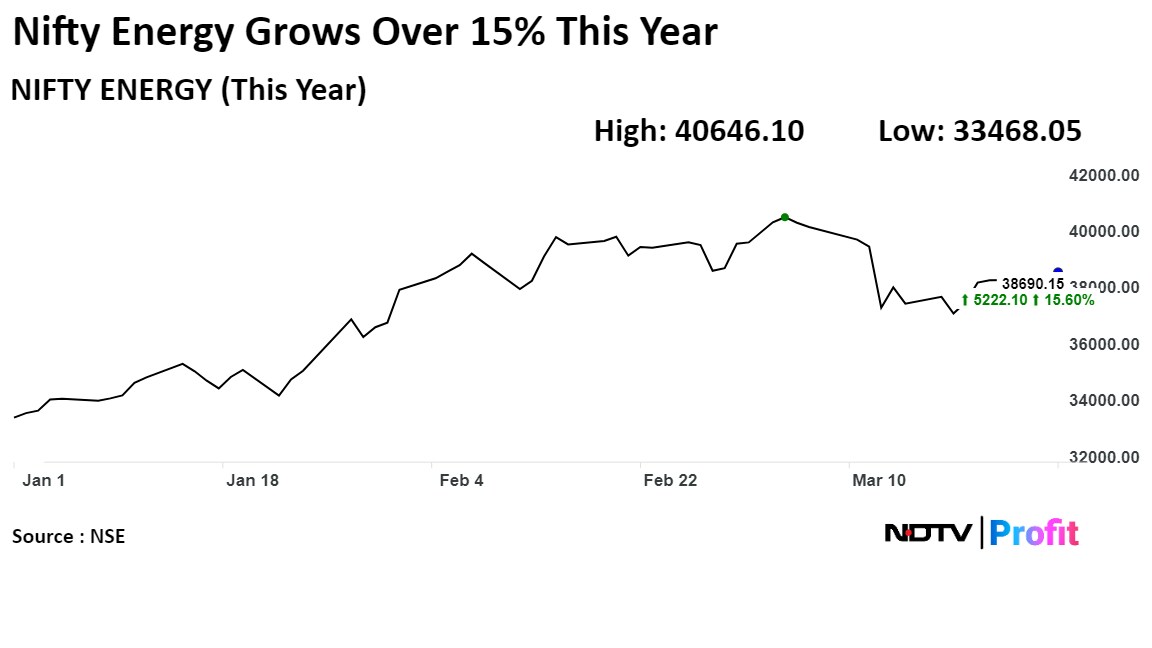

The energy sector has been on an upward trend for the last few months, with the Nifty Energy rising as much as 15.6% this year, according to Kenneth Andrade, chief investment officer of Old Bridge Mutual Fund.

On his choices in the energy sector, Andrade said: "The contractors, capital goods companies and obviously, the commodities. And commodities is my favourite for now."

In terms of commodities, he is not just bullish on companies for fuel inputs but also on everything that goes into building the capex for the energy sector.

Among commodities, metals are also a good choice with a fairly large cycle and reasonable pricing, the CIO told NDTV Profit's Niraj Shah in an interview.

He also gave an example of the power cycle between 2001 and 2017, where he said the government had decided to invest one-time gross domestic product of 2001 in power for the next 15 years.

This created many opportunities. Similarly, if the cycle is to be repeated today, then the "size of opportunity is significant", Andrade said.

The earnings cycle are back-ended and the stocks represent opportunity in the sector, according to Andrade. He suggested that investors should look at the entire value chain from developers to raw material providers and then see where there is opportunity to make long-term gains.

On the FMCG sector, Andrade said: "These are very sustainable businesses that are out there, so they will consolidate around these levels." He said there had been a switch in investors as they are moving towards companies or sectors that are more scalable and currently, that's how the capital is moving.

In terms of specialty chemicals, Andrade said there would be a revival but when that will happen is still a question. He said pharmaceuticals had experienced a similar cycle and the only thing that can be done is to give these companies some time to recalibrate their business.

