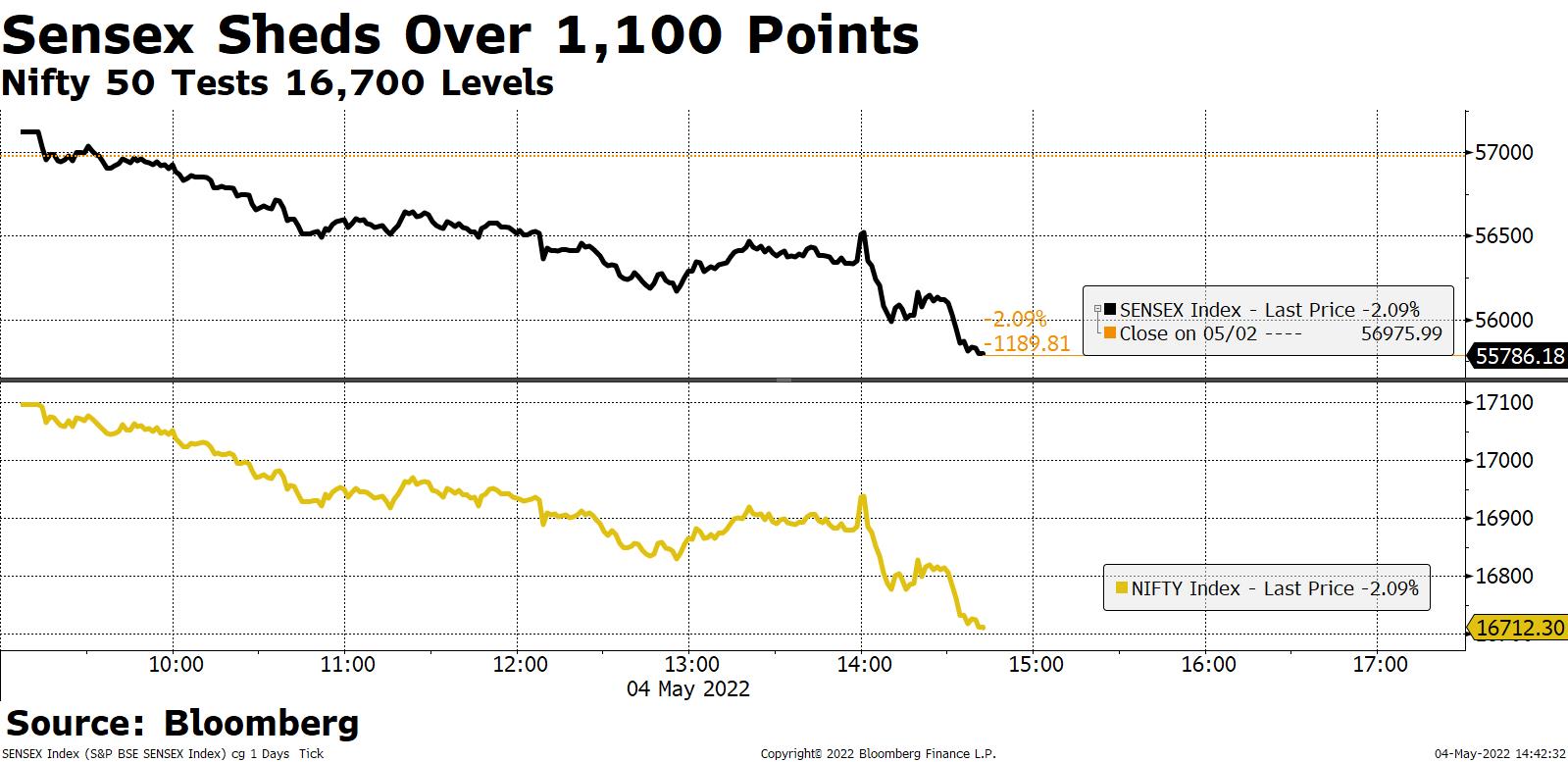

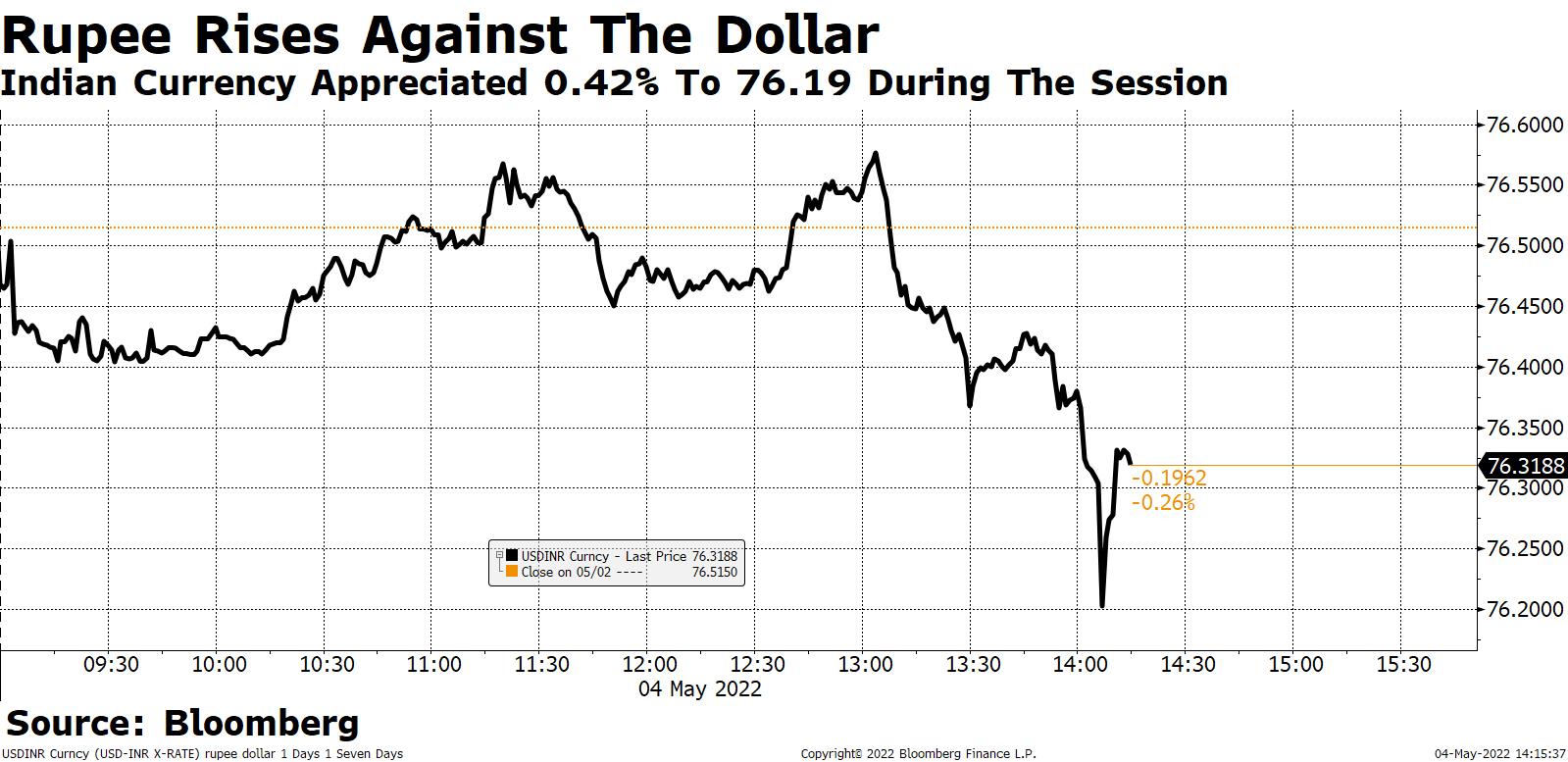

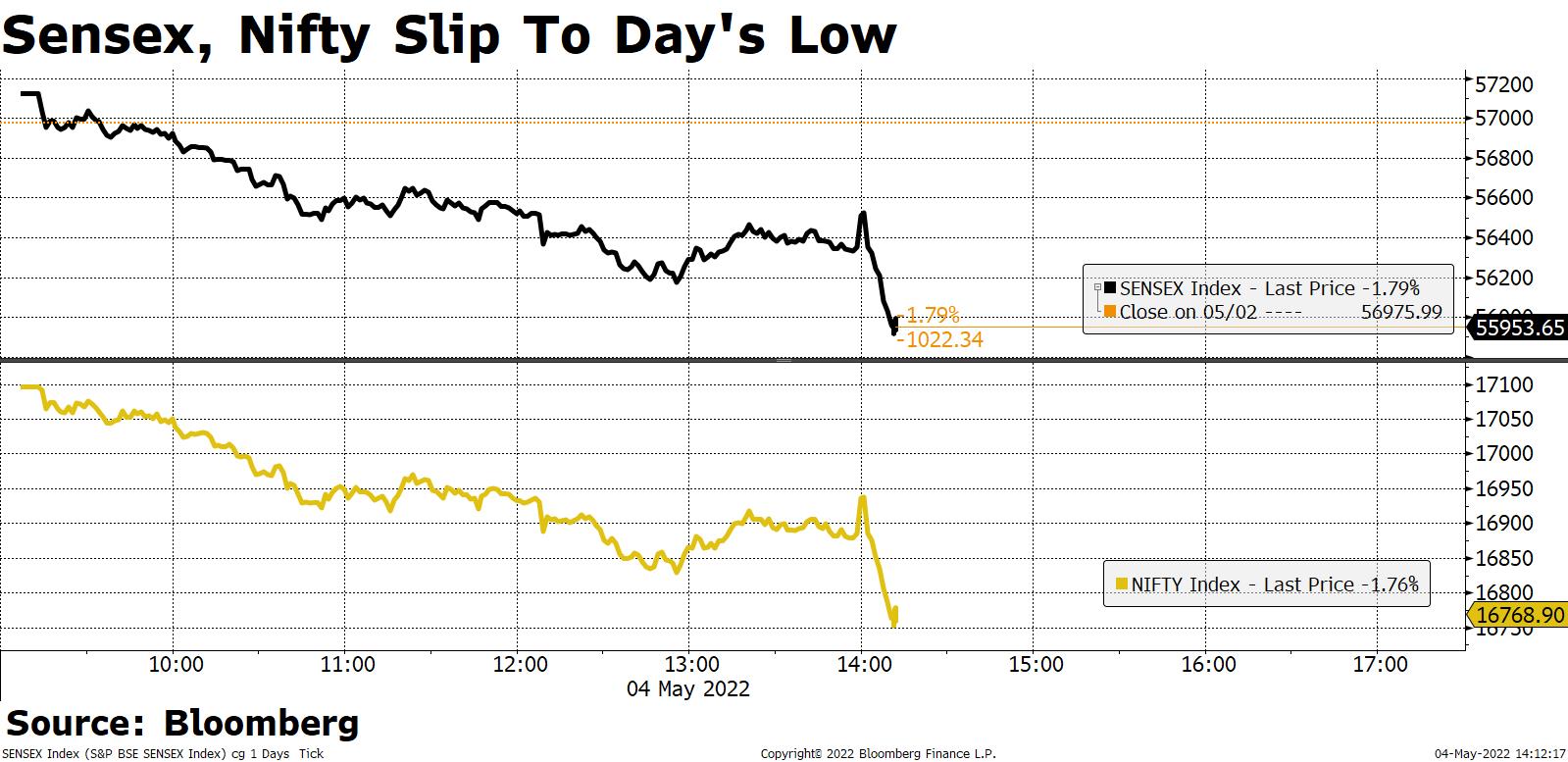

"The RBI monetary policy committee increased the key lending rate by 40 basis points, citing persistent inflationary pressures in the economy. All the sectoral indices ended in red today. USD INR gained immediately while markets fell after this announcement", according to Mohit Nigam, Head - PMS, Hem Securities. In a note, he added that "FOMC meeting outcome will also come today, so we believe this volatility will remain at elevated levels in coming sessions too. Investors should be cautious in these markets and can use these dips to make fresh positions in fundamentally sound stocks".

Tata Steel Says May Review Dividend Policy

Shares of UPL were volatile after the company announced acquisition of OptiCHOS.

OptiCHOS is a naturally derived fungicide for its Natural Plant Protection business unit.

OptiCHOS offers farmers a low-risk, residue free, bio-degradable fungicide with negligible impact on environment. The fungicide has already been submitted for approval for use in the European Union.

Trading volume was nearly twice the 30-day average. The company is scheduled to report its earnings for the quarter-ended March on Monday.

Of the 30 analysts tracking the company, 26 maintain 'buy', two suggest 'hold' and two recommend 'sell'. The overall consensus price of analysts tracked by Bloomberg implies an upside of 17.3%.

Source: Exchange filing, Bloomberg

Biggest contribution to overall macroeconomic and financial stability stability, as well as sustainable growth, will come from our effort to maintain price stability.

Source: RBI Governor statement

RBI Governor to Make Unscheduled Statement, Spurring Hike Talk

Sharp rise in March inflation print was propelled in particular by food inflation, says RBI Governor.

High frequency price indicators for April indicate the persistence of food price pressures.

Food price indices of the FAO and the World Bank touched historical highs in March and remain elevated.

Prices of edible oils may firm up further due to export restrictions.

