(Bloomberg) -- Short selling on individual US-listed stocks is at its highest level in six months, with shares in the tech, telecom and media sector among the most targeted, according to Goldman Sachs Inc. data.

The increase in short positions comes after a powerful 9% first-quarter advance for the S&P 500, with the most number of record closing highs since 2017. The data signals that some hedge funds using long-short equity strategies have started to fight the rally.

“Single stocks saw the largest notional short selling in six months,” flow and derivatives specialist Cullen Morgan wrote in a note, referring to last week's data. “US TMT stocks collectively made up about 75% of this week's notional net selling in all US single stocks, driven almost entirely by short sales.”

According to Goldman's prime brokerage data, TMT stocks collectively now make up 29.1% of total US single stock net exposure, down from this year's high of 32.5% in mid-February.

The resilient economy, combined with less dovish comments from Federal Reserve officials, have dampened expectations that the US central bank will start cutting rates in June. The technology sector's valuations would likely be among the most affected by a higher-for-longer rates environment.

Morgan added that the overall prime book saw the largest net selling in five weeks as gross trading activity increased for the 12th straight week. Activity was driven by short sales in single stocks outpacing long buys in macro products by 1.6 to 1.

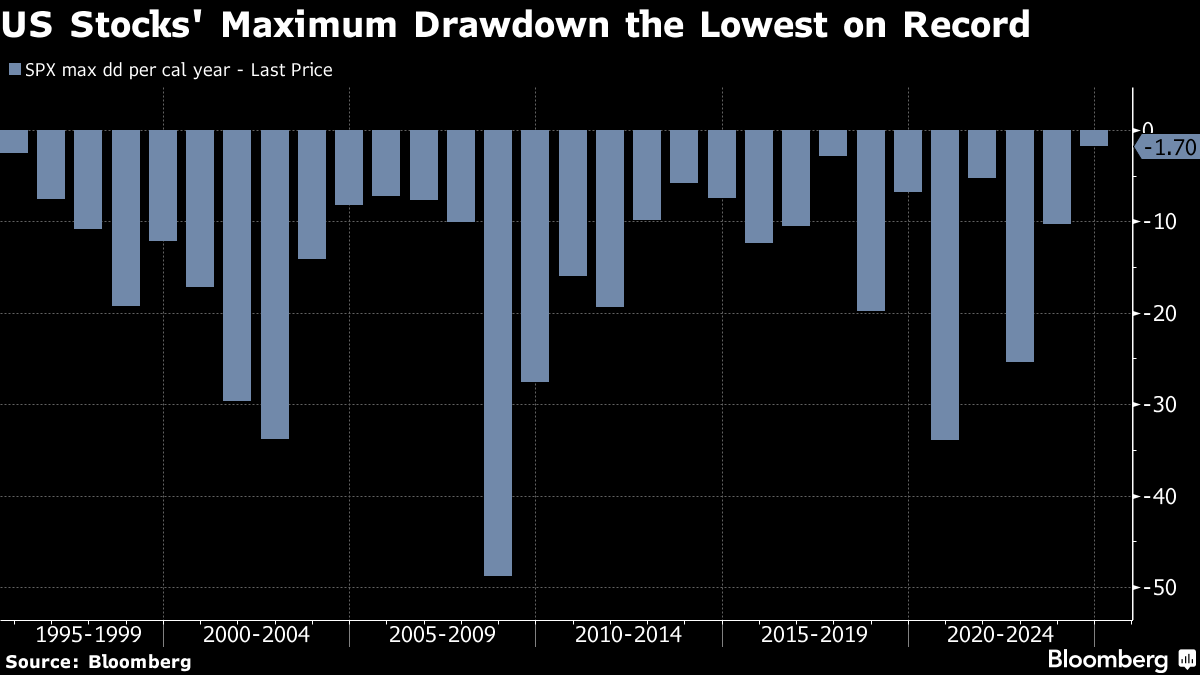

The benchmark's maximum drawdown — or decline from market-peak — has been just 1.7% so far this year, a record low. The increased short-selling activity is boosting pressure for a bigger drop when markets turn south.

So-called trend following strategies, or CTAs, built up an estimated $165 billion long position in global equities, the 100th percentile in term of historical exposure, according to Goldman data. In a down market over the next month, these funds would need to sell up to $141 billion worth of stocks, it estimated.

--With assistance from Jan-Patrick Barnert.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.