Overseas investors remained net buyers of Indian equities for the third consecutive session on Monday.

Foreign portfolio investors mopped up stocks worth Rs 16.03 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net sellers and offloaded equities worth Rs 155.96 crore, the NSE data showed.

The yield on the 10-year bond closed 4 bps lower at 7.20% on Monday.

Source: Bloomberg

-The local currency strengthened 2 paise to close at 83.14 against the U.S dollar on Monday.

-It closed at 83.16 on Friday.

Source: Bloomberg

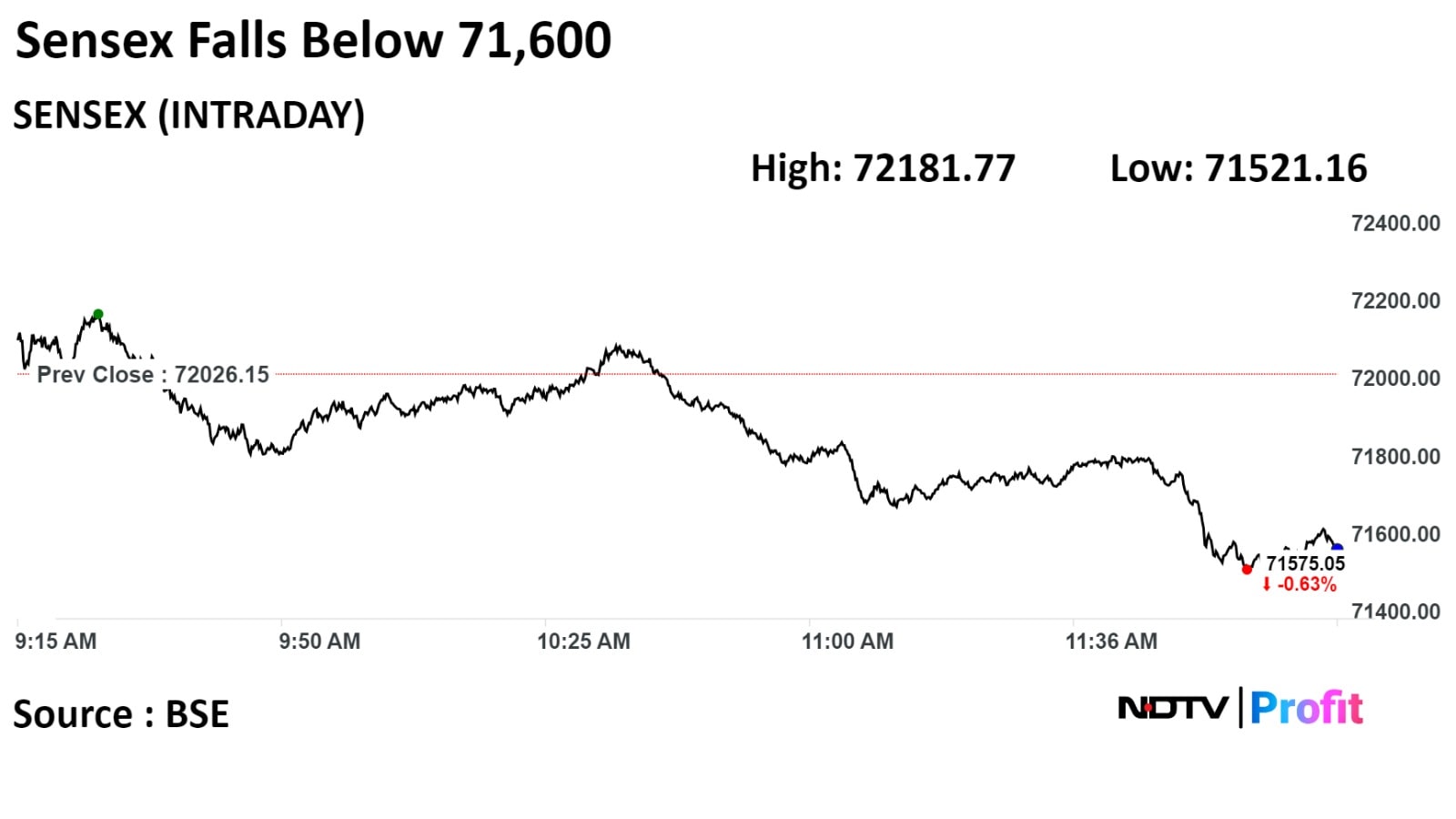

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Benchmark indices ended snapped their two-session rally to end lower after opening with marginal gains. Today's fall was because of losses in shares of financial services, FMCG and IT companies.

The Nifty ended 199.70 points or 0.92% lower at 21,511.10 points while the Sensex lost 665.73 points or 0.92% to end at 71,360.42 points. Intraday, Nifty hit a low of 21,492.90 and the Sensex hit a low of 71,301.04.

"The current market texture is volatile hence levels based trading would be the ideal strategy for the short-term traders," said Shrikant Chouhan, head of equity research at Kotak Securities.

He added, "Technically, the index has formed bearish candle on daily charts and it also formed lower top formation on intraday charts, which supports further weakness from the current levels."

Shares of HDFC Bank Ltd., ICICI Bank Ltd., ITC Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd., dragged the index lower.

Meanwhile, those of HCL Technologies, Adani Ports and Speacial Economic Zone Ltd., NTPC Ltd., Bajaj Finance Ltd., and Bharti Airtel Ltd., capped the downside.

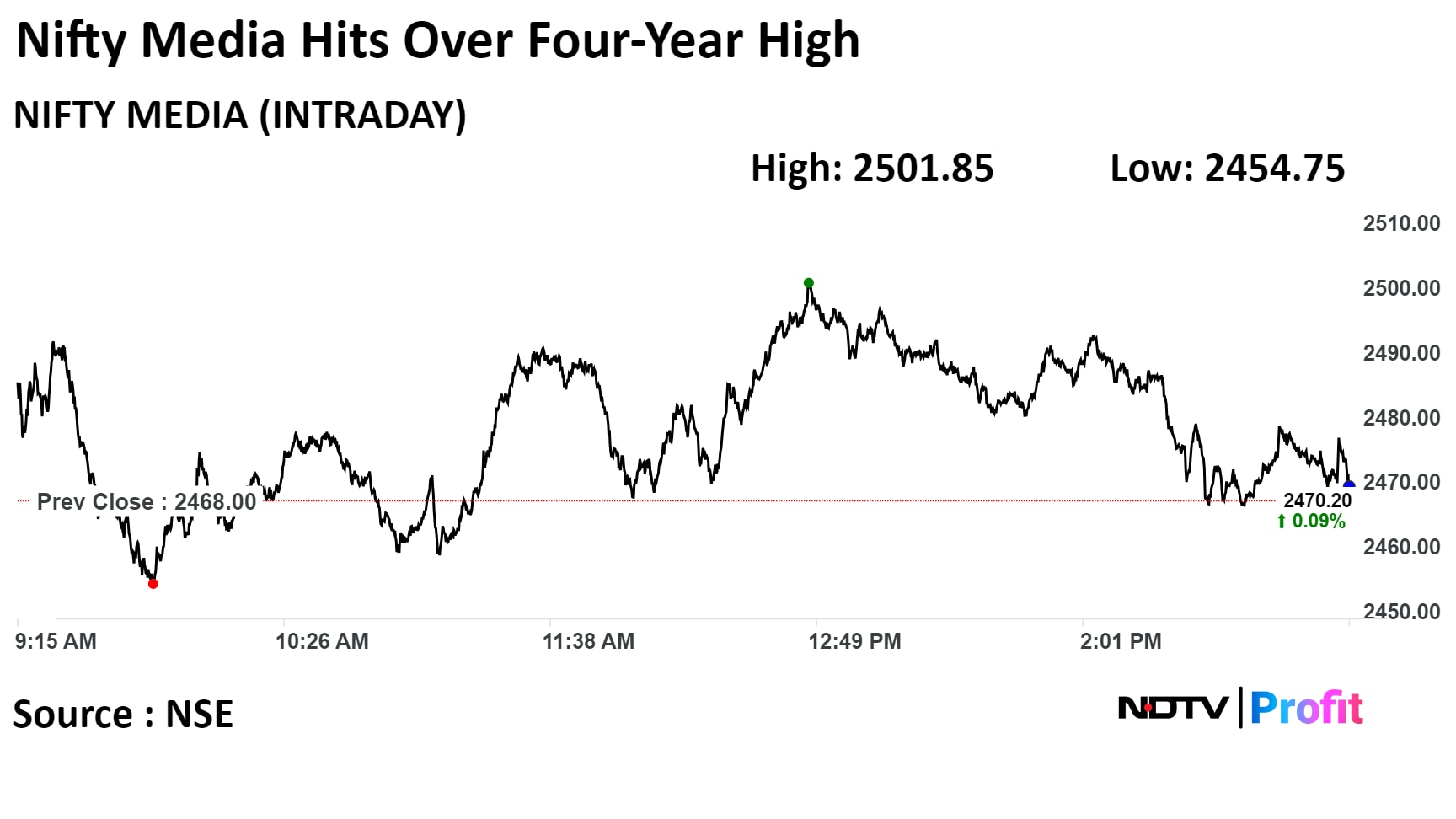

All sectoral indices fell except Nifty Realty and Nifty Media. Nifty PSU Bank fell the most by over 2.5%.

The broader markets outperformed benchmark indices. The S&P BSE Smallcap Index declined 0.36%, whereas S&P BSE MidCap Index was 0.87% lower. On BSE, 18 out of 20 sectors declined, while two advanced. S&P BSE FMCG declined 1.55% and was the top loser among sectoral indices. The S&P BSE Realty was the top gainer among sectoral indices.

The market breadth was skewed in favour of the sellers. About 2,044 stocks declined, 1,927 advanced, and 103 remained unchanged on the BSE.