Source: RBI Governor statement

Debt distress rising in developing world, says RBI Governor Shaktikanta Das

Amidst global challenges, Indian economy has shown resilience

Monetary policy continues to foster congenial financial conditions by being accommodative

Have been able to preserve macro stability

Source: RBI Governor statement

European markets decline ahead of U.S. Federal Reserve's rate decision. Geopolitical tensions between European Union and Russia have intensified as well with EU proposing a total ban on Russian oil.

Source: Bloomberg

Tax Reassessment Issue Reaches Supreme Court

Hero MotoCorp Q4 Review: Analysts See Rural Demand Revival, Launches To Help

Inflationary risks to India’s economy warrant an earlier tightening of monetary policy by India’s central bank, according to Nathan Sribalasundaram, Southeast Asia and India rates analyst at Nomura in Singapore.

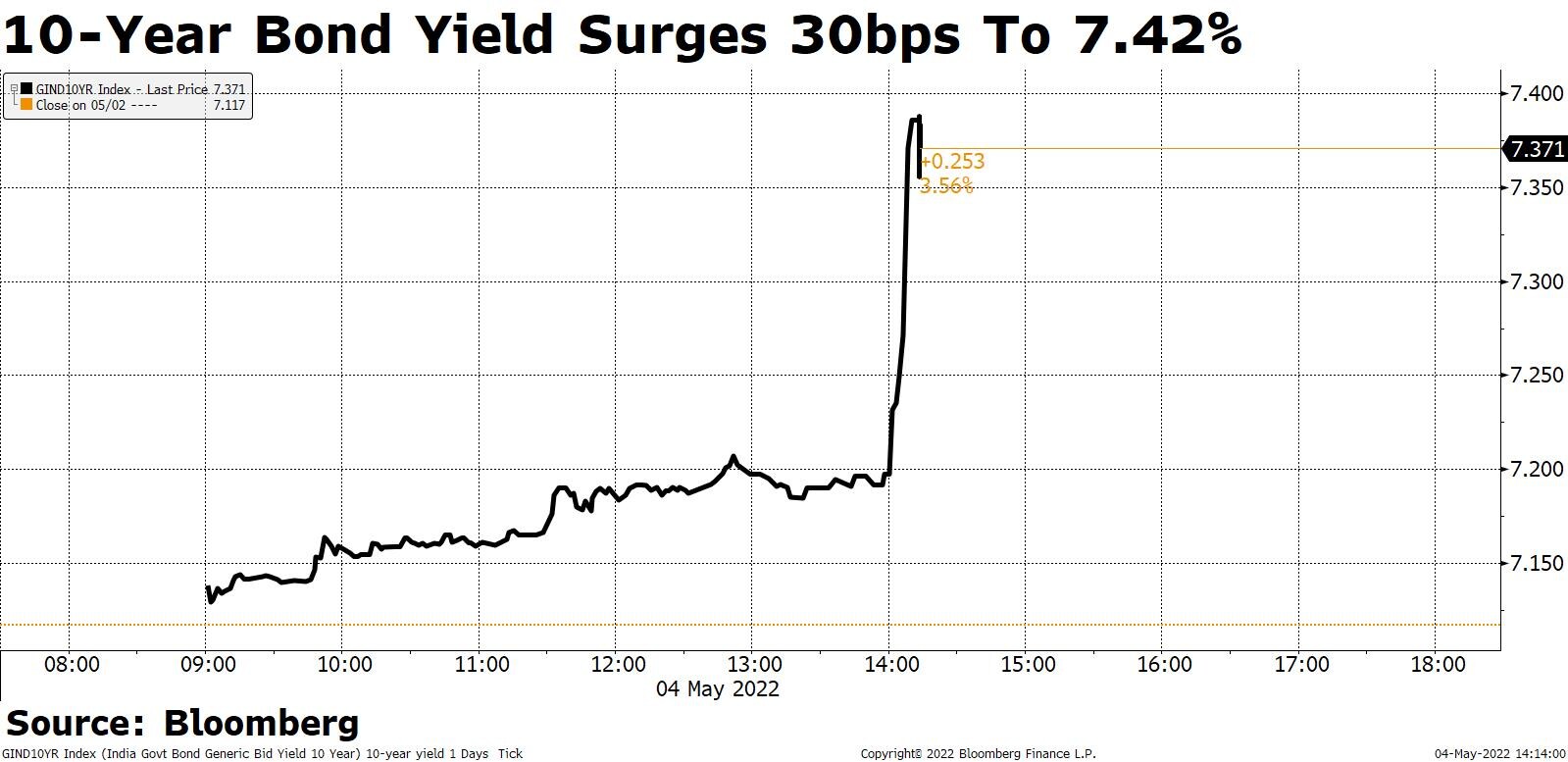

The Reserve Bank of India said its governor will make an unscheduled statement on Wednesday, sending bond yields surging on speculation of a rate hike.

