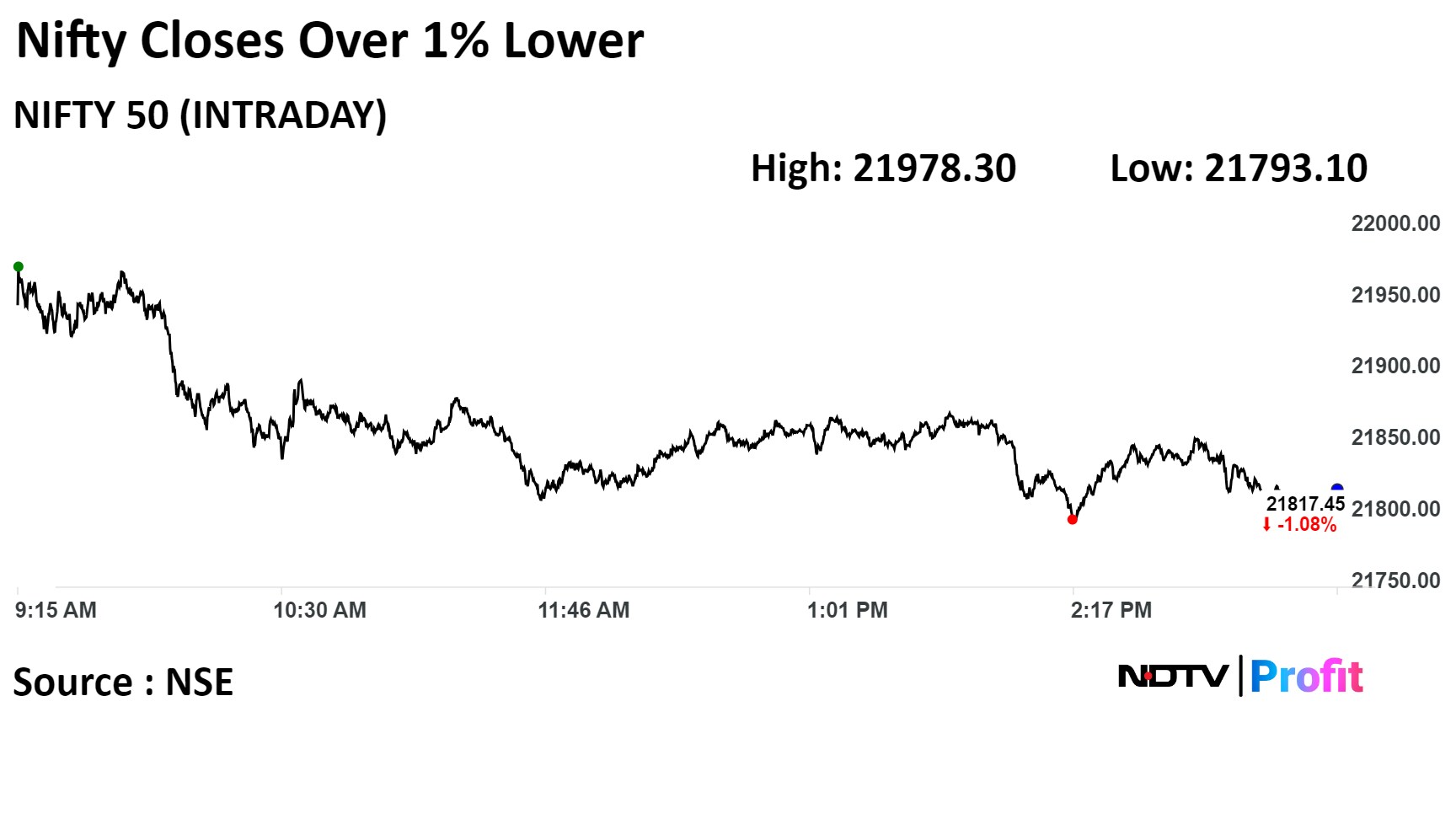

The NSE Nifty 50 has broken the support level and a further dip in the markets can lead to major corrections, according to Vaishali Parekh of Prabhudas Lilladher Pvt.

The Nifty 50 has fallen below the support of 21,900/850 and if it drops below the 21,800 mark, then it can get into "major trouble," the vice president of technical research told NDTV Profit on Tuesday.

Parekh recommends a 'buy' call for shares of Bajaj Finance Ltd. at Rs 6,628 apiece, stop loss at Rs 6,800 at a target price of Rs 6,500 per share, along with a 'buy' call for Clean Science & Technology Ltd. at Rs 1,311 apiece, stop loss at Rs 1,250 at a target price of Rs 1,400 per share.

Currently, the Bank Nifty looks stronger as compared to the Nifty 50, according to Parekh, who suggests a wait-and-watch approach.

The benchmark stock indices ended at the lowest level in over a month as the Nifty closed 238.25 points or 1.08%, lower at 21,817.45, while the Sensex fell 736.37 points or 1.01%, to end at 72,012.05.

