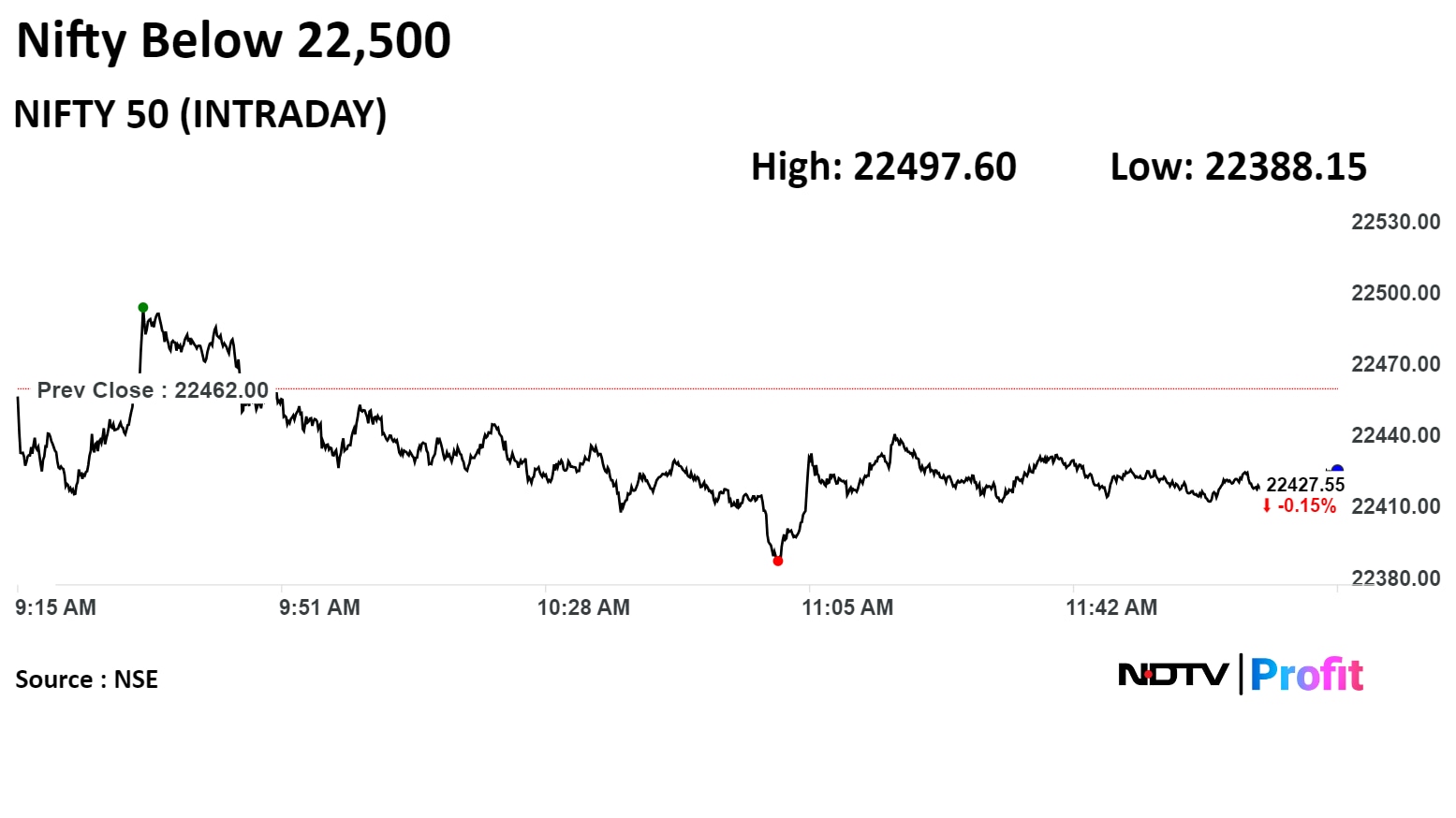

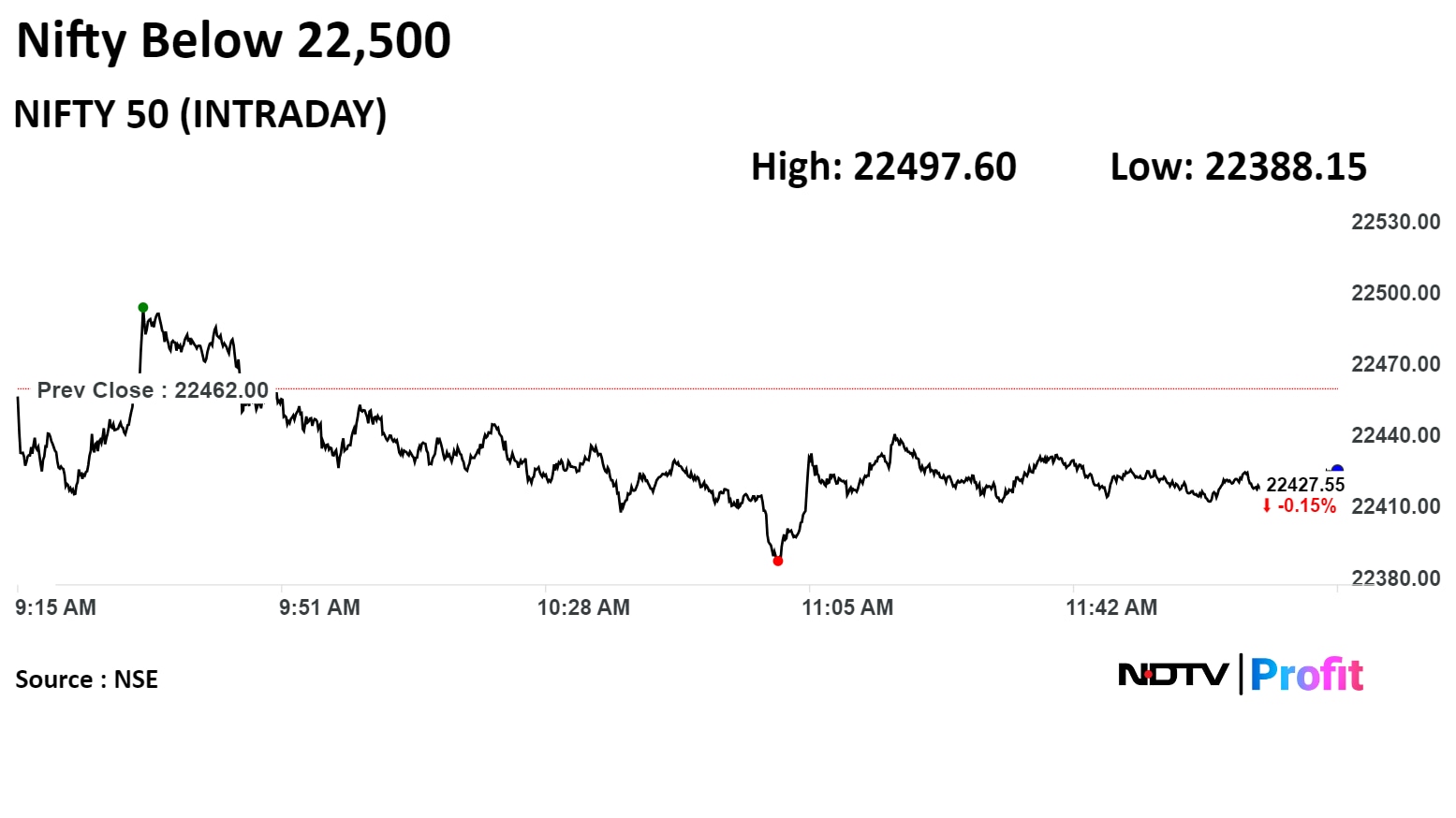

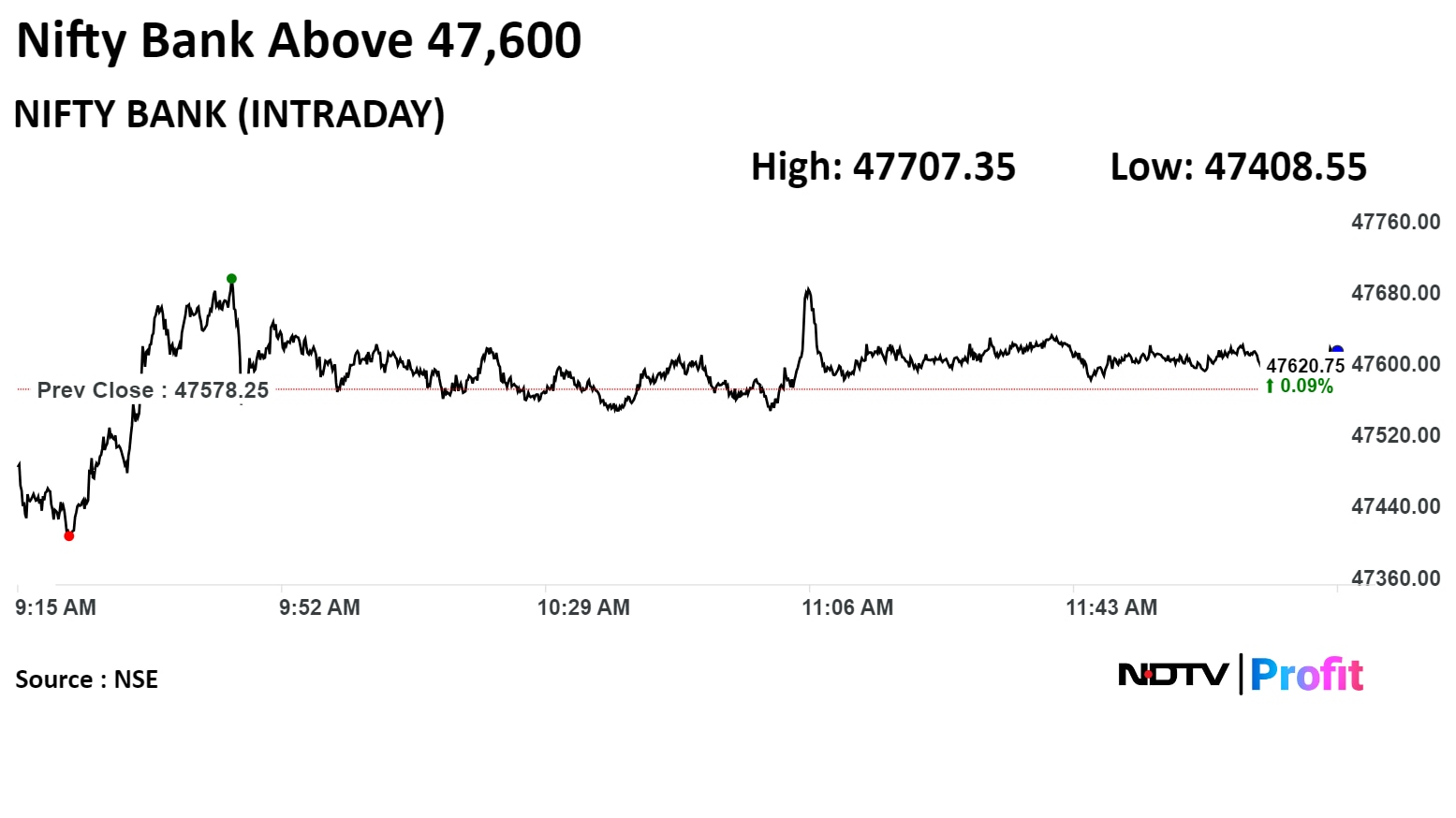

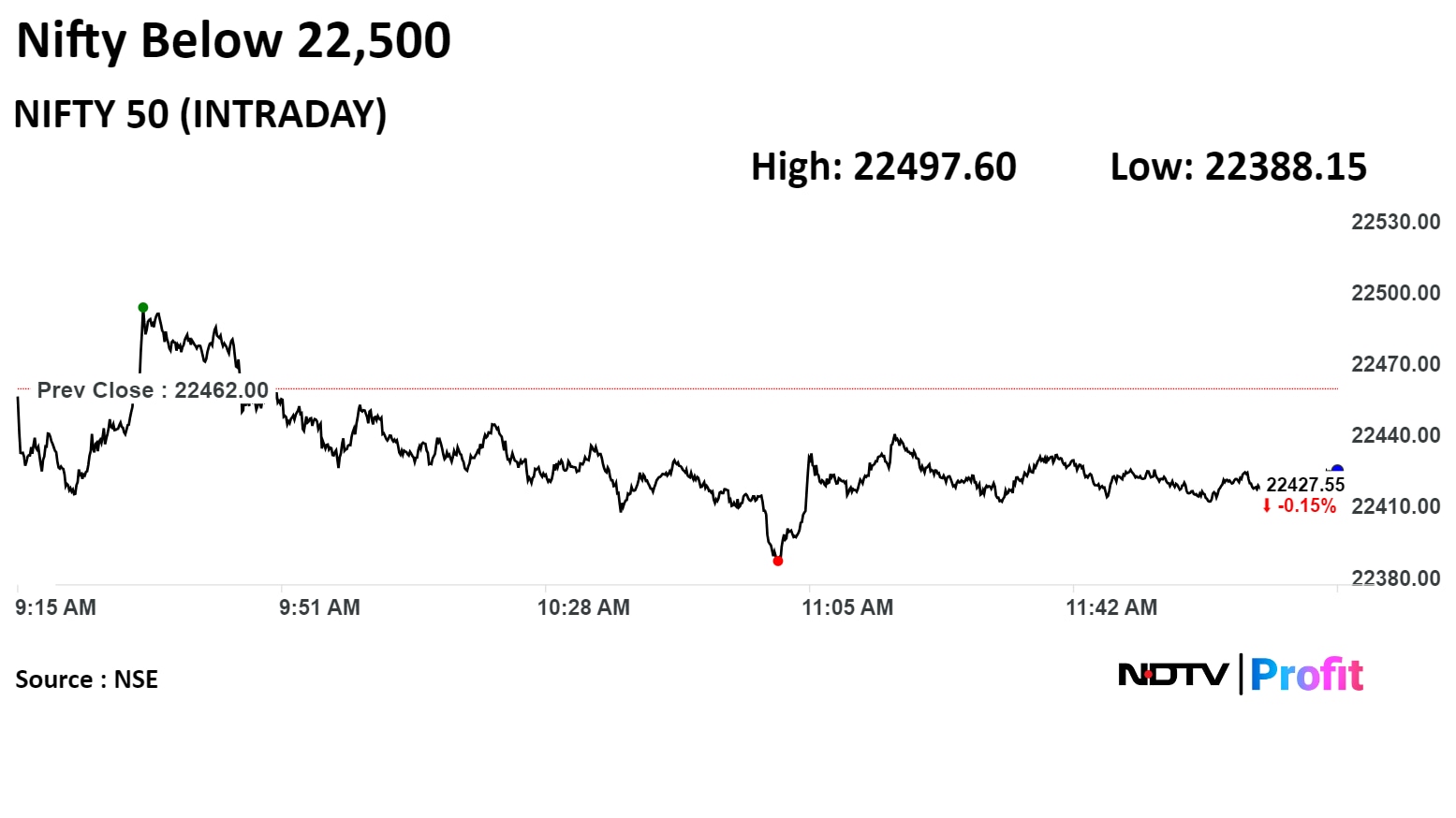

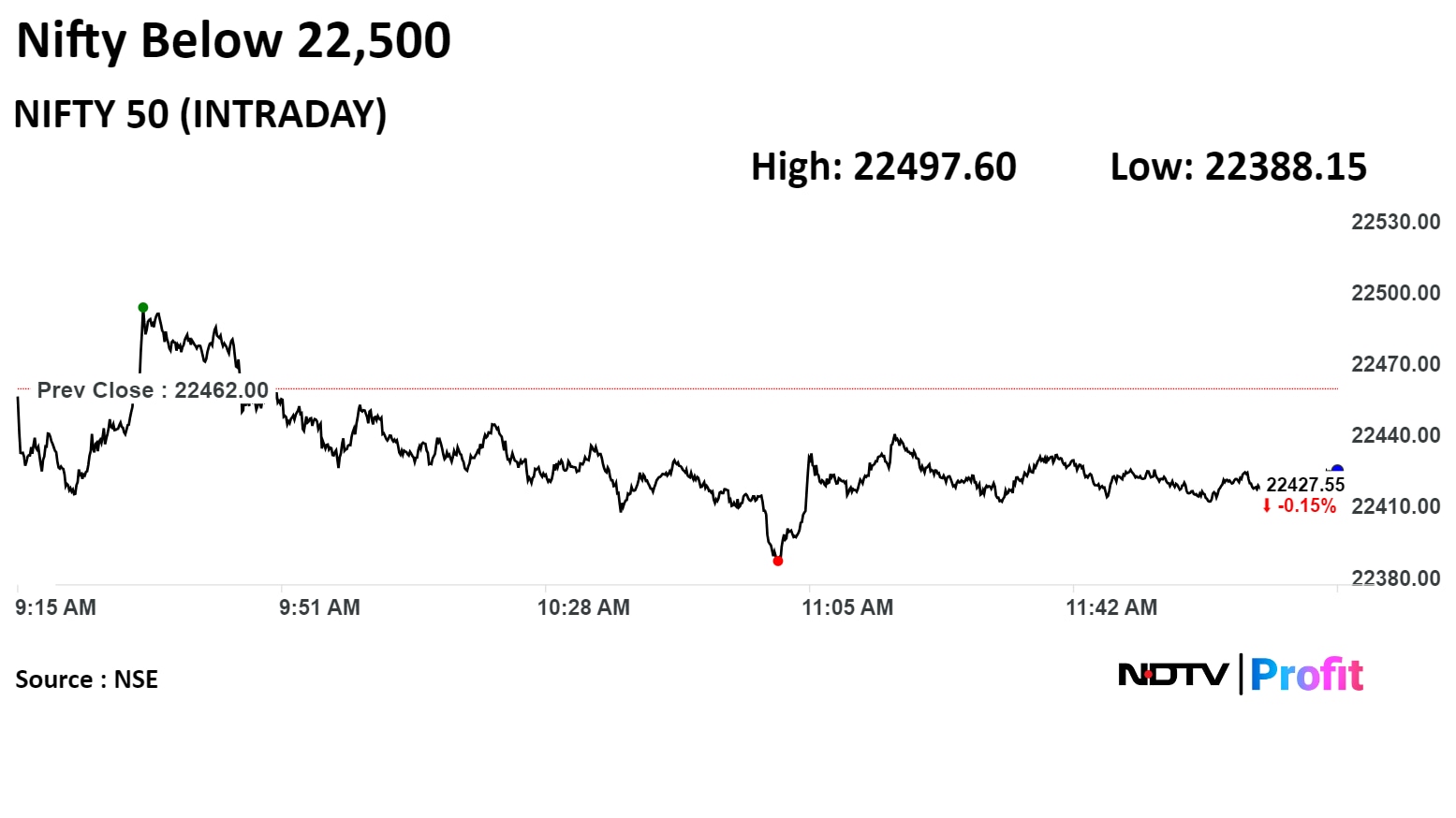

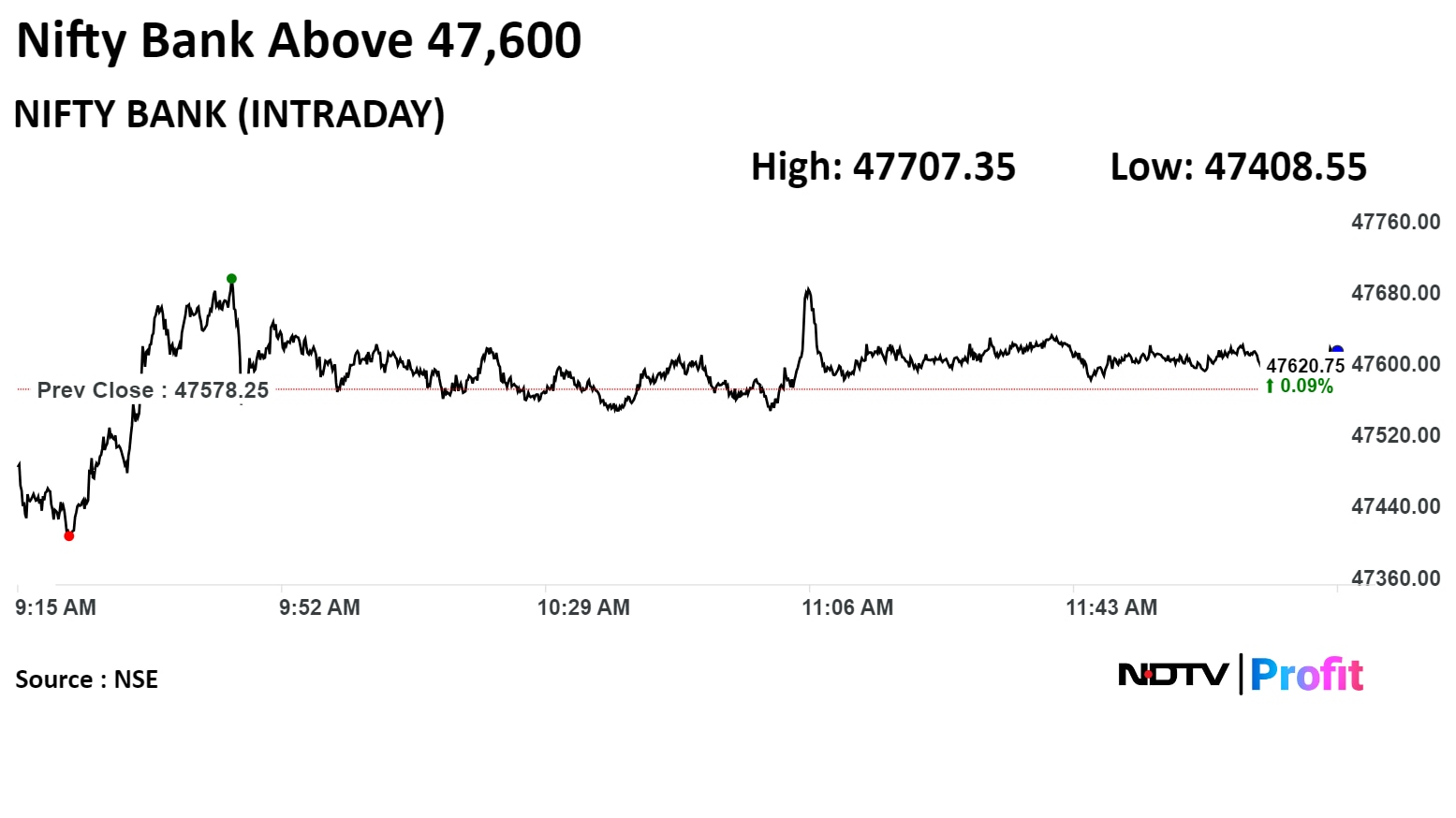

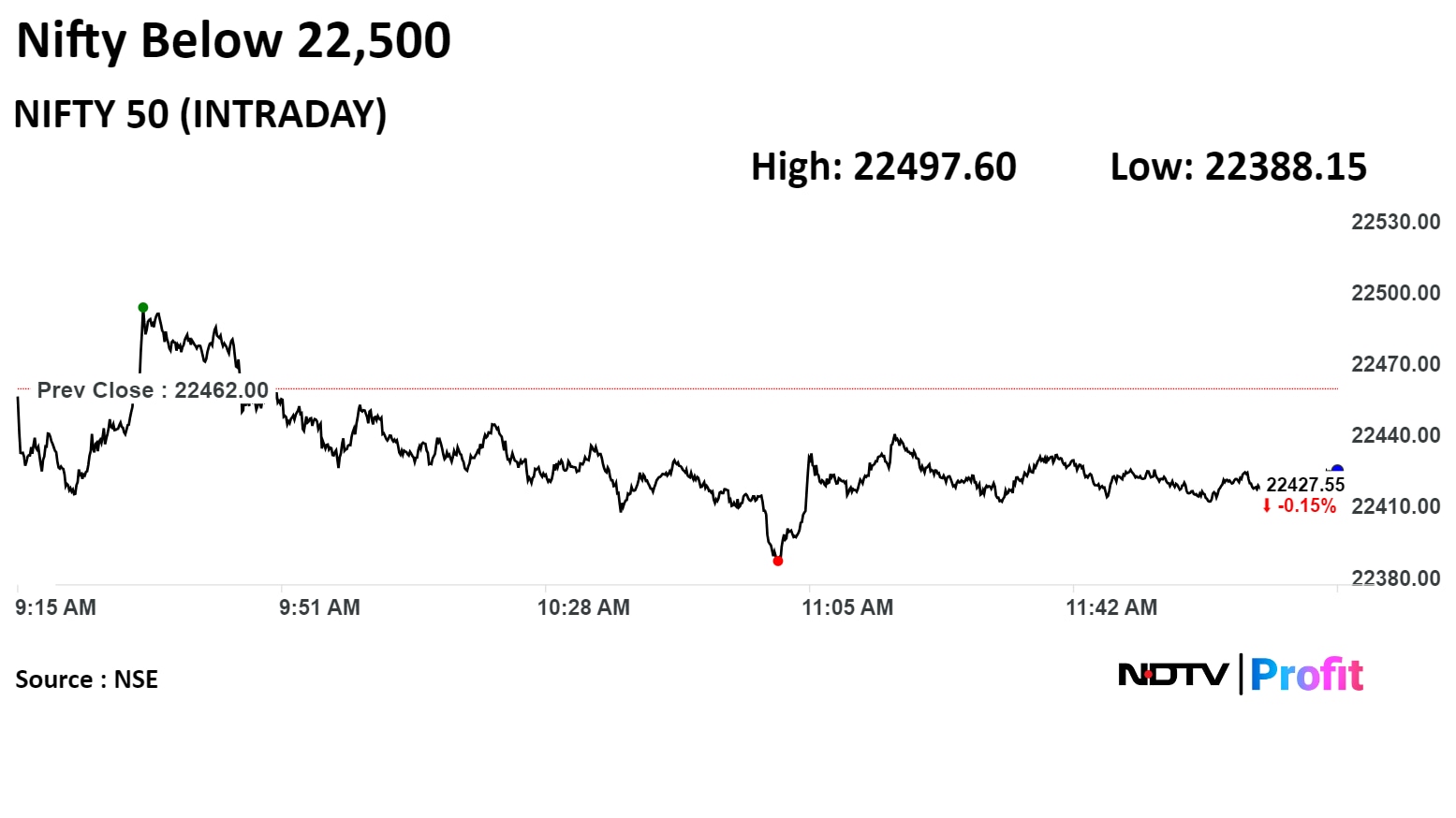

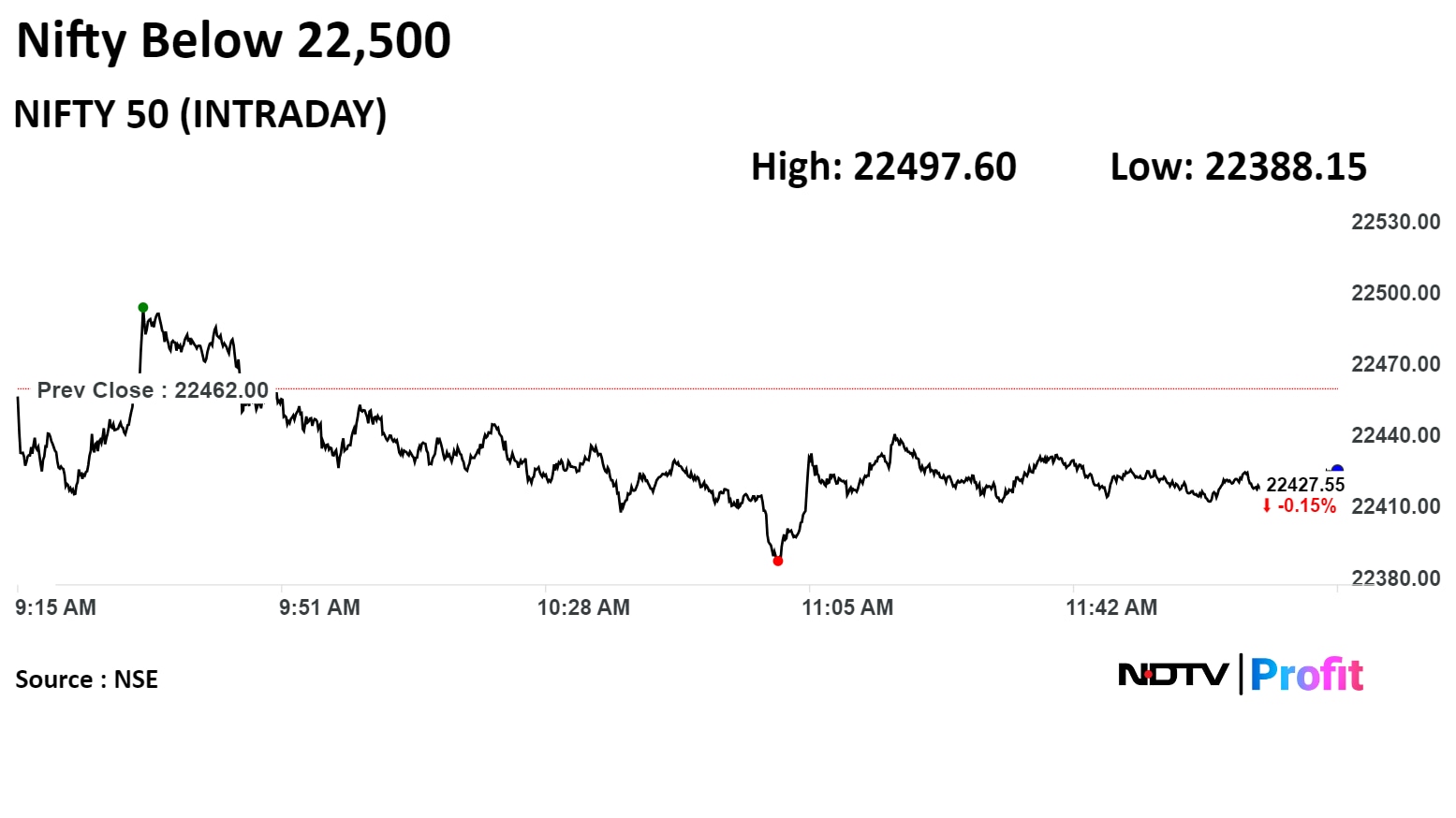

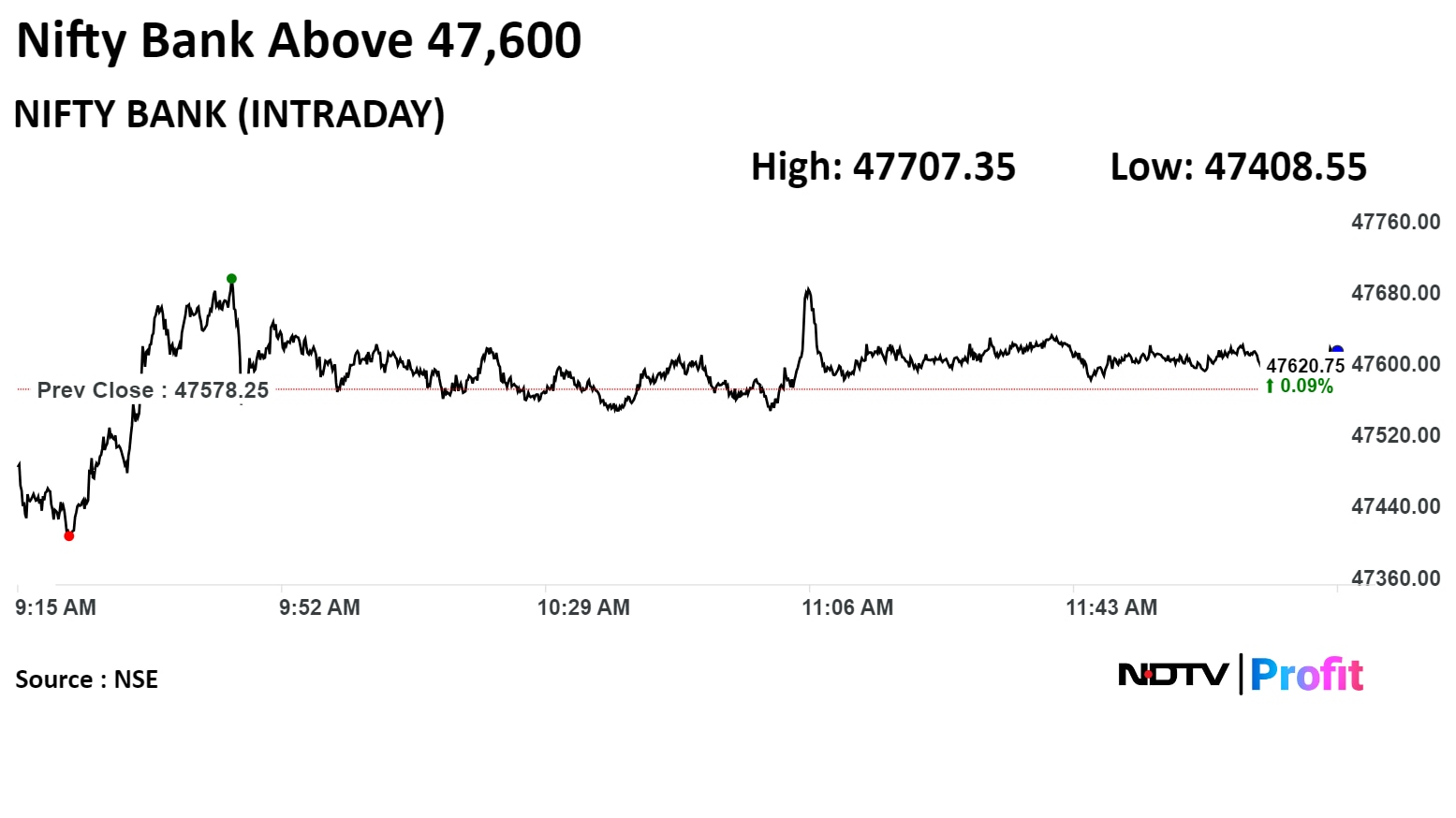

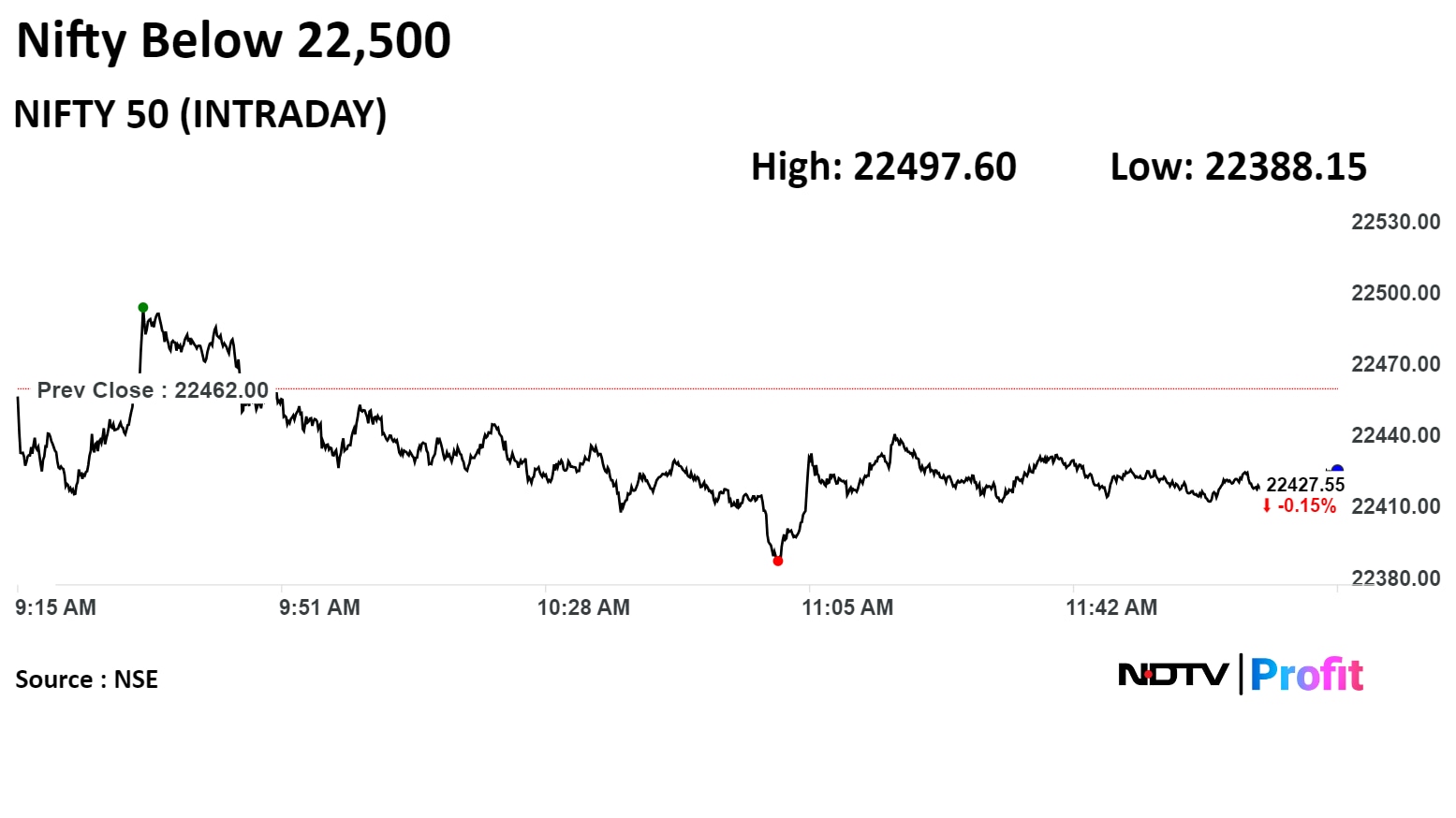

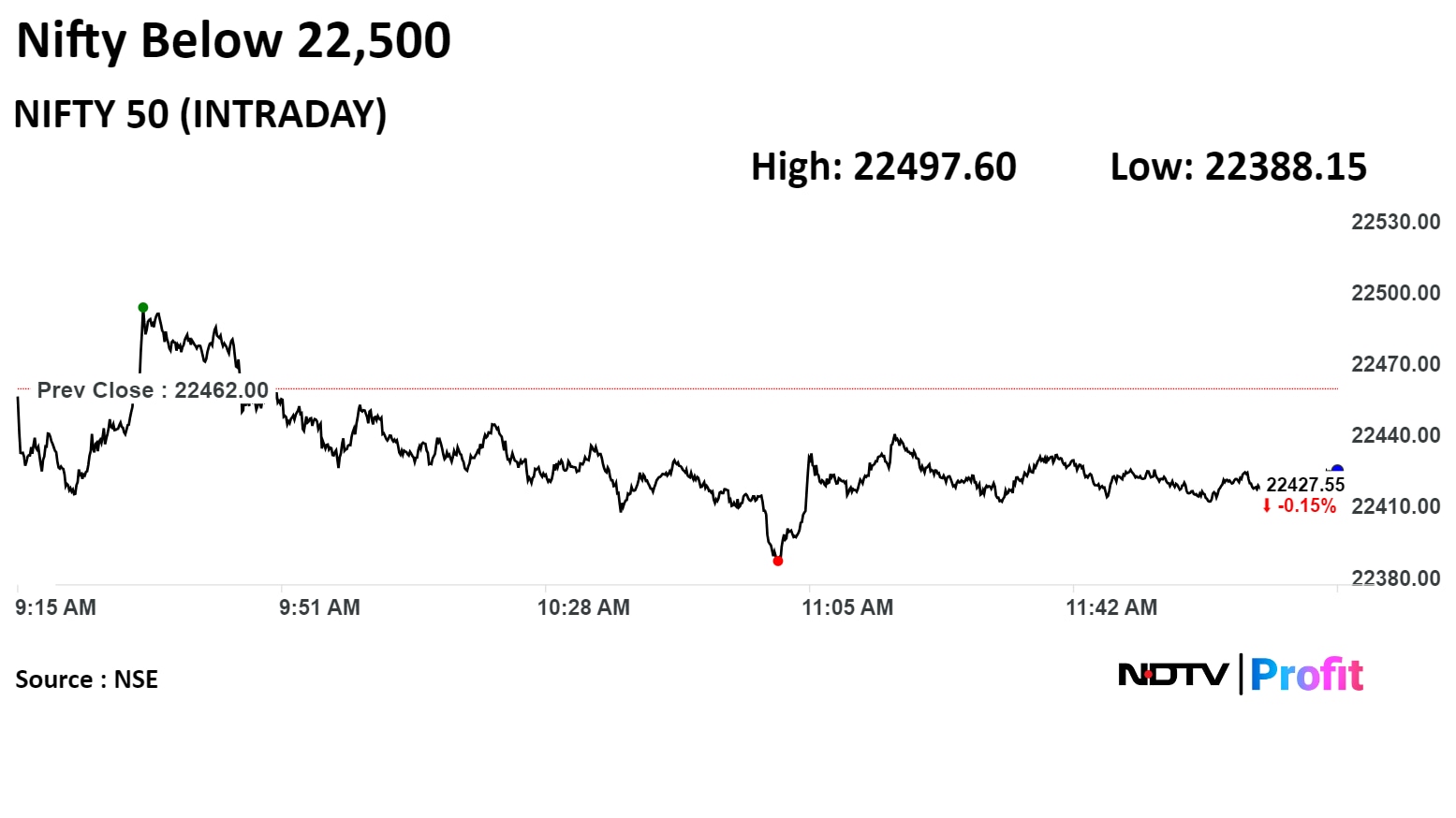

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

India's benchmark indices declined through midday on Tuesday on likely profit booking after hitting a fresh record high in the previous session.

Mixed global cues and worries of a delay in rate cuts by the Fed pulled IT stocks lower, led by Infosys Ltd. and Tata Consultancy Services Ltd.

As of 12:15 p.m., the NSE Nifty 50 was trading 40.05 points, or 0.18%, lower at 22,421.95, and the S&P BSE Sensex fell 172.22 points, or 0.23%, to trade at 73,842.33.

The Nifty fell 0.33% to hit an intraday low of 22,388.15, and the Sensex declined 0.36% to touch a low of 73,746.22 so far in the day.

"The short-term market trend is still positive. Our view is that the broader market structure is bullish, but a fresh uptrend rally is possible only after the rejection of 22,550/74,250," said Shrikant Chouhan, head of equity research at Kotak Securities.

