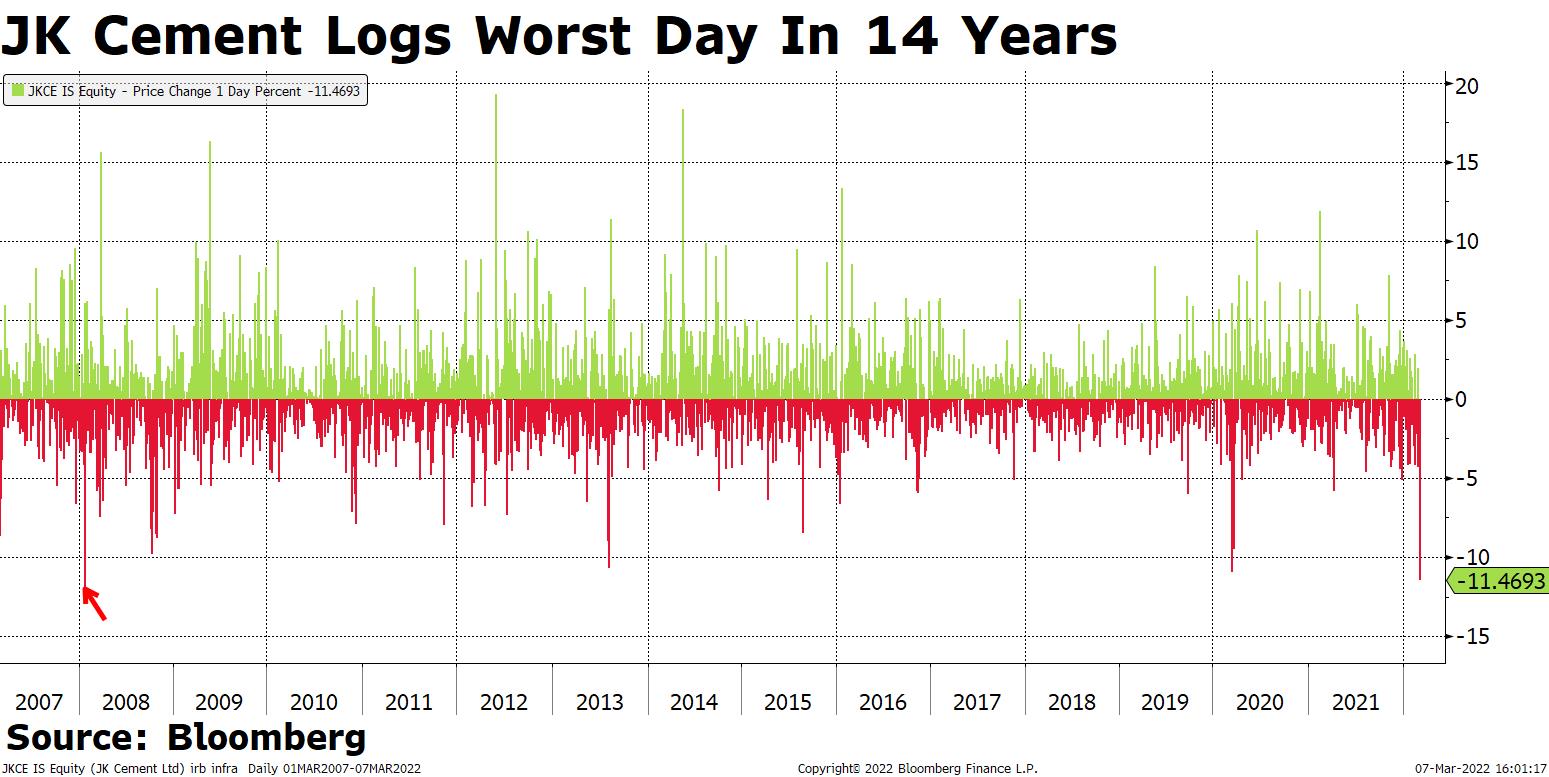

Shares of JK Cement Ltd. logged the worst day in 14 years as analysts raised concerns about the company's "aggressive" investment plan to enter the paints business.

JK Cement's wholly owned subsidiary will make, sell, trade, import and export of all types of paints and allied products, the company announced on Saturday. It plans to invest Rs 600 crore into the new business over the next five years.

New players struggle to scale up in the paints business due to high entry barriers, according to analysts from ICICI Securities, Emkay Global and Kotak Institutional Equities. That may raise capital allocation concerns.

Consumer preference for existing brands and infrequent purchase cycle could also make it difficult for JK Cement to gain share in the mid-to-premium emulsions business, they said.

Investment plans are "aggressive" as the land acquisition and regulatory clearances are pending, analysts said.