"After violating its immediate support of 21,900, the (Nifty 50) index is about to form an advanced harmonic pattern known as the bullish cypher at 21,740," Aditya Gaggar, director at Progressive Share Brokers Pvt., said. "Post the pattern-reversal confirmation, one can expect the target of 22,000, followed by 22,200."

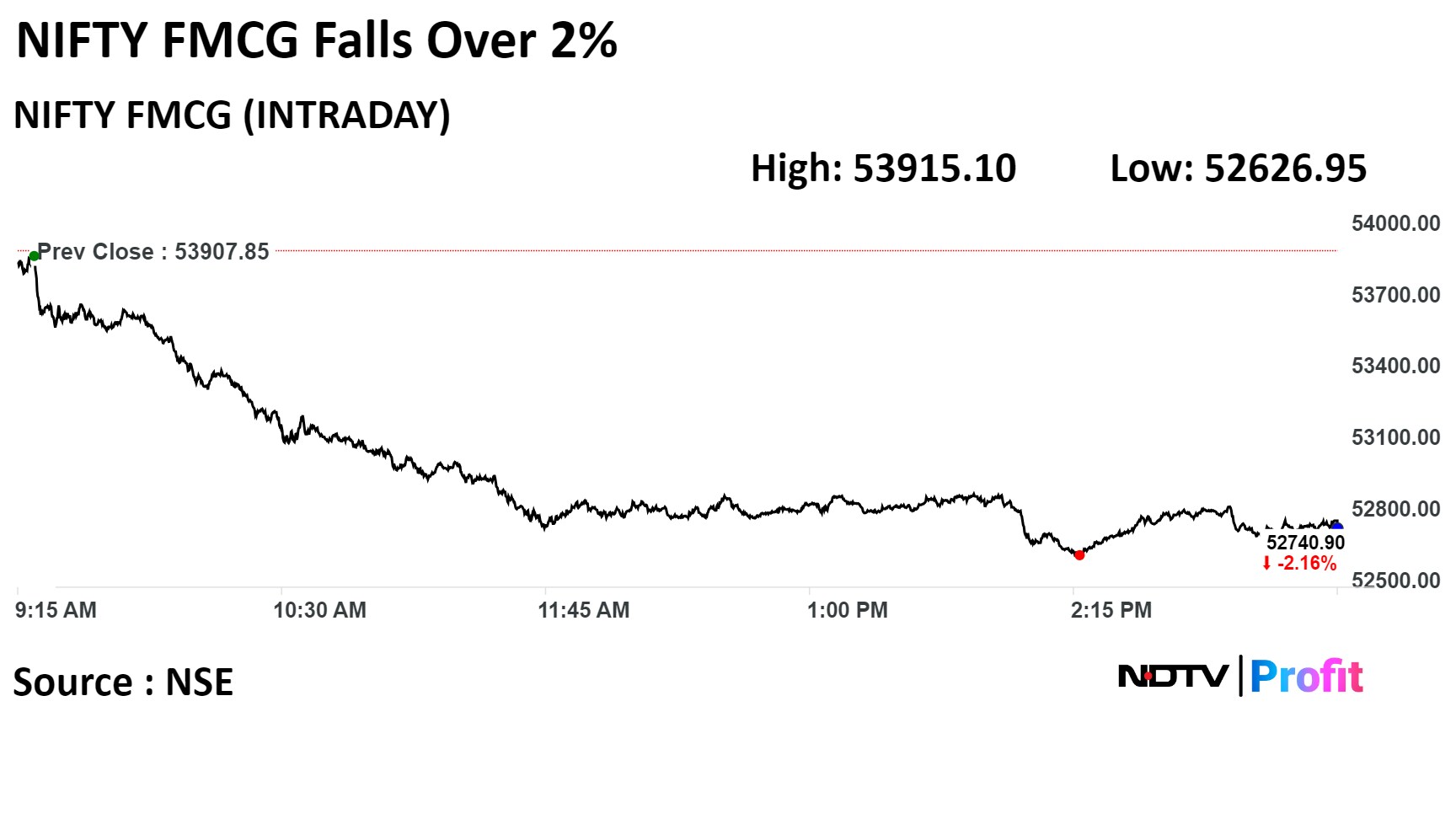

FMCG Sector

Dharmesh Kant of Cholamandalam Securities Ltd. recommends investors stay away from the consumption sector as import prices are set to increase and they can experience it in the fourth quarter and the June quarter of the next financial year.

The head equity research also emphasised that since two of the states have already hiked the minimum support price of wheat, this would impact the production of ITC Ltd. and other biscuits and food makers.

"It's not the right time to enter the consumption sector. For many consumption companies, we have seen the volume growth was only around 1.5 to 2%," Kant said.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Watch The Conversation Here

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.