Traders can take a contra trade around 22,325/22,300 with a stop loss of 22,200 levels, Chouhan said.

HDFC Bank Ltd., Bajaj Auto Ltd., Tata Motors Ltd., Adani Ports and Special Economic Zones Ltd., and Mahindra & Mahindra Ltd. were contributing to the Nifty.

Infosys Ltd., Tata Consultancy Services Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and ICICI Bank Ltd. were weighing on the index.

On NSE, nine sectoral indices were trading higher, while three declined. The NSE Nifty Realty rose the most, while the NSE Nifty IT fell the most among sectoral indices.

Broader markets outperformed benchmark indices with the S&P BSE Midcap rising 0.83% and the S&P BSE Smallcap gaining 1.02% through midday on Tuesday.

On BSE, 16 sectors advanced, while four declined. The S&P BSE Consumer Durables rose the most among sectoral indices, while the S&P BSE TECK index fell the most.

Market breadth was skewed in favour of buyers. Around 2,633 stocks rose, 1,019 stocks fell, and 121 stocks remained unchanged on BSE.

Commissions 3 MTPA integrated cement plant in Andhra Pradesh

Source: Exchange Filing

Sale to new subsidiary Mankind Consumer Products by Oct 1

To invest Rs 5 crore initially in Mankind Consumer Products, followed by a further investment of Rs 250 crore