“Hard to say if this will be a rate hike or further calibration of the liquidity,” says Sribalasundaram, “Clearly though the inflationary risks warrant a more aggressive and earlier tighten of monetary policy.”

Yields will move sharply higher and we can expect the 6m-18m part of swap curve to come under the most pressure as the market re-calibrate should a rate hike happen.

Source: Bloomberg

Exide Industries raised to 'buy' from 'accumulate' at Elara Securities India; price target set at Rs 243, implied return of 58%.

Endurance Technologies raised to 'buy' from 'accumulate' at Elara Securities India; price target set at Rs 2,101, implied return of 70%.

Source: Bloomberg

European Commission President Ursula von der Leyen proposes a complete ban on Russian oil in EU’s sixth package of sanctions.

The EU will also de-swift Sberbank, Russia's largest bank and two other major banks.

EU to also ban three big Russian state-owned broadcasters from its airwaves.

Source: Ursula von der Leyen’s Twitter

About 2.46 million shares, aggregating to 6.1% of equity, of IFB Industries changed hands in a large trade.

Details of buyers, sellers are not known immediately.

Source: Bloomberg

The S&P BSE MidCap almost mirrored its larger peers while S&P BSE SmallCap outperformed, with losses to the tune of 0.8%. All the 19 sectoral indices compiled by BSE Ltd. logged losses with S&P BSE Consumer Durables, Healthcare and Metal indices leading the decline.

The market breadth was skewed in the favour of bears. About 1,092 stocks advanced, 2,153 declined and 139 remained unchanged.

Titan Shares Slide After Q4 Results, But Outlook Still Promising

The board of InterGlobe Aviation Ltd., the operator of IndiGo Airlines, announced the appointment of Venkataramani Sumantran, an Independent Non-Executive Director as Chairman.

He takes over from Meleveetil Damodaran, who has stepped down as an Independent Non-Executive Director on May 3, 2022, on attaining the age of 75 years.

Source: Exchange Filing

Traders are trying into price in the possibility of an interim rate hike ahead of the Fed.Harish Agarwal, Fixed Income Trader, FirstRand Bank

RBI Governor Shaktikanta Das to make a video statement on May 4, 2PM

Source: RBI

Most yields along the India sovereign yield curve rose, with 10-year bonds moving the most in Wednesday morning trading.

The 1-year yield remained unchanged at 5.13%

The 10-year yield rose 4.1bps to 7.159%

The 18-year yield remained unchanged at 7.33%

The 2-year-10-year yield spread was 162.7bps, vs previous close 160.8bps

Source: Bloomberg

HDFC Bank has 1.31 million shares change hands in a large trade.

SBI Cards has 1 million shares change hands in a large trade.

Details of buyers, sellers are not known immediately.

Source: Bloomberg

LIC IPO Subscription Status: Day 1 Live Updates

Adani Airports Holdings’ subsidiary Mumbai International Airport has raised $750 million (Rs 5,730 crore) through 7.25-year USD Notes through U.S. private placement.

Funds raised to be used for, refinancing of existing debt and for new capital expenditure requirements.

Source: Exchange filing

The broader indices outperformed their larger peers. The S&P BSE MidCap rose 0.15% while S&P BSE SmallCap added 0.4%. Ten of the 19 sectoral indices compiled by BSE Ltd. advanced with S&P BSE Realty rising 0.6%.

The market breadth was skewed in the favour of bulls. About 1,610 stocks gained, 862 declined and 120 remained unchanged.

JefferiesMaintains 'buy', target price raised to Rs 2,100 from Rs 2,000, an implied return of 29.97%

Firm delivered a strong 4Q with pre-sales, cash collections and reported profits at a record.

Management is aiming for pre-sales to cross Rs 10,000 crore in FY23 and a strong launch pipeline of 21 msf should help deliver on the same

New project adds at 6 msf were strong; though low gearing and a still early-stage housing cycle means much more should be done in FY23

Motilal Oswal

Maintains 'neutral' with the target price cut to Rs 1,750 from Rs 1,800, an implied return of 8.31%.

Firm reported highest ever quarterly sales and annual pre-sales and collections, inline with expectations.

Value of bookings also rose 17% to Rs 7,860 crore in FY2022, a record.

Raises FY23/24 pre-sales estimate by 1%/2%.

Expects the company to continue to grow at a healthy pace.

MMR and Bengaluru remain the company's top priorities, while it also pursues new project additional opportunities in key focus markets.

New project additions outside its four core markets will mostly be under the plotted development category.