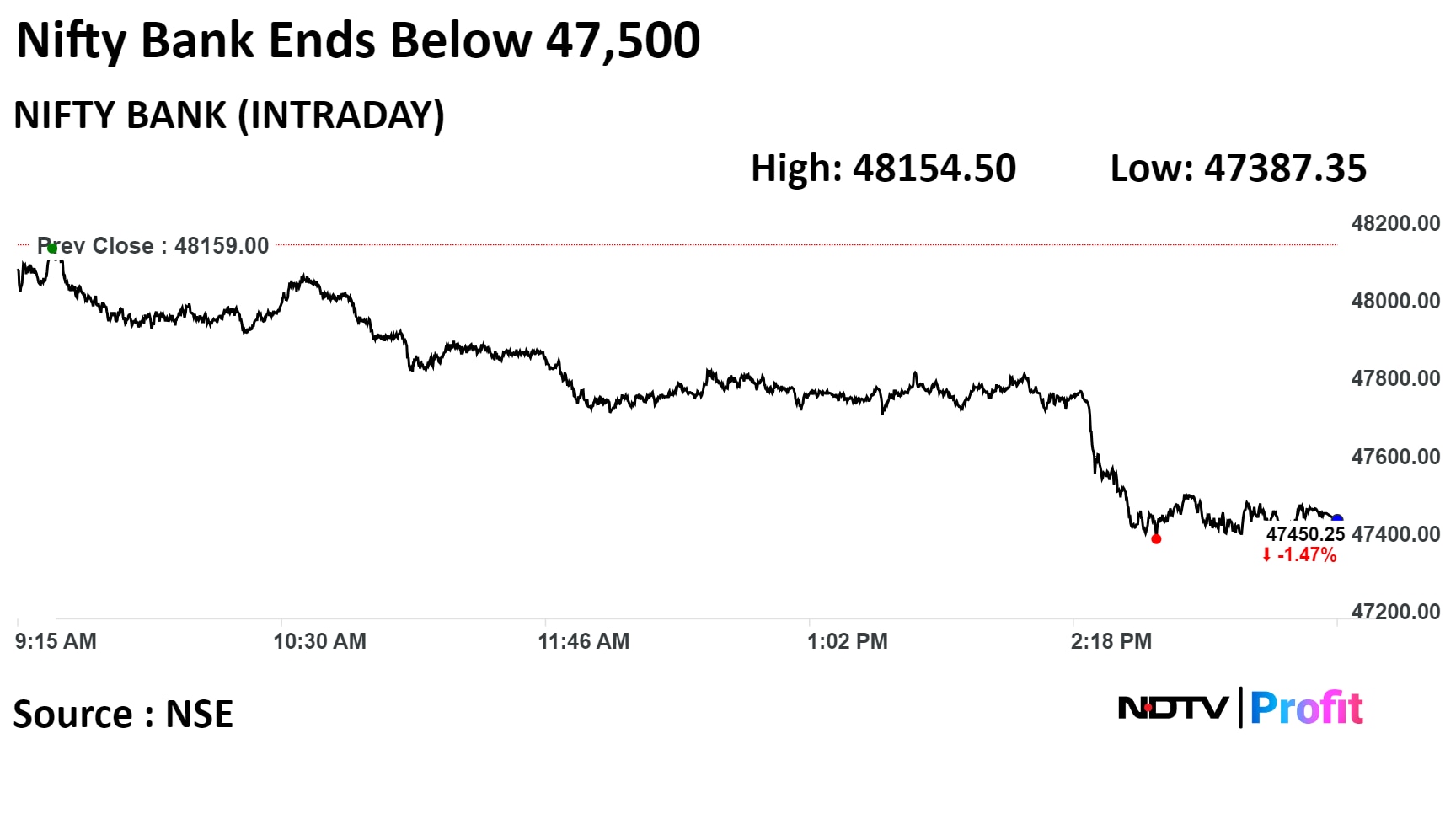

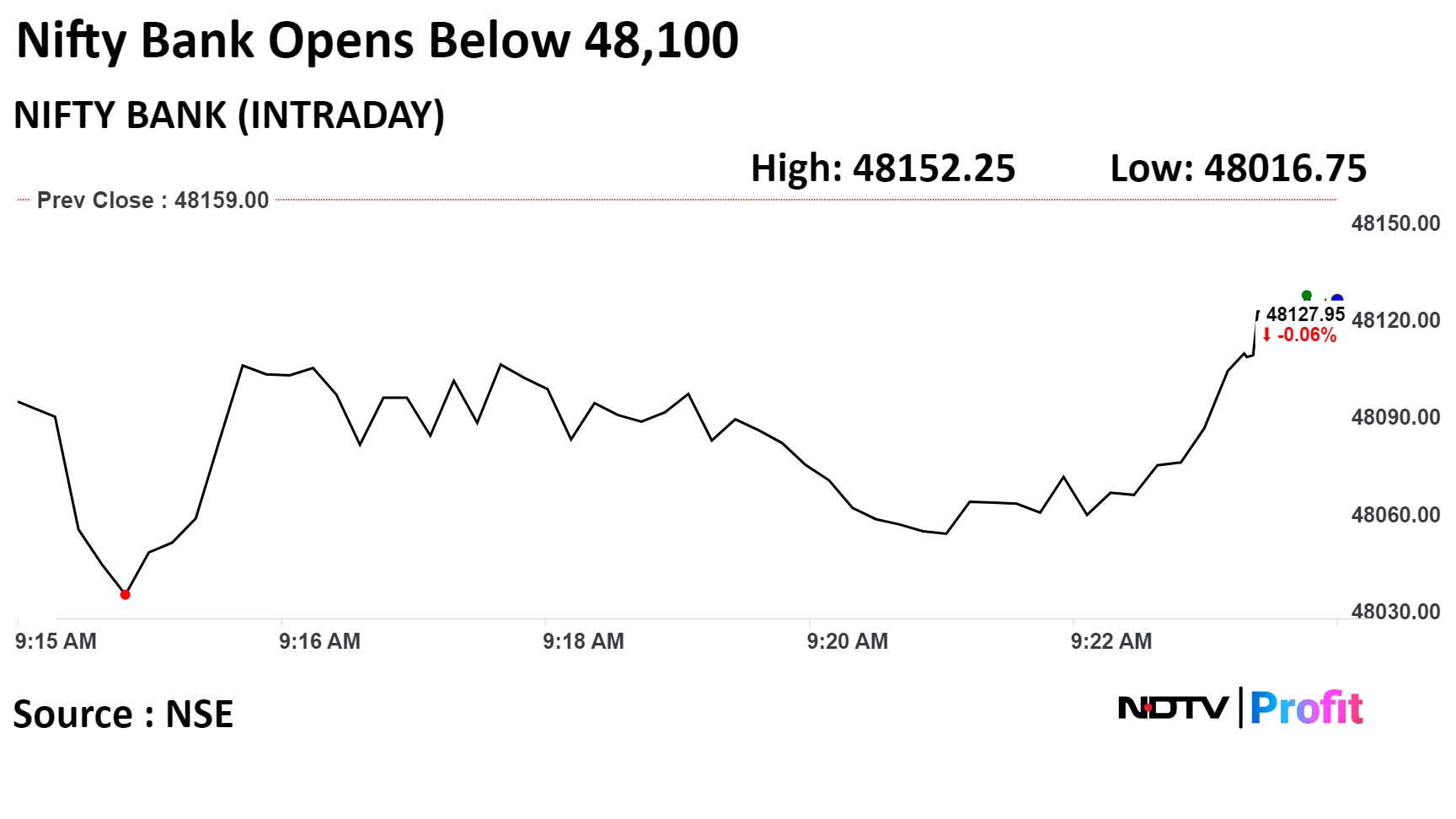

SBI, HDFC Bank and Kotak Mahindra Bank weigh on Bank Nifty

SBI, HDFC Bank and Kotak Mahindra Bank weigh on Bank Nifty

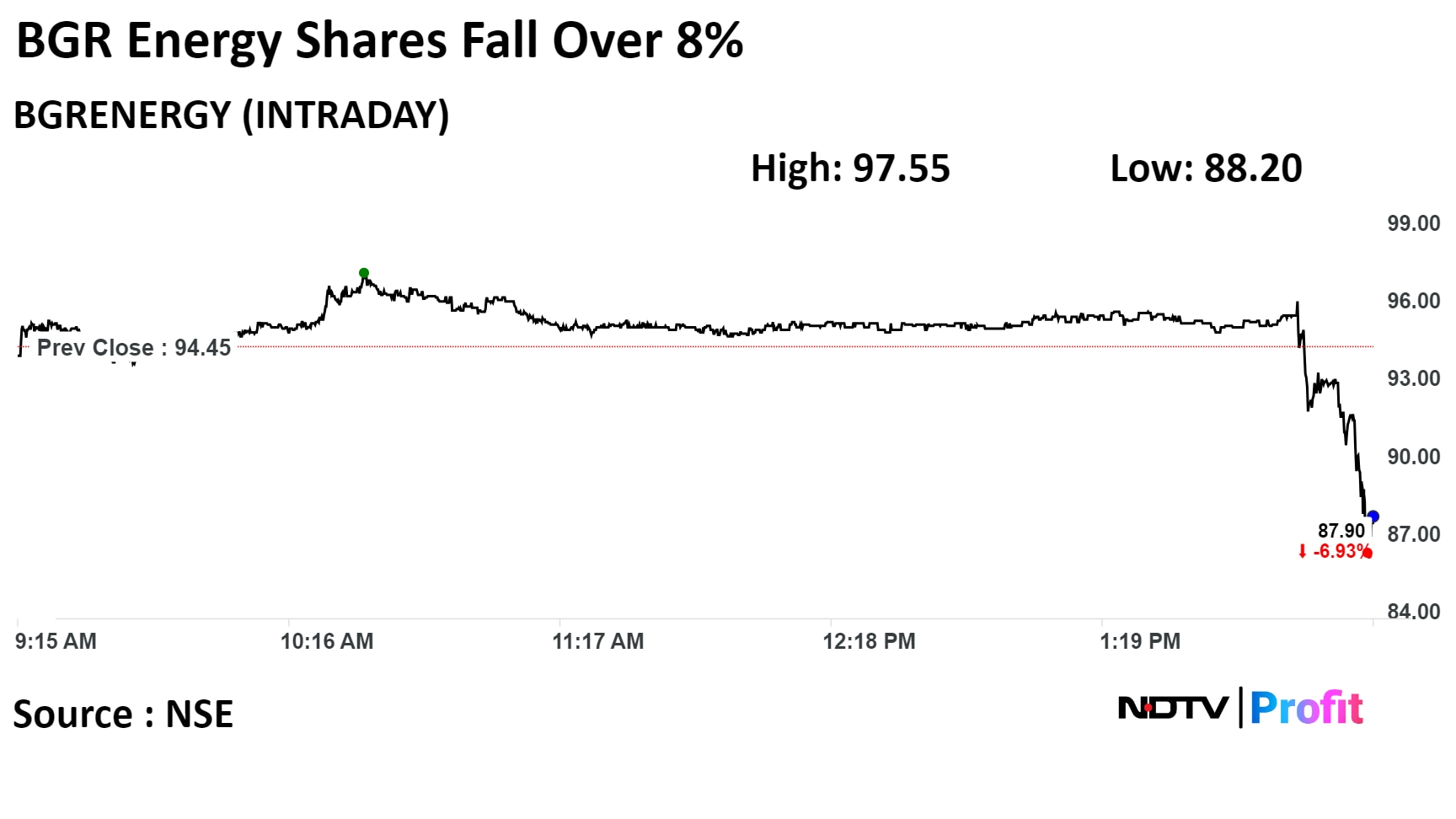

--Amount owed to ICICI Bank, Indian Bank, Bank of India

--Defaults occurred in October and November, 2023

--Total outstanding dues to financial institutions at Rs 4,256 crore

--Total indebtedness at Rs 4,688 crore

Source: Exchange notice

--Amount owed to ICICI Bank, Indian Bank, Bank of India

--Defaults occurred in October and November, 2023

--Total outstanding dues to financial institutions at Rs 4,256 crore

--Total indebtedness at Rs 4,688 crore

Source: Exchange notice

The scrip fell as much as 8.42% to Rs 86.50 apiece, the lowest level since December 8, 2023. It pared losses to trade 8.36% lower at Rs 86.55 apiece, as of 2:24 p.m. This compares to a 0.7% decline in the NSE Nifty 50 Index.

It has risen 45.22% in the last 12 months. The relative strength index was at 43.85.

"We raise HDFC AMC’s TP to Rs2,375 from Rs2,200 capturing (1) rise in near-to-medium term PAT estimates by 4-7% (~Rs100) and (2) rollover to Dec ‘25E (~Rs75)."

"We raise our AAUM growth and yield assumptions for 2HFY24E to capture current strength in equity markets driving elevated MTM and robust equity flows."

"Additionally, we raise our yield estimates for 2HFY24E (50.1 from 48.1 bps earlier) owing to favourable equity-oriented mix. High base of FY2024E drives an increase in medium-term profitability estimates. We however remain cautious on HDFC AMC owing to rich valuations."

The brokerage has a 'sell' rating for the stock. "Current price likely factors in sustained top-notch performance of equity schemes or continued rally in equity markets. The company has rapidly expanded its talent base; moderation in market sentiment or weakness in net flows can lead to downside risks. Additionally, we expect distributor payouts to remain elevated for a prolonged period leading to continued pressure on fresh yields. "