Source: Exchange filing

In pact for EV charging technologies

Source: Exchange Filing

NTPC Records highest-ever yearly generation of 422 BU in FY24, up 6% YoY

Source: Press Release

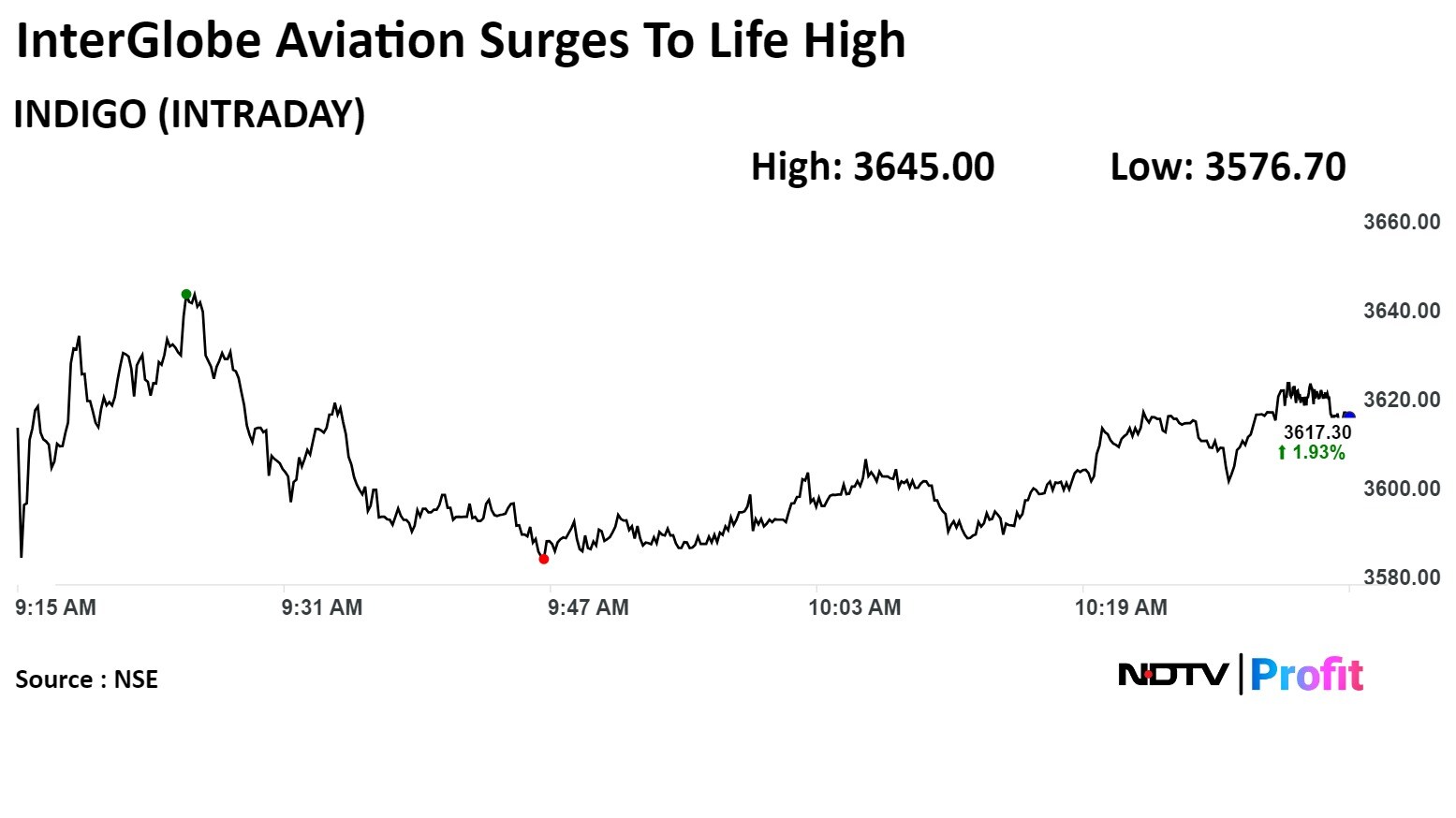

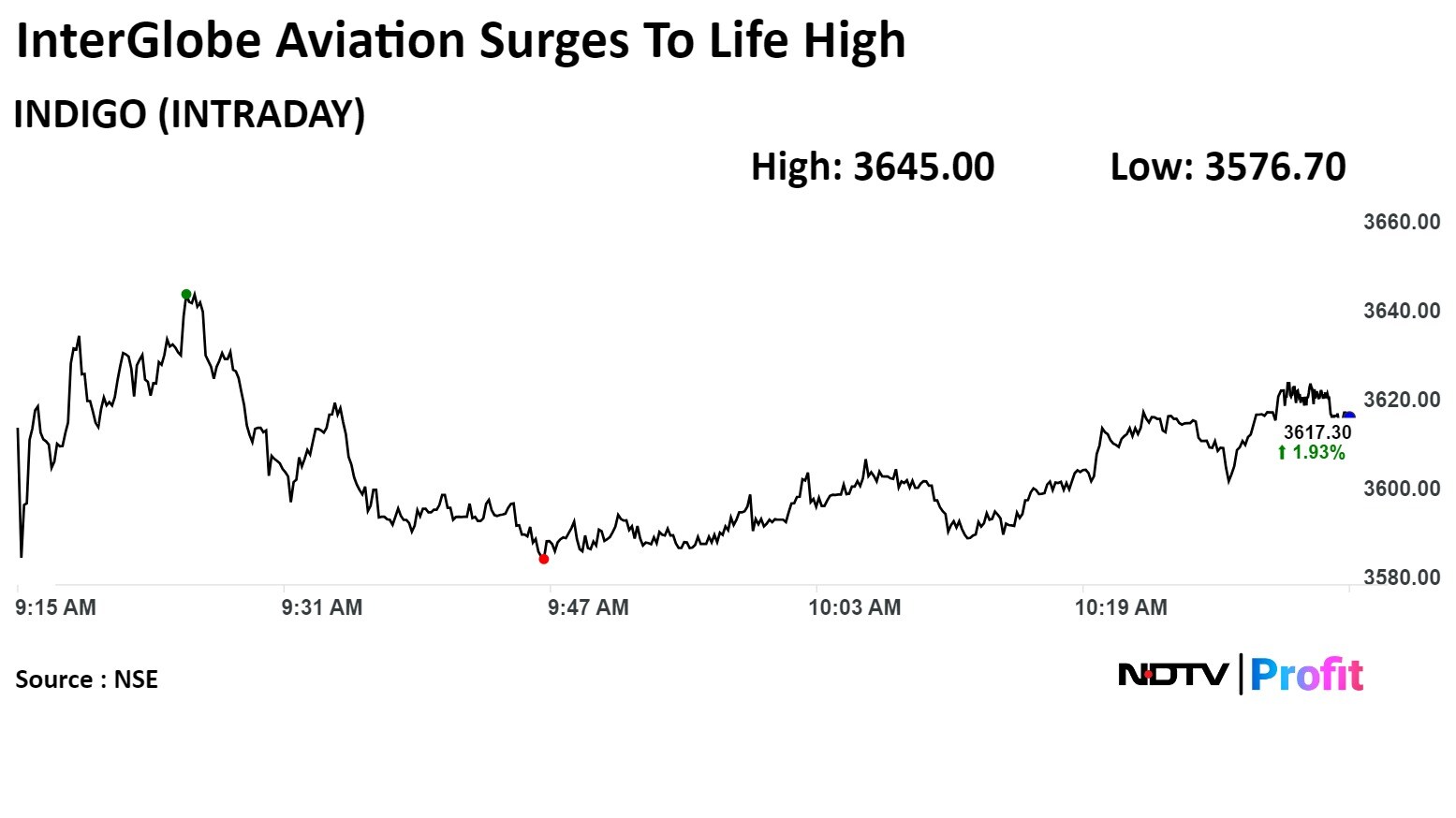

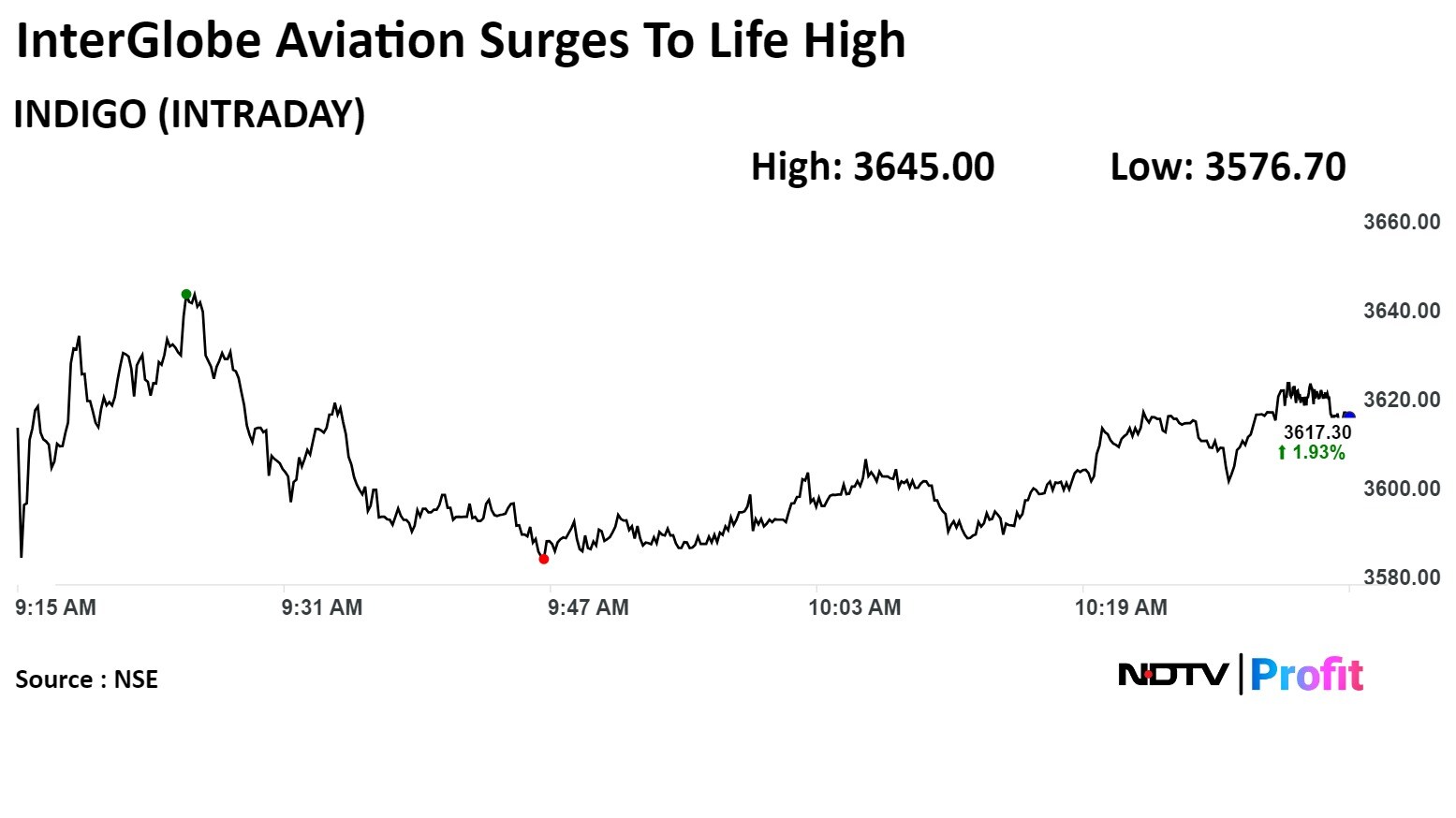

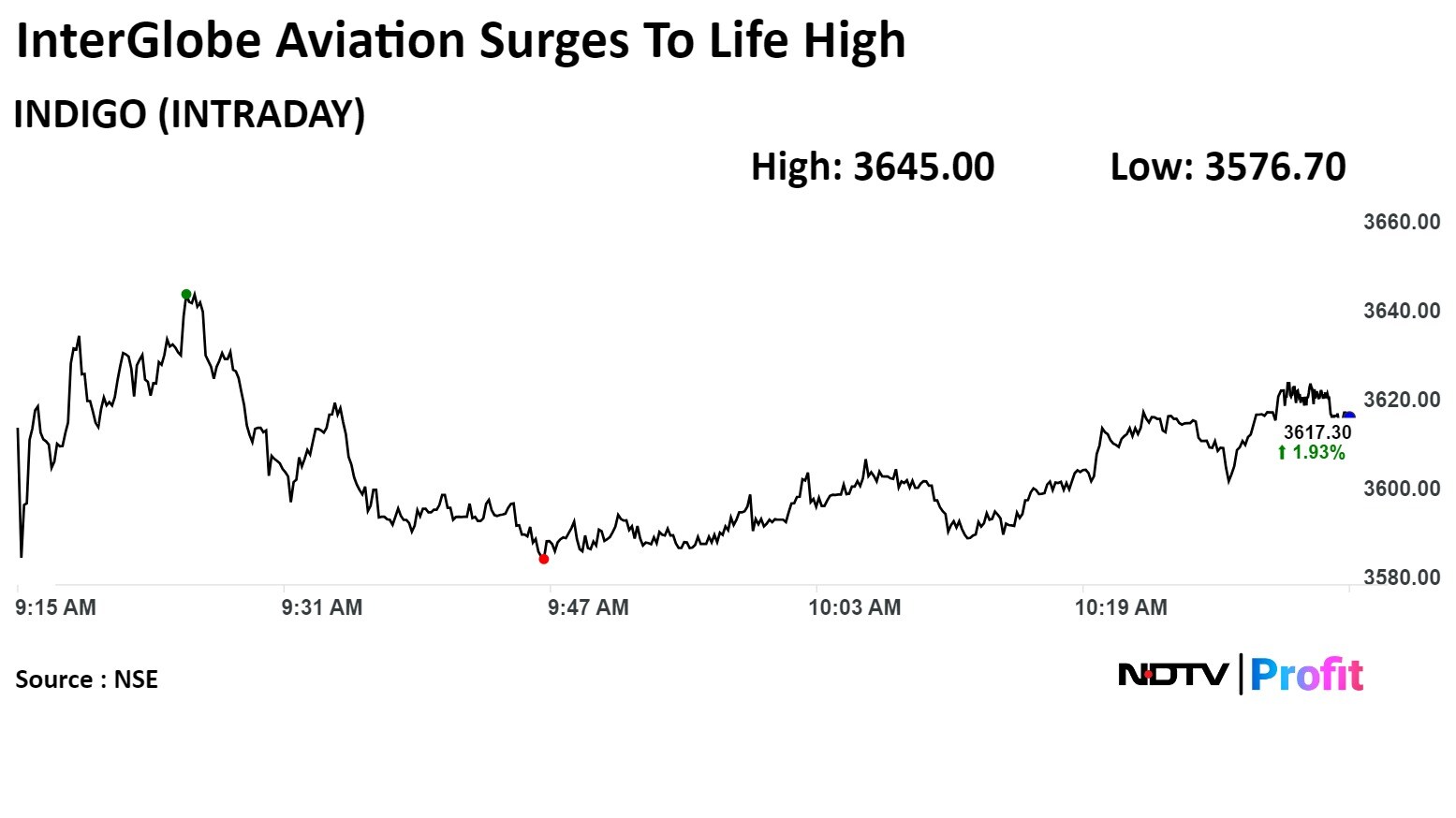

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. rose as much as 2.71% to Rs 3,645.00, the highest level since its listing on Nov 10, 2015. It was trading 1.11% higher at Rs 3,588.35 as of 11:08 a.m., compared to 0.17% decline in the NSE Nifty 50 index.

The scrip has gained 77.24% in 12 months. Total traded volume so far in the day stood at 0.30 times its 30-day average. The relative strength index was at 75.35.

Out of 22 analysts tracking the company, 17 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.3%.

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. rose as much as 2.71% to Rs 3,645.00, the highest level since its listing on Nov 10, 2015. It was trading 1.11% higher at Rs 3,588.35 as of 11:08 a.m., compared to 0.17% decline in the NSE Nifty 50 index.

The scrip has gained 77.24% in 12 months. Total traded volume so far in the day stood at 0.30 times its 30-day average. The relative strength index was at 75.35.

Out of 22 analysts tracking the company, 17 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.3%.

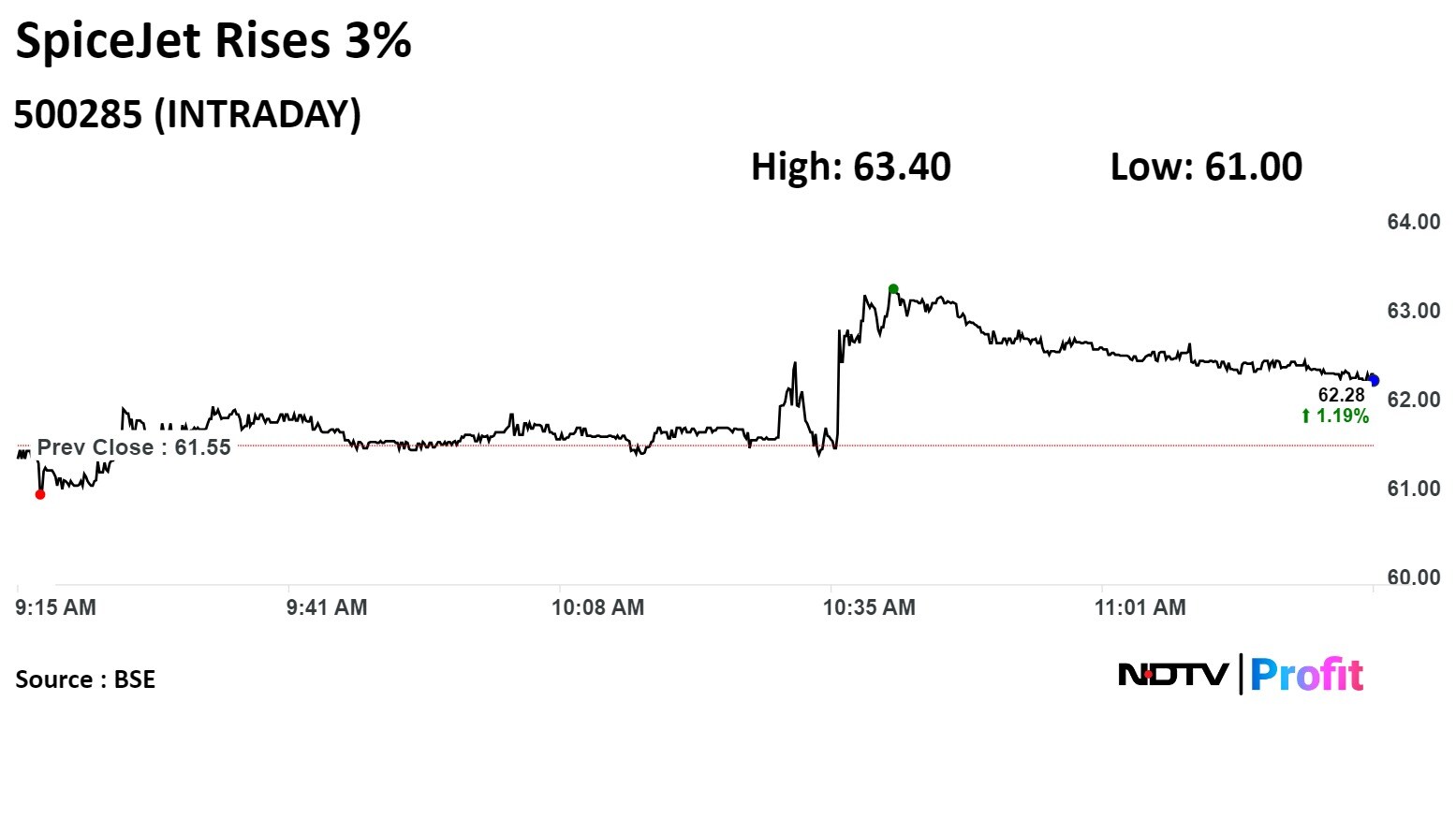

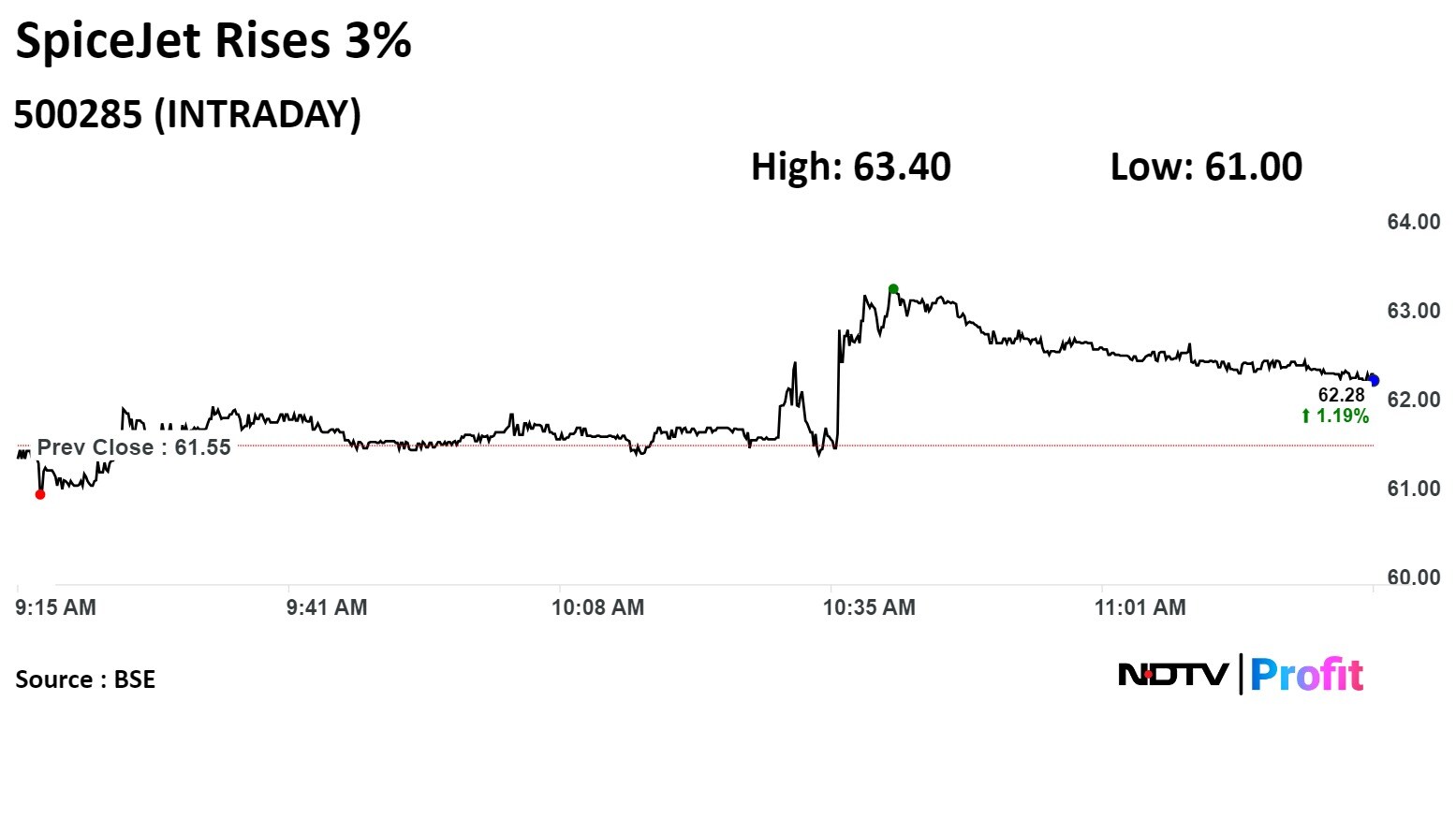

SpiceJet Ltd. rose as much as 3.01% to Rs 63.40, the highest level since March 11. It was trading 1.51% higher at Rs 62.48 as of 11:17 a.m., as compared to 0.14% decline in the S&P BSE Sensex index.

It has risen 101.55% in 12 months. The relative strength index was at 57.98.

Out of four analysts tracking the company, one maintains a 'buy' rating, three recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 28.9%.

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. rose as much as 2.71% to Rs 3,645.00, the highest level since its listing on Nov 10, 2015. It was trading 1.11% higher at Rs 3,588.35 as of 11:08 a.m., compared to 0.17% decline in the NSE Nifty 50 index.

The scrip has gained 77.24% in 12 months. Total traded volume so far in the day stood at 0.30 times its 30-day average. The relative strength index was at 75.35.

Out of 22 analysts tracking the company, 17 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.3%.

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. shares rose to a life time high on Tuesday while crisis in Tata Group airline Vistara deepened with further delays and cancellation of flights.

InterGlobe Aviation Ltd. rose as much as 2.71% to Rs 3,645.00, the highest level since its listing on Nov 10, 2015. It was trading 1.11% higher at Rs 3,588.35 as of 11:08 a.m., compared to 0.17% decline in the NSE Nifty 50 index.

The scrip has gained 77.24% in 12 months. Total traded volume so far in the day stood at 0.30 times its 30-day average. The relative strength index was at 75.35.

Out of 22 analysts tracking the company, 17 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.3%.

SpiceJet Ltd. rose as much as 3.01% to Rs 63.40, the highest level since March 11. It was trading 1.51% higher at Rs 62.48 as of 11:17 a.m., as compared to 0.14% decline in the S&P BSE Sensex index.

It has risen 101.55% in 12 months. The relative strength index was at 57.98.

Out of four analysts tracking the company, one maintains a 'buy' rating, three recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 28.9%.

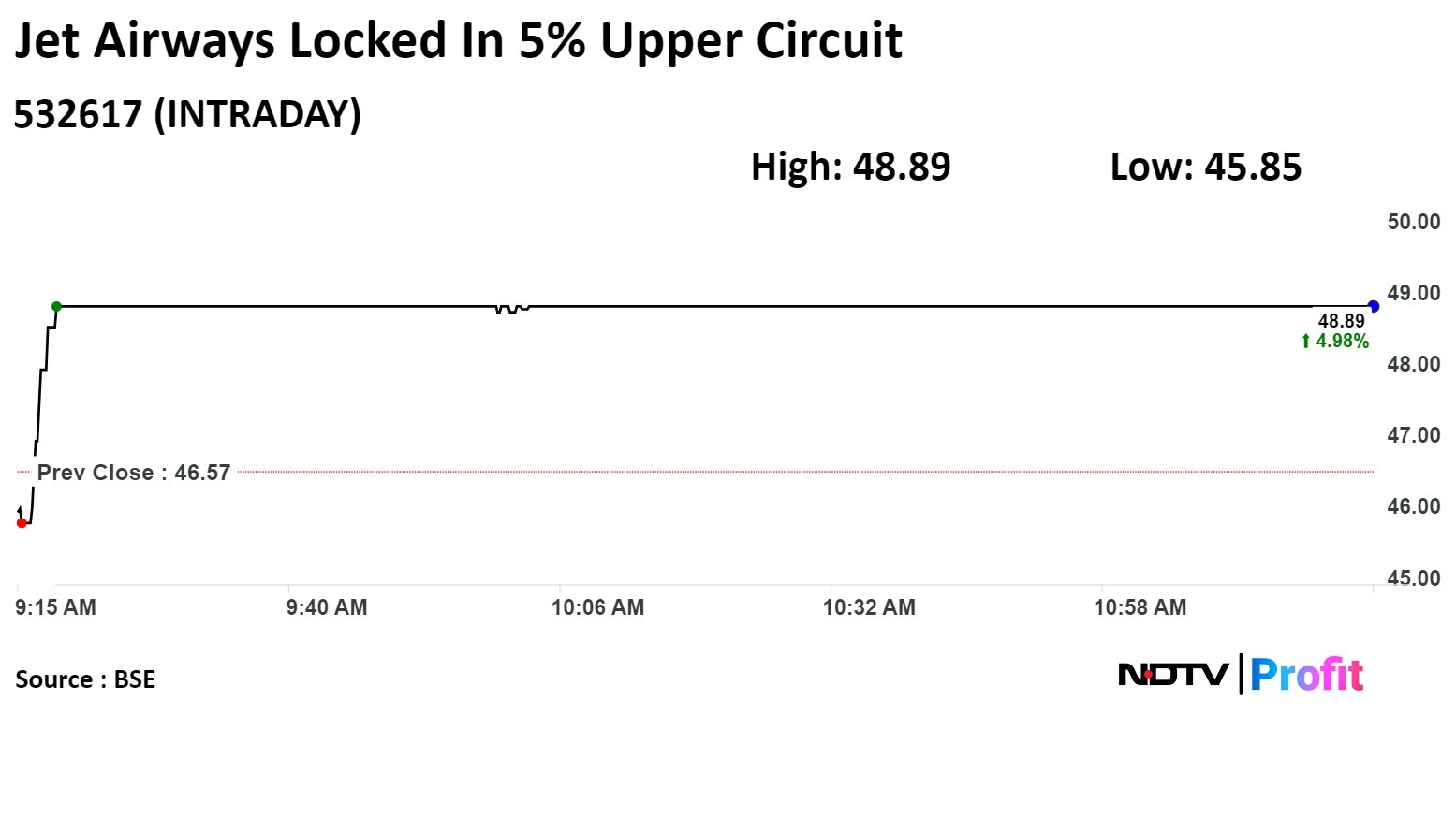

On NSE, Jet Airways India Ltd. hit a 5% upper circuit, and rose to Rs 49.10, the highest level since March 28. It remained locked in the upper circuit as of 11:25 a.m. as compared to 0.18% decline in the NSE Nifty 50 index.

The scrip has declined 18.78% in 12 months. Total traded volume so far in the day stood at 4.8 times its 30-day average. The relative strength index was at 47.08.

To buy stake for Rs 17.2 crore

Source: Exchange Filing

Got project worth Rs 520 crore from Jodhpur Vidyut Vitran Nigam in JV with Solar91 Cleantech

Source: Exchange Filing

To provide supply chain finance operations

Source: Exchange Filing

Target Price Unchanged at Rs 500 on 8.5x FY26e EPS

FY24 operating performance better than expectations

Supply to power sector exceeded demand by 8.5mt

Management indicated production & sales volume target of 838mt each

Estimates production at 820mt and sales volume at 811mt

Supply to NRS likely to stay elevated due to better rake availability and pit-head inventory

Gets 2 LoAs worth Rs 156 crore from Jodhpur Vidyut Vitran Nigam for solar power plants

Source: Exchange Filing

FY24 ore production at 3.78 MT, up 13% YoY

FY24 metal in concentrate output at 27,404 tons, up 11% YoY

Source: Exchange Filing

Kheda plant has potential to generate 50,000-60,000 units of carbon credits annually, expected to generate annual revenue of Rs 100 crore

Co holds 52% stake in JV with Thailand-based SCG International

Source: Exchange Filing

March wholesales hit a speedbreaker

PV witnessed demand moderation with higher year end discounts

2W fell short of analyst expectations but EVs were a key positive

Tractors and CV on a slow road; on high base and election led pause

CV outlook receovery only in H2FY25

Buy on Maruti and Tata Motors

To get aircraft as part of settlement inked last year

Company to now have a total of 6 Q400 aircraft from NAC

4 major settlements that were recently announced to result in savings worth Rs 1,252 crore

Source: Exchange filing

Manufacturing PMI rises to 16-year high of 59.1 in March

India records highest manufacturing PMI reading since Feb 2008

Source: S&P Global

Reiterates 'Underperform'

Expect softer net adds in Q4 led by higher-than-expected churn

Collections growth also to slow down

See near-term impact on growth as company looks to defocus on monthly plan

Better margin on lower opex to aid overall growth

Limited visibility on churn reduction

Reduce FY25/26 EPS on lower revenue growth

Signs 25-year power purchase agreement with Clean Renewable SPV

Source: Exchange filing

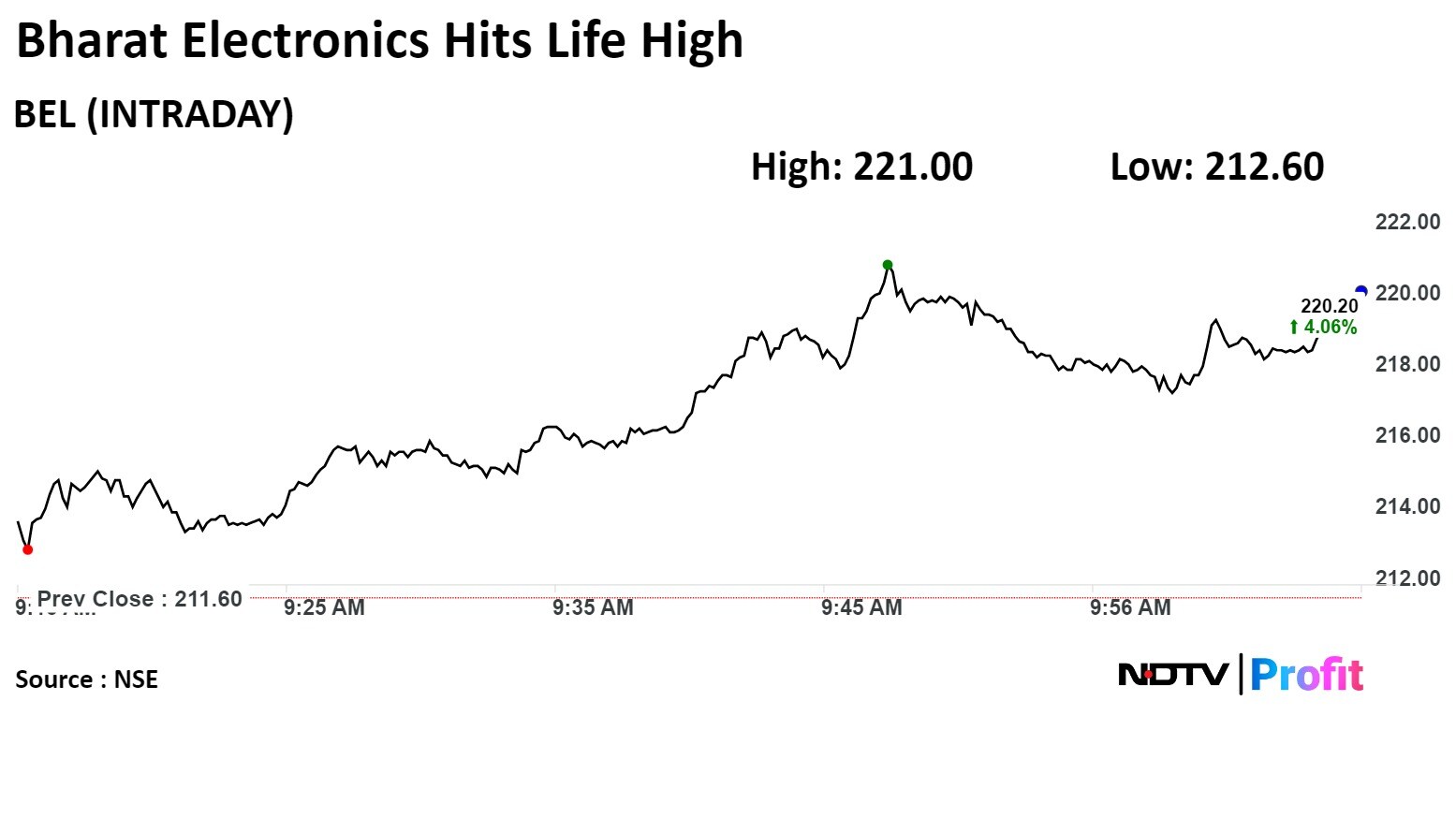

Bharat Electronics rose to fresh high after the company has recorded turnover of Rs 19,700 Crore in FY24, which is 13.7% higher from Rs 17,333 Crore in FY23, according to an exchange filing.