Watch The Complete Interview Here:

Edited Excerpts From The Interview:

Kenneth, there is this whole conundrum that people have about whether earnings can match to the valuations given the economic cycle, both globally and locally. What's your sense about this push between the economic cycle versus the earnings cycle?

Kenneth Andrade: As we have always seen in multiple cases, the earnings cycle is usually back-ended and stocks or price earnings multiples usually represent the opportunity that is there in that exact space. That's essentially what's playing out at this point in time.

So you will have to map that entire value chain from the developer right to the raw material providers, which are the commodity players and see essentially where the opportunity lies and which part of that value chain can be extremely valuable to own over a long-term perspective.

So every investor has got his favourite allocation. Now there is an investor who likes capex businesses or developers, but then the balance sheet size consistently continues to expand. These are companies or businesses, which attract a lot of bondholders. So obviously, their return on capital employed is very close to the cost of capital or it's an arbitrage between internal capital employed and cost of capital.

Then there's the capex good manufacturers and then the commodity manufacturers. And I think that entire cycle is going to play out as we go through the course of the next couple of years—all the way to 2030. And this is not just in India, but it happens across the world. And you can see the western world also trying to put serious capex into play and that “capex” is largely linked to power capex—that is energy capex—that's taking place. So I think that's the position that we are at, at this point in time and every part of this entire value chain is going to benefit quite substantially.

So would it be fair to assume that this could be a multi-year capex cycle? We might not be at the very beginning, but we are definitely far away from this capex cycle ending.

Kenneth Andrade: Some of these numbers are a little hard to believe, but let me give you a small perspective from 2001 to 2017. That was probably a cycle that I have seen in my career.

I will talk about just one cycle out there which is the energy capex, which is power and the kind of power capacities that we put up at work out there. Between 2001 and 2015 or maybe 2016, India invested its one-time GDP of 2001 over the next 15 years in the power capacities. Think about it this way. For the next 15 years, if we are to replicate that cycle, the size of opportunity is significant. How do you capture that and where do you capture that and that's what the valuations of stocks are fortelling.

So we've gone beyond the value phase or valuation zone to be actually mapping some of these companies on the opportunity or the total addressable market that is there. That makes it very difficult in an environment like this for investors like us to try and pick the right businesses at the right valuations. So that's where we are in the cycle. We are just about probably starting and there's one large industry that always leads it. It is not just in India but anywhere in the world, it's basically the energy cycle. I'll give you a small structural size of how big this opportunity could be.

You are saying that what happened between 2001 and 2016, if the same gets replicated from 2024 or 2023, for the next 15 years, then the size of the opportunity is very large. As a result, you're not getting businesses at the right valuation. Some of the valuations have gone up.

Kenneth Andrade: That's right.

But if the cycle is so long, would you go out and buy some of these businesses even at higher valuations, because the opportunity size I mean, say for execution risks, the runway is very long?

Kenneth Andrade: It depends upon what you want to choose and what you want to participate in. So obviously we are part of the cycle. We like the way the environment is playing out. I wouldn't say we were very loaded on to some of these businesses, but yes, we have got a fair representation of some of these companies in our portfolio.

It's again, a very wide bucket the traditional energy, new energy, power financiers and ancilliers. It's a wide bucket. Maybe I missed something, but what within this whole gamut do you like more than the others?

Kenneth Andrade: I think the contractors, the Capital goods companies and obviously the commodities. And commodities is my favourite for now.

By commodities, do you mean, fossil fuels cum other aspects which are going into the energy sector?

Kenneth Andrade: May not be fuel inputs, but everything else that goes into building out the capex. That's probably where we are. So everything in the metal cycle seems to be fairly large and quite reasonably priced, I would say.

Save for some special metals which might be going and which might be hard to get, the base metals and both ferrous non ferrous, would there be an overhang of a lack of clarity around China demand which might be stronger than the longer term demand scenario for these companies on the capex side?

Kenneth Andrade: It's a little complicated when you bring in the Chinese environment and why they supply deflation into the economy. Now this is a complicated statement by itself. But if you notice what's happening globally, there's a reasonable amount of inflation which is there in the West and the same holds true for even India or other parts of the world.