Gets order from Mahan Energen for construction work

Order for construction of 2 x 800 MW thermal power project in Madhya Pradesh

Source: Exchange filing

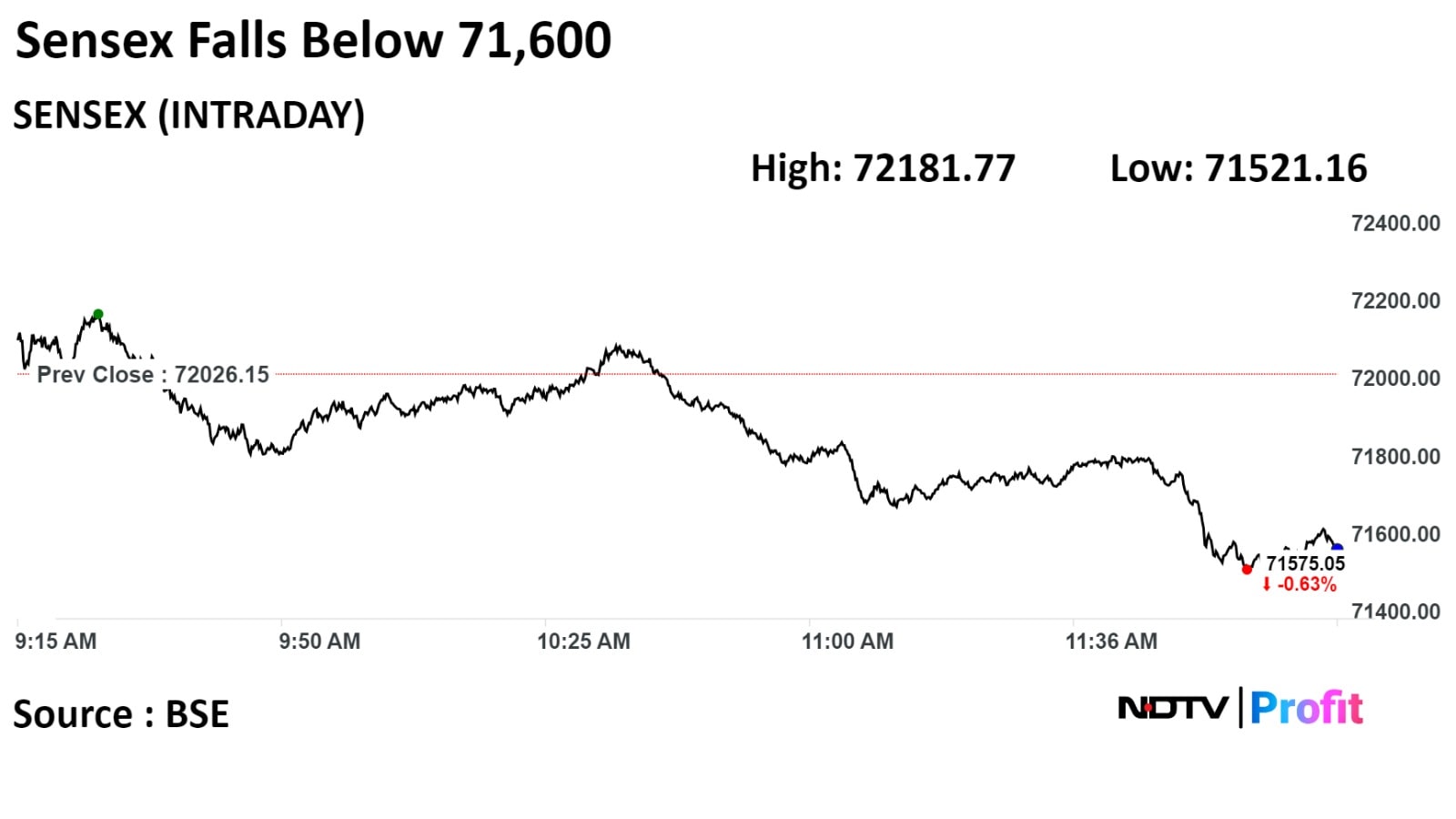

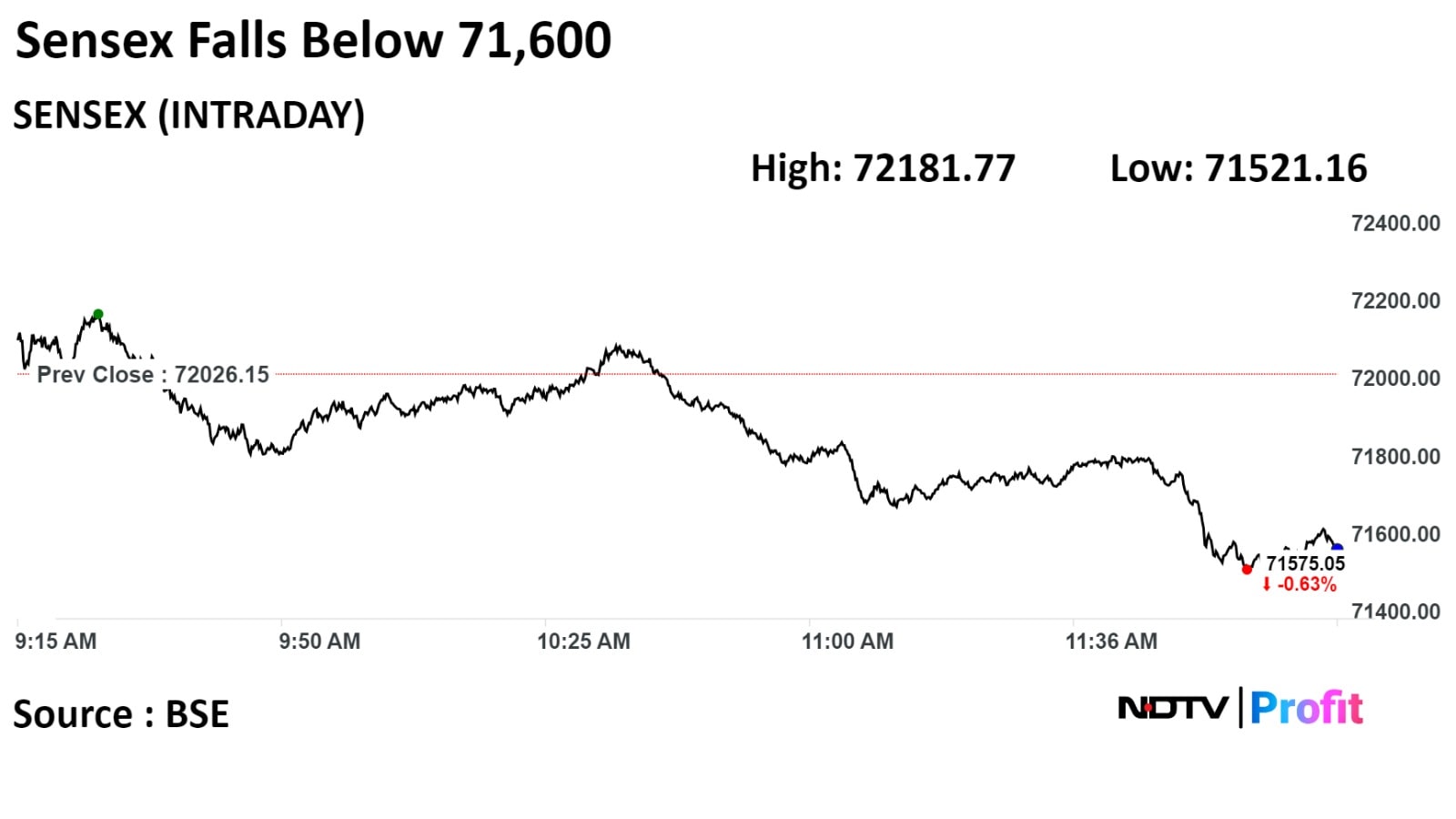

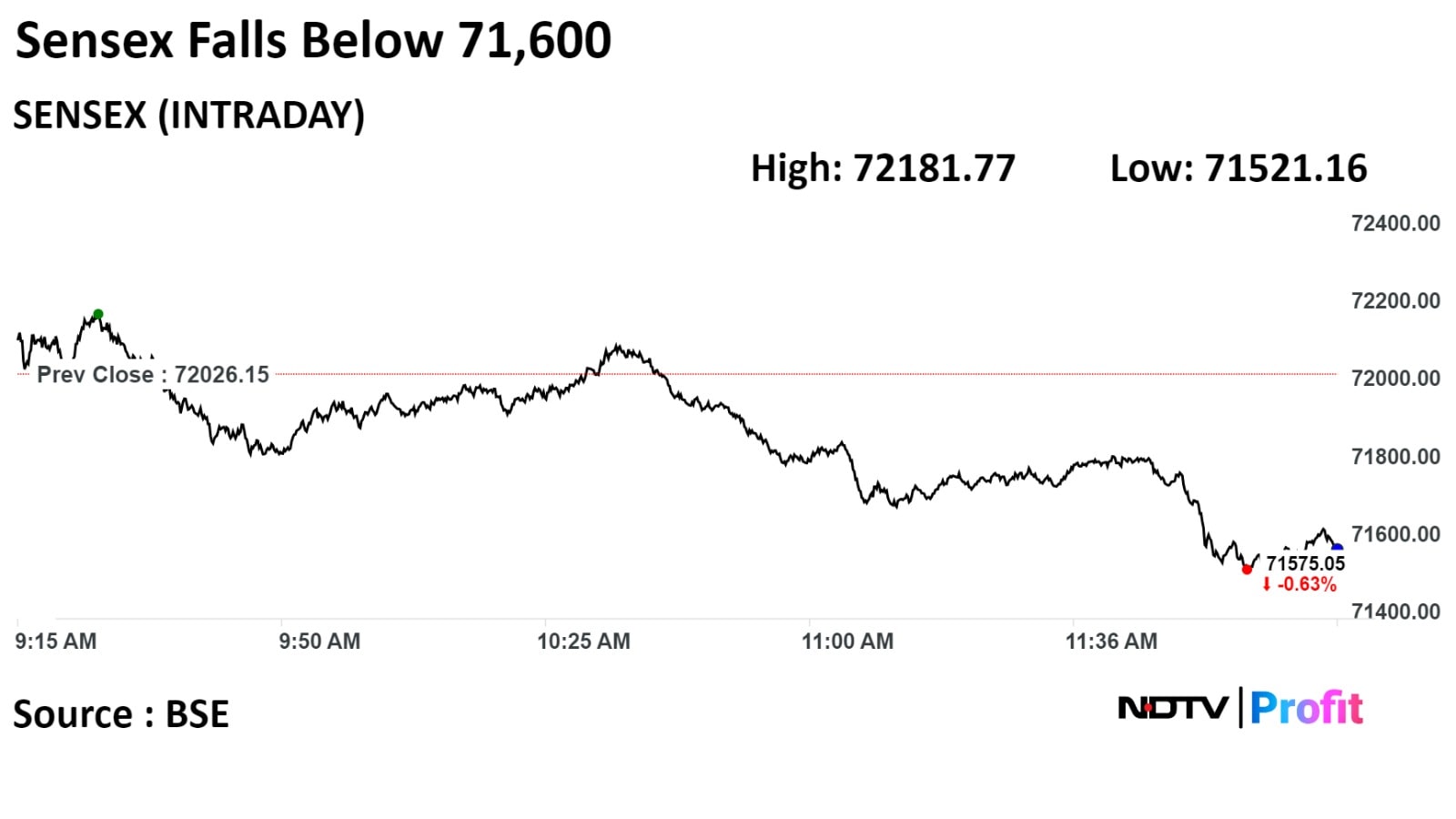

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

Most bank stocks declined on the NSE, with the HDFC Bank Ltd., State Bank of India and Bank of Baroda declining the most. Only AU Small Finance Bank was up 0.05% on the NSE.

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

India's benchmark indices extended losses through midday on Monday amid volatility as stocks of fast-moving consumer goods and financial services exerted pressure on the indices.

As of 12:30 p.m., the NSE Nifty 50 fell 123 points or 0.57% to 21,587.40, while the S&P BSE Sensex declined 408 points or 0.57% to 71,618.32. The Nifty hit intraday low of 21,552.75 and the Sensex fell to a low of 71,521.16.

Most bank stocks declined on the NSE, with the HDFC Bank Ltd., State Bank of India and Bank of Baroda declining the most. Only AU Small Finance Bank was up 0.05% on the NSE.

"The market outlook is poised to be significantly shaped by the impending quarterly earnings reports from major IT companies," Shrey Jain, chief executive officer of SAS Online, said.

The support for the Nifty is expected to materialise within the range of 21,600 to 21,650, with a robust buy zone projected at 21,500–21,550, Jain said.

Q3 performance beat expectations across BPC, fashion verticals

Raise estimates to 20% and 32% YoY in BPC, fashion NSV growth

Expect Q3 Ebitda margins at 6.7% (+130bps QoQ; +140bps YoY)

Q3 has significant operating leverage (+18% QoQ revenue growth)

Margins to be seasonally strong, driving growth in fashion vertical

Gets order for supply of products for defence based application to international client

Source: Exchange Filing

29.6 lakh shares or 0.05% equity changed hands in a large trade

Buyers and sellers not known immediately

Source: Bloomberg

32.6 lakh shares changed hands in a large trade

1% equity changed hands at Rs 437.2 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Adani Green delivers cash-backed redemption plan for $750 million Holdco bond.

Delivers on refinancing plan for $750 mn of notes due on September 9, 2024.

Source: Exchange Filing

Buyback approved at Rs 450 per share

Source: Exchange Filing

Q3 cement production at 7,49,703 tn, up 5% YoY

Source: Exchange Filing

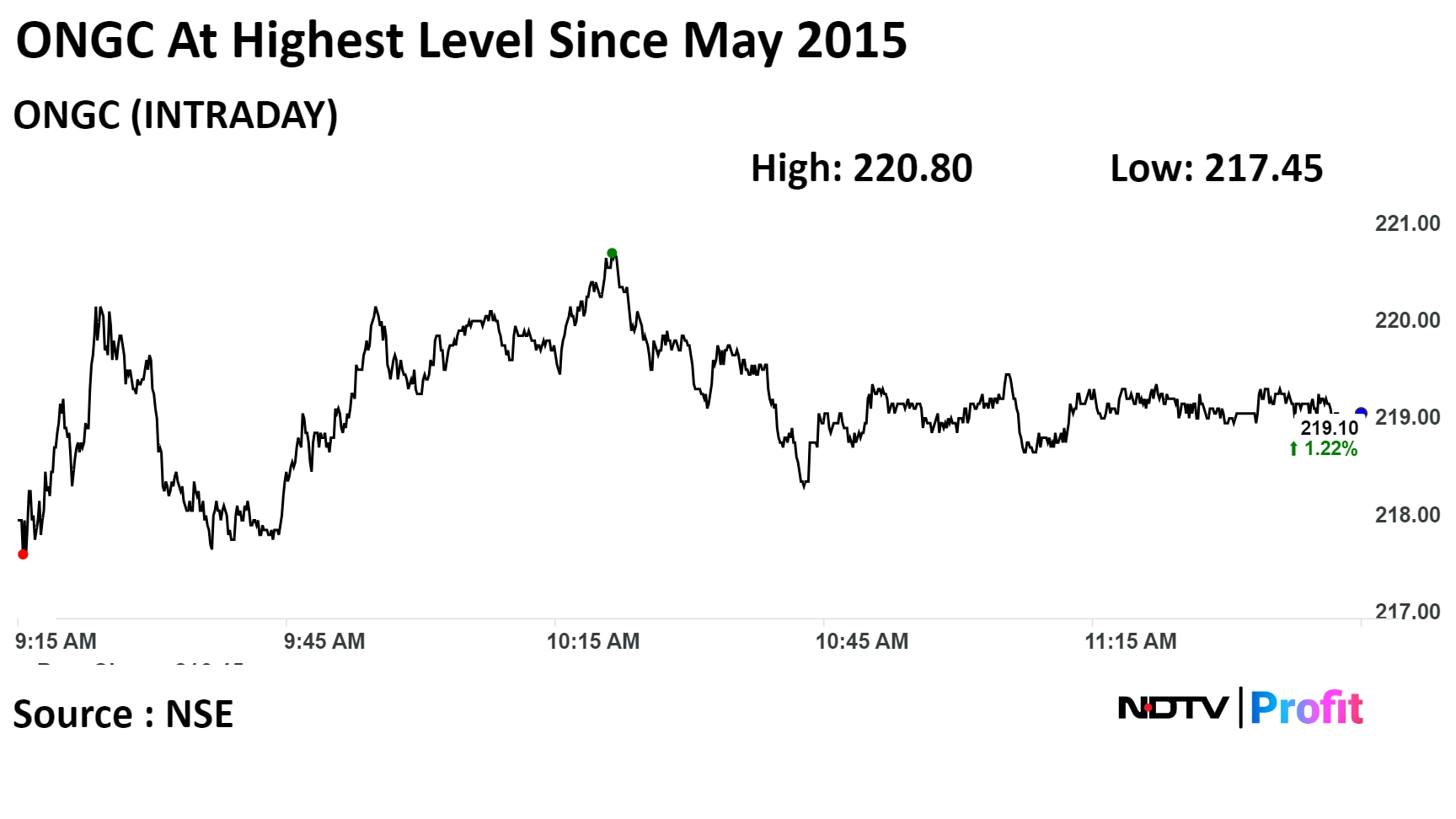

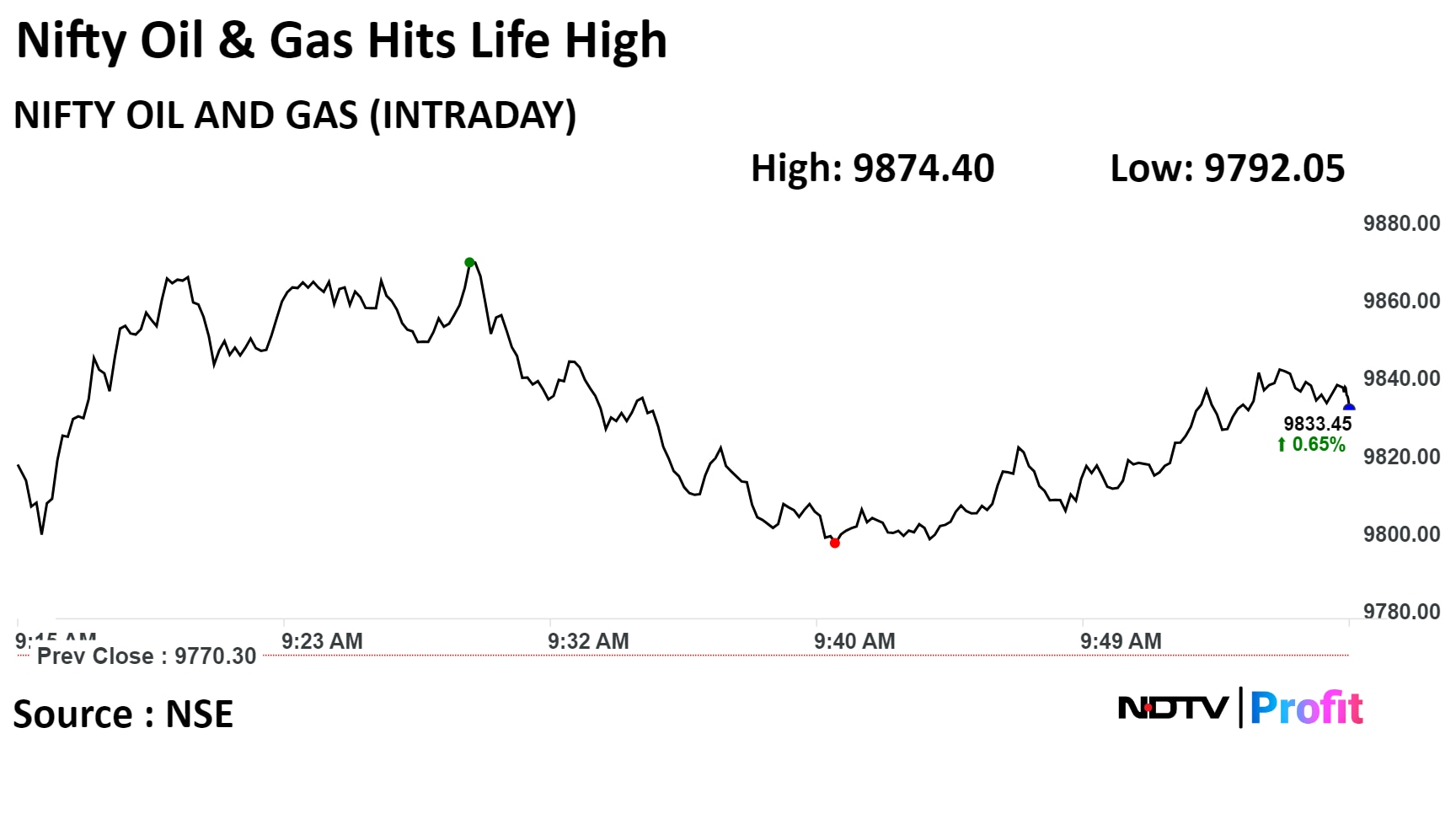

Shares of Oil and Natural Gas Corp Ltd. jumped to hit a multi-year high after the company announced successful commencement of “First Oil” production from its deep-water KG-DWN-98/2 Block, located off the coast of the Bay of Bengal, on Sunday.

Shares of Oil and Natural Gas Corp Ltd. jumped to hit a multi-year high after the company announced successful commencement of “First Oil” production from its deep-water KG-DWN-98/2 Block, located off the coast of the Bay of Bengal, on Sunday.

The scrip rose as much as 2.01% to Rs 220.80 piece, the highest level since May 29, 2015. It pared gains to trade 0.76% higher at Rs 218.80 apiece, as of 11:56 a.m. This compares to a 0.65% decline in the NSE Nifty 50 Index.

It has risen 47.22%in the last twelve months. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 72.97, indicating that the stock may be overbought.

Out of 28 analysts tracking the company, 19 maintain a 'buy' rating, five recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.4%.