It's order book stands at Rs 76,000 crore as on April 1.

Bharat Electronics rose to fresh high after the company has recorded turnover of Rs 19,700 Crore in FY24, which is 13.7% higher from Rs 17,333 Crore in FY23, according to an exchange filing.

It's order book stands at Rs 76,000 crore as on April 1.

Bharat Electronics rose as much as 4.69% to Rs 221.00 apiece, the highest level since Jul 19, 2000. It was trading 4.57% higher at Rs 220.75 apiece, as of 10:13 a.m. This compares to a 0.15% decline in the NSE Nifty 50 Index.

It has risen 128.00% in 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 69.49.

Out of 33 analysts tracking the company, 17 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 2.2%.

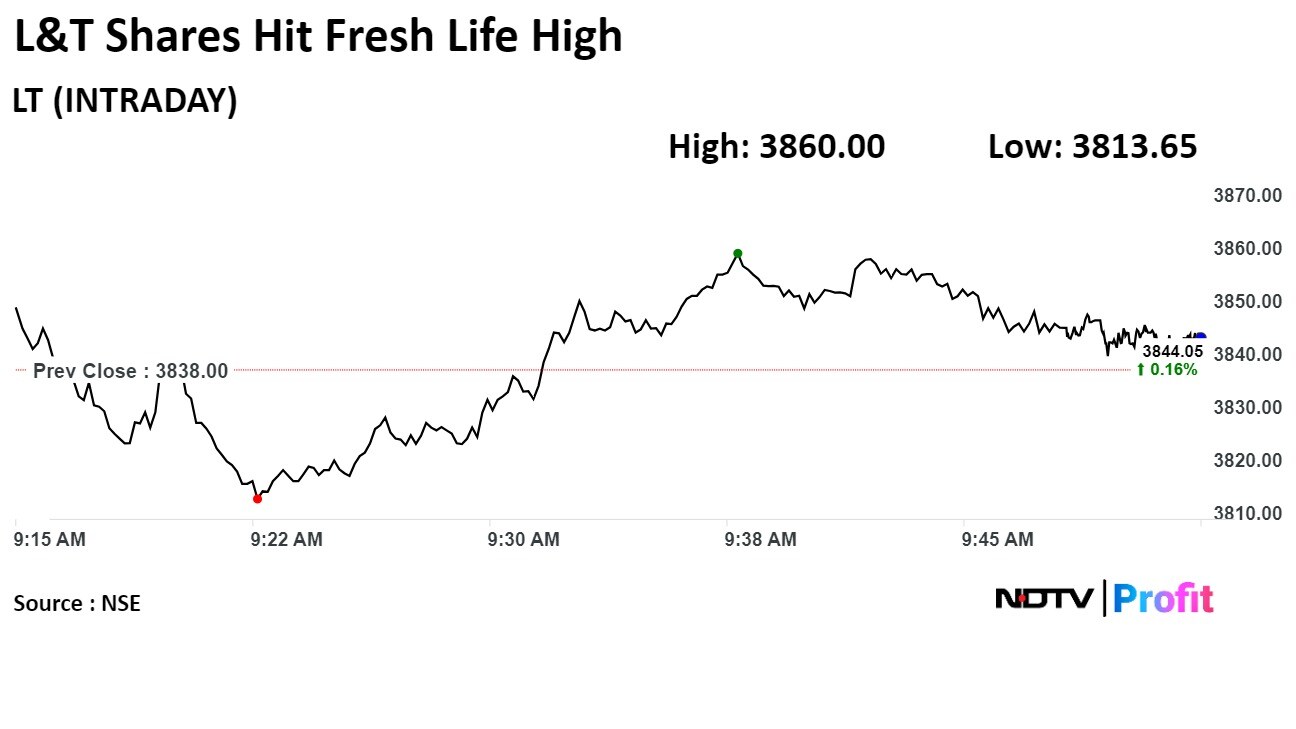

Shares of Larsen and Toubro Ltd. hit an all-time high on Tuesday after its target price was raised by Citi Research, citing the ongoing capex upcycle and potential rerating in the sector.

Citi has raised its target price for the multinational conglomerate to Rs 4,373 per share from an earlier Rs 4,082 per share. The revised target price implies a potential upside of 14% from Monday's closing on the BSE.

Shares of Larsen and Toubro Ltd. hit an all-time high on Tuesday after its target price was raised by Citi Research, citing the ongoing capex upcycle and potential rerating in the sector.

Citi has raised its target price for the multinational conglomerate to Rs 4,373 per share from an earlier Rs 4,082 per share. The revised target price implies a potential upside of 14% from Monday's closing on the BSE.

Shares of L&T rose as much as 0.57% to hit an all-time high of Rs 3,860 apiece on the NSE. It was trading 0.19% higher at Rs 3,845.4 apiece, compared to a 0.02% deline in the benchmark Nifty 50 as of 9:52 a.m.

The stock has risen 77.09% in the past 12 months. The relative strength index was at 70.

Thirty out of the 35 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.6%.

Target price: Rs 230

Top pick in NBFC space

Poised to show strong growth in earnings and lending

Moats: strong parentage, leveraging group strength, diversified products, strong leadership

Stock has potential to double in 3years

TP based on SOTP valuation; 1.9x PBV on NBFC and 1.4x on HFC

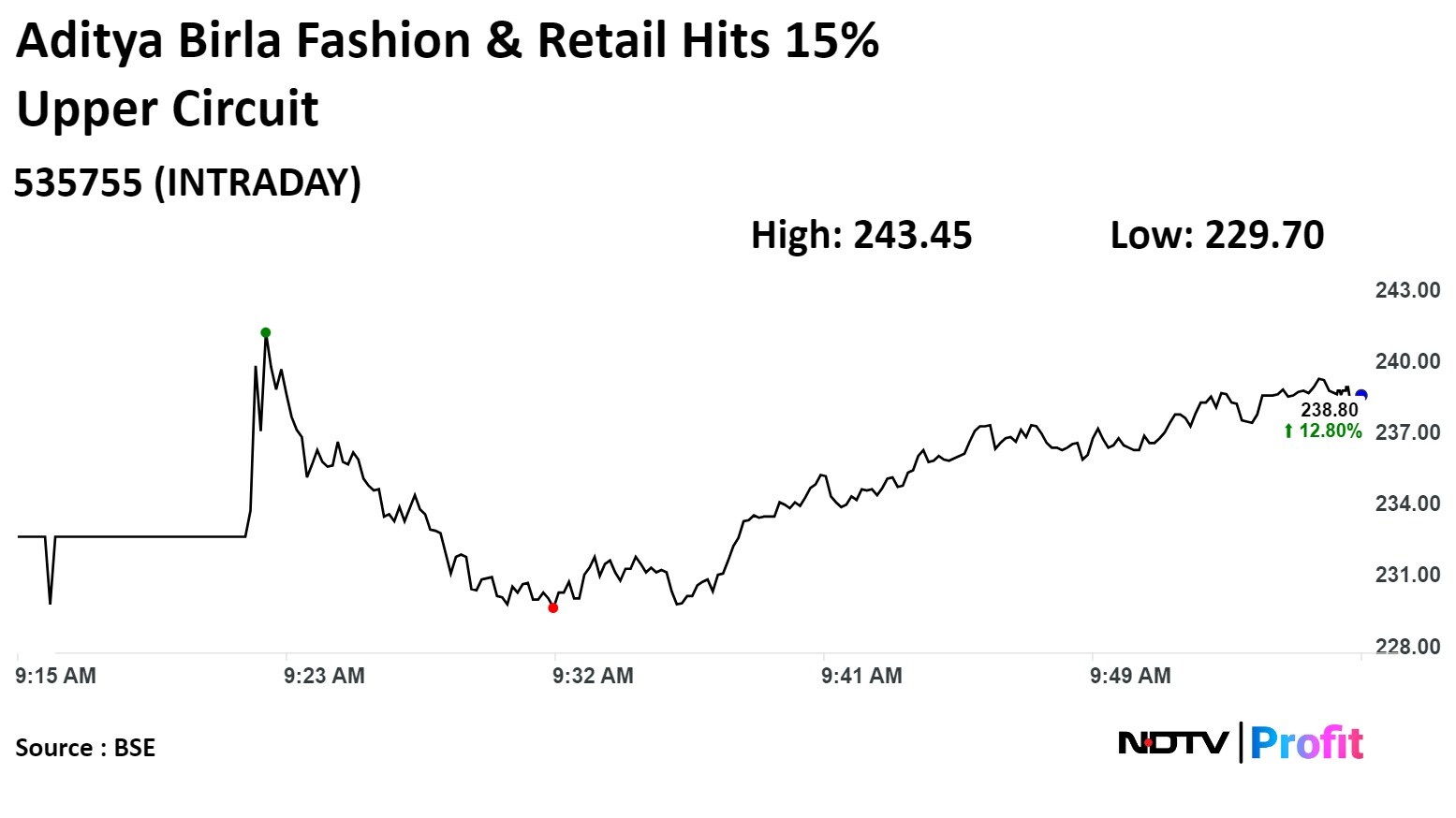

Aditya Birla Fashion and Retail Ltd. hit a 15% upper circuit as the company announced a demerger with Madura Fashion & Lifestyle Business.

Shareholders of Aditya Birla Fashion and Retail will have identical ownership in the new entity, the exchange filing said.

Aditya Birla Fashion and Retail Ltd. hit a 15% upper circuit as the company announced a demerger with Madura Fashion & Lifestyle Business.

Shareholders of Aditya Birla Fashion and Retail will have identical ownership in the new entity, the exchange filing said.

The scrip hit 15.00% upper circuit and rose to Rs 243.45 apiece, the highest level since Feb 2. It pared gains to trade 11.71% higher at Rs 236.50 apiece, as of 09:47 a.m. This compares to a 0.07% decline in the S&P BSE Sensex Index.

It has risen 9.67% in 12 months. Total traded volume so far in the day stood at 51 times its 30-day average. The relative strength index was at 65.01.

Out of 24 analysts tracking the company, five maintain a 'buy' rating, nine recommend a 'hold,' and 10 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.7%.

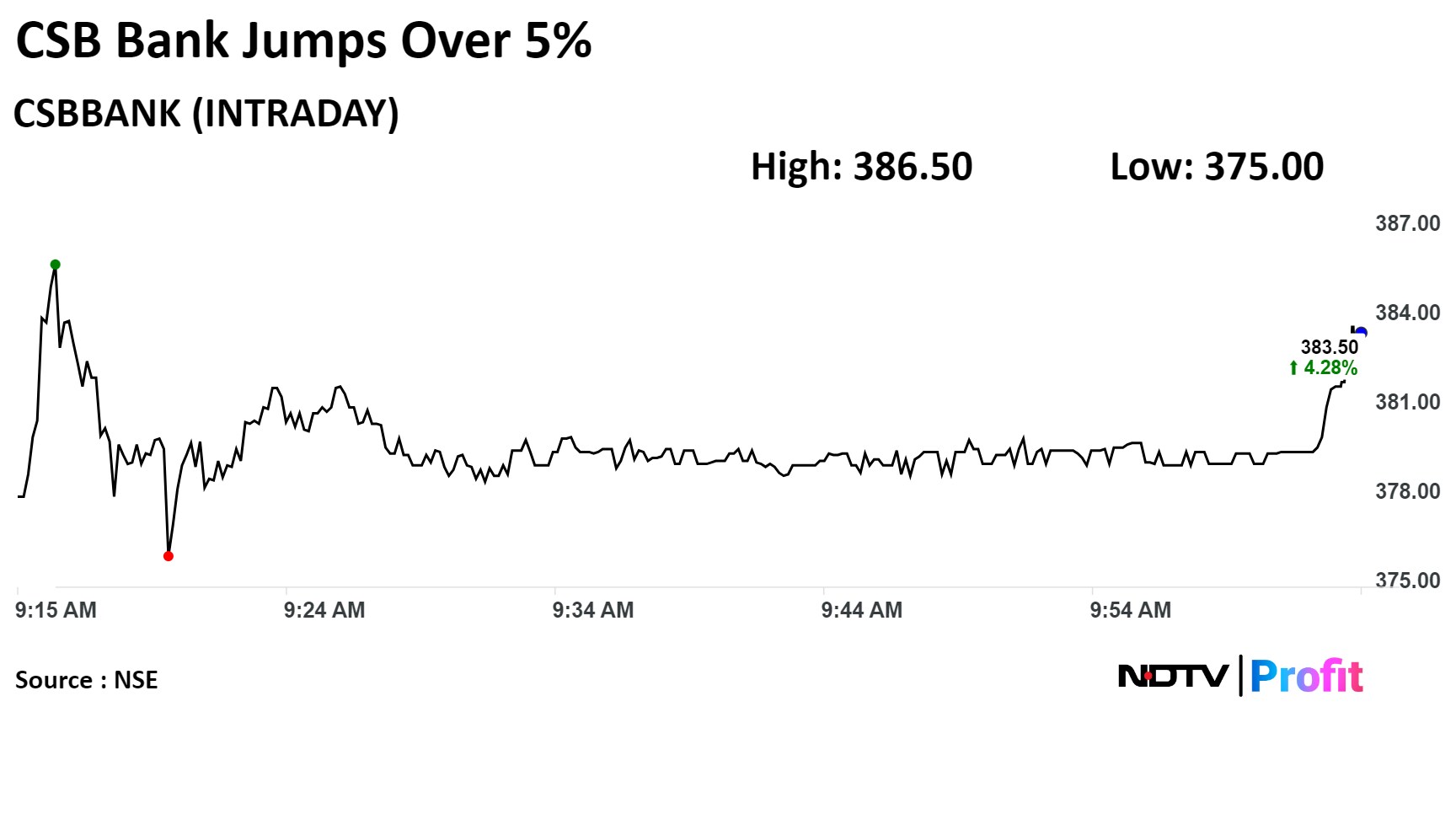

Shares of CSB Bank Ltd. jumped to hit their highest level in near two-months after the lender reported a 17.91% year-on year increase in its gross advance to Rs 24,574 crore.

Shares of CSB Bank Ltd. jumped to hit their highest level in near two-months after the lender reported a 17.91% year-on year increase in its gross advance to Rs 24,574 crore.

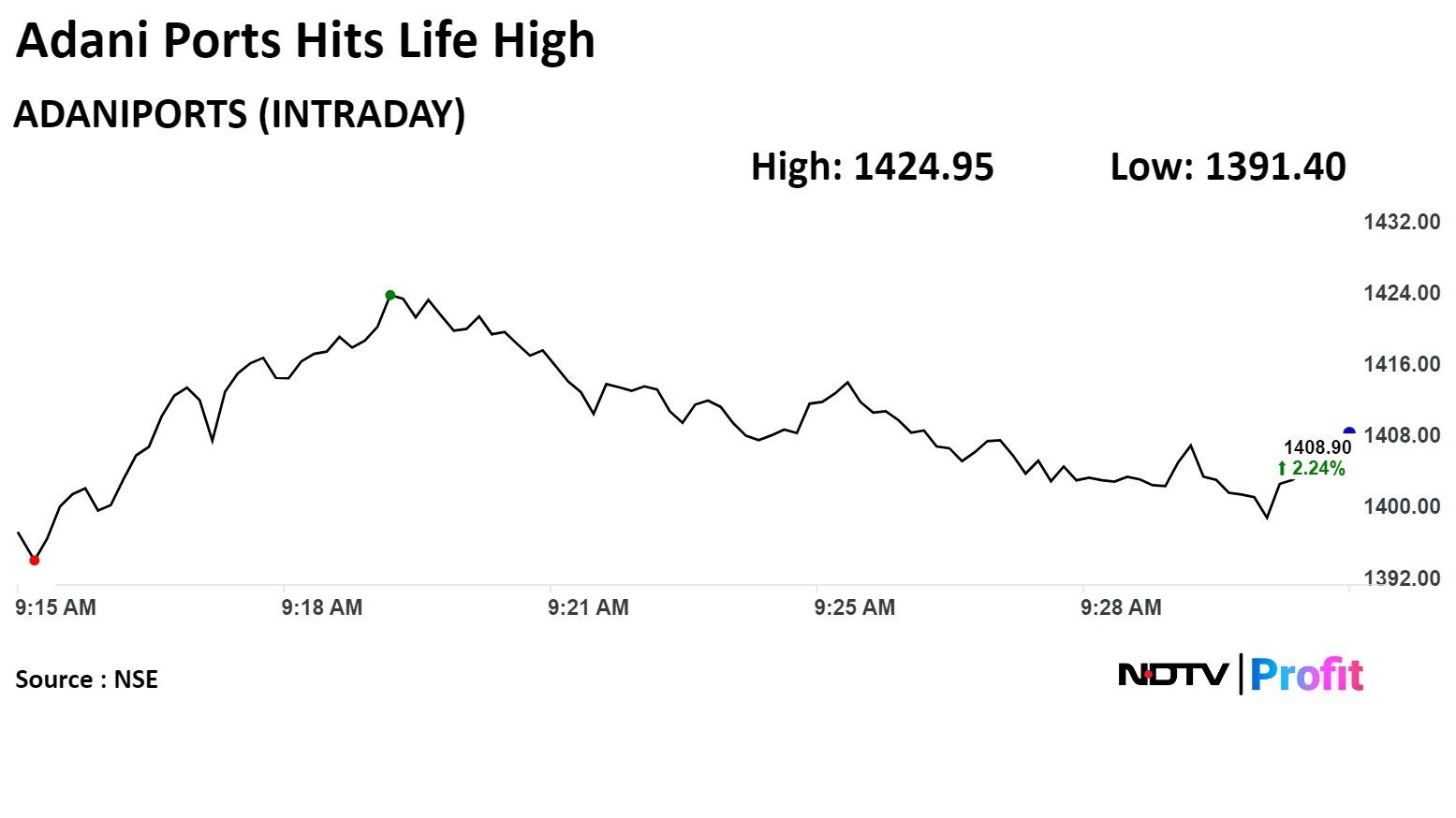

Adani Ports and Special Economic Zone Ltd. to report strong volume, revenue and Ebitda growth along with good cash flows in fourth quarter in FY24E results, according to Citi Research.

The research firm is opening a 90 days +ve catalyst watch on the ports company.

Adani Ports and Special Economic Zone Ltd. to report strong volume, revenue and Ebitda growth along with good cash flows in fourth quarter in FY24E results, according to Citi Research.

The research firm is opening a 90 days +ve catalyst watch on the ports company.

Adani Ports rose as much as 3.56% to Rs 1,424.95 to hit a life. It pare gains and was trading 2.03% higher at Rs 1,403.80, compared to 0.7% decline on NSE Nifty 50 index as of 9:32 am.

It has risen 123.61% in 12 months. The relative strength index was at 68.

Out of 22 analysts tracking the company, 20 maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.1%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

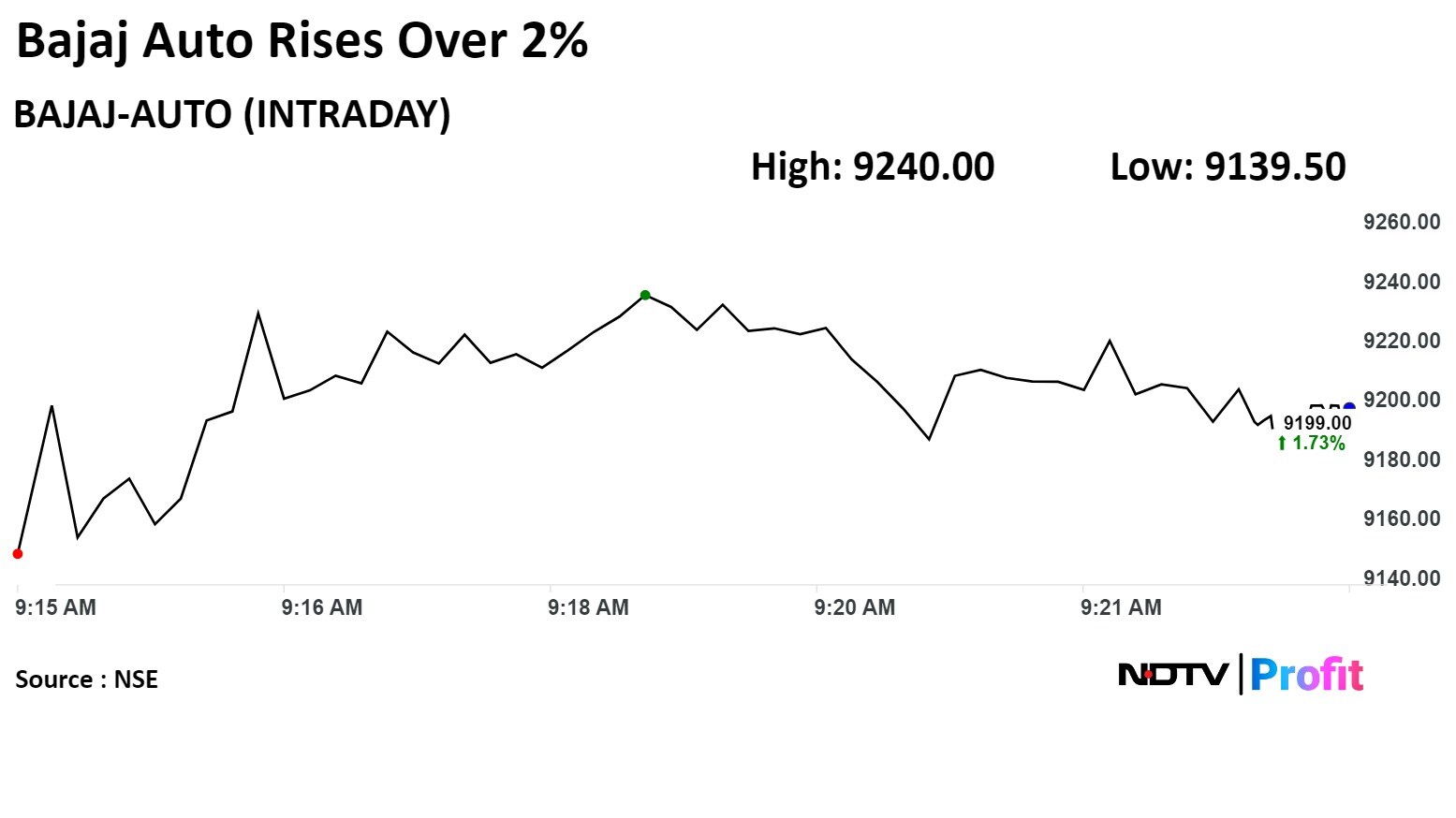

Bajaj Auto Shares snapped two-day fall and rose over 2% today after the company's total sales in March was up 25% on year to 3.7 lakh units.

Bajaj Auto Shares snapped two-day fall and rose over 2% today after the company's total sales in March was up 25% on year to 3.7 lakh units.

The scrip rose as much as 2.26% to Rs 9,246 apiece, the highest level since March 27. It pared gains to trade 1.57% higher at Rs 137.85 apiece, as of 09:55 a.m. This compares to a flat Nifty 50.

