(Bloomberg) -- Oil steadied near the lowest closing level in three months as traders weighed rising US crude stockpiles and signs that the Federal Reserve may hold interest rates higher for longer.

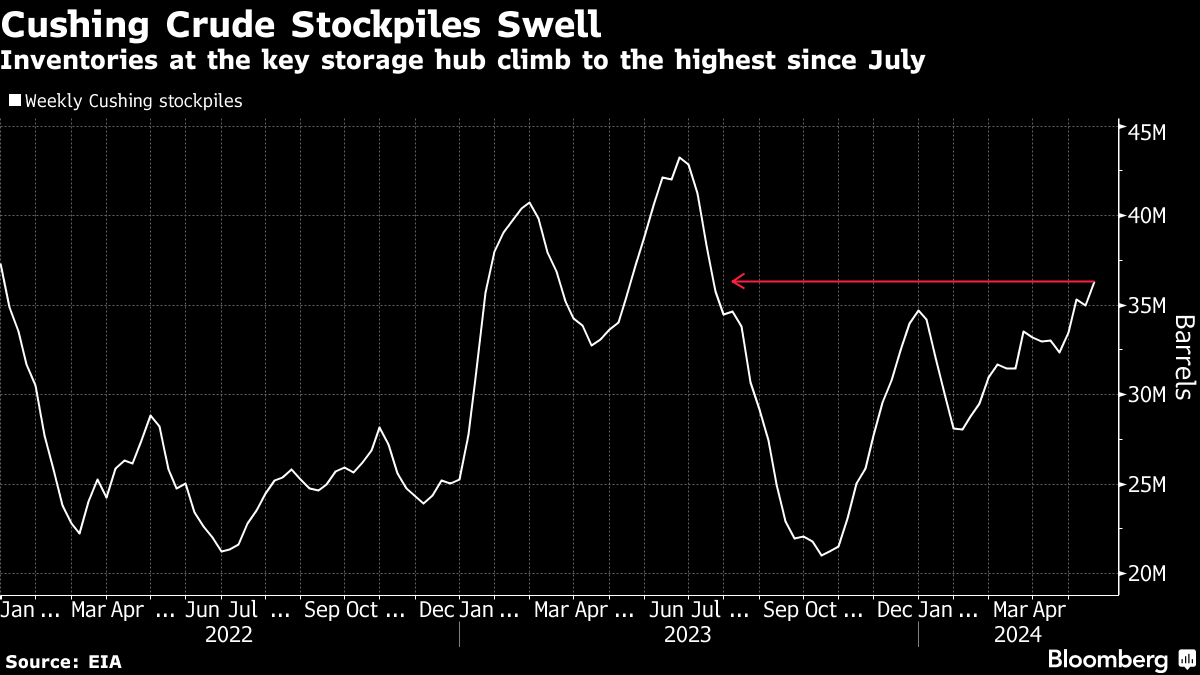

Brent futures changed hands near $82 a barrel in London after settling on Wednesday at the lowest since late February. US crude stockpiles rose last week, while inventories at the storage hub at Cushing, Oklahoma, swelled to the highest level since July, according to government data. Fed minutes from a meeting earlier this month indicated a hawkish stance from officials.

Crude prices have retreated 11% from this year's peak, even as global demand powers to a new annual record, amid plentiful supplies from the Americas, a fragile economic outlook in China and uncertainty over US monetary policy.

That has led money managers to trim their bets on rising prices. The prompt spread for Brent, a key market measure, is also close to a bearish contango structure, which would indicate ample supply.

As a result, the OPEC+ alliance of producers led by Saudi Arabia and Russia is widely expected to prolong current output curbs into the second half of the year when they meet on June 1. Moscow pledged yesterday to make up for pumping above its agreed limit, but the country has a mixed track record on compliance.

“Recent market softness has come on the back of weaker data, including rising oil inventories, tepid demand, and refinery margin weakness and the increasing risk of run cuts,” analysts at Citigroup Inc. including Eric Lee and Francesco Martoccia said in a report.

--With assistance from Sarah Chen.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.