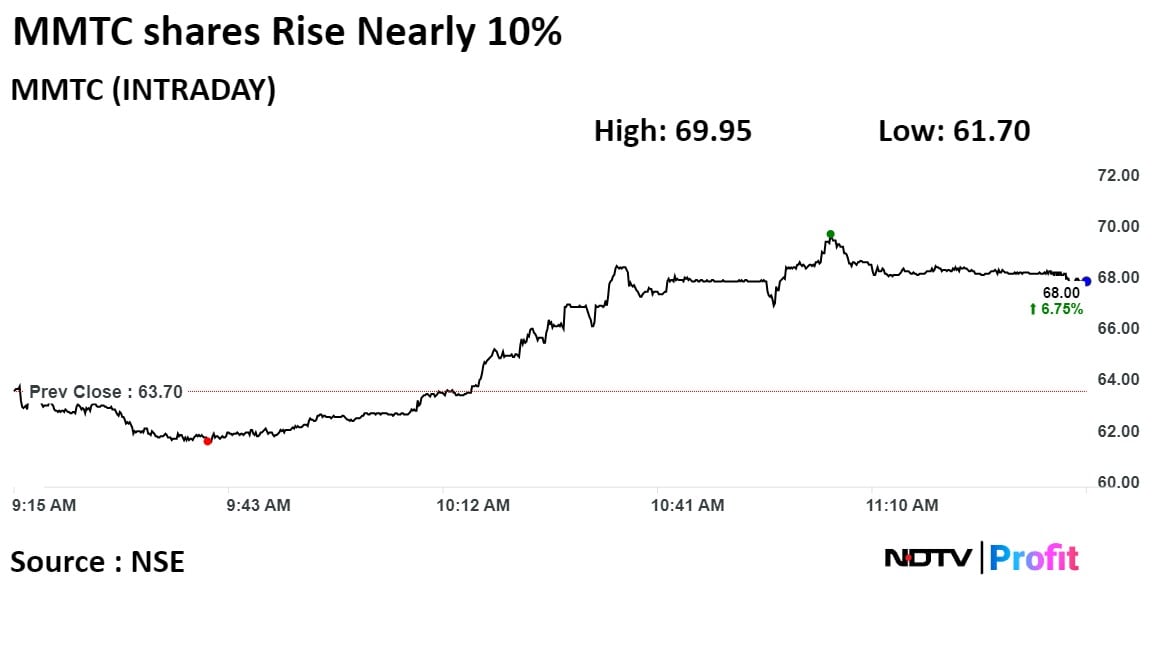

MMTC shares rise over 9% on Monday.

The scrip rose as much as 9.81% to 69.95 apiece, the highest level since Oct. 19, 2023. It pared gains to trade 6.28% higher at Rs 67.70 apiece, as of 11:38 a.m. This compares to a 0.34% decline in the NSE Nifty 50 Index.

It has risen 86.50% in the last 12 months. Total traded volume so far in the day stood at 5 times its 30-day average. The relative strength index was at 73.

Most FMCG stocks declined after BofA's earnings estimates cut for these companies post disappointing Q3FY24 update from Godrej Consumer Products Ltd, and Marico Ltd. The brokerage gave an 'underperform' rating to Marico, and maintained 'Neutral' rating on Godrej Consumer Products Ltd.

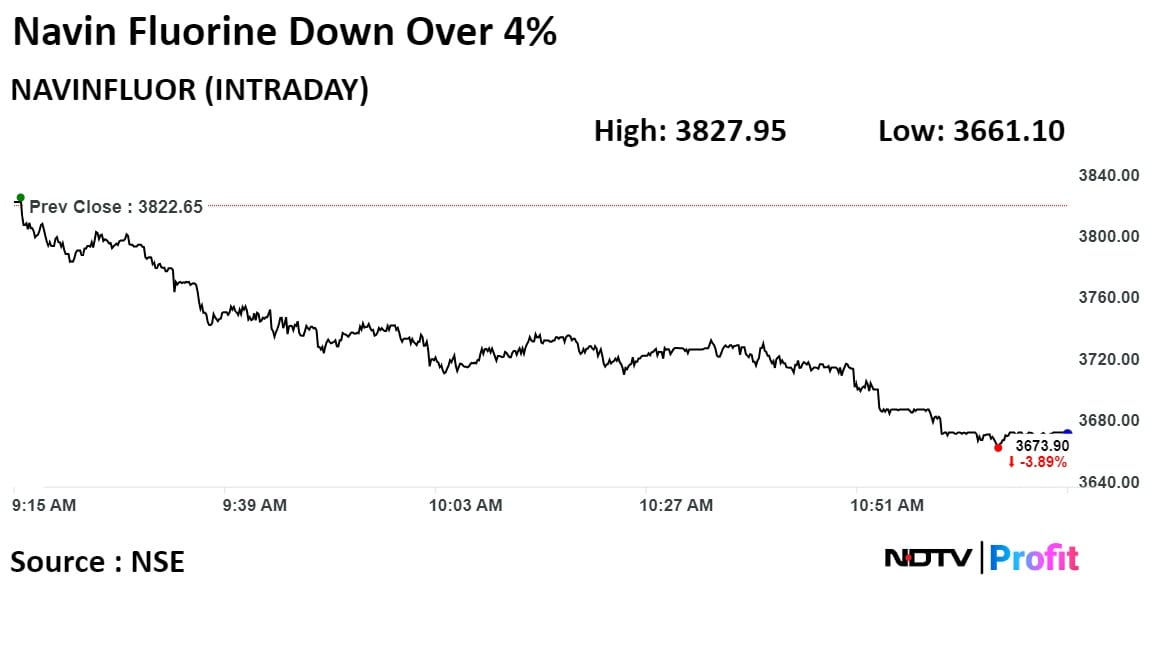

Navin Fluorine International shares fall to six week low on Monday.

The scrip fell as much as 4.23% to 3,661.10 apiece, the lowest level since Nov. 23, 2023. It pared losses to trade 3.91% lower at Rs 3,673 apiece, as of 11:13 a.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

It has fallen 7.13% in the last 12 months. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 38.

Out of 30 analysts tracking the company, 18 maintain a 'buy' rating, 10 recommend a 'hold,' and 2 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 4.1%.

Navin Fluorine International shares fall to six week low on Monday.

The scrip fell as much as 4.23% to 3,661.10 apiece, the lowest level since Nov. 23, 2023. It pared losses to trade 3.91% lower at Rs 3,673 apiece, as of 11:13 a.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

It has fallen 7.13% in the last 12 months. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 38.

Out of 30 analysts tracking the company, 18 maintain a 'buy' rating, 10 recommend a 'hold,' and 2 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 4.1%.

10.1 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 1,828.7 apiece

Buyers and sellers not known immediately

Source: Bloomberg

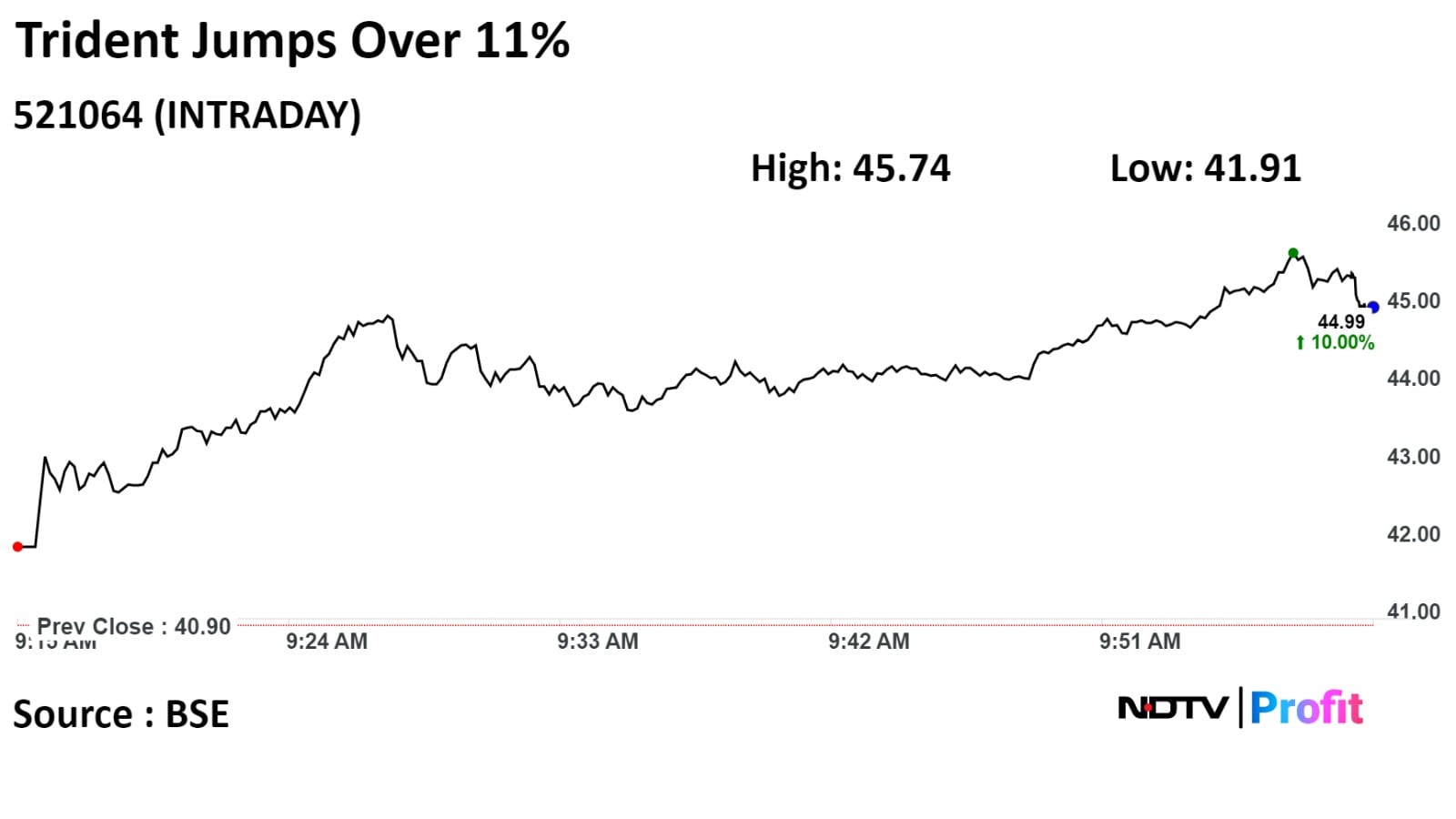

Trident Ltd at 11.01 times its 30 day average

Garware Technical Fibres Ltd at 10.27 times its 30 day average

Sula Vineyards Ltd at 9.24 times its 30 day average

Fiem Industries Ltd at 7.88 times its 30 day average

Elecon Engineering Co Ltd at 5.64 times its 30 day average

Bank Of America has initiated 'neutral' rating on Tata Technologies Ltd. with a target price of Rs 1,250. This implies 6% upside return potential.

The research firm view Tata Technologies as well positioned to participate in the fast growing Auto engineering services sector.

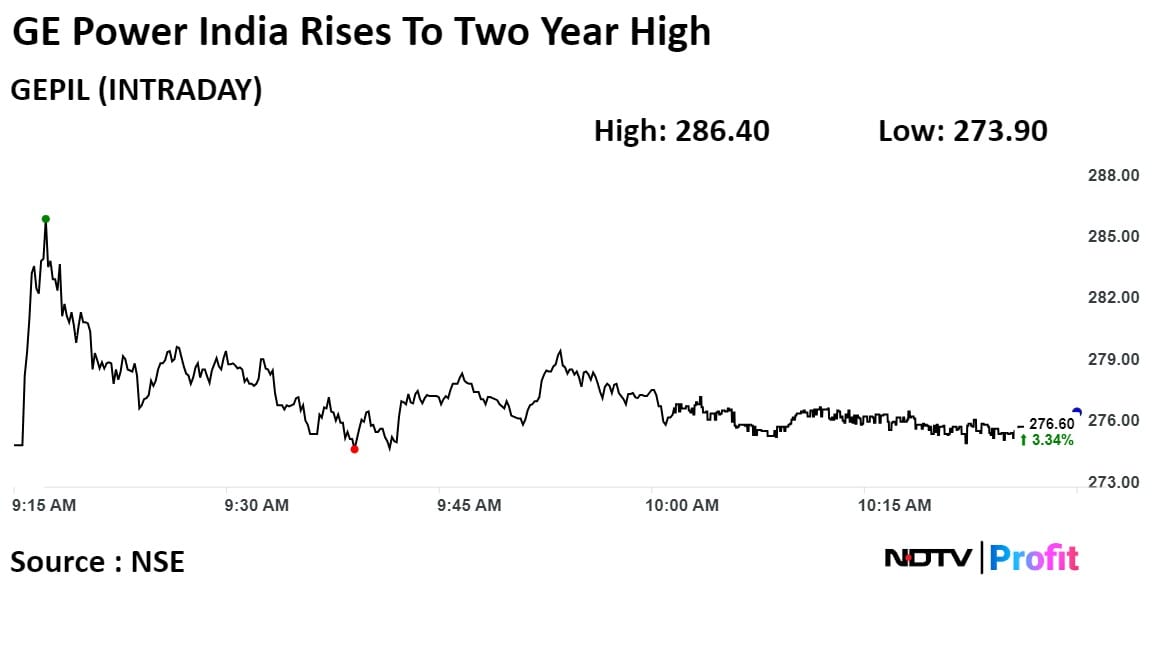

Shares of GE Power India Ltd rose on Monday after the company won order worth Rs 22.15 crore from Maithon Power Ltd for combustion modification of boilers.

The scrip rose as much as 7% to 286.40 apiece, highest in over two years. This is the highest level since Dec. 13, 2021. It pared gains to trade 3.01% higher at Rs 275.70 apiece, as of 10:27 a.m. This compares to a 0.04 advance in the NSE Nifty 50 Index.

It has risen 101.90% in the last 12 months. Total traded volume so far in the day stood at 6.6 times its 30-day average. The relative strength index was at 79.

Shares of GE Power India Ltd rose on Monday after the company won order worth Rs 22.15 crore from Maithon Power Ltd for combustion modification of boilers.

The scrip rose as much as 7% to 286.40 apiece, highest in over two years. This is the highest level since Dec. 13, 2021. It pared gains to trade 3.01% higher at Rs 275.70 apiece, as of 10:27 a.m. This compares to a 0.04 advance in the NSE Nifty 50 Index.

It has risen 101.90% in the last 12 months. Total traded volume so far in the day stood at 6.6 times its 30-day average. The relative strength index was at 79.