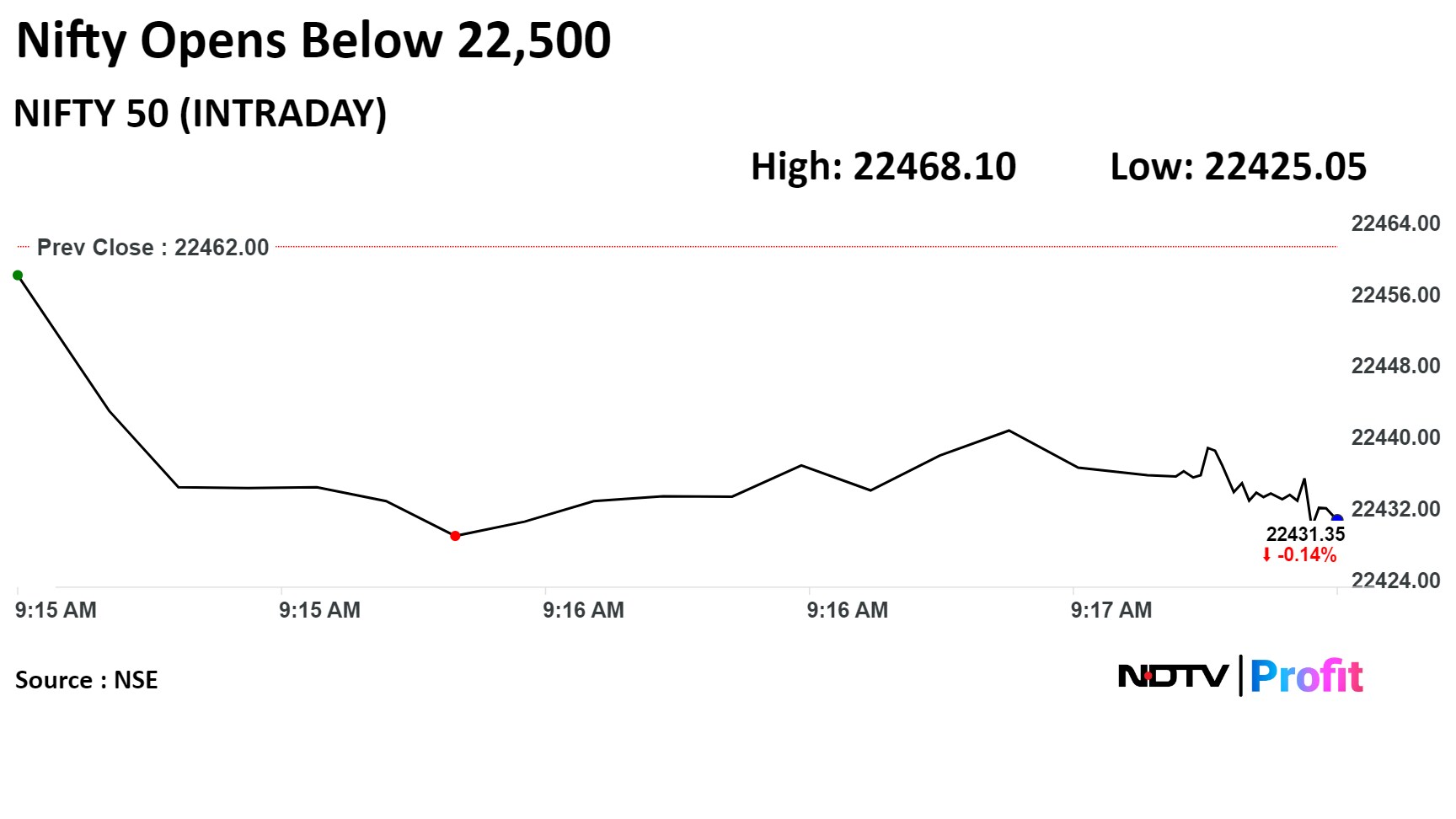

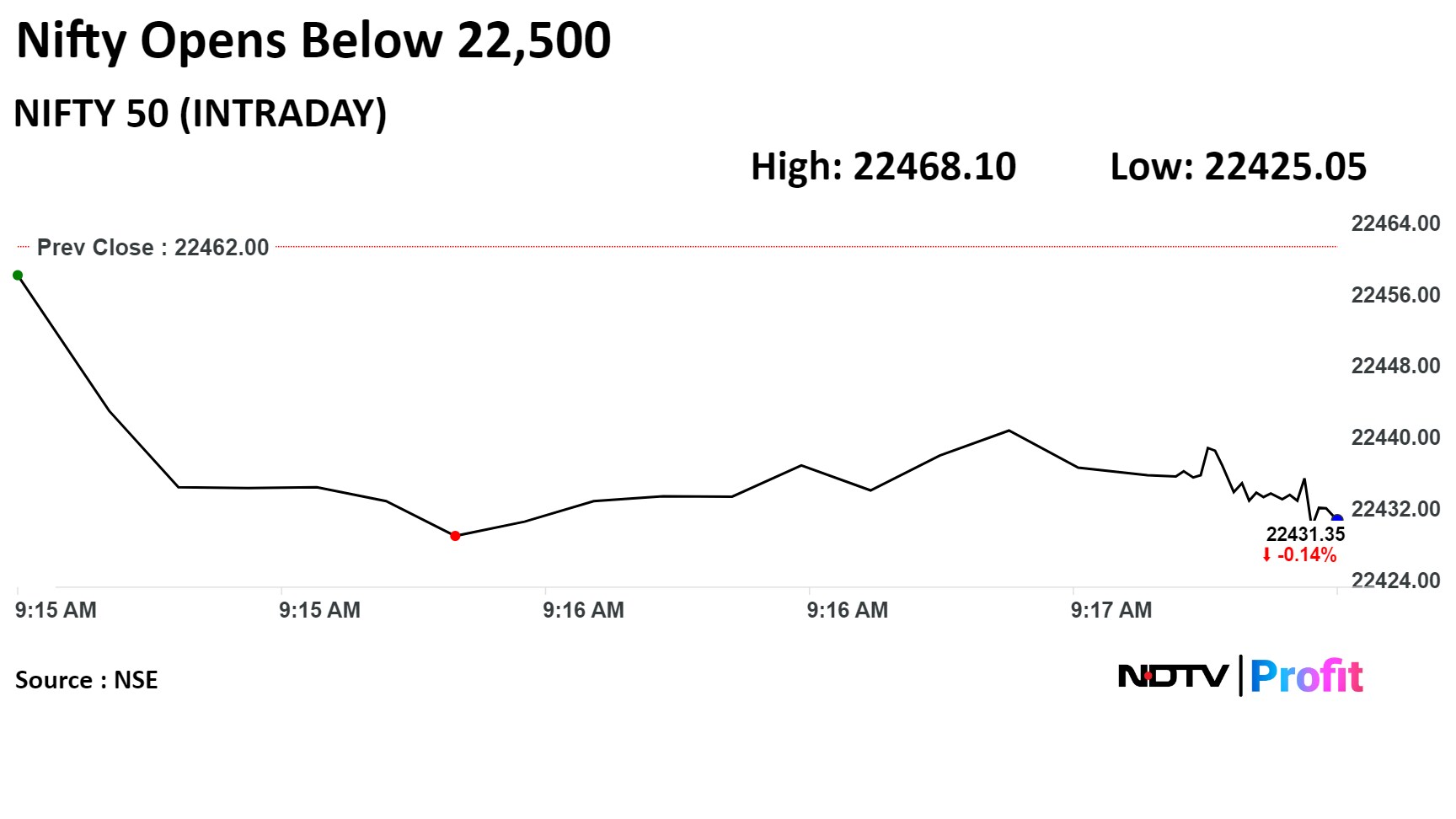

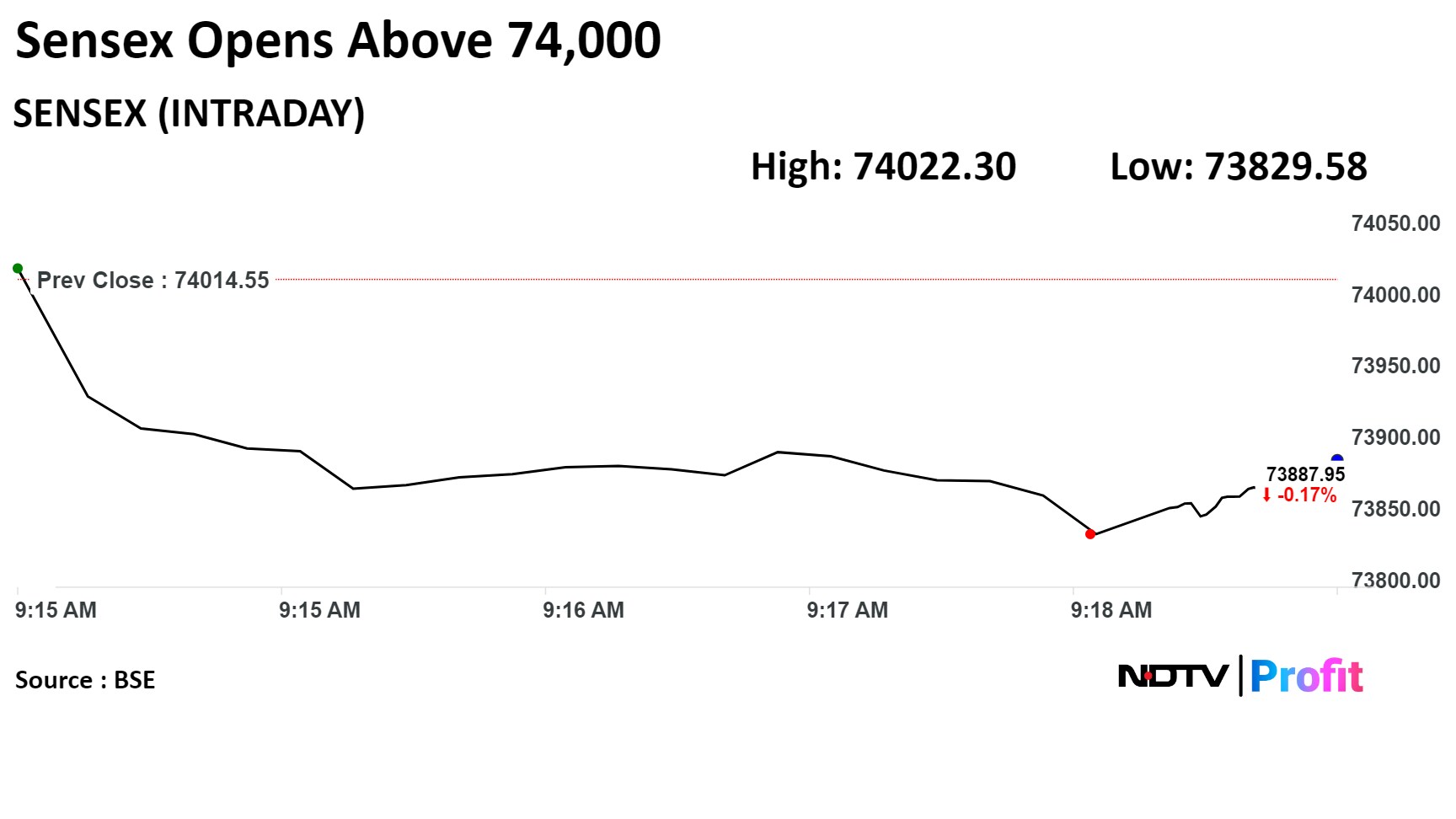

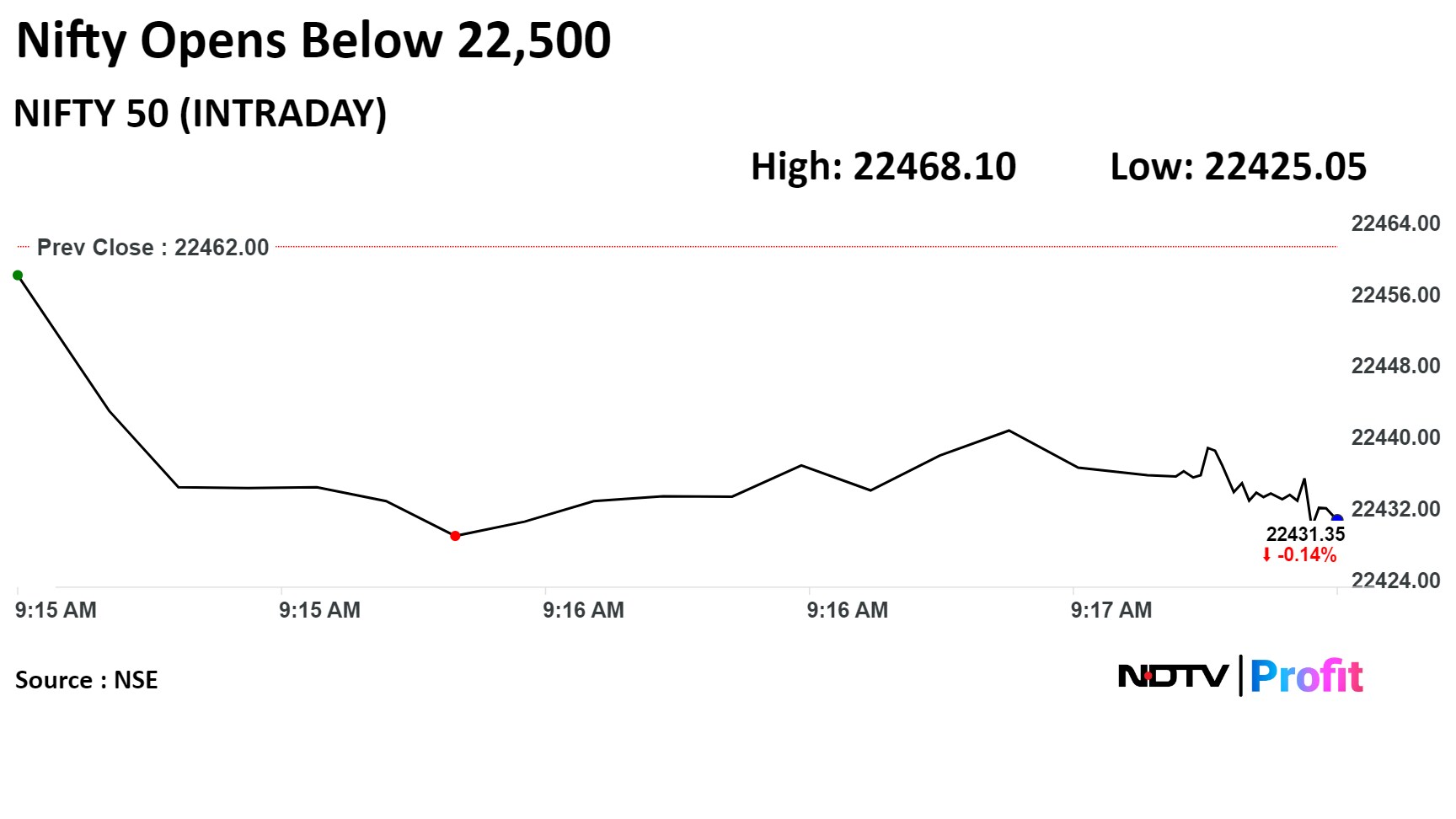

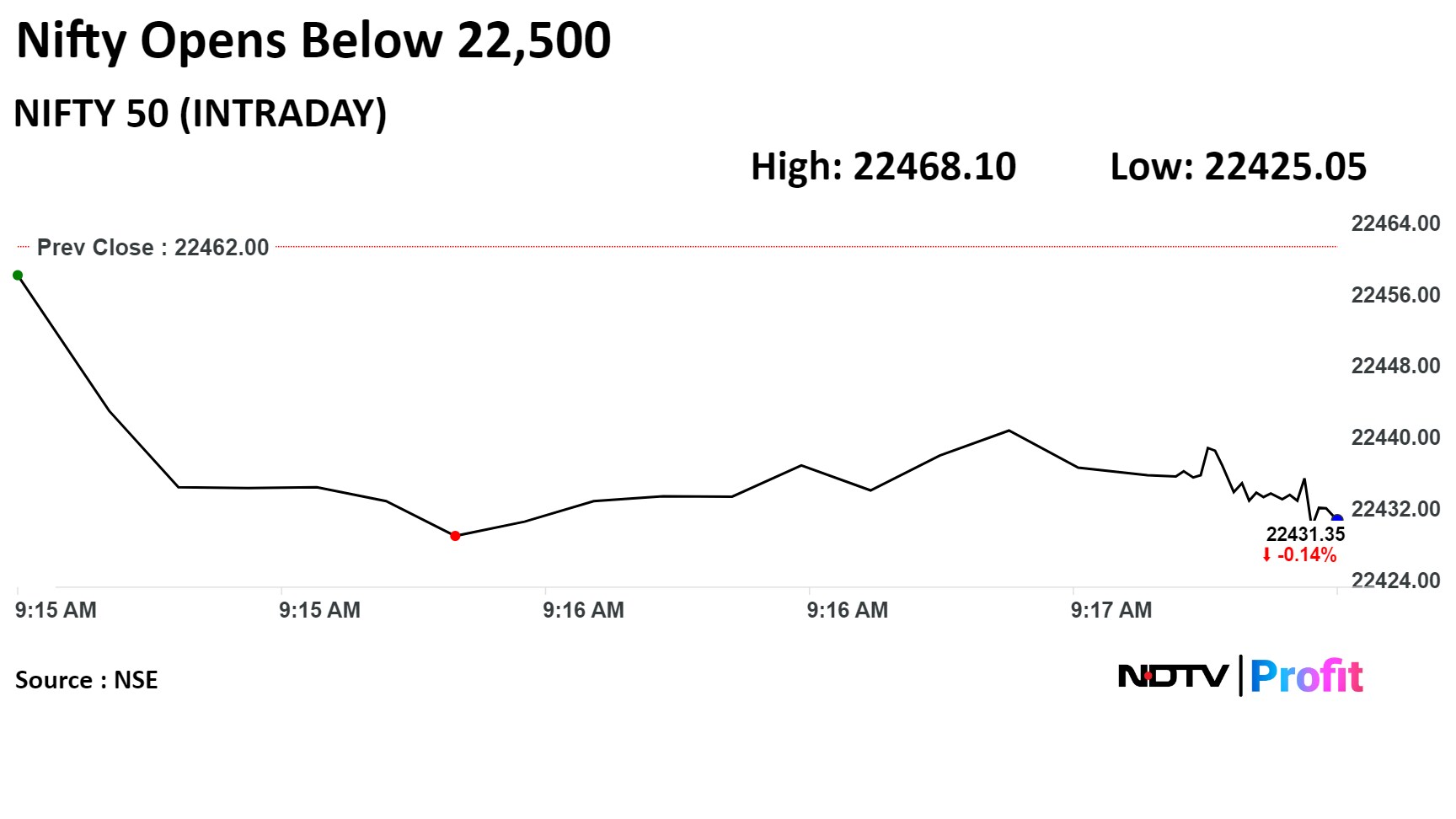

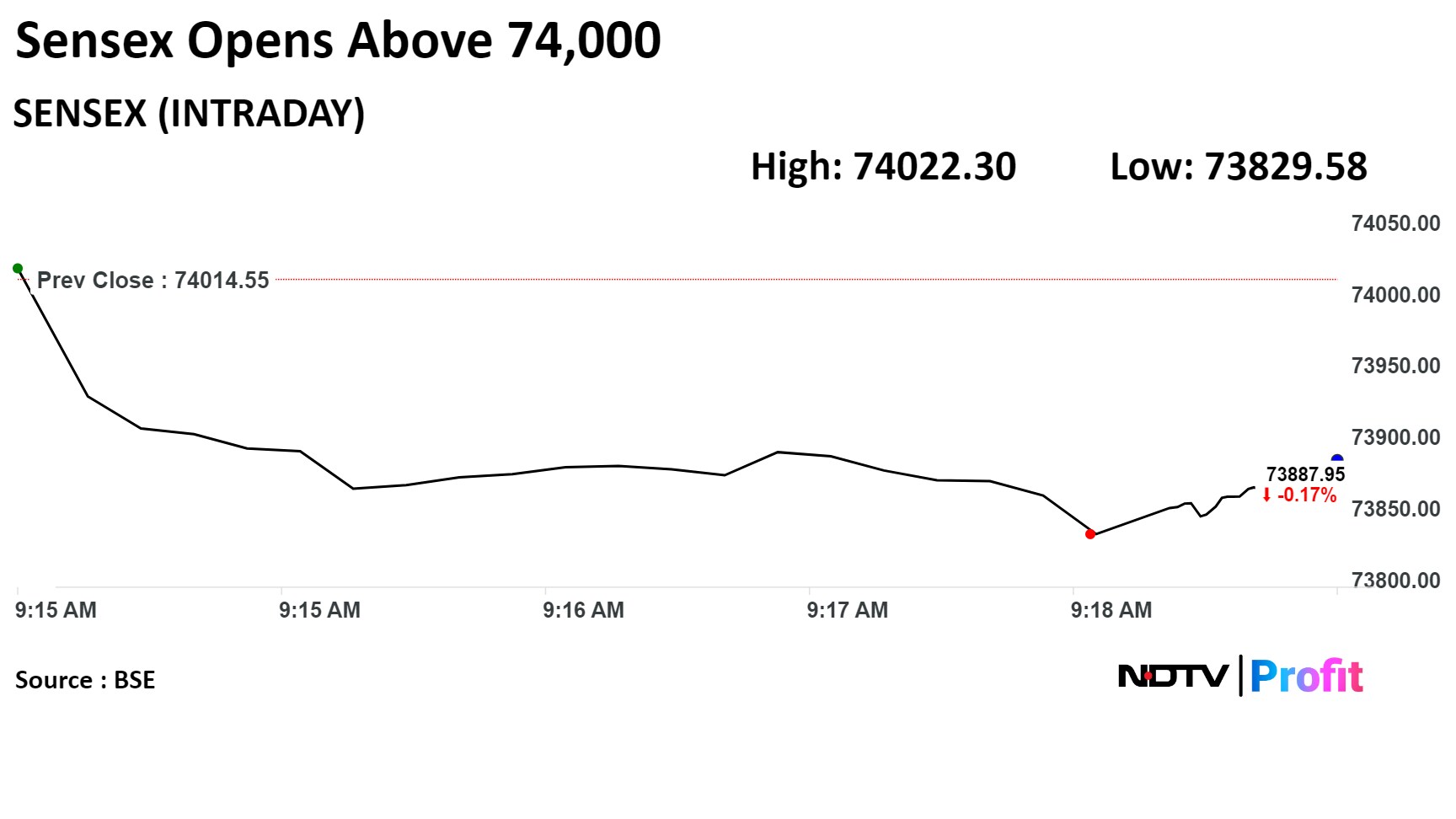

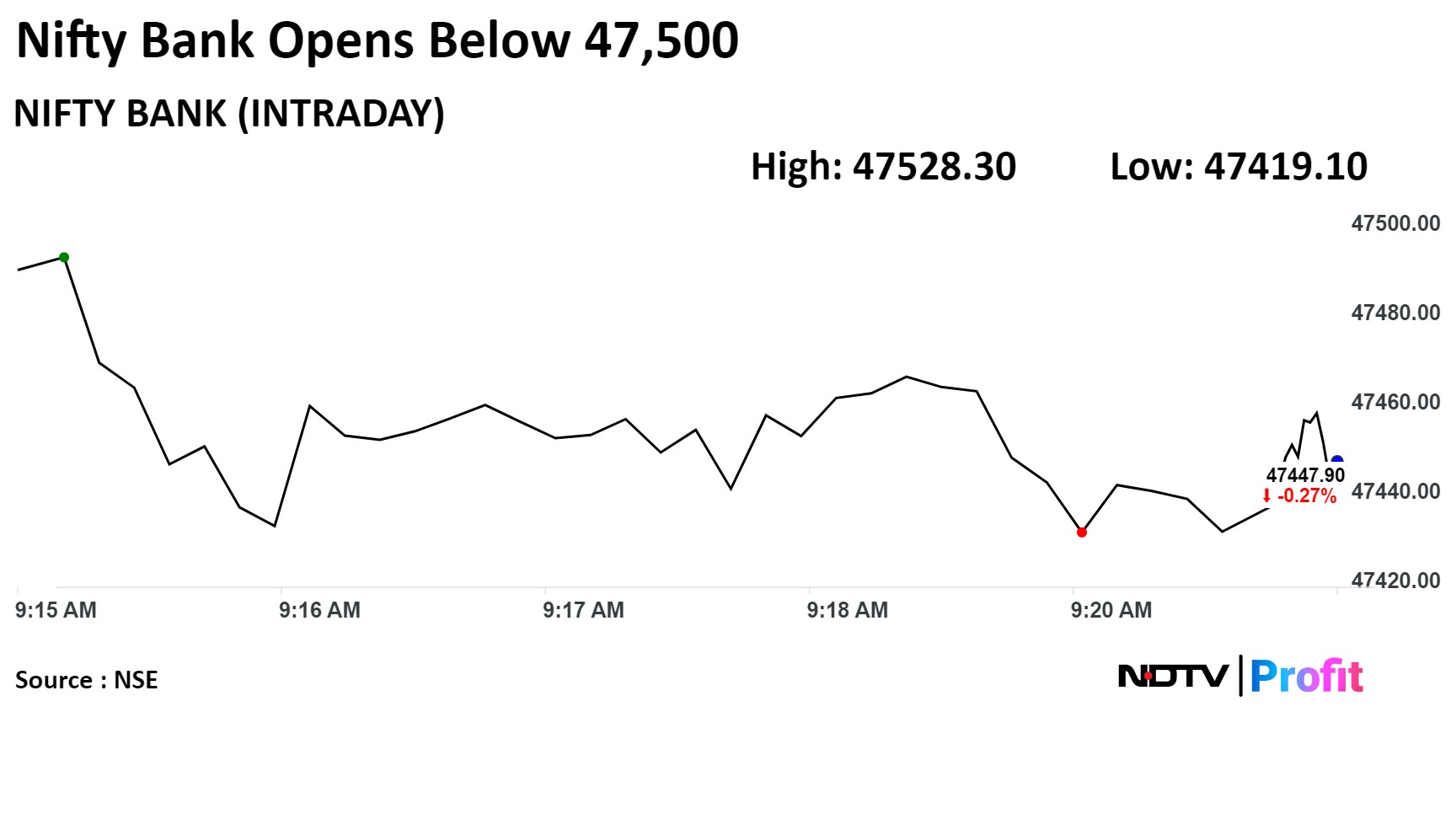

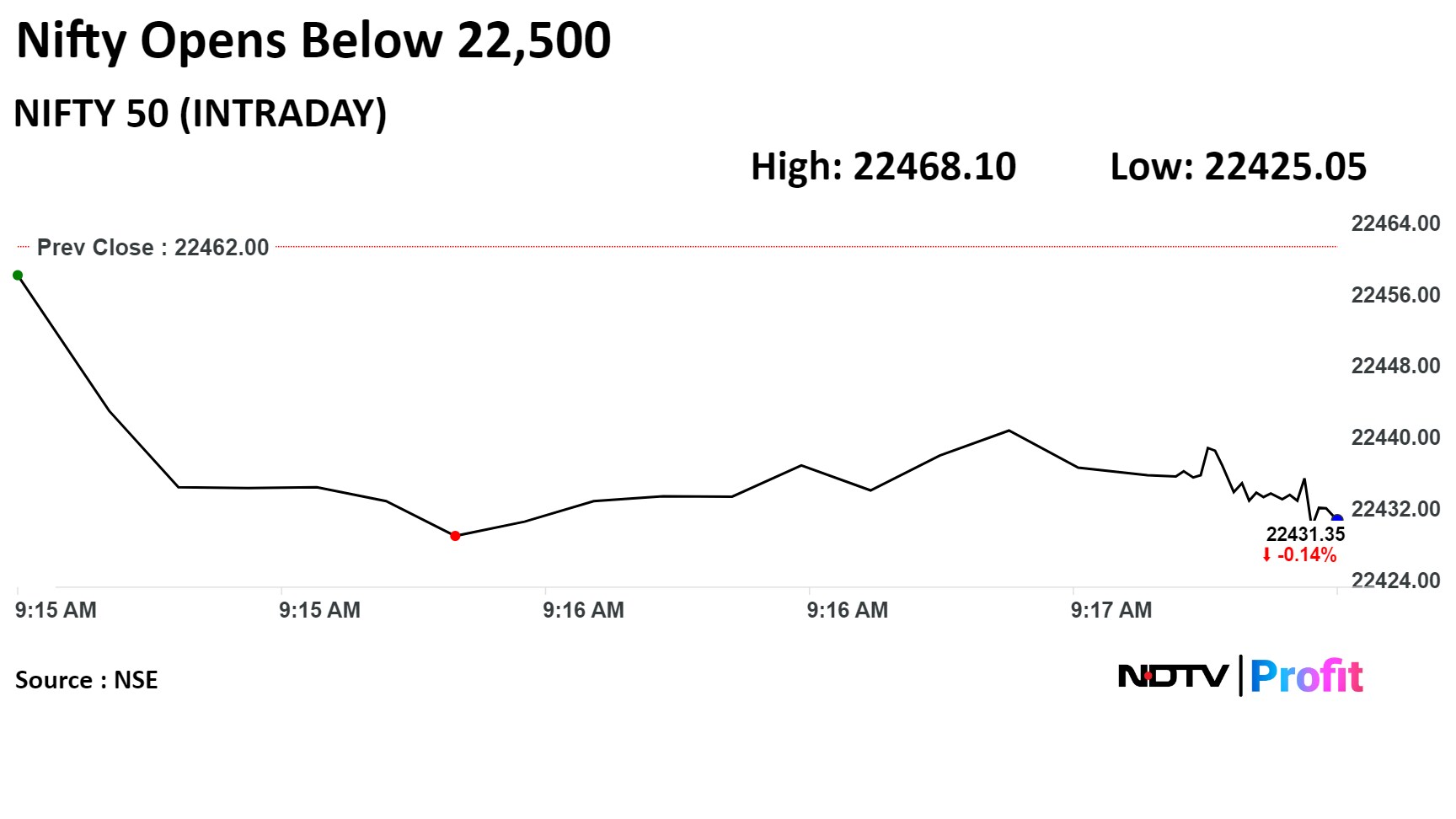

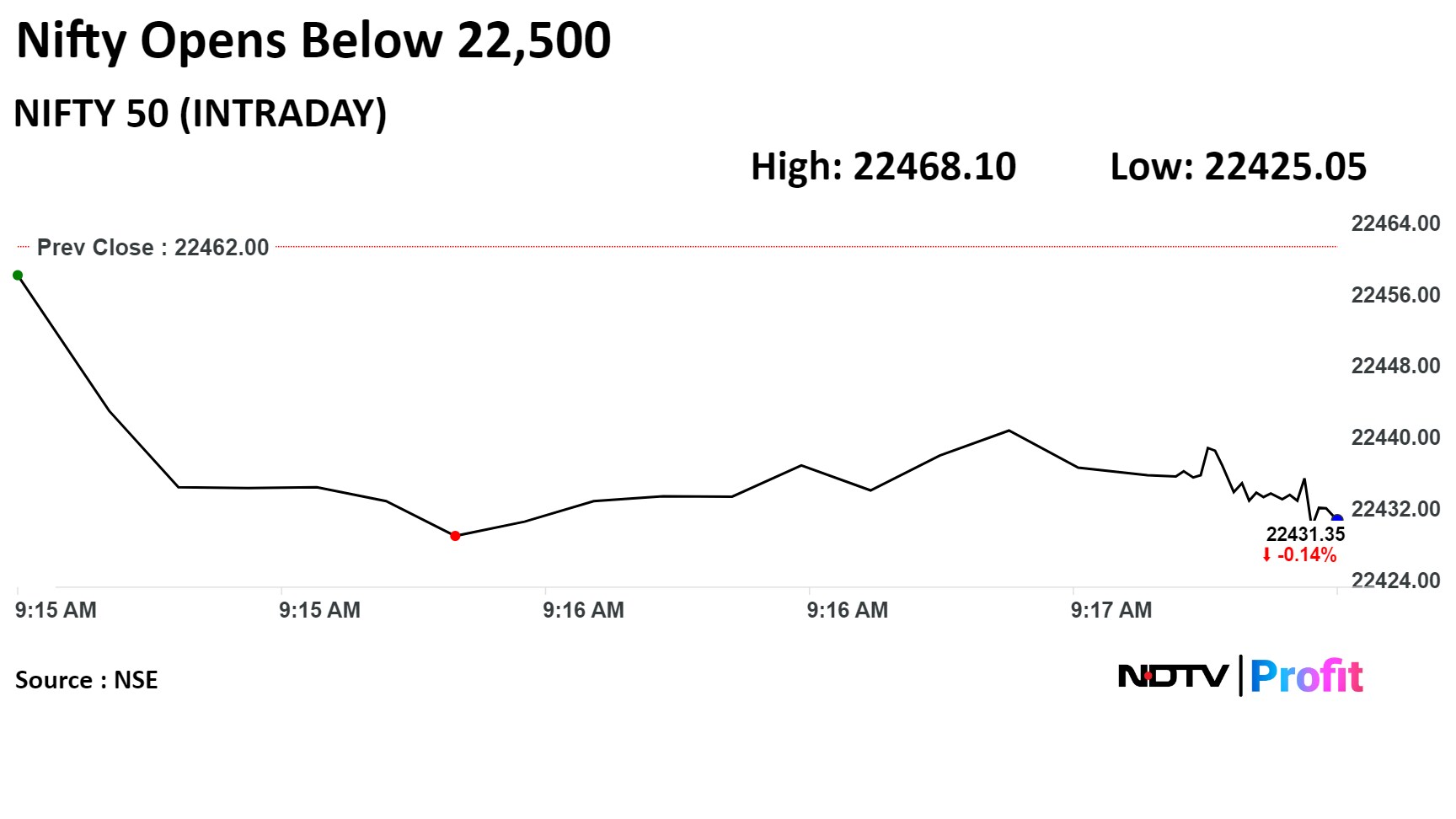

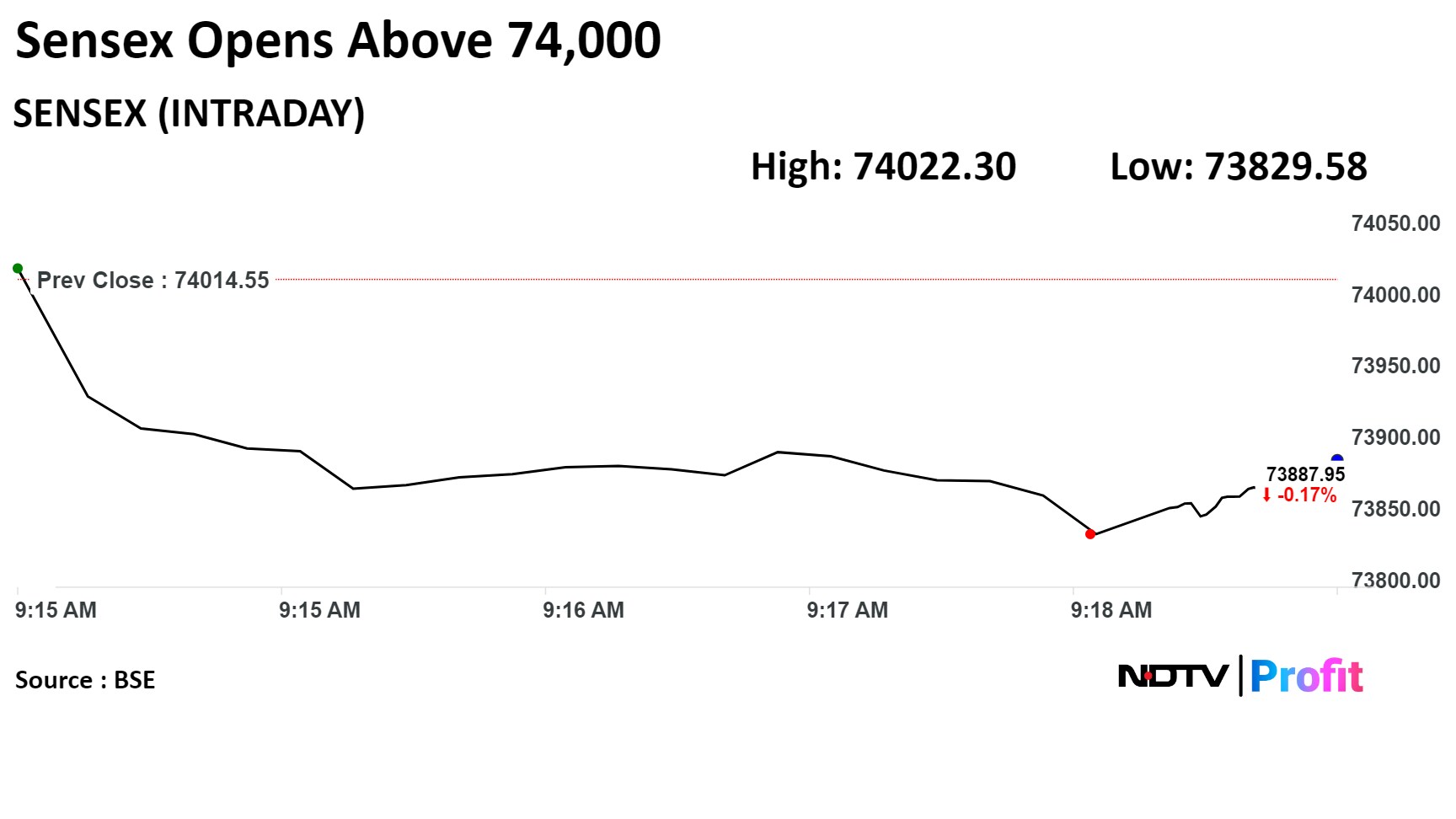

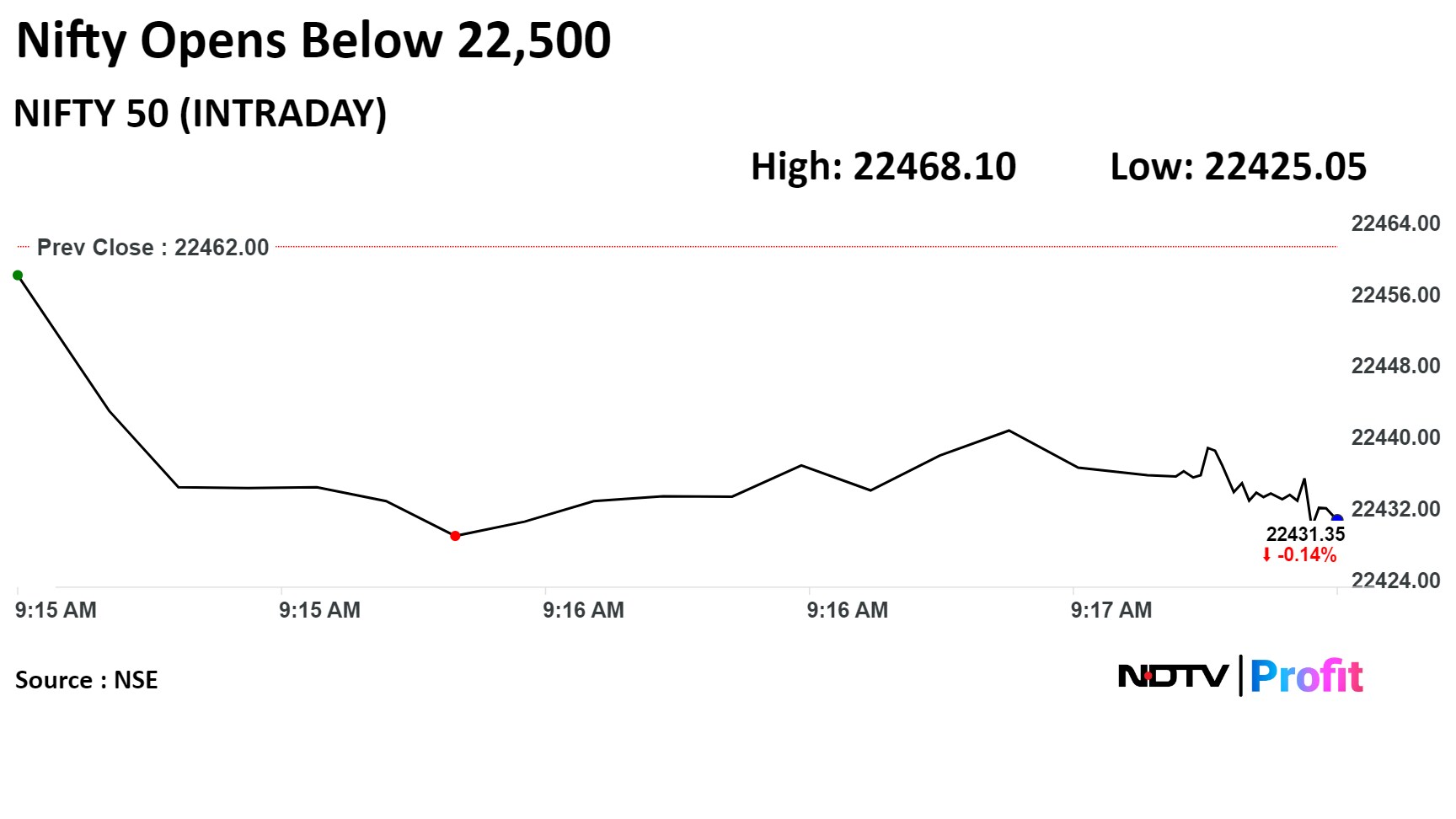

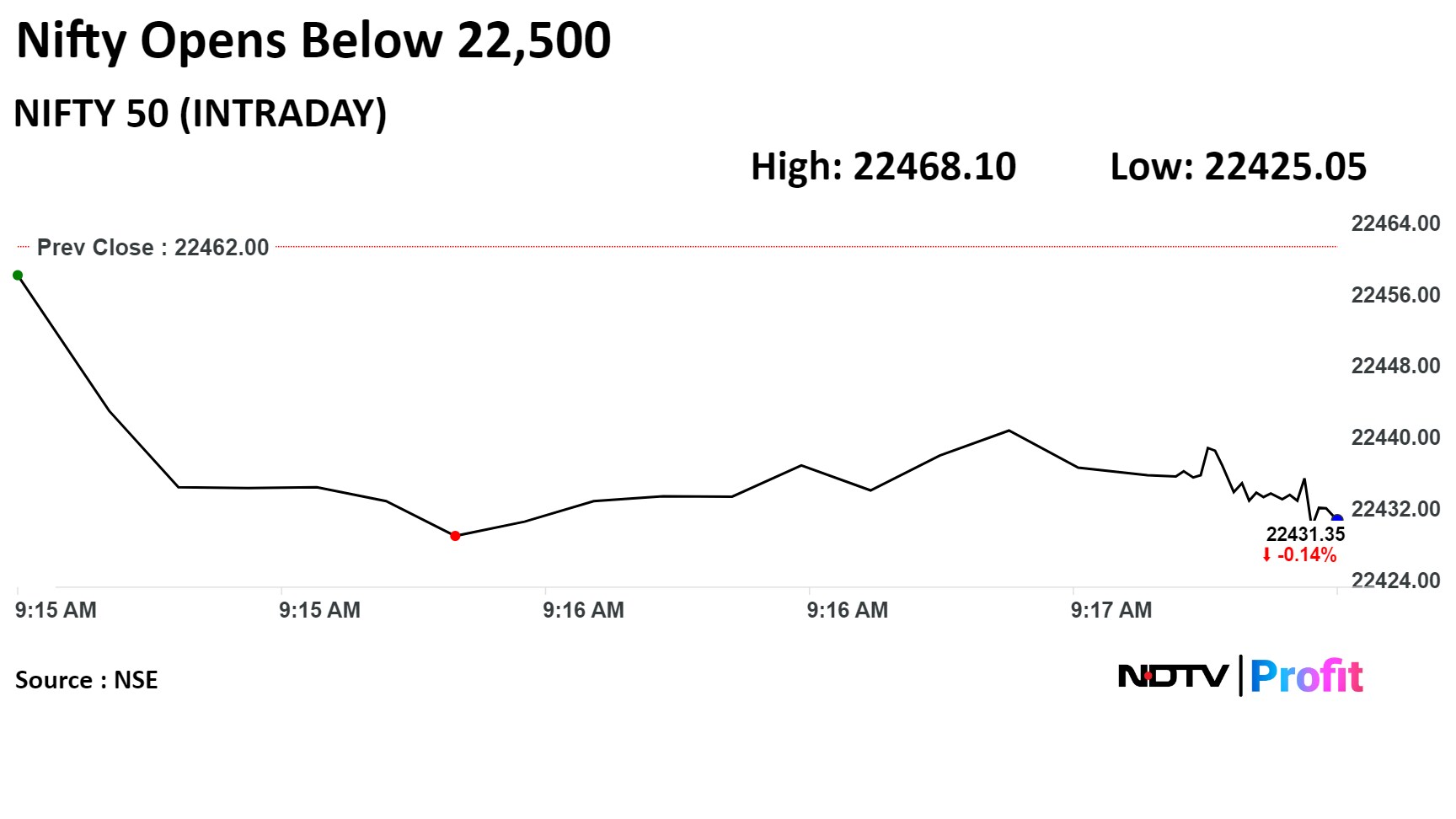

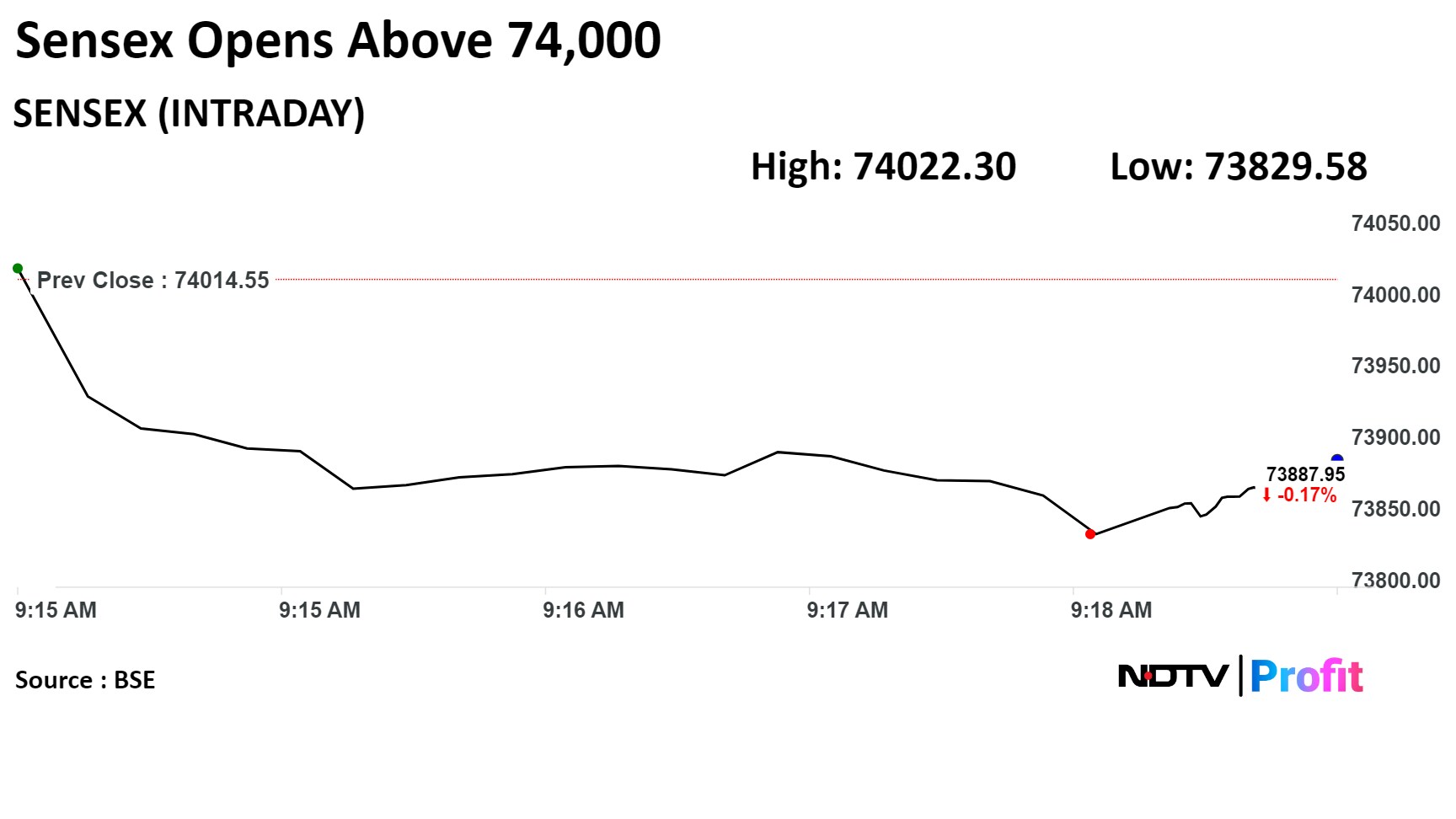

