Polycab Share Price Extends Decline For Fifth Session Amid Large Deal

Polycab Block Deal: The seller is likely a domestic mutual fund, according to market sources.

Shares of Polycab India Ltd. saw a dip after the counter witnessed a significant block trade of $135 million on the National Stock Exchange, signaling strong institutional activity in the cable manufacturer’s shares. The transaction stands out as one of the notable block deals in the current market environment.

The seller is likely a domestic mutual fund, according to market sources. Shares were offered at a discount of up to 2.7% to the current market price, making the deal attractive for buyers looking to accumulate positions in the company.

Kotak Capital and Citi acted as brokers to the transaction, underscoring the involvement of leading financial institutions in facilitating the deal. Such block trades often indicate strategic portfolio adjustments or liquidity moves by large funds, and they tend to draw attention from market participants tracking institutional flows.

This development highlights the growing interest in Polycab’s stock and could influence near-term price action, as investors assess the implications of this sizable trade on overall market sentiment.

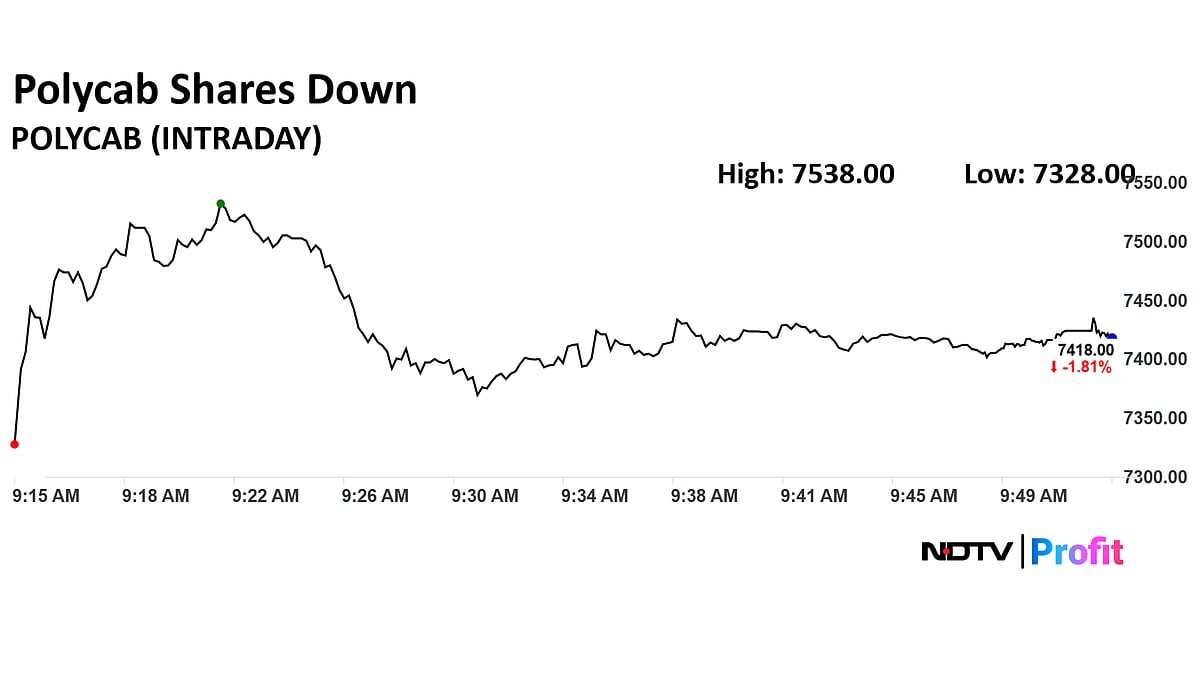

Polycab Share Price Today

The scrip fell as much as 3% to Rs 7,328 apiece, proceeding to pare losses to trade 1.98% lower at Rs 7,405 apiece, as of 09:50 a.m. This compares to a 0.15% decline in the NSE Nifty 50 Index.

It has risen 14.42% in the last 12 months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 52.53.

Out of 36 analysts tracking the company, 25 maintain a 'buy' rating, six recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.7%.