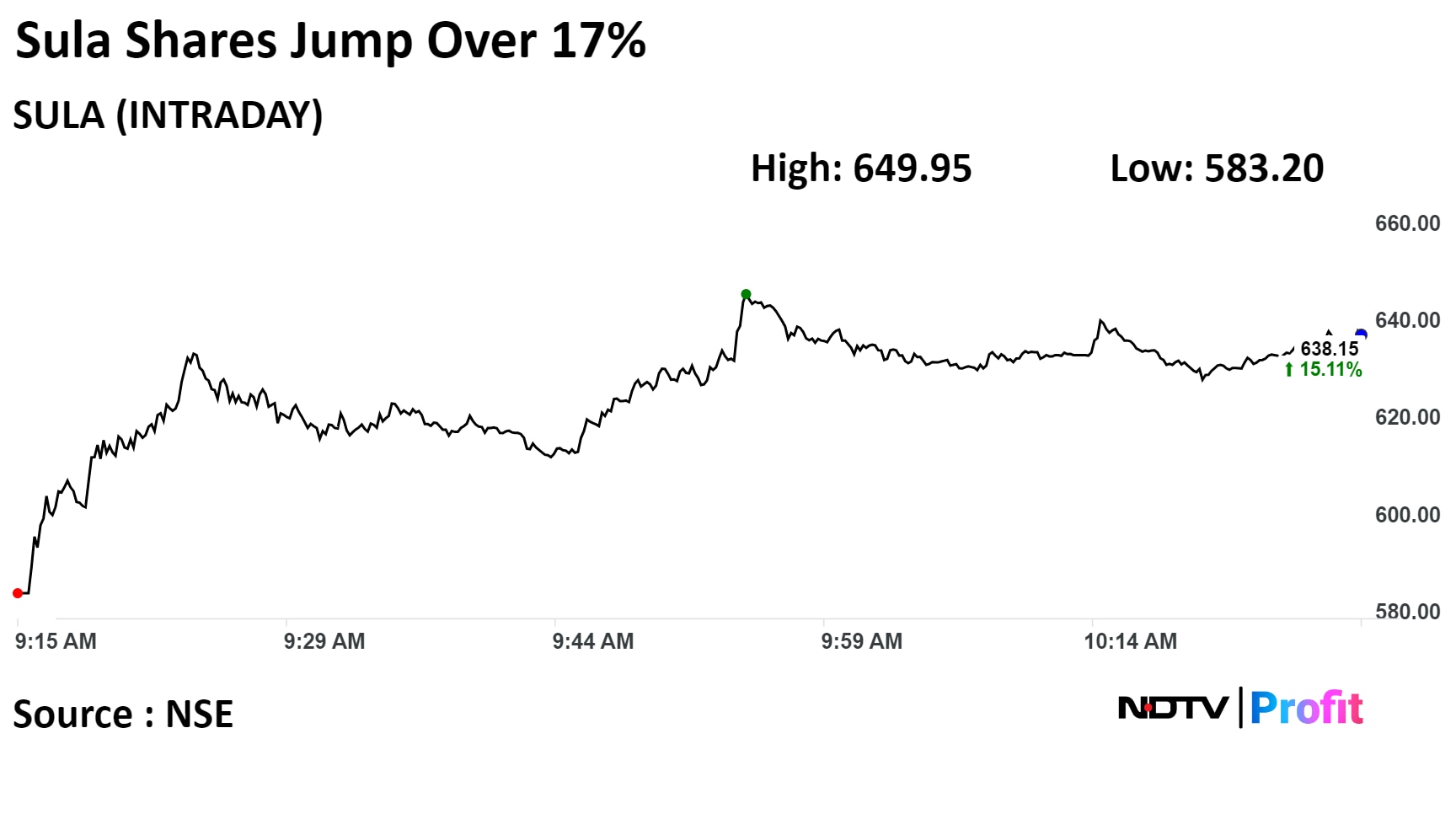

Shares of Sula Vineyards Ltd., jumped as much as 17.23% to hit Rs 649.95, its highest level since listing. It has risen 95.6% in the last twelve months. Total traded volume so far in the day stood at 37 times its 30-day average. The relative strength index was at 88.37, indicating that the stock may be overbought.

Five analysts tracking the company have a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.5%.

Shares of Sula Vineyards Ltd., jumped as much as 17.23% to hit Rs 649.95, its highest level since listing. It has risen 95.6% in the last twelve months. Total traded volume so far in the day stood at 37 times its 30-day average. The relative strength index was at 88.37, indicating that the stock may be overbought.

Five analysts tracking the company have a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.5%.

Reiterates ADD rating for Sula Vineyards

Expect WIPS extension for next five years to offer better earning visibility

Expect WIPS continuation decision to be approved in upcoming state cabinet meeting

WIPS proposal failed to get state cabinet approval in Dec'22

Continuation of WIPS removes regulatory uncertainty and merits stock re-rating

Note: WIPS stands for Wine Industry Promotion Scheme

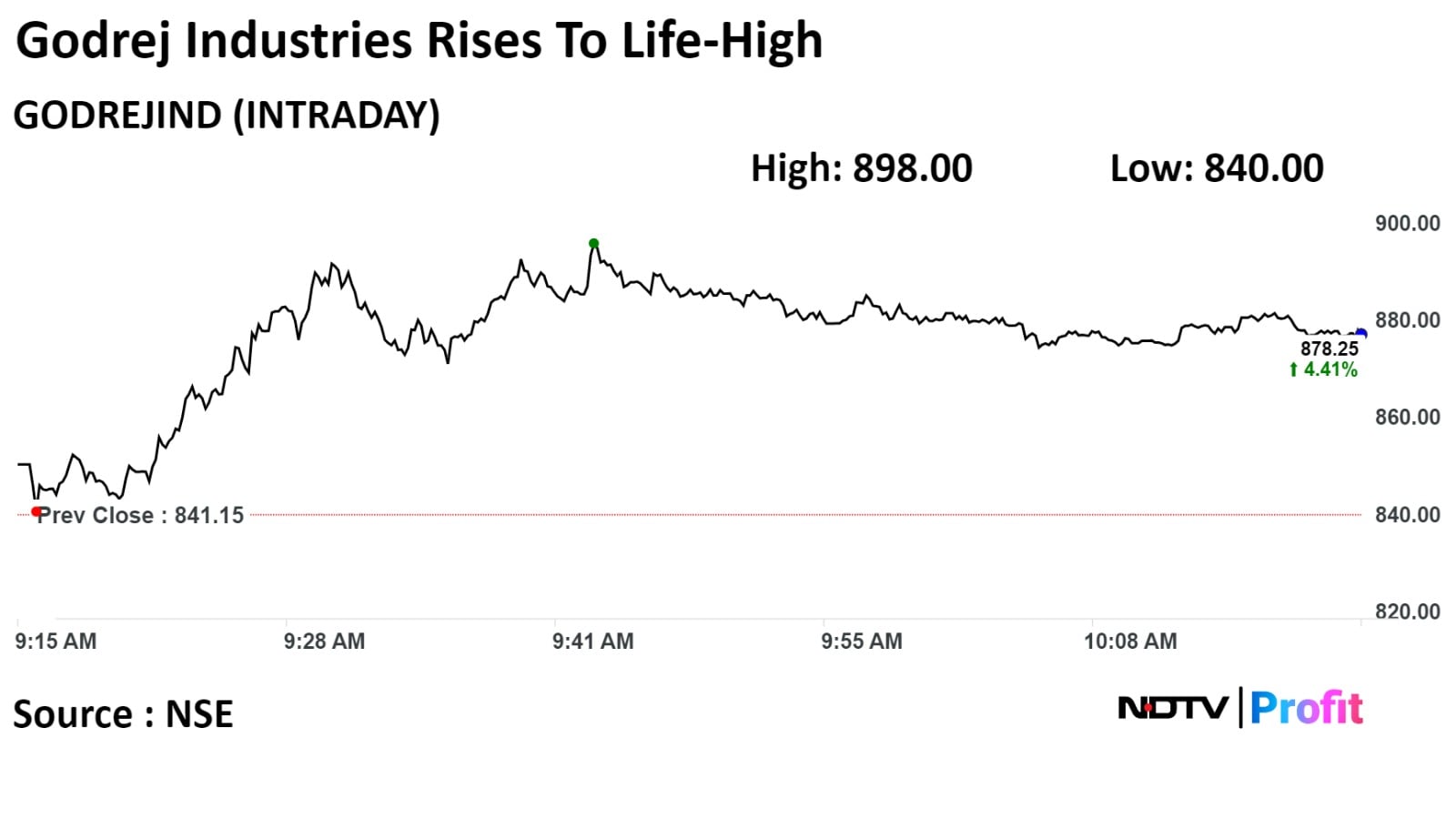

Godrej Industries Ltd rose nearly 7% on Monday as the company signed a non-binding MoU with Gujarat Government to invest Rs 600 crore to expand its operations, said an exchange filing.

The investment is expected to generate 250 employments, said the exchange filing. Godrej Industries already has a facility in Valia, located in Gujarat's Bharuch district, which makes oleo chemical products derived from organic material.

Godrej Industries Ltd rose nearly 7% on Monday as the company signed a non-binding MoU with Gujarat Government to invest Rs 600 crore to expand its operations, said an exchange filing.

The investment is expected to generate 250 employments, said the exchange filing. Godrej Industries already has a facility in Valia, located in Gujarat's Bharuch district, which makes oleo chemical products derived from organic material.

Shares of Godrej Industries rose 6.76%, the highest since May 14, 1990 when it was listed on BSE. It pared gains to trade 4.43% higher at 10:25 a.m., compared to a 0.09% decline in the NSE Nifty 50.

The stock has risen 93.08% in last 12 months. Total traded volume so far in the day stood at 7.3 times its 30-day average. The relative strength index was at 87.66, implying that the stock may be overbought.

The one analyst tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 96.2%.

Shares of the company rose as much as 11.86% to Rs 45.75 apiece. It was trading 10.51% higher at Rs 45.05 apiece, compared to a 0.13% decline in the benchmark BSE Sensex at 10:02 a.m.

The total traded volume so far in the day stood at 39 times its 30-day average. The relative strength index was at 84, indicating that stock may be overbought.

The two analyst tracking the company, maintain a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month price targets given by analysts implies a downside of 14%.

Shares of the company rose as much as 11.86% to Rs 45.75 apiece. It was trading 10.51% higher at Rs 45.05 apiece, compared to a 0.13% decline in the benchmark BSE Sensex at 10:02 a.m.

The total traded volume so far in the day stood at 39 times its 30-day average. The relative strength index was at 84, indicating that stock may be overbought.

The two analyst tracking the company, maintain a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month price targets given by analysts implies a downside of 14%.

Oil and Natural Gas Corp Ltd., Hindustan Oil Petroleum Corp Ltd., and Reliance Industries Ltd. contributed the most to the gains.

Oil and Natural Gas Corp Ltd., Hindustan Oil Petroleum Corp Ltd., and Reliance Industries Ltd. contributed the most to the gains.

- Maintain "overweight" on HPCL at Rs 555 target

- Maintain "overweight" on BPCL at Rs 644 target

- Maintain "overweight" on IOCL at Rs 191 target

- Potential for re-rating multiples, similar to 2014-18.

- Favorable risk-reward on higher fuel demand and less government intervention

- Hardware upgrades to add $4 billion in EBITDA over 3 years for OMCs, HPCL to reap most benefits

- Indian fuel retailers to see margins 25-30% above mid cycle level

- India's interest in Venezuelan oil imports to add 15% to earnings

- Expect OMCs' 5 year investment plan to focus on petrochem, gas, and renewables

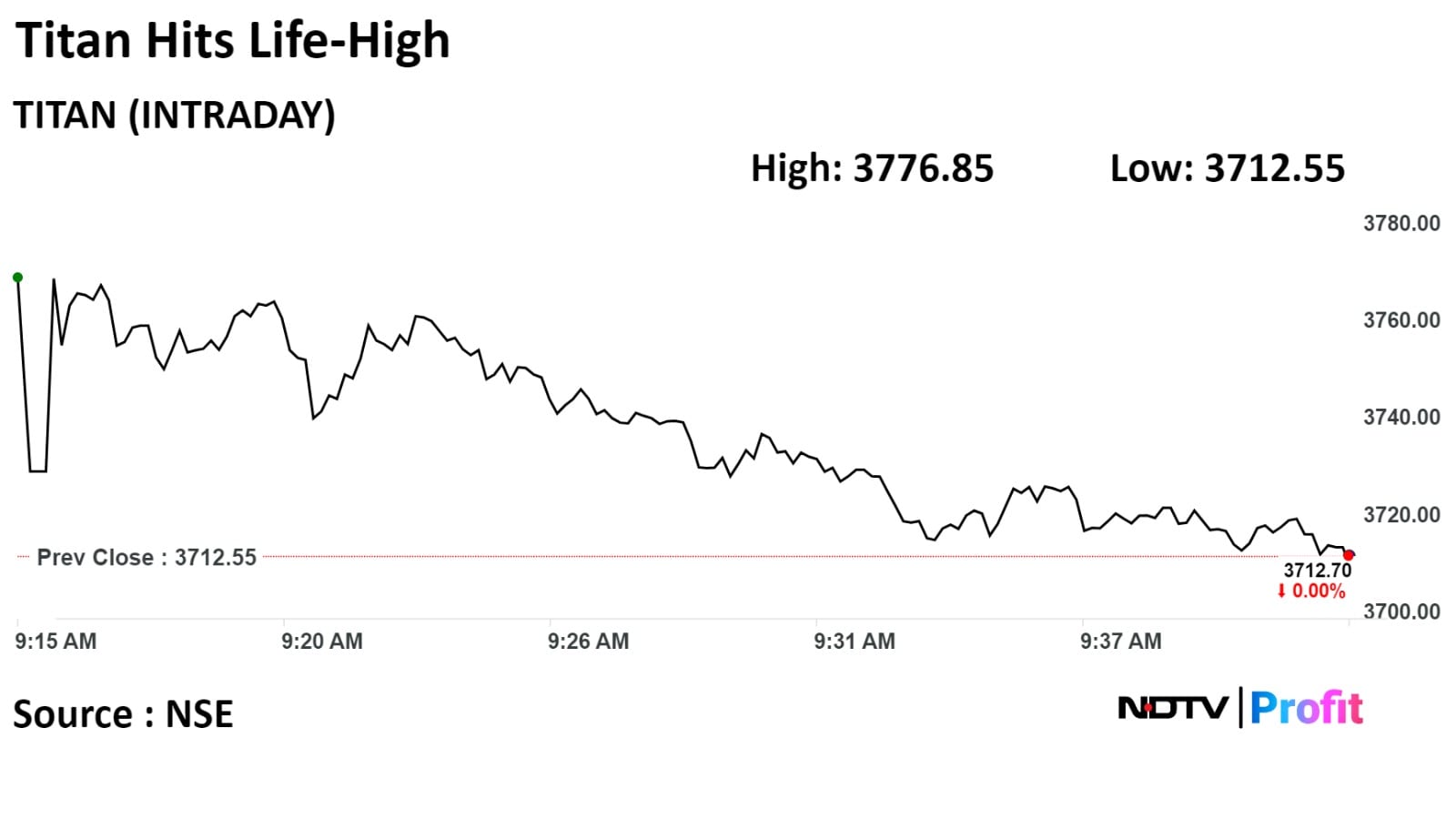

Shares of Titan Co. Ltd. rose to a record high on Monday as the company posted 22% year-on-year growth in its Q3FY24 revenue as it expanded footprint with new stores.

Titan added 90 stores in Q3, with total stores now at 2,949.

Moreover, Citi Research said Titan's valuation remained high on the back of its positive medium-term business outlook due to its continuous share gains. The brokerage has a target price of Rs 3, 650 on Titan.

Shares of Titan Co. Ltd. rose to a record high on Monday as the company posted 22% year-on-year growth in its Q3FY24 revenue as it expanded footprint with new stores.

Titan added 90 stores in Q3, with total stores now at 2,949.

Moreover, Citi Research said Titan's valuation remained high on the back of its positive medium-term business outlook due to its continuous share gains. The brokerage has a target price of Rs 3, 650 on Titan.

The scrip rose as much as 1.93% to Rs 3,784 apiece, the highest level since its listing on NSE on Sep 24, 2004. It pared gains to trade 0.09% higher at Rs 3,715.85 apiece, as of 09:49 a.m. This compares to a 0.27% decline in the NSE Nifty 50 Index.

It has risen 49.20% in 12 months. Total traded volume so far in the day stood at 5.9 times its 30-day average. The relative strength index was at 67.60.

Out of 32 analysts tracking the company, 23 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 3.8%.