Now the only country that's providing cheaper products into the marketplace right now, is companies from the Chinese economy. Now when you link that—their providing cheaper products into the global environment—to the Chinese stock market, lower prices results in lower profits for the Chinese, which leads to lower market capitalisations and that's what the entire Chinese economy is stuck with.

So our sense is that we may not continue this scenario in perpetuity and there may be a cycle somewhere between maybe in a year or two years, where this actually reverses. So in our limited understanding of capital cycles, the deflationary impact or the low prices that the Chinese have been supplying the world with, may not last into maybe for one year, maximum two years. And that will bring back pricing into virtually every product that is there on the ground and it could be inflationary, but it's very good for corporate profits. I think that's our take and that's why we like some part of the commodity basket extremely well.

How does that augur for the end user segments? For now, or at least the better part of 2023, some of these companies have benefited or shown earnings growth not because of volume growth necessarily but for margin expansion, presumably because of low costs. Does that change?

Kenneth Andrade: Of course it will change. So if you essentially look at the way the environment keeps moving, margins keep moving from one part of the value chain to the other part. So when you had a commodity boom in 2020 and 2021, the converters suffer. And then you had the converters who did well in the last year or two because the commodity prices came off.

So margins will be always transitory but over a longer term cycle both benefit and that's why you'll have an economic expansion.

You've constantly told me about the deleveraged corporate balance sheet and how that augurs well for India Inc's capability to undertake capex. Hitherto, save for select sectors, we haven't seen the advent of private capex in a meaningful way. Does that change in FY25, or calendar year 2024?

Kenneth Andrade: I think in 2025, you will definitely see the advent of private capex.

Why that belief, Kenneth?

Kenneth Andrade: If you get on the ground, everyone's running out of capacity and if you have a government continuing to spend an incentivised capex, you will see that (private capex) come back very, very strongly.

UBS has come up with a note about why the valuations could be premium for ABB going ahead. ABB India has gained over 6-7% in today's session.

Kenneth, there could be different reasons why different stocks trade at the valuations that they do, but earnings growth, margin accretion and the long cycle seem to be the common points among all the expensive capex beneficiaries in the capital goods space. Do you believe these valuations could stay elevated for some of these businesses?

Kennet Andrade: Usually when the cycles last, I think valuations will remain elevated for a very long period of time.

Is lower valuation and low growth a new norm for FMCG companies in the bargain? We've just not seen them perform. I am moving tracks now.

Kenneth Andrade: This is the new norm. I wouldn't say low valuations. These are very sustainable businesses. So they will consolidate around these levels and if you look at the capital cycle, or the way money actually works, money is always directed towards faster growth. And you've got a situation or you've got an inflection point, wherein traditionally all FMCG and consumer names have always grown at double digits and the highest earnings growth has been probably closer to 20%. But that's no longer the norm right now.

And you got a shift in the way investors actually think about moving to something which is much more scalable, larger, etc. So that's how capital moves from one part of the market to the other, because there's so much visibility out there. Whether it is infrastructure or power or whether it's the capex cycle, there is a rationalisation and how you see portfolios actually change.

So 2010 to 2020 it was all about consumption because infrastructure, capital capex, etc., fell off the cliff. I think you are seeing a reversal of that entire cycle between 2022 and 2030 and maybe beyond that for a while. There's got to be some losers and those businesses are not losers. It is not because they're bad companies, but still they just have to go through a consolidation.

I think that what will happen with consumer businesses, they don't fall off the cliff. That is a reversal to me. If I remember this in 2006, 2007 and 2008, most of the FMCG businesses including Lever came down between 24-35 times earnings. So that's how you will see this environment also play out. I don't know what number they will settle at. But it could be a standard situation for companies like this.

Kenneth, two pockets have kind of stagnated for the last maybe couple of years. One of them is specialty chemicals, the toast of town until 2020-21. Suddenly, it has gone into hibernation as a bucket, save for maybe one or two specific pockets. What's the sense here? Do they make a comeback at some point of time and the survivors particularly of this current cycle?

Kenneth Andrade: Of course, you will see them revive themselves. When, is the big question mark. And obviously, we are going through a supply glut in the international market, obviously driven by one particular country. So we will have to see how that environment plays out.