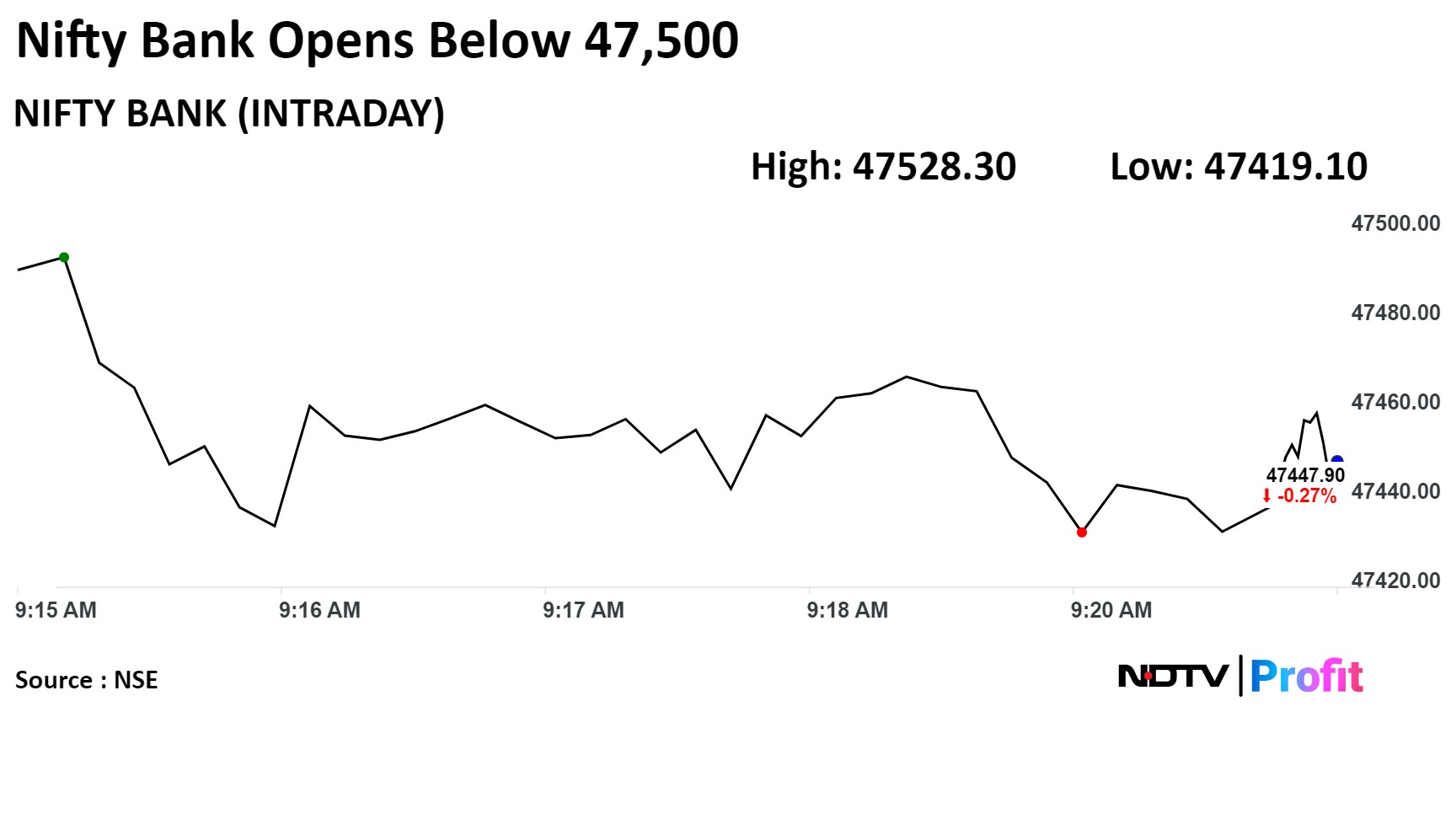

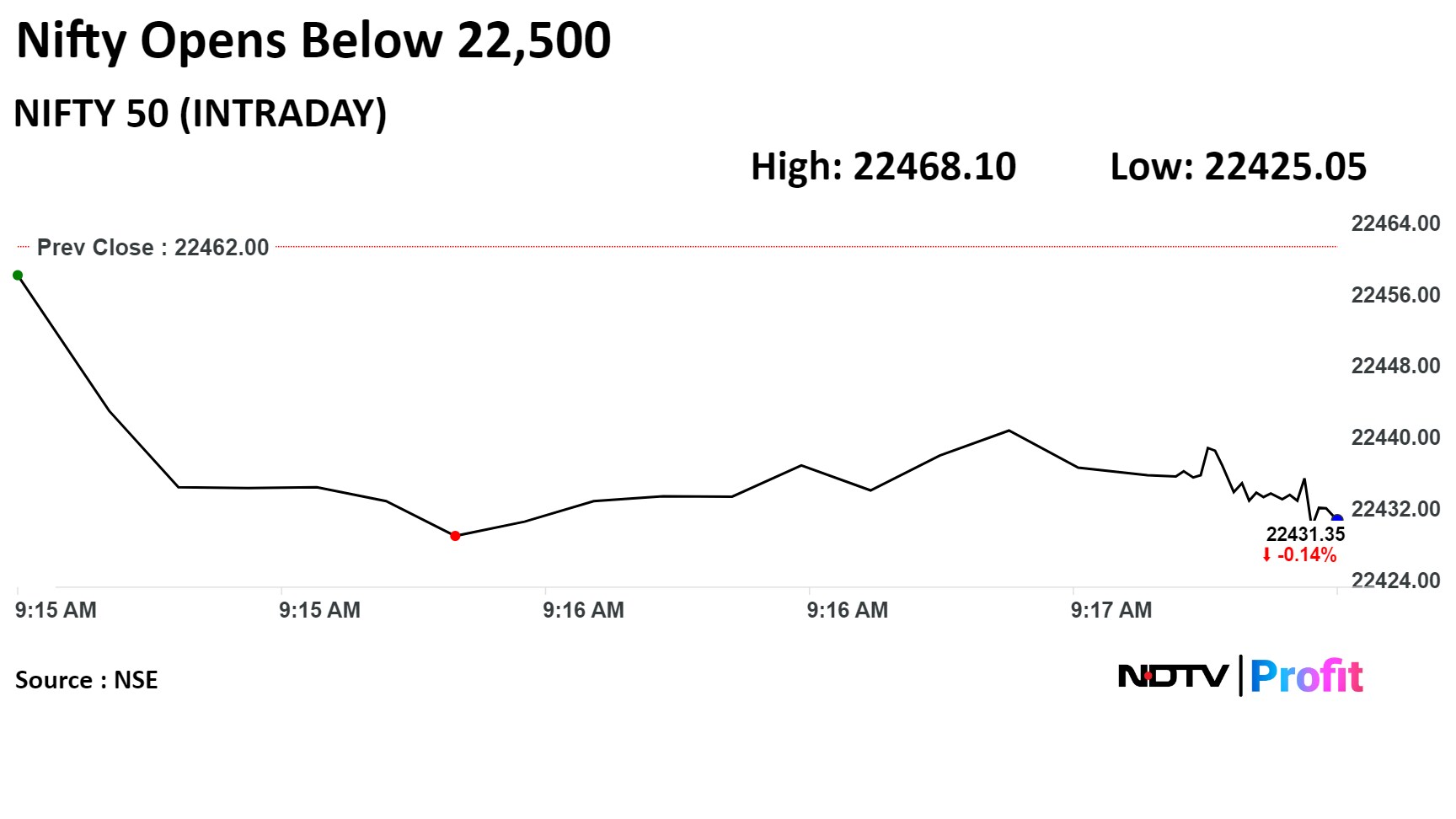

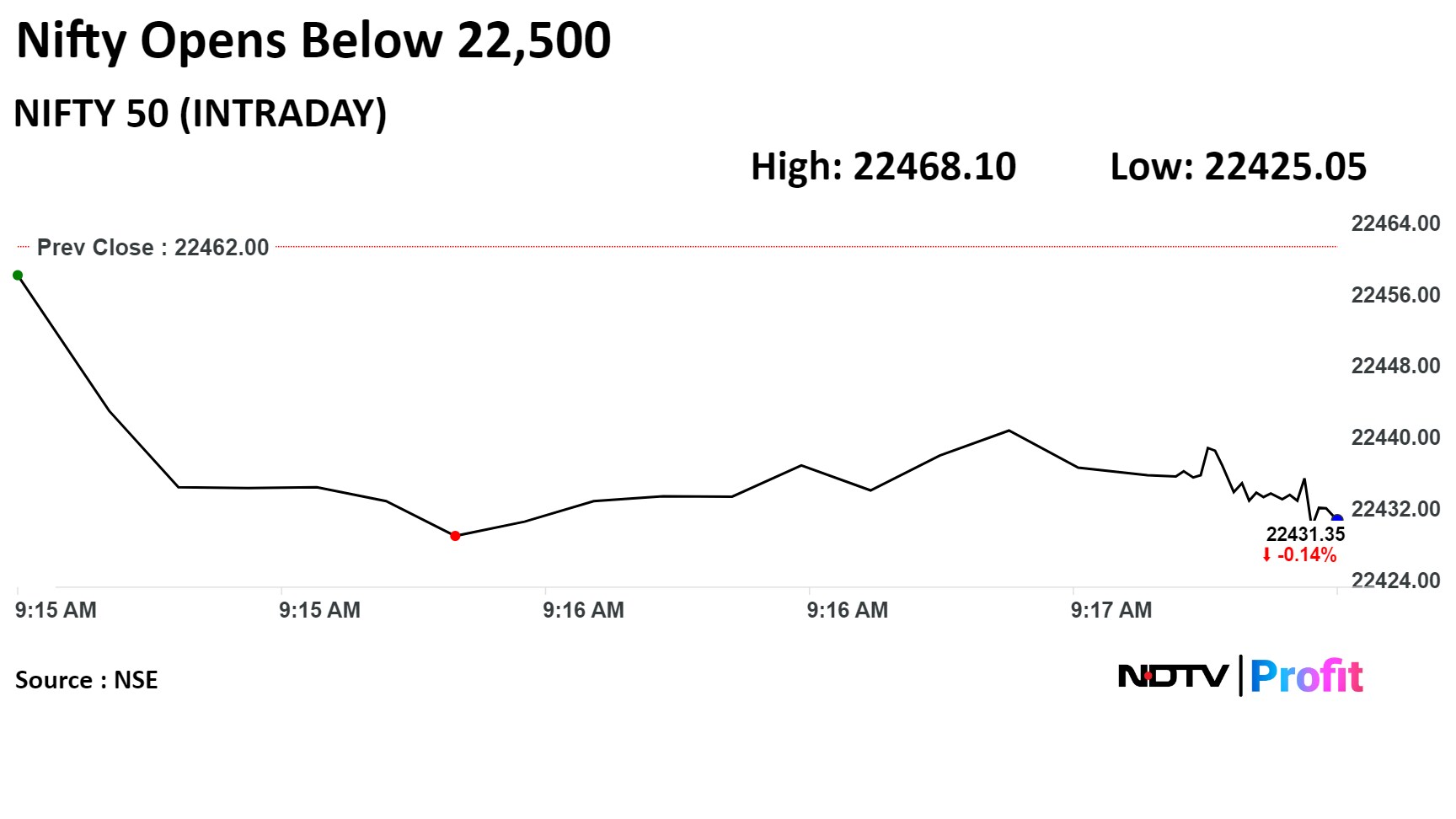

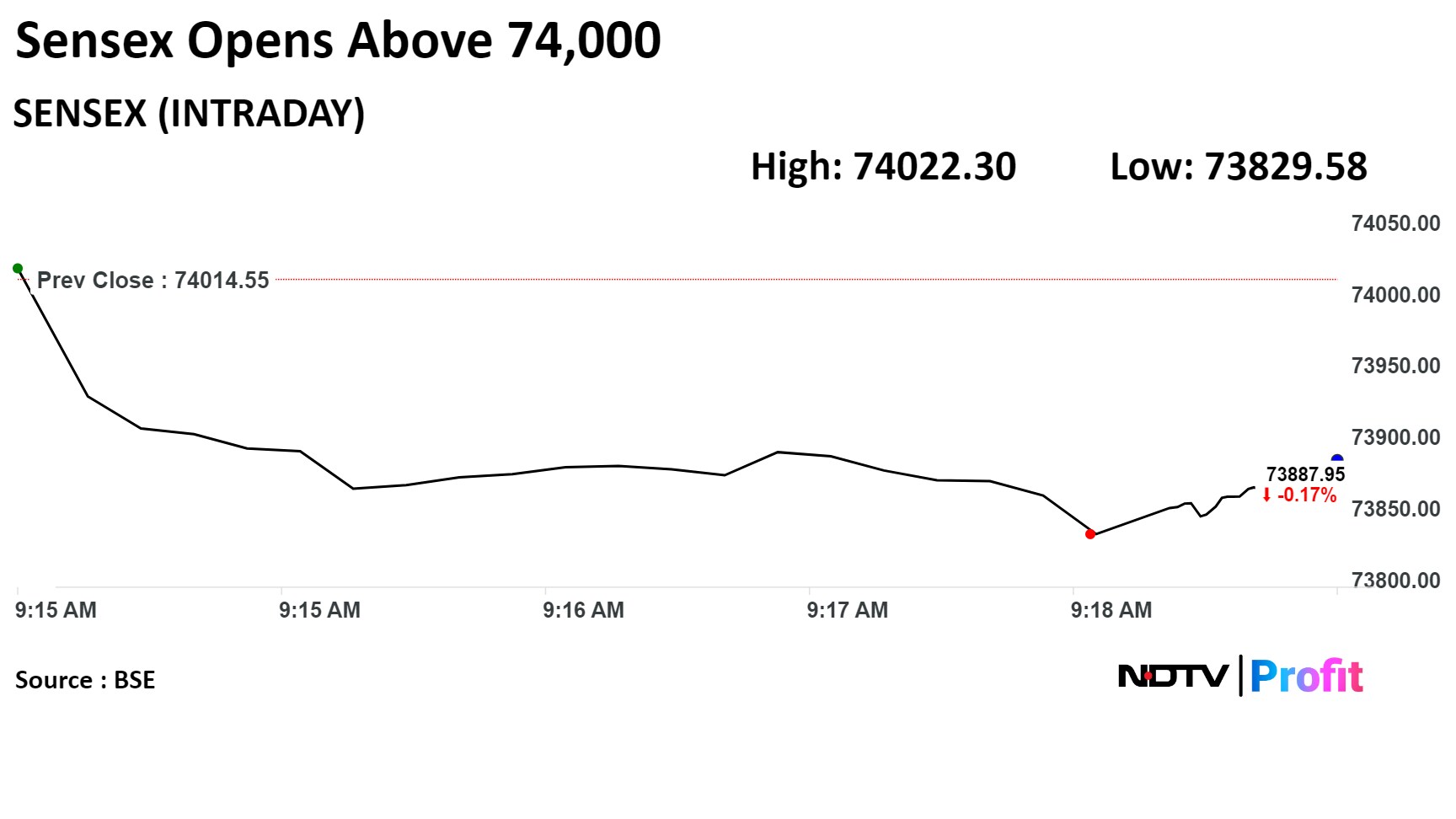

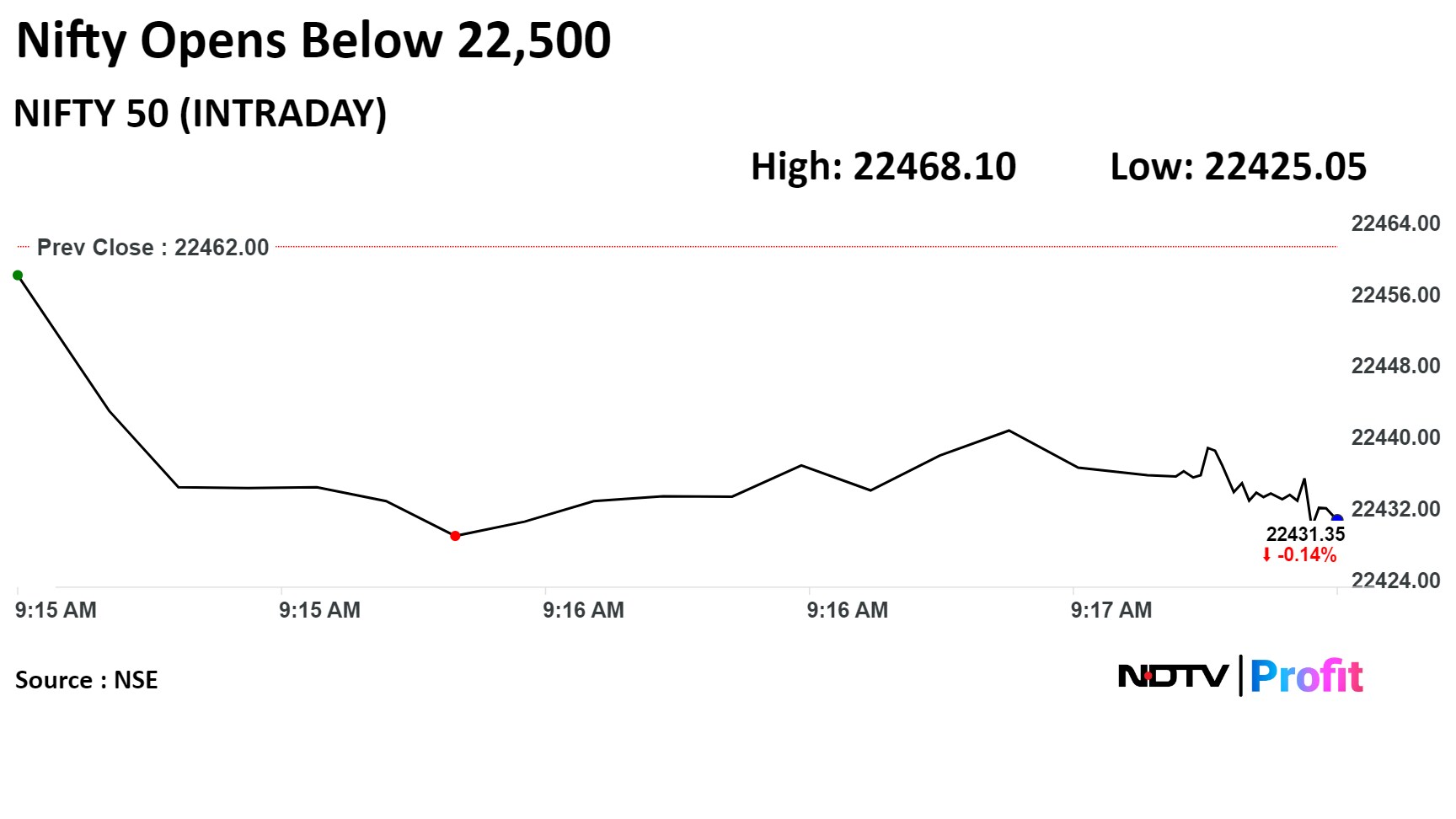

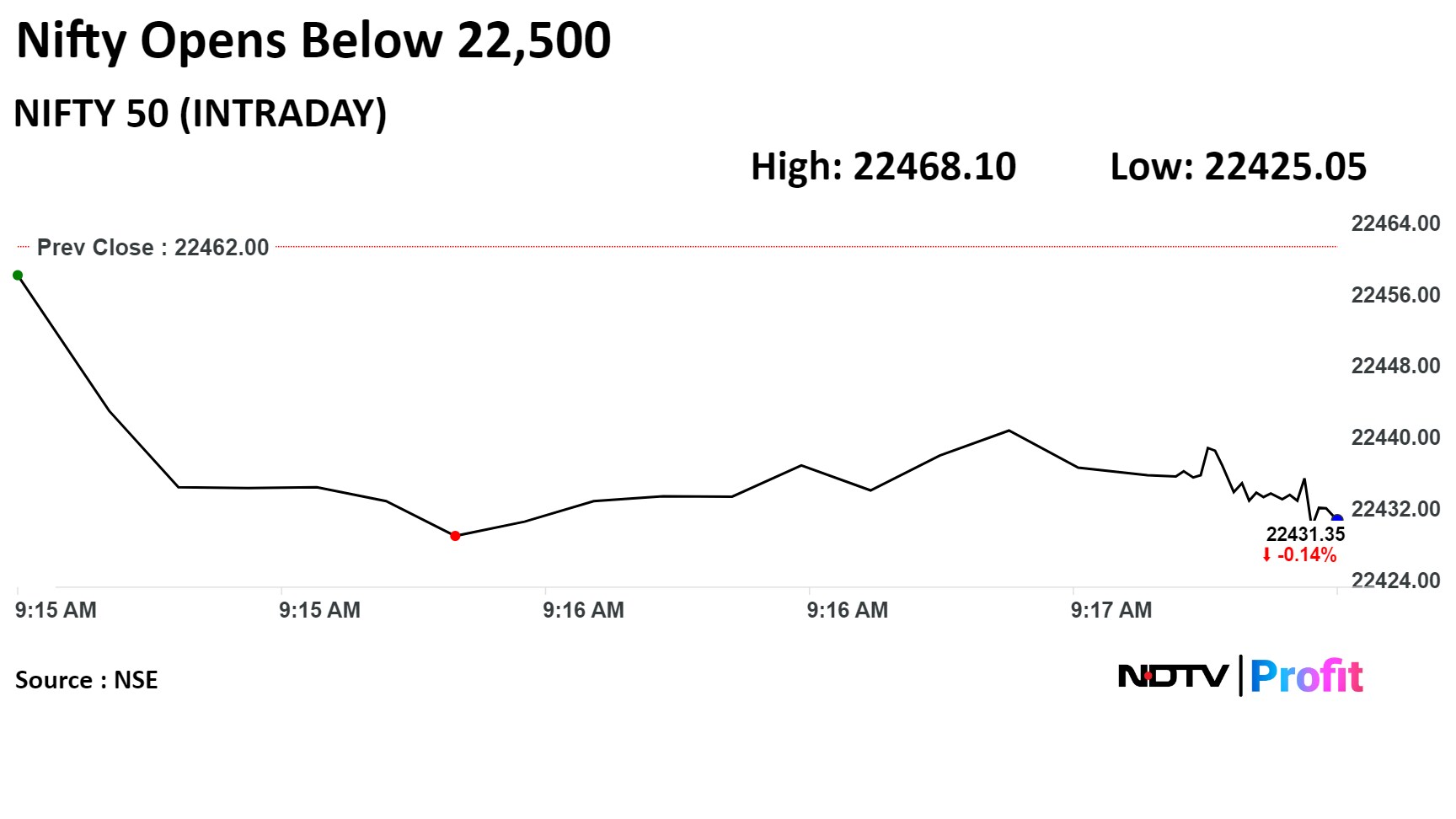

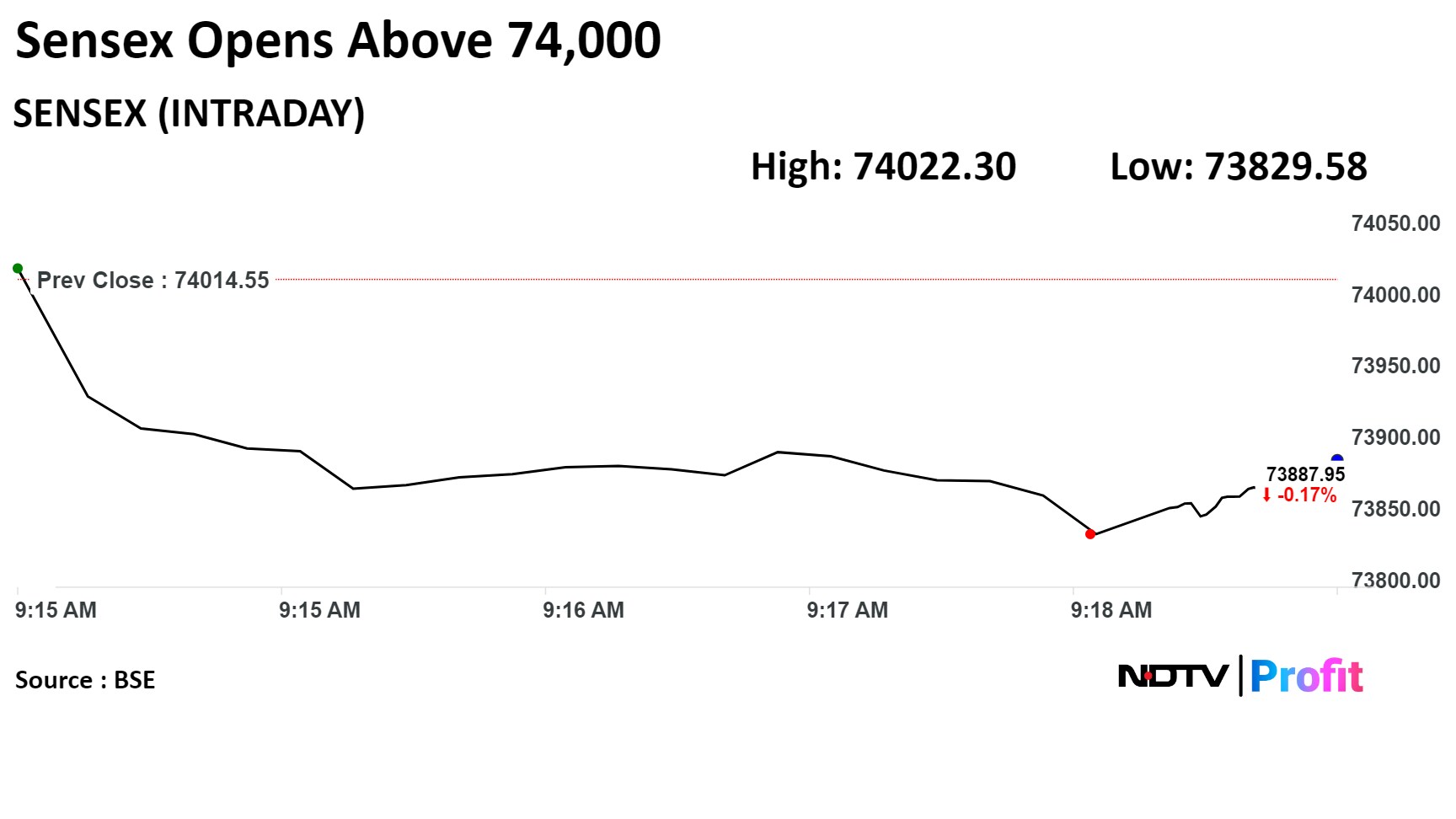

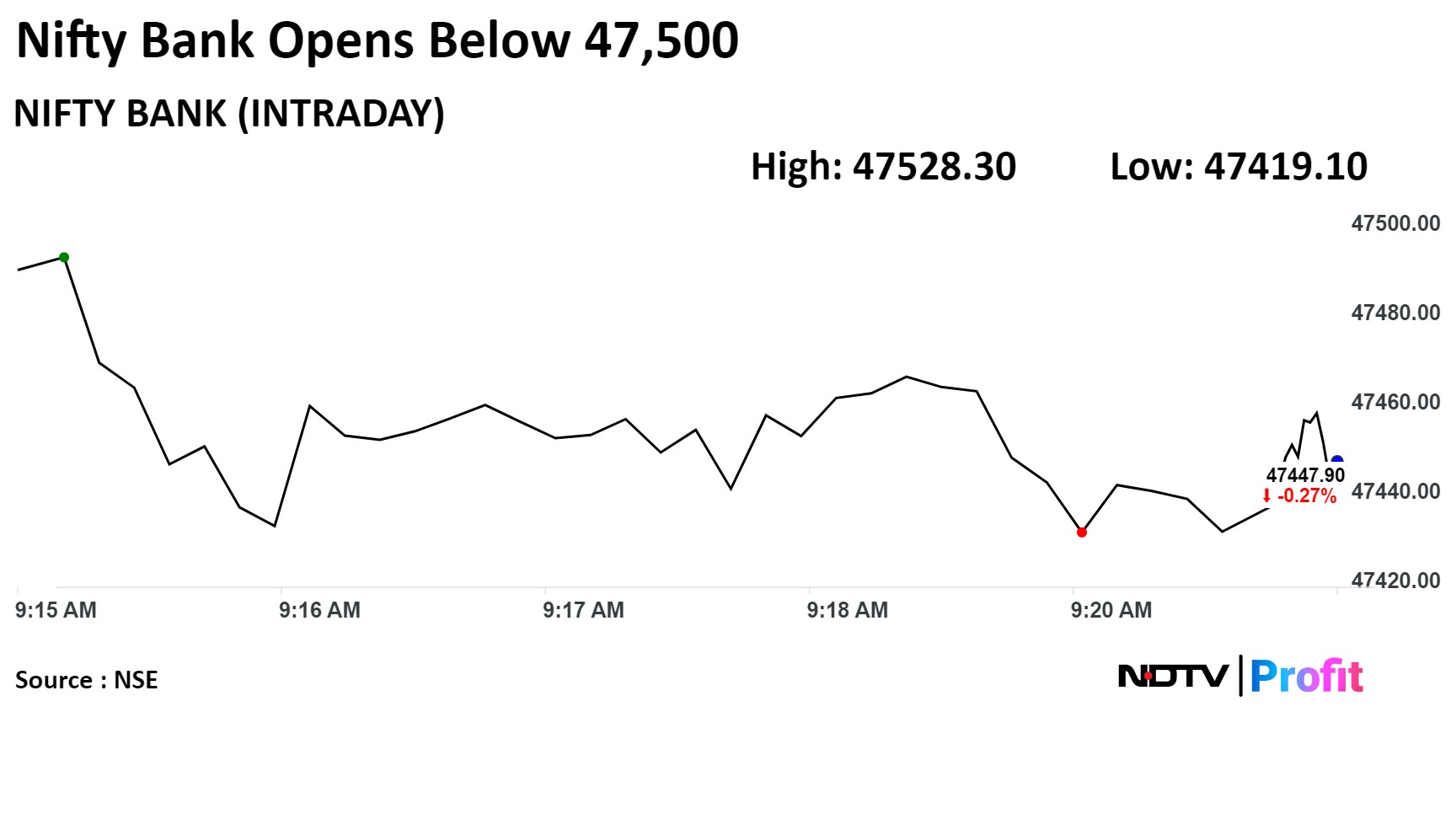

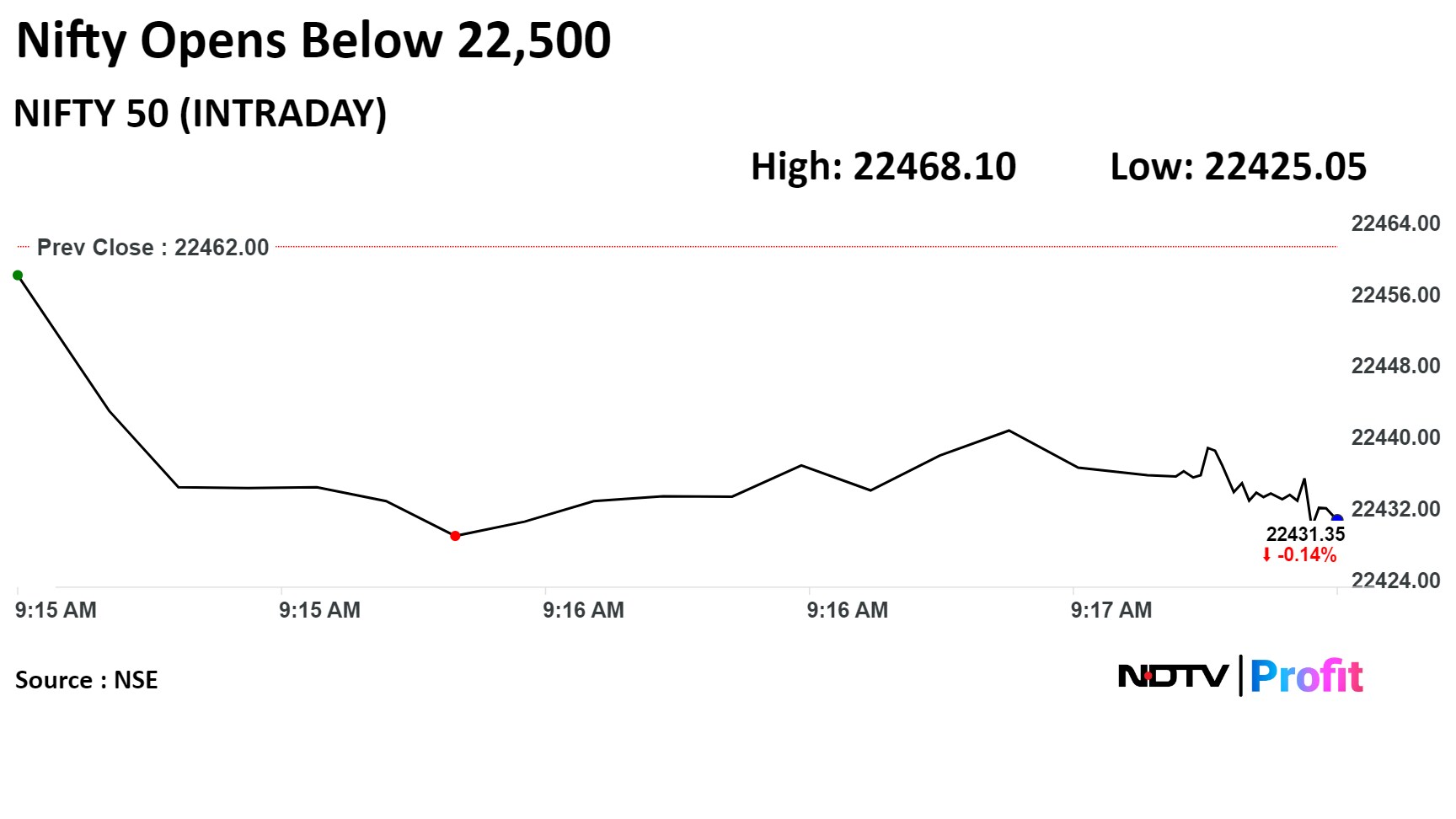

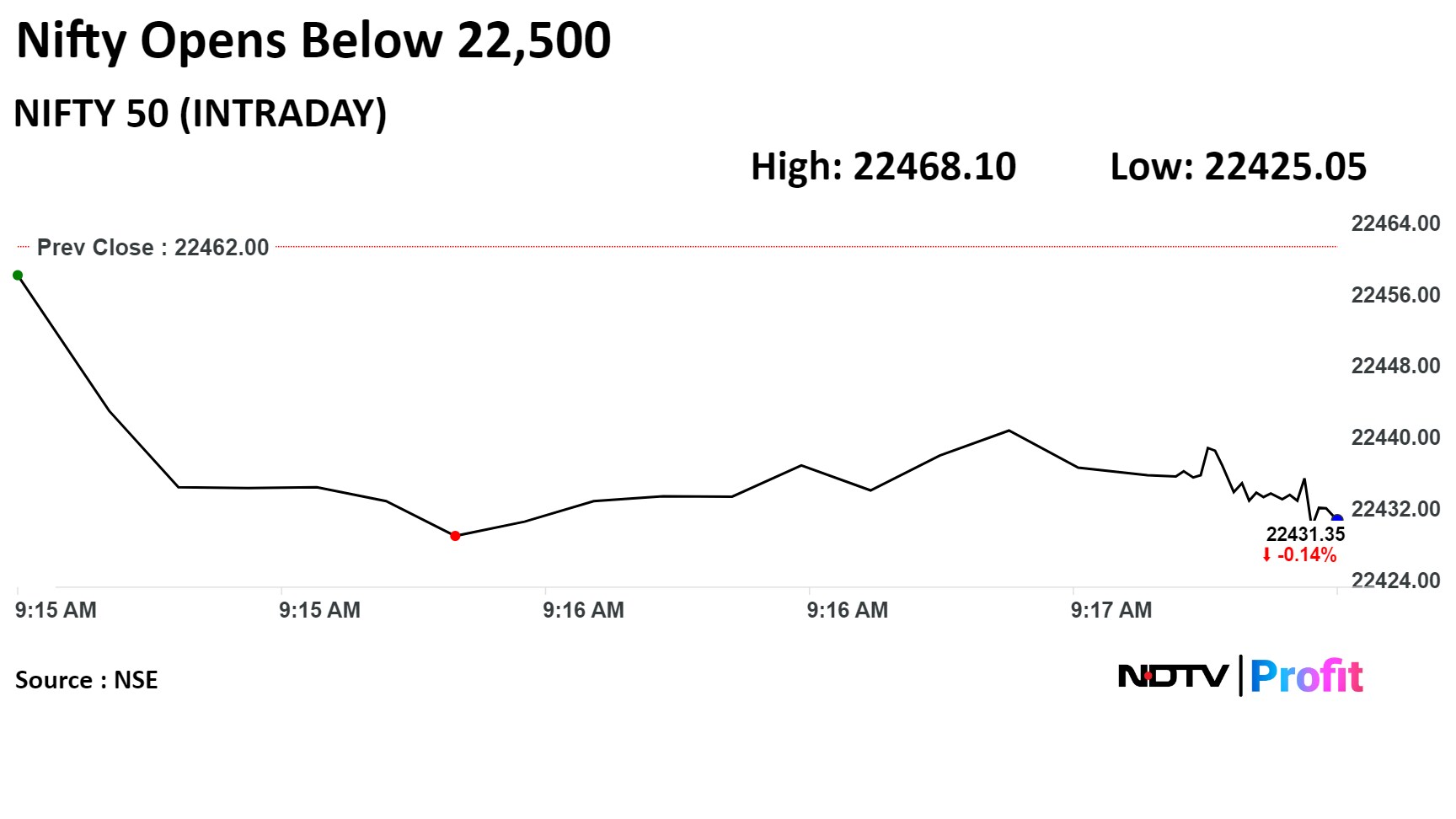

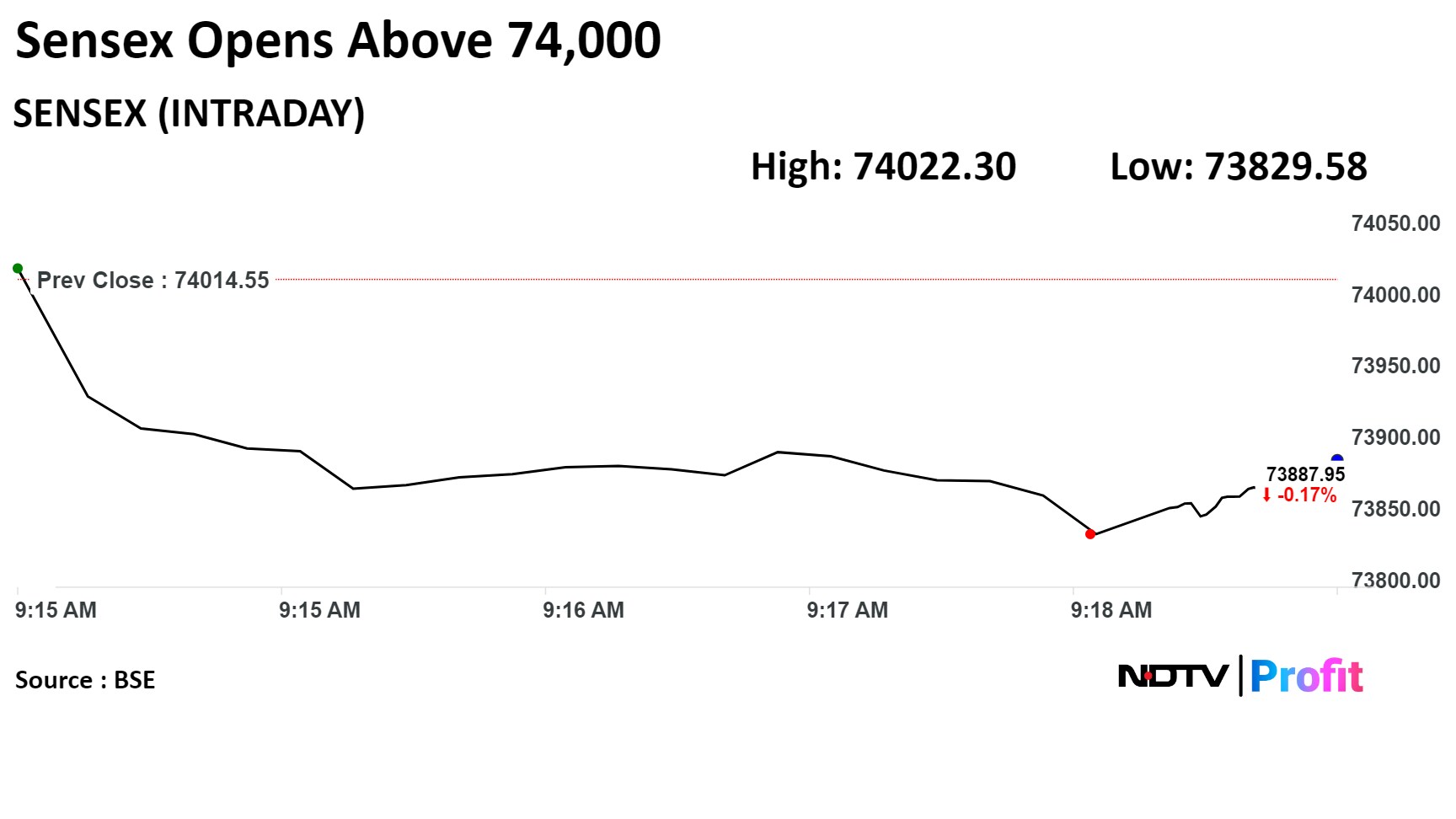

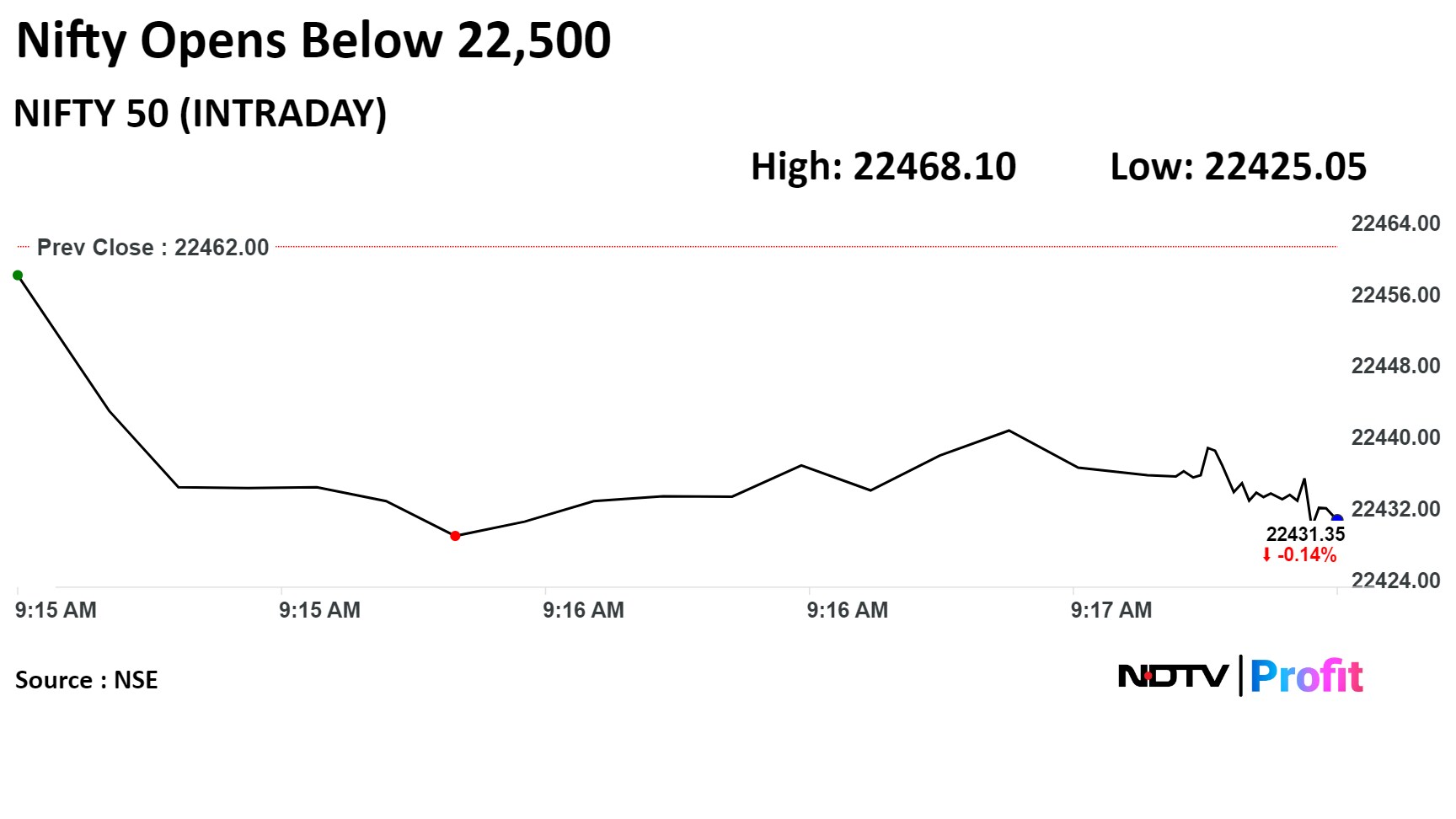

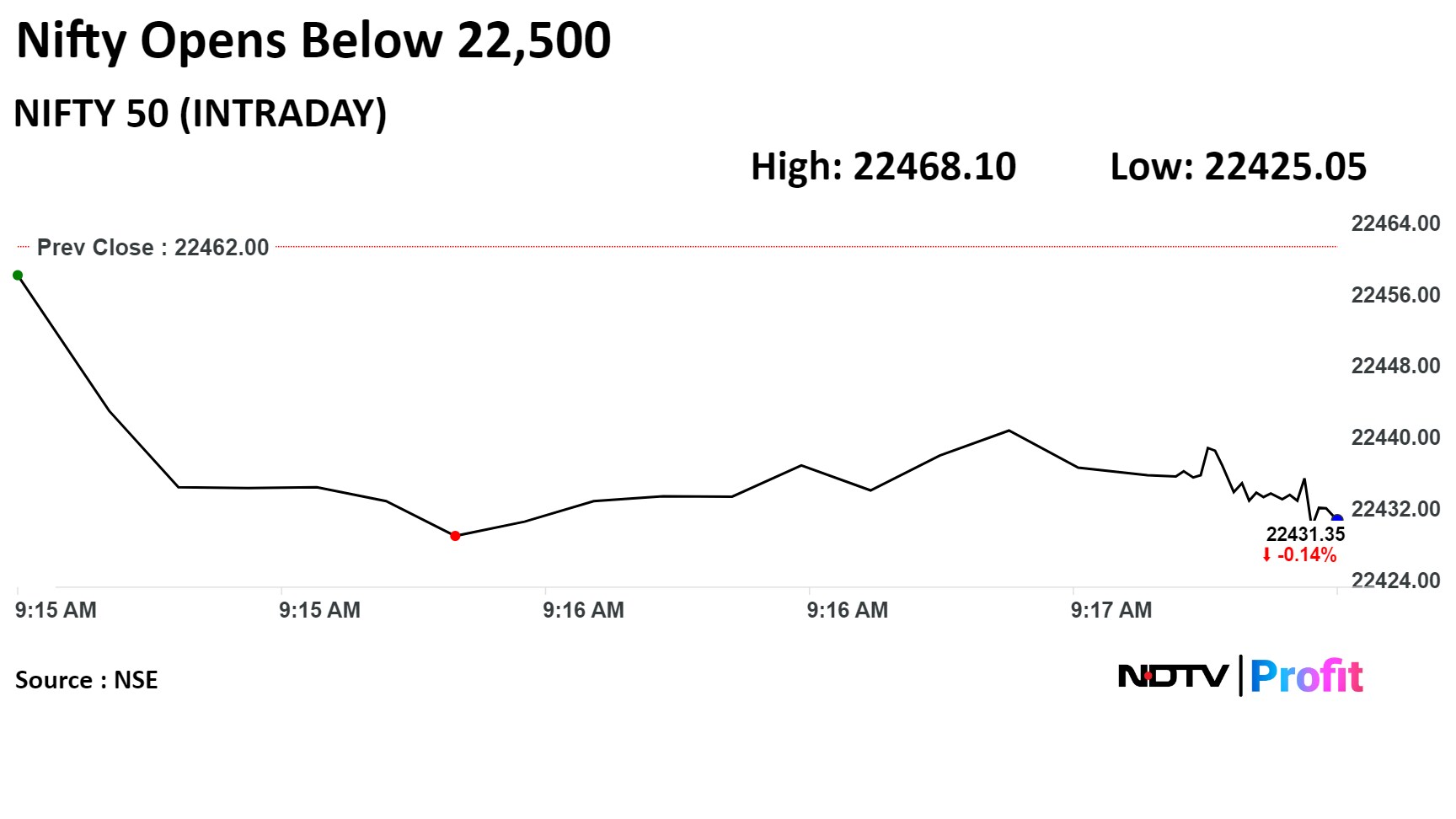