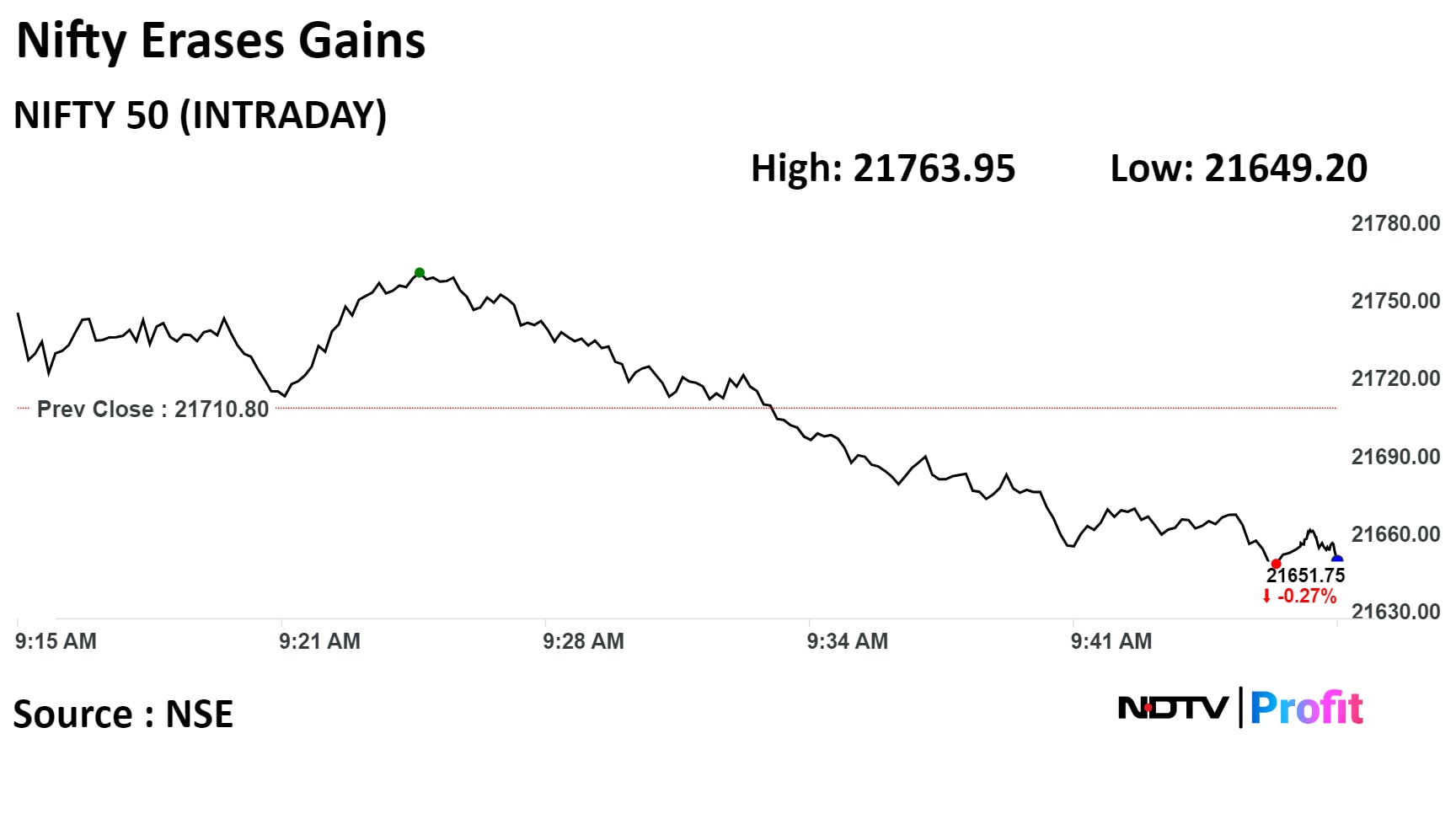

As of 9:49 a.m., the Nifty 50 traded at 21,652.00, down 58.80 points or 0.27% and the Sensex was 199.66 points or 0.28% lower at 71,826.49.

As of 9:49 a.m., the Nifty 50 traded at 21,652.00, down 58.80 points or 0.27% and the Sensex was 199.66 points or 0.28% lower at 71,826.49.

As of 9:49 a.m., the Nifty 50 traded at 21,652.00, down 58.80 points or 0.27% and the Sensex was 199.66 points or 0.28% lower at 71,826.49.

As of 9:49 a.m., the Nifty 50 traded at 21,652.00, down 58.80 points or 0.27% and the Sensex was 199.66 points or 0.28% lower at 71,826.49.

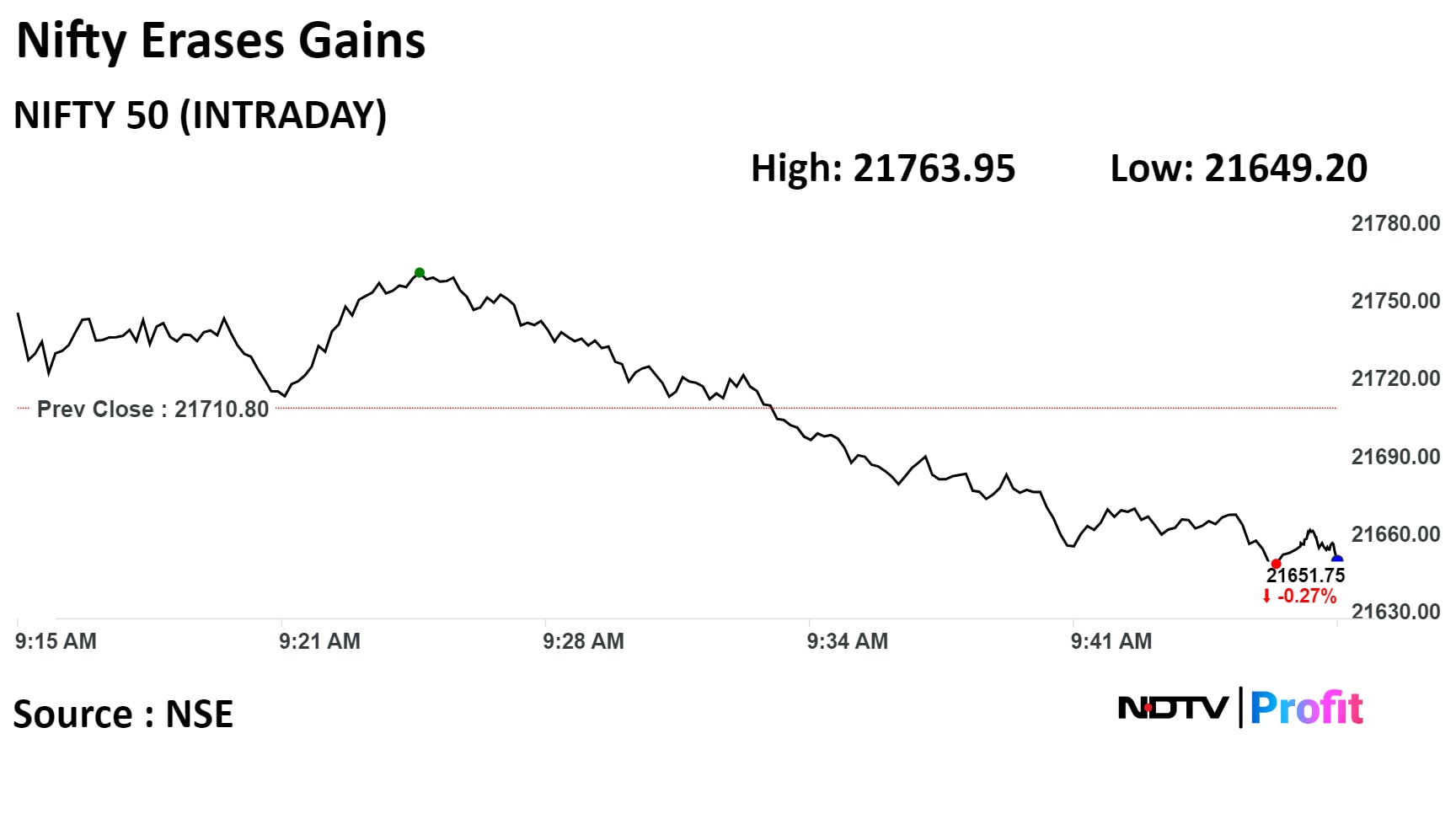

Adani Ports and Special Economic Zone Ltd. to report strong volume, revenue and Ebitda growth along with good cash flows, according to Citi Research.

The ports company continues to execute well and grow its dominance in India’s port and logistics space. The market share of the company and its industry dominance is set to increase in port and logistics industry in India and it remains Citi's top-pick.

Adani Ports and Special Economic Zone Ltd' stock rose as much as 1.30% during the day to Rs 1,169.25 to hit an life high. It was trading 0.29% higher at Rs 1, 157.65 apiece, compared to a 0.03% advance in the benchmark Nifty 50 at 9:33 a.m.

The stock has risen over 41.76% in the last 12 months. The RSI of the stock is at 80, indicating that stock may be overbought.

Nineteen out of the 21 analysts tracking the company have a 'buy' rating on the stock and two recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 7.9%.

Adani Ports and Special Economic Zone Ltd. to report strong volume, revenue and Ebitda growth along with good cash flows, according to Citi Research.

The ports company continues to execute well and grow its dominance in India’s port and logistics space. The market share of the company and its industry dominance is set to increase in port and logistics industry in India and it remains Citi's top-pick.

Adani Ports and Special Economic Zone Ltd' stock rose as much as 1.30% during the day to Rs 1,169.25 to hit an life high. It was trading 0.29% higher at Rs 1, 157.65 apiece, compared to a 0.03% advance in the benchmark Nifty 50 at 9:33 a.m.

The stock has risen over 41.76% in the last 12 months. The RSI of the stock is at 80, indicating that stock may be overbought.

Nineteen out of the 21 analysts tracking the company have a 'buy' rating on the stock and two recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 7.9%.