Maintains 'buy', target price raised to Rs 2,100 from Rs 2,000, an implied return of 29.97%

Firm delivered a strong 4Q with pre-sales, cash collections and reported profits at a record.

Management is aiming for pre-sales to cross Rs 10,000 crore in FY23 and a strong launch pipeline of 21 msf should help deliver on the same

New project adds at 6 msf were strong; though low gearing and a still early-stage housing cycle means much more should be done in FY23

Maintains 'neutral' with the target price cut to Rs 1,750 from Rs 1,800, an implied return of 8.31%.

Firm reported highest ever quarterly sales and annual pre-sales and collections, inline with expectations.

Value of bookings also rose 17% to Rs 7,860 crore in FY2022, a record.

Raises FY23/24 pre-sales estimate by 1%/2%.

Expects the company to continue to grow at a healthy pace.

MMR and Bengaluru remain the company's top priorities, while it also pursues new project additional opportunities in key focus markets.

New project additions outside its four core markets will mostly be under the plotted development category.

Source: Motilal Oswal, Jefferies notes

Indian markets are likely to open on a flat to positive note tracking mixed global cues as investors are braced for the biggest Federal Reserve interest rate-hike since 2000. Domestic markets were closed on Tuesday on account of Eid-Ul-Fitr. On Monday, the market ended marginally lower on the back of losses in IT, auto stocks partially offset by gains in BFSI stocks amid mixed cues from global peers. US markets ended higher amid release of macroeconomic data and ahead of a Fed meeting scheduled on Wednesday.ICICI Direct note

GMR Infrastructure's subsidiary GMR Hyderabad International Airport received letter of confirmation from Ministry of Civil Aviation extending the term of concession agreement for operating Hyderabad's Rajiv Gandhi International Airport for further period of 30 years from March 23, 2038 to March 22, 2068.

The extension is in terms of the concession agreement dated December 20, 2004. The Rajiv Gandhi International Airport in Hyderabad was commissioned in a record time of 31 months and inaugurated in March 2008. The initial capacity of the airport was 12 million passengers per year. It has now risen to 21 million passengers per annum.

Source: Exchange Filing

Adani Ports reported cargo volume for April of 28.64 million tons Vs. 24.46 million YoY.

April Results

Cargo volume 28.64 million tons, +17% YoY

Commentary & Context

Coal volumes grew 23% YoY; agriculture cargo and fertilizer handling at ports grew 350%

Source: Exchange filing

The rupee may advance with inflows watched as the nation’s biggest ever share sale opens for subscription on Wednesday. An easing in crude prices on Tuesday may also help.

Life Insurance Corp. of India’s public offering drew anchor investors including Norway’s sovereign wealth fund and the Singaporean government, raising Rs 5,630 crore ($736 million) ahead of its full initial public offering.

USD/INR rose 0.1% to 76.5150 on Monday. Indian markets were closed for a holiday on Tuesday.

10-year yields fell 2bps to 7.12%.

Global funds sold net Rs 1,850 crore of India stocks Monday: NSE.

They bought Rs 28 crore of sovereign bonds under limits available to foreign investors on Monday, and withdrew Rs 2,260 crore of corporate debt.

State-run banks sold Rs 758 crore of sovereign bonds on May 2: CCIL data. Foreign banks bought Rs 1,660 crore of bonds.

Source: Bloomberg

LIC IPO Date, Price, Lot Size And Details: All You Need To Know

Adani Total Gas

Adani Green Energy

Tata Consumer Products

Kotak Mahindra

IIFL Wealth Management

ABB India

Havells India

Equitas Small Finance Bank

EIH Hotels

Deepak Nitrite

SIS

Rain Industries

Oracle Financial Services Software

MAS Financial Services

Laxmi Organic Industries

Cigniti Technologies

Bombay Dyeing

Aptech

SpiceJet: The Directorate General of Civil Aviation grounded Spicejet Boeing 737-800 jets after severe turbulence incident. DGCA is also inspecting air carrier’s entire fleet.

PowerGrid: The company approved acquisition of 77,30,225 equity shares of IL&FS Energy Development Company in Cross Border Power Transmission Company. CPTCL is a joint venture of Power Grid Corporation of India Limited (26%), Satluj Jal Vidyut Nigam Limited (26%), Nepal Electricity Authority (10%) and IEDCL (38%).

Voltas: The company entered into a joint venture with Highly International (Hong Kong), a wholly owned subsidiary of Shanghai Highly (Group) Company, to engage in the business of design, development, manufacture, marketing, sale and service of inverter compressors for room air-conditioners, motors for inverter compressors, and their associated parts including sourcing of raw materials and components required for manufacturing these products.