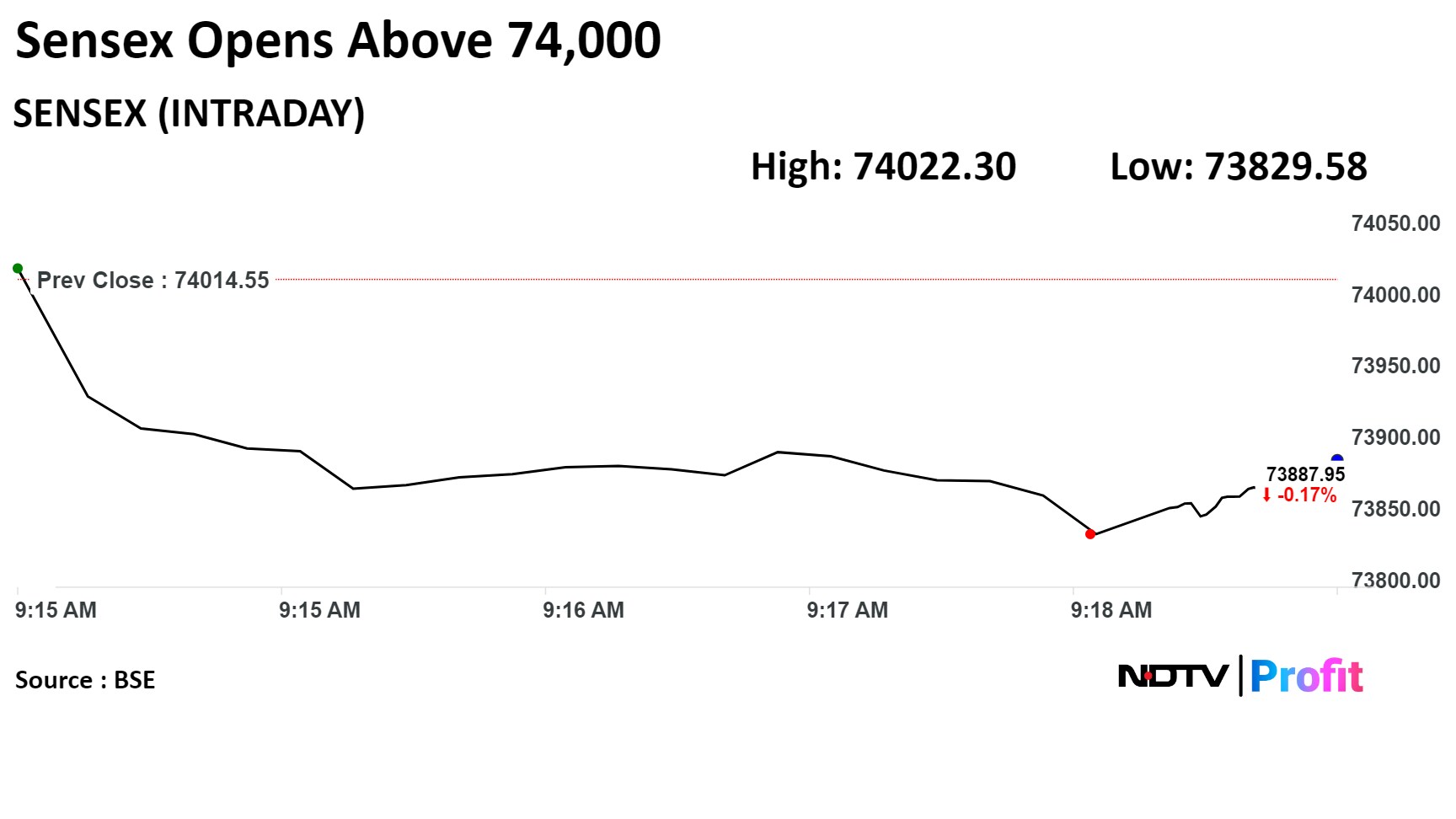

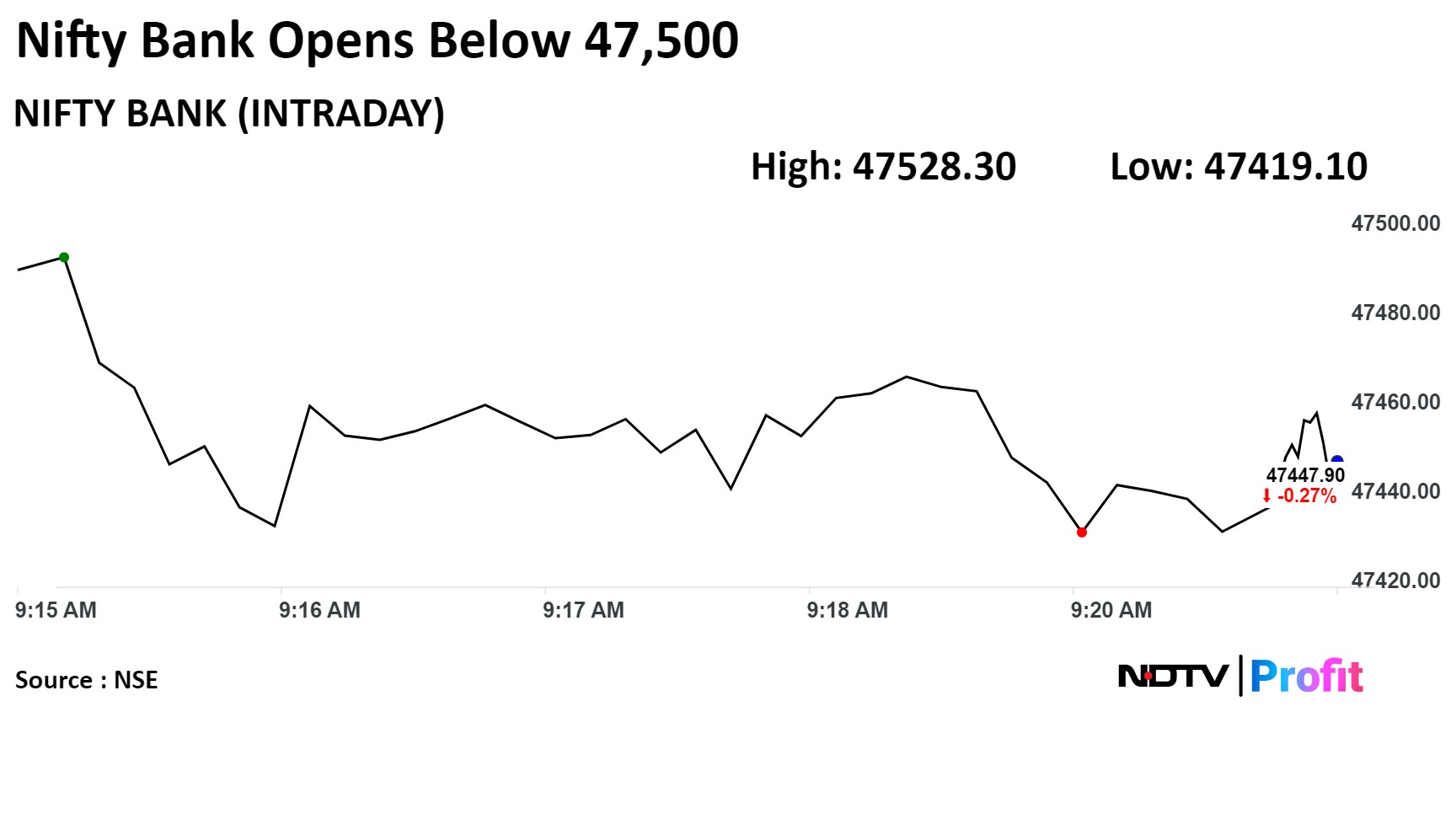

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

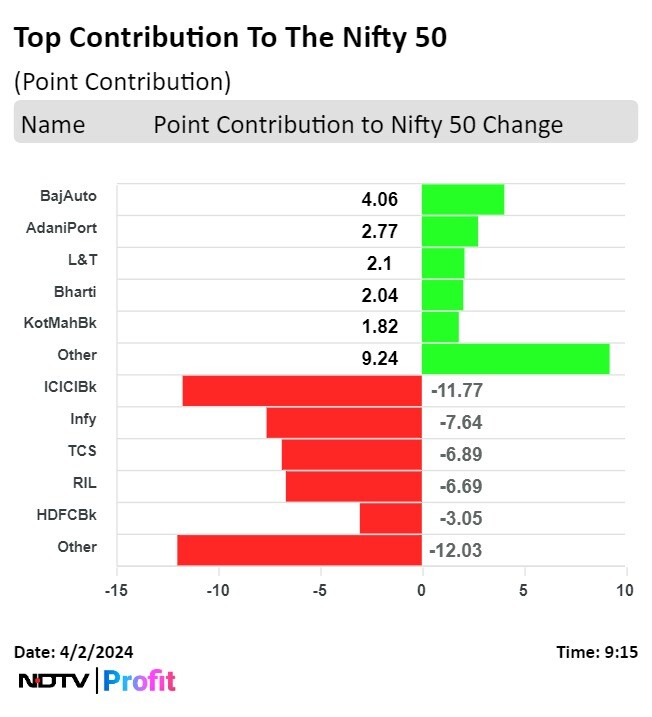

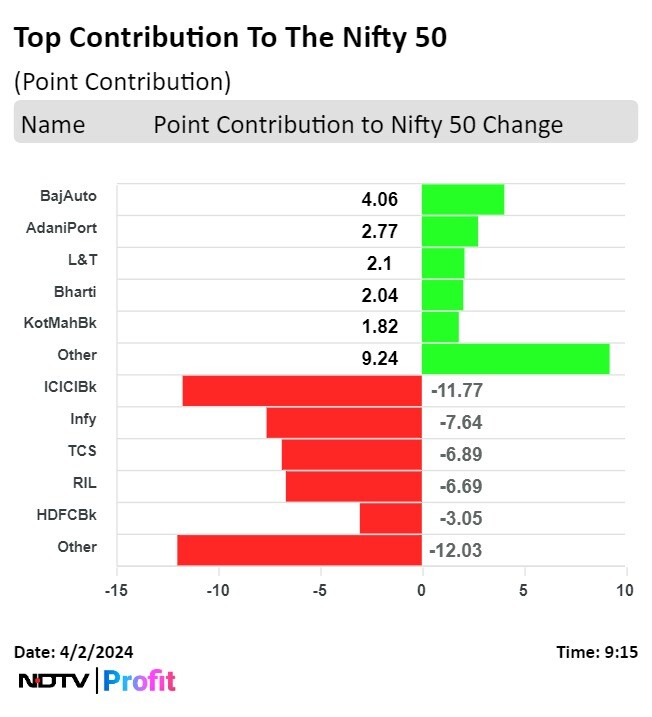

Shares of HDFC Bank Ltd., ICICI Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., and Reliance Industries Ltd. weighed on the Nifty 50.

Meanwhile, those of Bajaj Auto Ltd., Adani Ports and Special Economic Zone Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., and Kotak Mahindra Bank Ltd. minimised the losses.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.

The NSE Nifty 50 was trading 3.20 points or 0.01% down at 22,458.80, and the S&P BSE Sensex was trading 7.75 points or 0.010% up at 74,022.30.

"The breakout of 22,200 levels will act as strong support on the downside while the upside could get extended to 22,800 levels over the next few weeks," said Vikas Jain, Senior Research Analyst at Reliance Securities.

Benchmark equity indices snapped their three-day rally and fell after opening flat as HDFC Bank and ICICI Bank dragged.