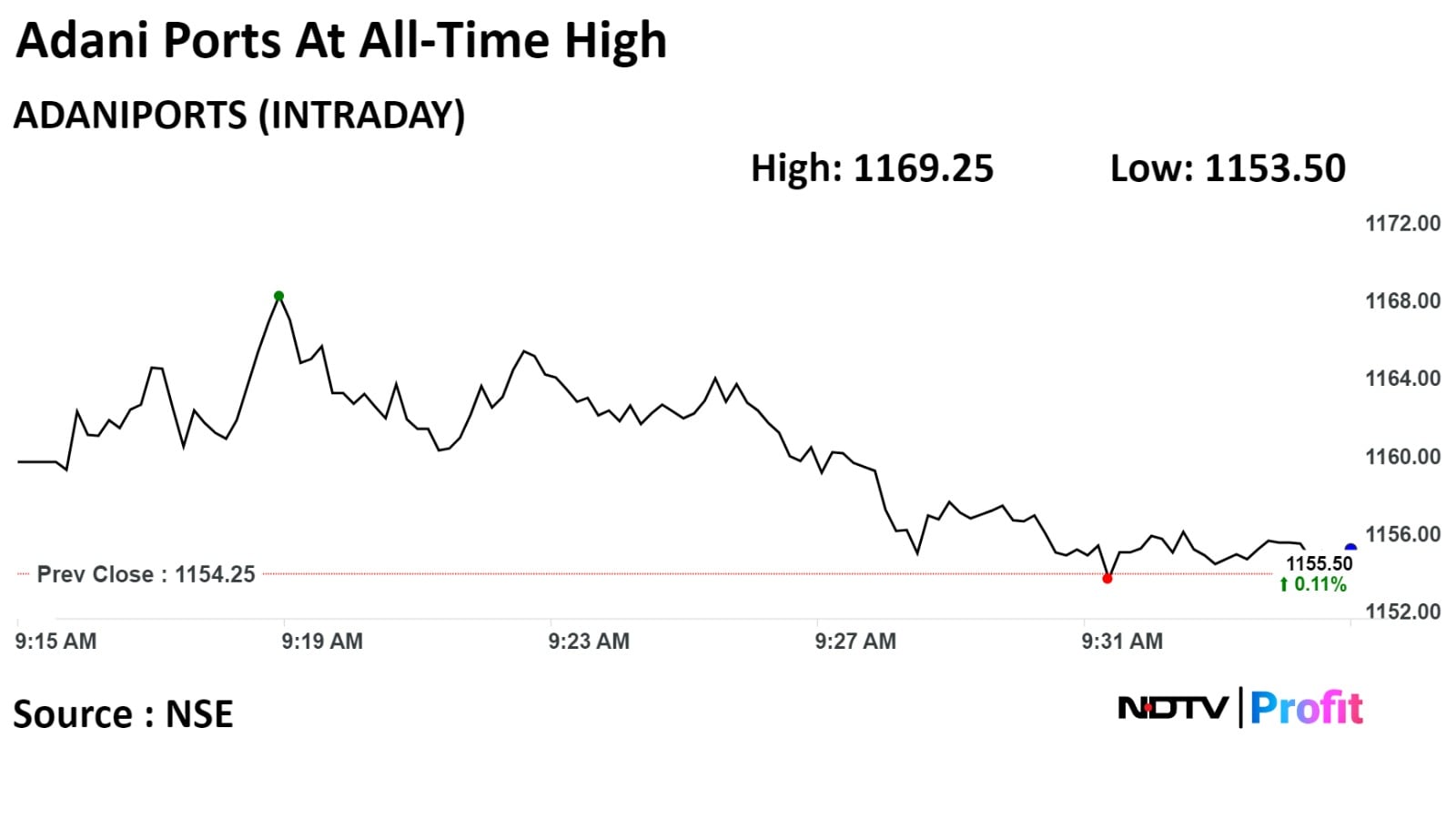

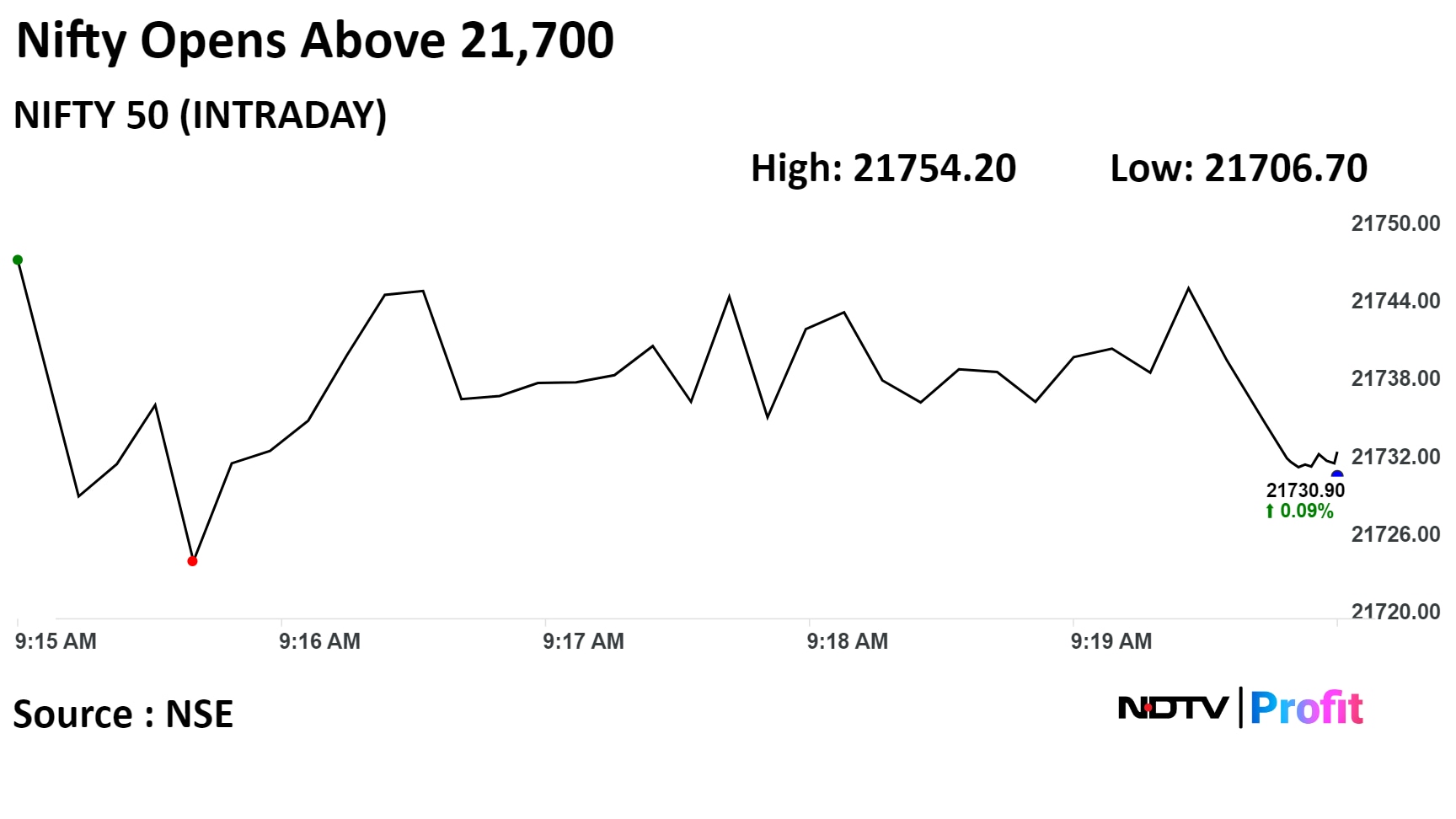

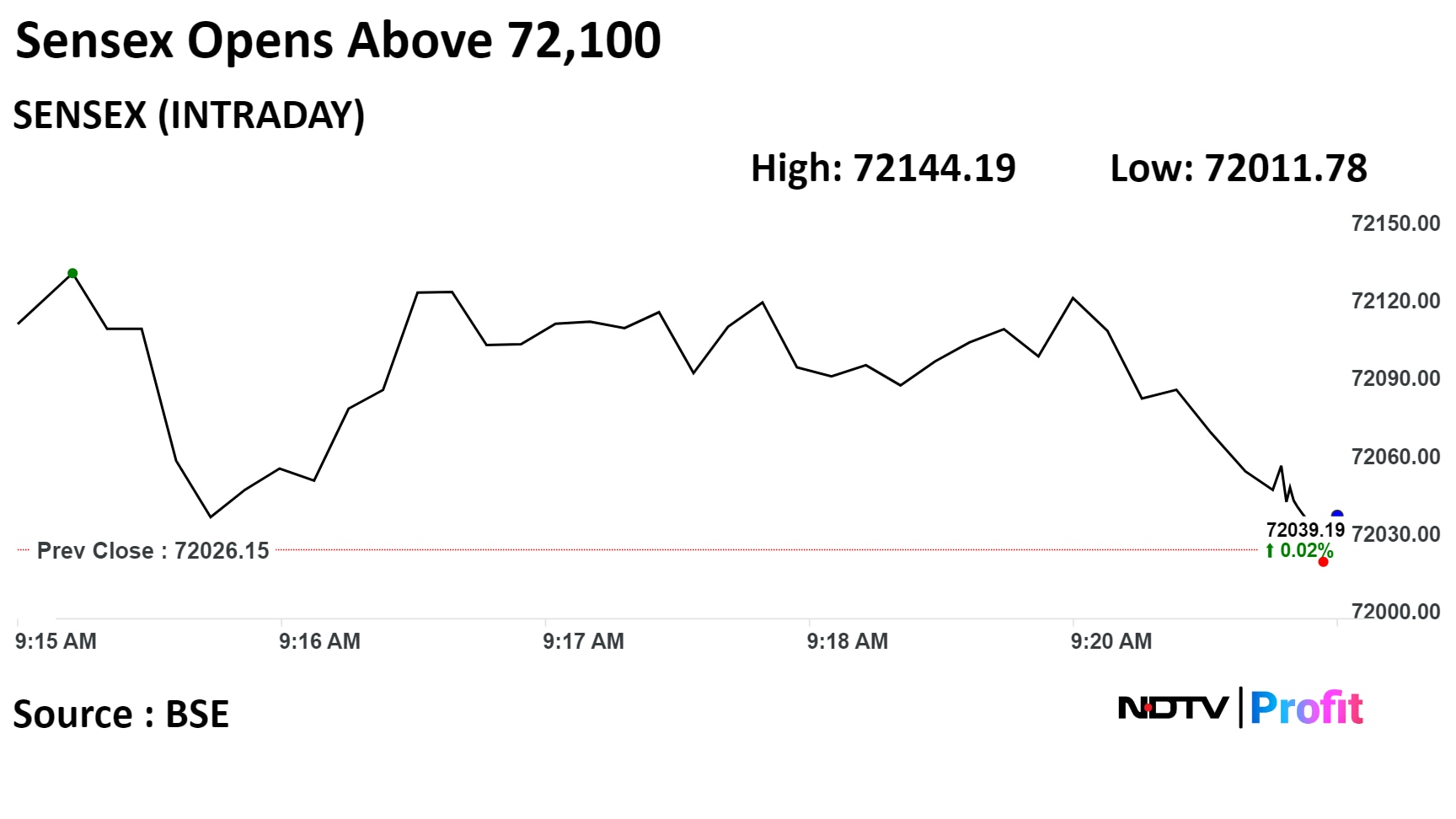

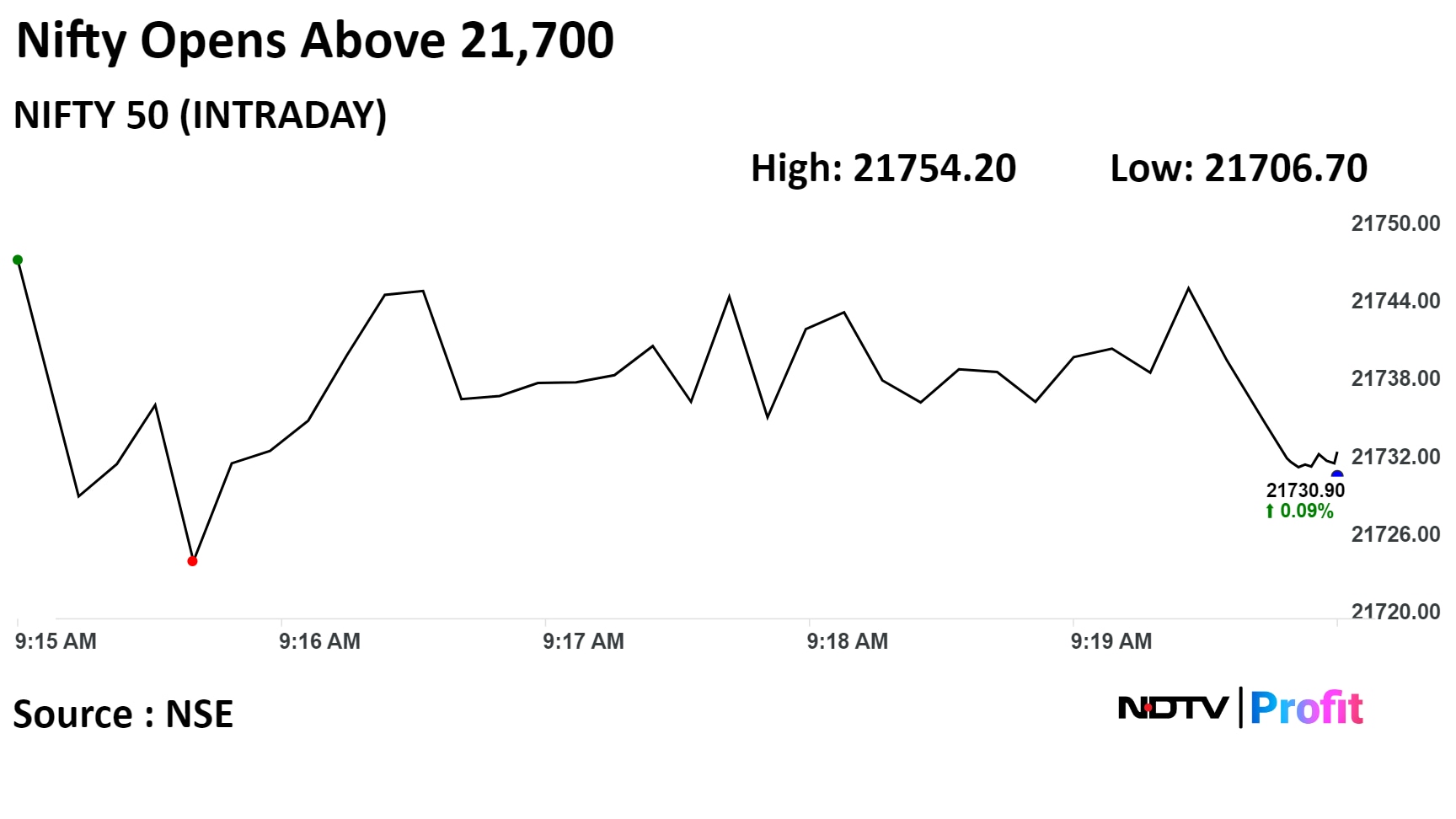

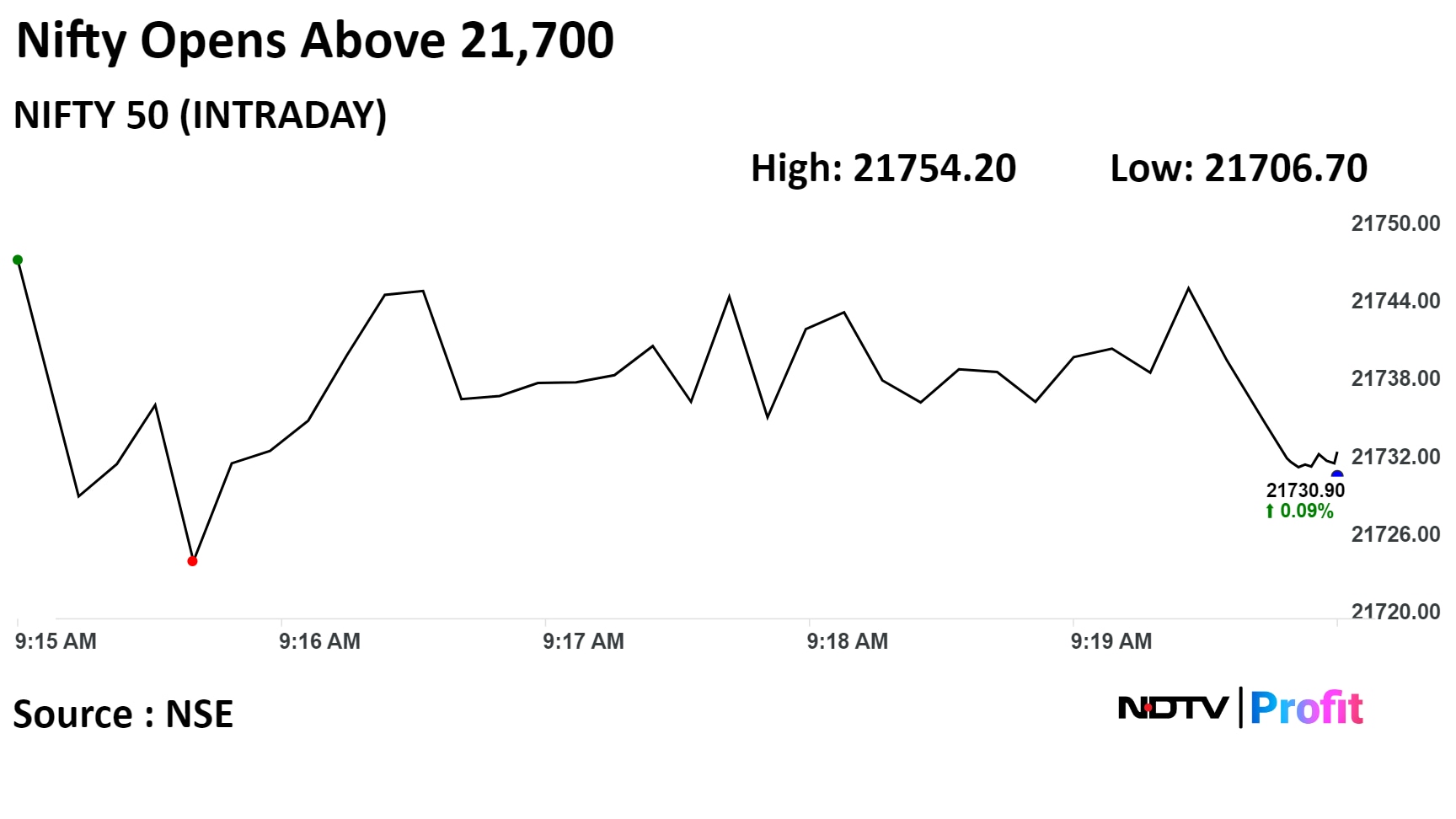

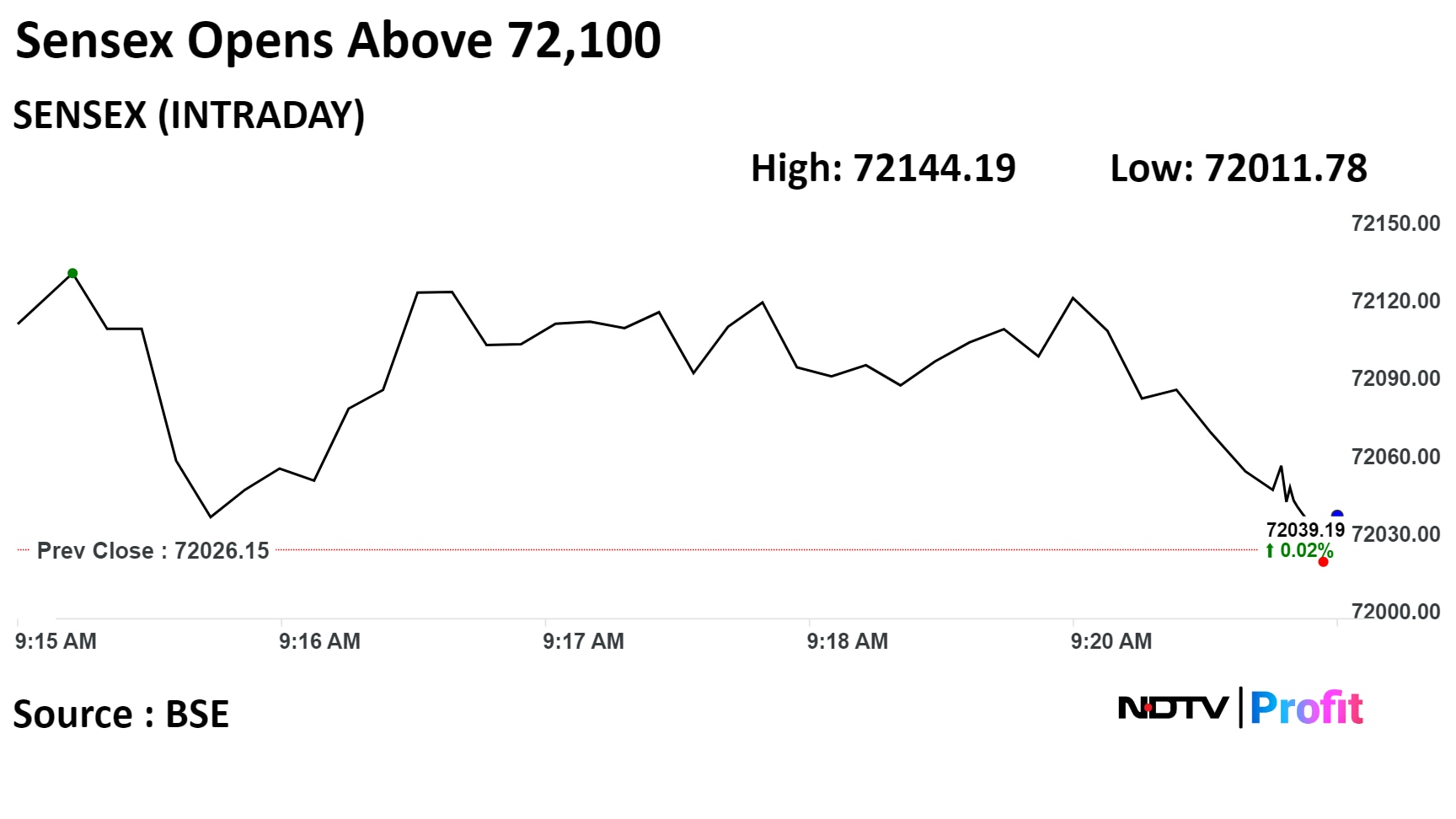

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Benchmark indices opened higher today, continuing their gains in the third consecutive session, led by gains in the shares of Reliance Industries Ltd., HCL Technologies Ltd., and Larsen & Toubro Ltd.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