But these are situations that come through. So what happened in the early 20s is that you democratise capital for this industry. And this industry got capital. They have been able to set up capacities. Now they have to work on cost and they have to go out and get market share.

So this is a period of time where they actually consolidate their business and drop costs and go out and get incremental new consumers and customers and there is a lead time to all of this happening. I think we are going through that lead time. I'm pretty much sure that the next cycle that they will come through, they will come through faster.

So another industry that went through the cycle is pharmaceuticals. In 2015, it stopped and 2021-22-23 we saw a number of companies take out their previous cycle. That was a seven-year cycle.

So you have to give these companies time and when I say that, I don't mean stock prices time but you give these companies time to recalibrate their business, look at the business opportunity with a new lens, go out and get market share and once you get a market share, I think you get back to category dominance. And as an investor, you necessarily have to look for companies with category dominance and it will all come through, probably in the next two or three years.

Kenneth, does the same thing hold true for some aspects of pharmaceuticals. I mean, in some sense, the U.S. generic companies have made a first move in calendar year 2023. But CDMO, API and the likes have kind of stagnated now for a while. Do they kind of make a comeback too?

Kenneth Andrade: You have already seen profits out there and they have made a historical high since 2015. I think in 2024, you will have most of the pharma companies facing the U.S. come through with extremely high profitability. I don't see this slowing down, at least for the next couple of years, because there is a lot of capex already on the ground.

A lot of registrations have been done and the best part of all of this is the Indian companies are gaining market share against the counterparts in the West. So it's a kind of an IT cycle playing out wherein Indian pharma companies are going to take their fair amount of market share in the international arena, whether the rest of the world market or the US. So I would watch that space. We're very optimistic about that part of the environment.

Are you going out on a limb and trying to take an early position into information technology or are you avoiding it? The commentary even from Accenture recently had no ray of hope if you will.

Kenneth Andrade: So they're fairly mature companies. So let's divide them into large companies and small companies. The large companies are fairly mature businesses. Now to trade them at extremely high multiples may not be the right case to see them dip in terms of margins and retrace them back immediately, over the course of the next one or two years is extremely difficult.

So you have to grade yourself. They are going to be very stable businesses, a very stable part of your portfolio. If you expect some of the large IT companies to have a blue sky scenario, it may not be the case out there. So they are stable businesses, great for a part of the portfolio, look for kitchen-sinking in some of these companies, as new management comes in place. Take the opportunity of that and utilise that. So, when I come down to very stock-specific and stock-picking in this industry, I wouldn't categorise the entire industry as a buy.

May I ask you what is it that you are most constructive on. Where is it that if you had a chance to put in money, currently, without bothering about when the return will come as long as the return is magnified, what would that bucket be?

Kenneth Andrade: Let me break this down again. So we're at 3% or 3.5% of world GDP. And we are at 22-23% of population.

As we continue to grow, we have to take market share from the rest of the world. You have to go and figure out companies that will build their franchises in the rest of the world. That's one element of all of it. We've seen how much wealth I.T. has gotten created. We've seen the dominance of Indian pharmaceutical businesses in the West. We've seen how Indian chemical companies have gone out and made their mark.

And from there, you'll see multiple businesses. I mean, we are the second-largest steel manufacturers in the world right now and we are growing capacity out there. So all of this is coming together quite nicely. Now pick up your franchise out there and this is the large trend that is playing out.

Domestically, infra businesses and utilities are expanding. If you put the numbers together, it's going to be a scale business out there. Now in that scale business you got to allocate your capital to parts of the value chain, where you feel comfortable with, and where you think the returns will be outlier. So these are two pockets that are there.

The third pocket is the consumer economy. I think that will come back. It might have a shorter cycle than the last time, but whenever it does come back you got to be a little ready for some of those businesses. Now, case in point—if you look at QSR businesses, they're going through a massive expansion in number of stores or capacity, but the market cap has just gone one way which is down. So look for these trends, look for a bottoming out of the entire cycle and just work your way around it.

So the first two are my priorities. The third one is essentially something that we're waiting and watching for.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.