(Bloomberg) -- US equities drifted at the start of a week packed with corporate earnings and economic data that may help illuminate the Federal Reserve's path for interest rates.

The S&P 500 was little changed and the Nasdaq 100 shed as manufacturing data arrived weaker than forecast and Treasury yields fell amid debt ceiling drama. Shares of Bed Bath & Beyond Inc. declined on plans to shutter all its stores. Meanwhile, the dollar was weaker against peers and oil rose.

“We believe that the bullish narrative behind the bear market rally — a corporate earnings trough, a mature Fed hiking cycle, an economic soft landing, a taming of inflation, and long-term interest rates will fall — is breaking down,” wrote Lisa Shalett, CIO of Morgan Stanley Wealth Management. “The aftereffects of central bank policy tightening and the regional banking credit withdrawals from small- and mid-sized businesses are apt to show up in corporate profit guidance as those entities pull back on investment and hiring.”

On deck for a busy week of earnings is First Republic Bank, up Monday, followed by tech majors Microsoft Corp., Meta Platforms Inc. and Amazon.com Inc. US GDP data is forecast to reveal slowing growth, while the so-called core PCE deflator, the Fed's preferred inflation gauge, is expected to show price growth cooled.

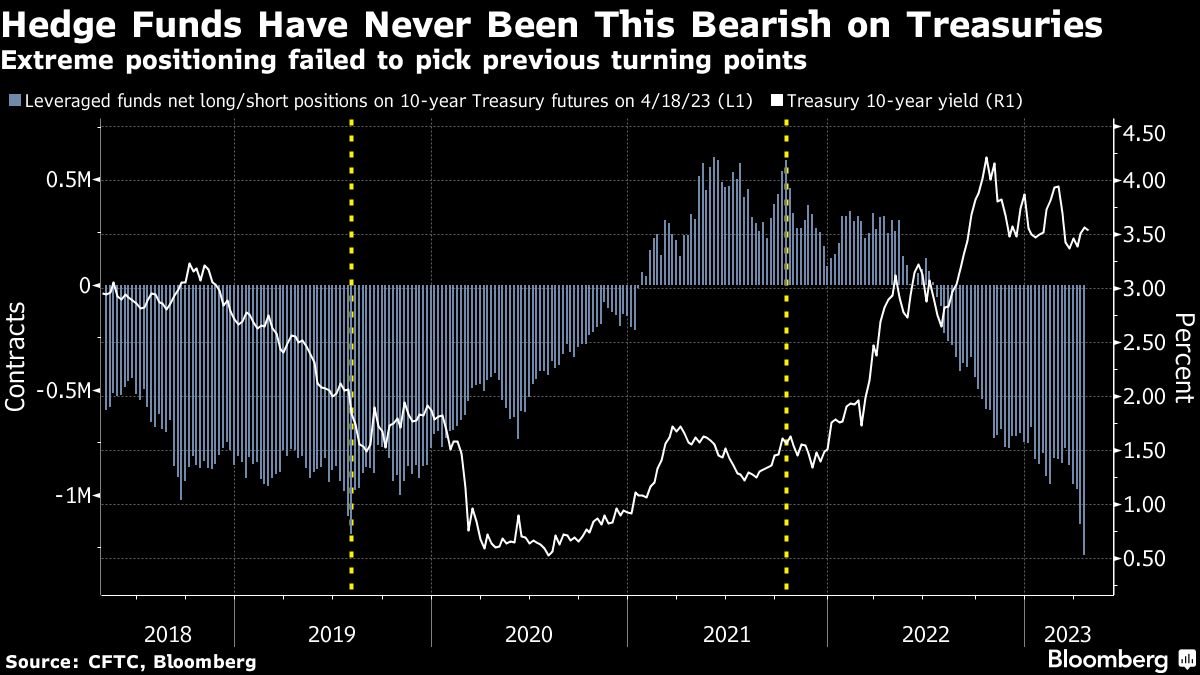

Swaps markets continue to see interest rates peaking in the coming weeks before a series of cuts later in the year. But, not everyone holds this view. Leveraged investors boosted net short positions on 10-year Treasury futures to a record this month, data from the Commodity Futures Trading Commission show. That indicates they think Fed officials will keep raising rates to tackle inflation.

“Economic data continues to deny investors an obvious growth or policy signal. Demand isn't falling fast enough to signal an imminent recession, but there are no indications of a reacceleration,” Dennis Debusschere at 22V Research wrote.

In Europe, UBS Group AG climbed after takeover target Credit Suisse AG reported outflows that were lower than some expected. The Stoxx Europe 600 was little changed. Elsewhere, the new Bank of Japan Governor Kazuo Ueda will hold his first policy meeting this week. The bank is expected to soon start its policy review of the past decades.

Key events this week:

- US new home sales, consumer confidence, Tuesday

- South Korea GDP, Tuesday

- Australia CPI, Wednesday

- Sweden rate decision, Wednesday

- Eurozone economic, consumer confidence, Thursday

- US initial jobless claims, GDP, Thursday

- Bank of Japan meets on interest rates, Friday

- Euro-area GDP, Friday

- US personal income, Friday

Earnings highlights:

- Tuesday: Pepsi, General Motors, General Electric, McDonalds, Microsoft, UBS, UPS

- Wednesday: Boeing, Meta, Hilton

- Thursday: Amazon, American Airlines, Intel, Mastercard, Southwest Airlines, Hershey, Honeywell, Barclays

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.1% as of 1:32 p.m. New York time

- The Nasdaq 100 fell 0.5%

- The Dow Jones Industrial Average was little changed

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.5% to $1.1040

- The British pound rose 0.3% to $1.2475

- The Japanese yen fell 0.1% to 134.35 per dollar

Cryptocurrencies

- Bitcoin fell 0.7% to $27,320.4

- Ether fell 1% to $1,829.78

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.51%

- Germany's 10-year yield advanced three basis points to 2.51%

- Britain's 10-year yield advanced two basis points to 3.78%

Commodities

- West Texas Intermediate crude rose 1.2% to $78.81 a barrel

- Gold futures rose 0.4% to $1,999.30 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Robert Brand, Tassia Sipahutar, Allegra Catelli and Garfield Reynolds.

(A previous verision was corrected to remove a timing reference to First Citizens earnings. Results will be held May 10.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.