"The market is projected to stay range-bound, with the Nifty 50 finding immediate support between 21,600 and 21,620 and resistance between 21,800 and 21,850," said Deven Mehata, Derivative Analyst at Choice Broking.

"A significant breach of 21,850 could drive the index to 22,000, while a break of the same level might send it to 21,500," he said.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., Titan Ltd., and Bharti Airtel Ltd., contributed the most to the gains.

Meanwhile, those of Infosys Ltd., Tata Consultancy Services Ltd., HDFC Bank Ltd., Bajaj Finance Ltd., and ITC Ltd. weighed on the indices.

Sectoral indices were mixed. Nifty Realty gained the most by over 1%, followed by Nifty Oil & Gas. On the other hand, Nifty PSU Bank and Nifty FMCG fell.

The broader markets underperformed as the BSE MidCap fell 0.24%, while the BSE SmallCap was 0.12% lower. Eight out of the 20 sectors compiled by the BSE advanced, while 12 declined.

The market breadth was skewed in the favour of buyers. As many as 1,825 stocks advanced, 1,346 declined and 107 remained unchanged on the BSE.

At pre-open, the S&P BSE Sensex Index was up 87.10 points or 0.12% at 72,113.25 while the NSE Nifty 50 was at 21,747.60, up 36.80 points or 0.17%.

The yield on the 10-year bond opened flat at 7.23% on Monday.

Source: Bloomberg

The local currency strengthened 6 paise to open at 83.10 against the U.S dollar on Monday.

It closed at 83.16 on Friday.

Source: Bloomberg

Sells luxury residences of over Rs 7,200 crore in Gurgram

Source: Exchange Filing

Acquires stake for Rs 425 crore

Alert: Existing holding of co in Asian Concretes is 45%

Source: Exchange Filing

Overall mixed performance

Estimate consolidated revenue/EBITDA to dip 13%/56% YoY

Standalone Q3 volumes are likely to grow 6% YoY, but value shall decline 15% YoY

Anticipate GM/EBITDA to decline 125bp/193bp YoY

Price cuts in edible oil stay a concern

Maintain ‘BUY’ with a TP of Rs 1,250

GAUM and LATAM currency devaluation and planned destocking to keep revenues flat

EBITDA to grow ~11% vs initial expectations of 8%/19.6% revenue/EBITDA growth

Expect RCCL to clock sales of Rs 150 cr in Q3

Expect gross and EBITDA margins to expand 485bp/227bp YoY to 56%/23.6% in Q3FY24

Reiterate buy as top pick among consumer staples

Sharp currency devaluation in Nigeria, Argentina impacted consol. revenue growth

Other geographies had mixed performance

Stay constructive from a 6-12M view

May see some near-term profit taking given sharp run-up, impact of currency devaluation

Q3 collections grew 45.9% QoQ

Source: Exchange Filing

BPC vertical GMV growth for the quarter is expected to be in the mid-twenties, and NSV growth around twenty percent on YoY basis.

Underlying order volume growth is healthy and consistent

The combined NSV of all BPC businesses is expected to grow at low to midtwenties on a YoY basis.

Nykaa Fashion has witnessed strong growth in Q3 FY24

Fashion vertical GMV for the quarter is expected to grow at around 40% and NSV growth expected in the low thirties on YoY basis.

Consolidated level NSV to grow in the mid-twenties and revenue to grow in the low twenties on a YoY basis.

Absolute valuations remain high, supported by Titan’s strong medium-term business prospects driven by continued share gains

Downside Risks:

- Deterioration in consumer sentiment or lower footfalls, sharp movements in gold prices and adverse govt impact

Upside Risks:

- Better-than-expected consumer traction, stronger traction to Titan’s new product launches and innovations, company’s aggressive expansion plans.

Maintains 'buy' rating

Opens a positive catalyst watch as company remains top pick

Expect strong volume growth in port cargo, rail container and GPWIS in Q3FY24

Expect consolidated Ebitda/PAT growth of 49%/70% YoY

Settled legal matters, good cash flows and improving leverage should drive stock performance

Financials remain strong; company reintroducing US$ bonds

Attractive valuations given high quality business and favorable valuations within industry

Maintains L&T as top pick with TP of Rs 4082

Expect L&T to show strong execution in core P&M business in Q3FY24

Expect 14% revenue growth and order inflows of Rs 500+ bn in P&M business

Sees P&M margin bottoming out in Q3FY24 and margin recovery over the years

L&T well-positioned to benefit from strong capex cycle in India and Middle East

Stock has given a 35% return since Nov23

Multiple tailwinds to help sustain share price outperformance

Outperformance driven by: Attractive valuation, EV growth, new product offerings, step-up in dividend

U.S. Dollar Index at 102.34

U.S. 10-year bond yield at 4.05%

Brent crude down 0.57% at $78.31 per barrel

Nymex crude down 0.57% at $73.39 per barrel

GIFT Nifty was down 13.5 points, or 0.06% at 21,767.50 as of 8:15 a.m.

Bitcoin was down 1.05% at 43,794.34

Price band revised from 20% to 10%: Alok Industries.

Price band revised from 10% to 5%: Himadri Speciality Chemical.

Price band revised from 5% to 2%: Jyoti Structures.

Moved into a short-term ASM framework: Allcargo Terminals, HPL Electric and Power, Vodafone Idea, Kiri Industries, Reliance Power, Salasar Techno Engineering.

Moved out of a short-term ASM framework: Asian Energy Services, Netweb Technologies India, Syncom Formulations.

Nifty January futures up by 0.04% to 21,793.85 at a premium of 83.05 points.

Nifty January futures open interest up by 2%.

Nifty Bank January futures down by 0.23% to 48,388.45 at a premium of 229.45 points.

Nifty Bank January futures open interest down by 7%.

Nifty Options Jan 11 Expiry: Maximum Call open interest at 22,500 and Maximum Put open interest at 21,000.

Bank Nifty Options Jan 10 Expiry: Maximum Call Open Interest at 50,000 and Maximum Put open interest at 46,000.

Securities in ban period: Balrampur Chini Mills, Chambal Fertilizer, Delta Corp, Escorts, Gujarat Narmada Valley Fertilizer and Chemicals, Indian Energy Exchange, Indian Cements, National Aluminium, Piramal Enterprise, SAIL, Zee Entertainment.

Swan Energy: Albula Investment Fund sold 30.24 lakh shares (1.14%), while Societe Generale bought 8.19 lakh shares (0.31%), BNP Paribas Arbitrage bought 4.99 lakh shares (0.18%), and Bandhan Mutual Fund bought 4.25 lakh shares (0.15%), among others, at Rs 519.9 apiece.

Titan: The company reported a 22% revenue growth in YoY terms and added 90 stores in Q3, with total stores now at 2,949.

Marico: The company’s Q3 consolidated revenue declined to a low single-digit on a year-on-year basis and saw robust gross margin expansion on a YoY basis.

Federal Bank: The Reserve Bank of India has asked the bank for its succession plans. The regulator has asked the bank to submit at least two fresh names for the roles of managing director and chief executive officer.

Adani Wilmar: The company estimated that elevated demand from the festive and wedding seasons benefited the company in the branded oil and foods segment, and it recorded the best-ever volume during the quarter.

Tata Steel: The company reported India's steel output at 5.32 million tonne, up 6% YoY, and deliveries at 4.88 million tonne, up 10% YoY, in its Q3 business update.

JSW Steel: The unit received possession of 2,678 acres of forest land from the Odisha government for setting up an integrated steel plant with a 13.2 MTPA crude steel manufacturing capacity.

Reliance Power: The company signed an agreement with DBS Bank India in the settlement of its entire obligations concerning its borrowings.

Godrej Industries: The company's chemical division signed a MoU with the Gujarat government to invest Rs 600 crore over the next four years.

SJVN: The company’s unit, SJVN Green Energy, signed a power usage agreement with Uttarakhand Power Corp. to supply 200 MW of solar power from the under-construction 1,000 MW Bikaner. The development cost of the project is Rs 5,491 crore.

Satin Creditcare Network, Karnataka Bank: Satin Creditcare entered into a co-lending agreement with Karnataka Bank to provide financial support to joint liability groups of economically active women in both rural and semi-urban areas.

RPSG Ventures: A fire occurred at the company’s job worker factory in Uttar Pradesh. The company is in the process of ascertaining the cause of the fire and damage.

Bhansali Engineering Polymers: The company issued a LoA to Toyo Engineering India for front-end engineering design and capex cost estimation for the brownfield ABS expansion project.

Narayana Hrudayalaya: The Insurance Regulatory Development Authority of India granted a licence to the company’s unit, Narayan Health Insurance, to carry on the health insurance business.

Godrej Consumer Products: The company reported double-digit volume growth in India for Q3 while sales growth was flat.

BCL Industries: The company announced an increase in the ethanol purchase price by oil marketing companies as Jan. 5. The oil marketing companies have raised the price by Rs 5.79 per litre for maize-sourced ethanol, impacting 70% of the company's ethanol supply.

Jupiter Wagons: The company received a contract worth Rs 100 crore from one of the leading automobile manufacturers to manufacture and supply four rakes of double-decker automobile carrier wagons.

Life Insurance Corp.: The company received a tax and penalty demand worth Rs 382 crore from the Gujarat tax authority for FY18 and FY19.

Union Bank: The company recorded total advances at Rs 8.96 lakh crore, up 11.4% YoY as of Dec. 31, total deposits at Rs 11.72 lakh crore, up 10.1% YoY, and total business at Rs 20.68 lakh crore, up 10.7% YoY.

Bank of Baroda: The bank reported global business at Rs 22.95 lakh crore, up 10.7% YoY as of Dec. 31, and advances at Rs 10.49 lakh crore, up 13.6% YoY, and deposits stood at Rs 12.45 lakh crore, up 8.3% YoY.

Oil India: The company approved incorporating a new subsidiary for the green energy business.

Cupid: The company will consider a stock split, a bonus issue, and a fundraiser on Jan. 23.

Sansera Engineering: The company invested Rs 19.54 crore in CleanMax Enviro Energy Solutions to achieve 70% renewable energy usage in its Bangalore and Pune plants.

NBCC: The company received an order worth Rs 25.38 crore from Lokpal of India for interior and fitout works for A-400 and A-500 Lokpal of India at Nauroji Nagar, New Delhi.

GE Power India: The company received an order worth Rs 22.15 crore from Maithon Power for combustion modification of boilers for 2 x 525 MW units.

TVS Motor: The company signed a memorandum of understanding with the Tamil Nadu government with the proposal to invest Rs 5,000 crore over five years in the state.

Asian stocks largely traded flat as they awaited the inflation figures of Australia, Japan, and China due later this week. Investors will also monitor the Bank of Korea's policy meeting outcome, due on Thursday.

Markets in Japan are closed for the observance of 'Coming of Age' day.

U.S. stocks hinted at a rebound after a dour start to the year as investors digested data hinting that the Federal Reserve can pull off a soft landing for the world’s largest economy, according to Bloomberg.

Brent crude was trading down 0.57% at $78.31 per barrel. Gold was down 0.11% at $2,043.20 an ounce.

The January futures contract of the GIFT Nifty traded 13.5 points, or 0.06%, lower at 21,767.50 as of 8:15 a.m.

India’s benchmark indices closed higher for the second consecutive day on Friday, led by gains in Larsen & Toubro Ltd., Tata Consultancy Services Ltd., and Infosys Ltd. The S&P BSE Sensex closed 179 points, or 0.25%, higher at 72,026.15, while the NSE Nifty 50 gained 52 points, or 0.24%, to end at 21,710.80.

Overseas investors remained net buyers of Indian equities for the second consecutive session on Friday. Foreign portfolio investors mopped up stocks worth Rs 1,696.8 crore, while domestic institutional investors remained net sellers and offloaded equities worth Rs 3,497.6 crore, the NSE data showed.

The local currency strengthened 7 paise to close at Rs 83.16 against the U.S. dollar on Friday.

Asian stocks largely traded flat as they awaited the inflation figures of Australia, Japan, and China due later this week. Investors will also monitor the Bank of Korea's policy meeting outcome, due on Thursday.

Markets in Japan are closed for the observance of 'Coming of Age' day.

U.S. stocks hinted at a rebound after a dour start to the year as investors digested data hinting that the Federal Reserve can pull off a soft landing for the world’s largest economy, according to Bloomberg.

Brent crude was trading down 0.57% at $78.31 per barrel. Gold was down 0.11% at $2,043.20 an ounce.

The January futures contract of the GIFT Nifty traded 13.5 points, or 0.06%, lower at 21,767.50 as of 8:15 a.m.

India’s benchmark indices closed higher for the second consecutive day on Friday, led by gains in Larsen & Toubro Ltd., Tata Consultancy Services Ltd., and Infosys Ltd. The S&P BSE Sensex closed 179 points, or 0.25%, higher at 72,026.15, while the NSE Nifty 50 gained 52 points, or 0.24%, to end at 21,710.80.

Overseas investors remained net buyers of Indian equities for the second consecutive session on Friday. Foreign portfolio investors mopped up stocks worth Rs 1,696.8 crore, while domestic institutional investors remained net sellers and offloaded equities worth Rs 3,497.6 crore, the NSE data showed.

The local currency strengthened 7 paise to close at Rs 83.16 against the U.S. dollar on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.