(Bloomberg) -- The Indian rupee tumbled to a record, weighed by a slump in equities amid concerns accelerating inflation may eat into company earnings.

The rupee dropped as much as 0.5% to 77.6313 per dollar on Thursday, hitting a new low for the second time this week before paring losses on possible central bank intervention. The benchmark Sensex Index tumbled 2.1% to the lowest in two months.

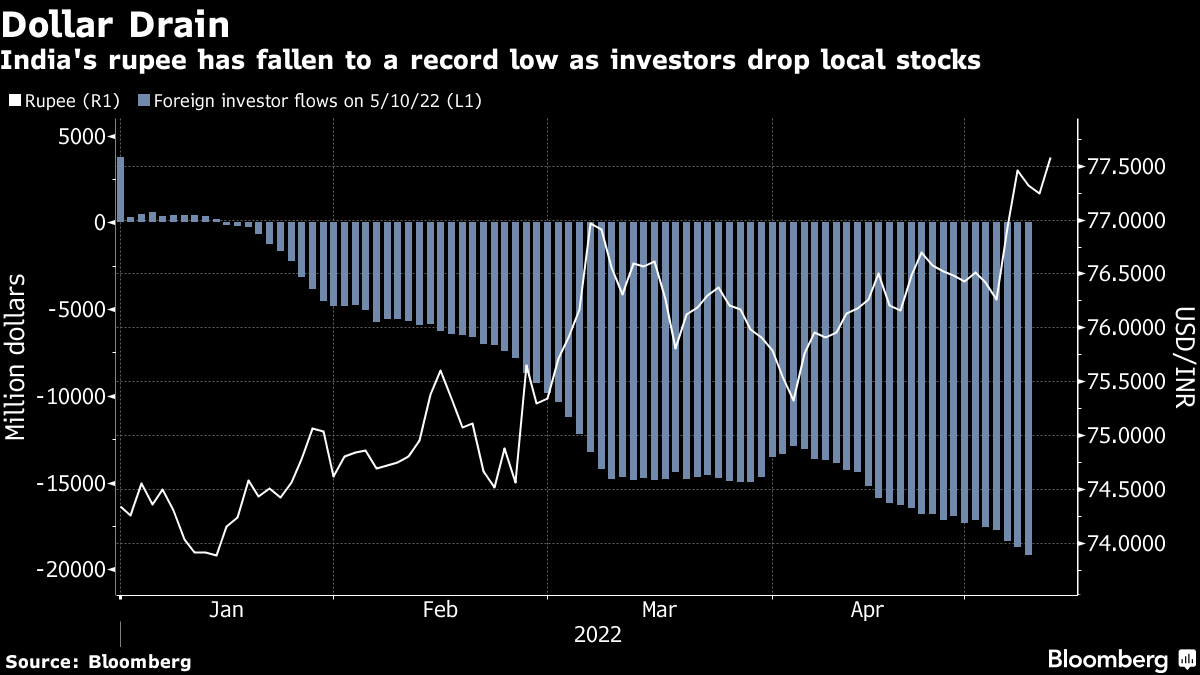

Foreign funds have pulled out $19 billion from Indian equities this year with surging inflation and the prospect of aggressive monetary tightening by the Federal Reserve roiling global markets. A surprise rate hike by India's central bank hasn't been able to stem the rupee's decline, amplified by worries over a widening current-account deficit amid elevated commodity prices.

“Our domestic inflation is picking up which will hit company earnings, and that's why we are seeing steep foreign outflows from equities,” said Arnob Biswas, head of FX research at SMC Global Securities. “That's creating two headwinds for the rupee, because there is also the Fed's aggressive hawkish stance, and India can't stand alone from EM.”

The rupee pared intra-day losses as India's central bank may have aggressively intervened in spot and forward markets, said Anindya Banerjee, currency analyst at Kotak Securities.

India's central bank is intervening in all foreign-exchange markets and will continue to do so to protect the rupee, a person familiar with the matter said earlier this week.

Investors are worried that inflation staying above the central bank's upper tolerance band of 6% for the fourth-straight month may nudge it to continue hiking rates, and weigh on companies' profitability. The RBI will raise its inflation forecast in the June monetary policy meeting, possibly setting the stage for more interest rate increases by August, a person familiar with the matter said.

“Sentiment is low, the stock market is low, and every day you see red,” said Anoop Verma, a fixed income trader at DCB Bank Ltd. “The biggest barometer for the economy is the currency's strength, and if that keeps weakening every day, it's not a good sign for any market.”

The yield on benchmark 10-year bonds rose three basis points to 7.24%. The yield had increased to the highest since April 2019 on Monday after the central bank raised interest rates in an out-of-cycle move last week.

(Updates prices and adds trader comment in the seventh paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.