Hindustan Zinc: The company has signed a memorandum of understanding with Sweden based Sandvik for supply of a battery-electric underground equipment fleet to be used at Sindesar Khurd Mine.

Bombay Dyeing: Chief Financial Officer Hitesh Vora resigned effective August 2.

Aurobindo Pharma: Says Unit Eugia Pharma gets approval for Bortezomib for injection.

Macrotech Developers: To merge nine-units with itself.

NMDC: April sales 3.12 million tonnes Vs 3.09 million tonnes YoY.

Zydus Lifesciences: Gets U.S. FDA approval for Bortezomib for injection.

Hero MotoCorp Q4 FY22 (Standalone, YoY)

Revenue down 15% at Rs 7,421 crore Vs Rs 8,686 crore (BBG estimate: Rs 7,465 crore)

Net profit down 28% at Rs 627crore Vs Rs 865 crore (BBG estimate: Rs 625 crore)

Ebitda down 32% at Rs 828crore Vs Rs 1,211 crore (BBG estimate: Rs 877 crore)

Margin at 11.2 % Vs 13.90% (BBG estimate: 11.75%)

Adani Wilmar Q4 FY22 (Consolidated, YoY)

Revenue up 40% at Rs 14,960.37 crore Vs Rs 10,672.34 crore

EBITDA up 21% to Rs 425.72 crore Vs Rs 353.17 crore

Margins at 2.8% Vs 3.3%

Net profit down 26% to Rs 234.3 crore from Rs 315 crore

Jindal Stainless Q4 FY22 (Consolidated, YoY)

Revenue up 68% at Rs 6,563.51 crore Vs Rs 3,913.64 crore

EBITDA up 55.2% at Rs 841.59 crore Vs Rs 542.22 crore

EBITDA margin 12.82% Vs 13.85%

Net profit up 154% at Rs 735.53 crore Vs Rs 289.19 crore

Approved transfer of entire stake in JSL Ferrous, wholly owned subsidiary of the company to Jindal United Steel, associate company.

Castrol India Q4 FY22 (Consolidated, YoY)

Revenue up 8.5% at Rs 1,235.7 crore Vs Rs 1,138.7 crore

EBITDA fell 6.7% at Rs 317.20 crore Vs Rs 340.1 crore

EBITDA margin 25.67% Vs 29.87%

Net profit fell 6.2% at Rs 228.4 crore Vs Rs 243.6 crore

Britannia Industries Q4 FY22

Revenue up 13% at Rs 3,550.45 crore Vs Rs 3,130.75 crore (Bloomberg Estimate: Rs 3,457.8 crore)

Net profit up 4% to Rs 379.87 crore from Rs 364.32 crore (Bloomberg Estimate: Rs 378.76 crore)

EBITDA up 8.7 % to Rs 549.68 crore Vs Rs 505.39 crore (Bloomberg Estimate: Rs 526.51)

Margins at 15.5% Vs 16.1% (Bloomberg Estimate: 15.2%)

Mahindra and Mahindra Financial Services Q4 FY22 (Consolidated, YoY)

Revenue fell 4.8% at Rs 2,865.08 crore Vs Rs 3,007.26 crore

EBIT up 31% at Rs 1,882.42 crore Vs Rs 1,436.57 crore

EBIT margin 65.7% Vs 47.77%

Net profit up 188% at Rs 623.78 crore Vs Rs 216.34 crore

Recommended dividend of Rs 3.6 per share of face value of Rs 2 each

JBM Auto Q4 FY22 (Consolidated, YoY)

Revenue up 44% at Rs 1072.29 crore Vs Rs 744.88 crore

EBITDA up 46% at Rs 123.05 crore Vs Rs 84.18 crore

EBITDA margin 11.48% Vs 11.3%

Net profit up 165% at Rs 85.63 crore Vs Rs 32.24 crore

Recommended final dividend of Rs 1 per share on face value of Rs 2 each

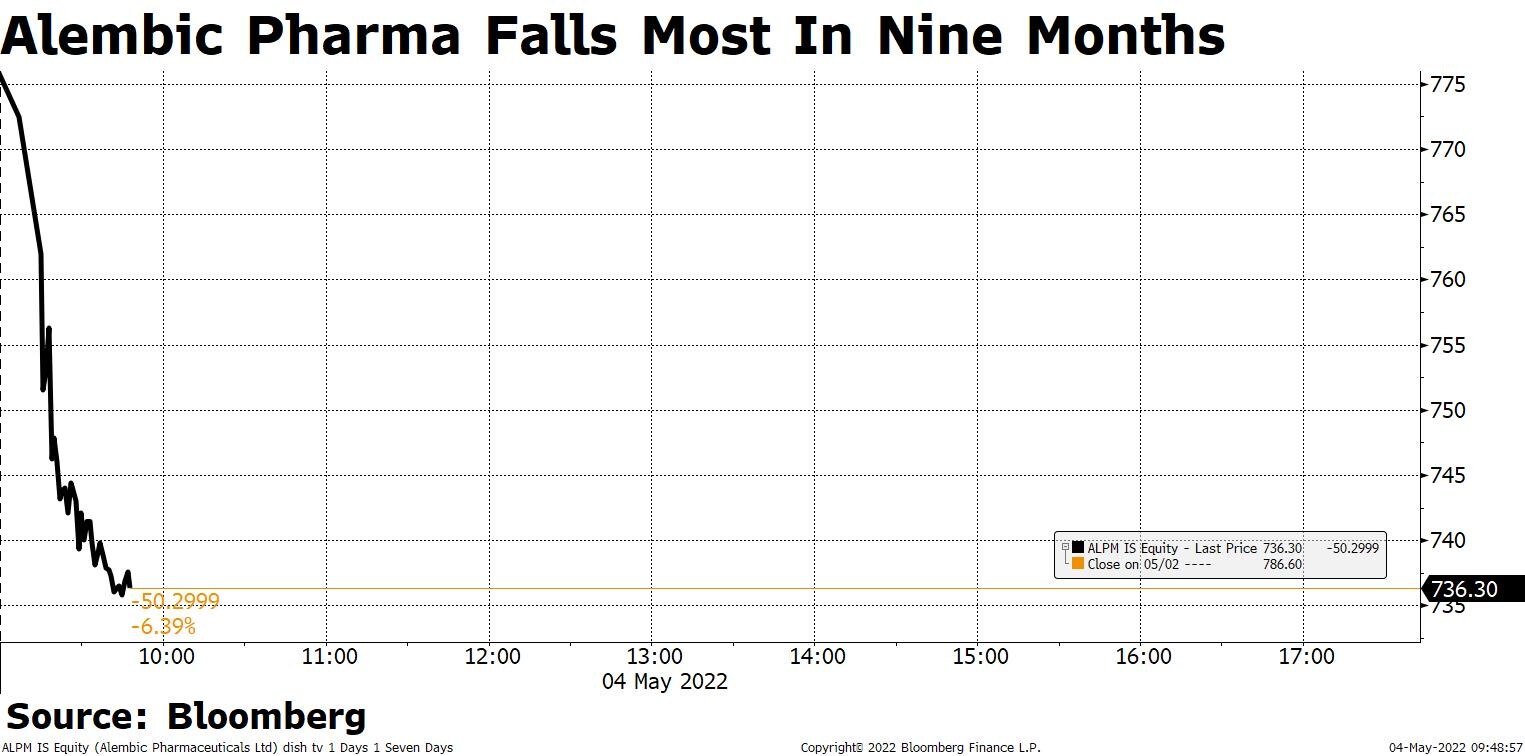

Alembic Pharmaceuticals Q4 FY22 (Consolidated, YoY)

Revenue up 9% at Rs 1,426 crore Vs Rs 1,306 crore (Bloomberg Estimate: Rs 1,254 crore)

EBITDA down 51% to Rs 170 crore from Rs 346 crore (Bloomberg Estimate: Rs 243 crore)

Margins at 11.9% Vs 26.5% (Bloomberg Estimate: 19.3%)

Net profit down 86% at Rs 34 crore from Rs 251 crore (Bloomberg Estimate: Rs 154 crore)

EPS at Rs 1.8 per share vs Rs 12.75 per share (Bloomberg Estimate: Rs 7.3)

Stocks rose on Wednesday and bonds remained under pressure as investors gear up biggest Federal Reserve interest rate-hike since 2000 as they await more clues on the U.S. central bank's plans to tackle inflation.

Equities advanced in Australia and South Korea, while S&P 500 and Nasdaq 100 futures rose. Japan and China are closed for holidays. The Singapore-traded SGX Nifty, an early barometer of India's benchmark Nifty 50, rose over 0.5% to 17,073 points as of 7 a.m.

The Fed is expected to raise rates by 50 basis points on Wednesday and detail plans for the reduction of its balance sheet. Key for markets will be Fed Chair Jerome Powell’s commentary, which might contains hawkish surprises.

In commodities, oil was at about $103 a barrel and gold was little changed. Bitcoin hovered around $38,000.