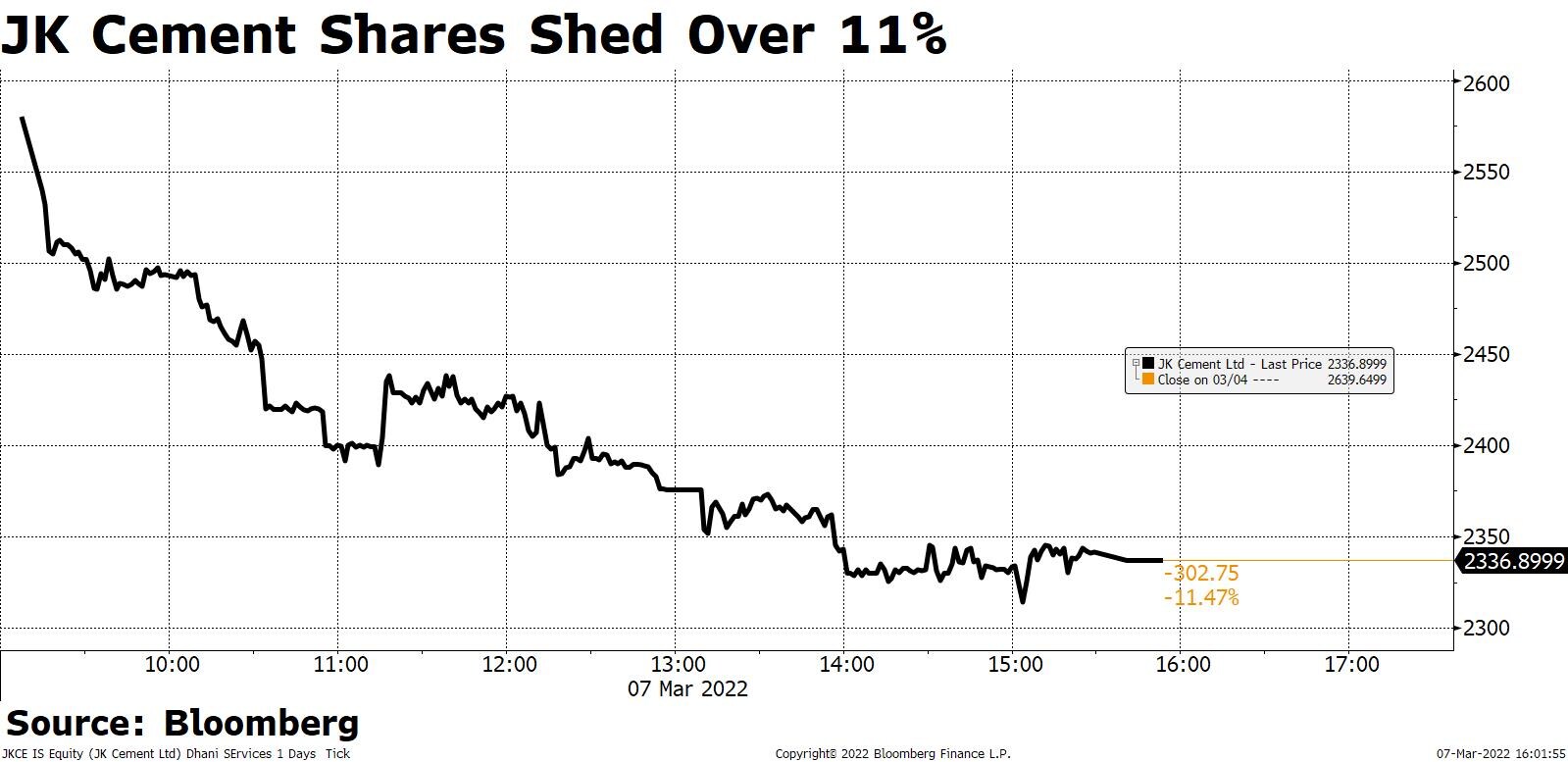

Shares of JK Cement closed nearly 12% lower, the worst day for the stock in 14 years and second worst since the stock got listed in 2006. Trading volume on the stock was 5.6 times the 30-day average volume when markets closed Monday.

The relative strength index was at 16, suggesting the stock may be oversold.

Of the 28 analysts tracking the company, 14 maintain a 'buy', 11 suggest a 'hold' and three recommend a 'sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 45.7%.

Here's a summary of brokerages' view on JK Cement's foray into the paints business:

ICICI Securities

Maintains 'buy' with the target price unchanged at Rs 3,935, an implied upside of 68.88%.

Company plans to diversify into paint business and invest up to Rs 600 crore in the next five years.

While the diversification plans may raise capital allocation concerns given the entry barriers, it may provide steady-state growth/stable income over the medium term.

Paint business is also likely to be a relatively small business for the company and constitute less than 5% of capital employed over the next five years.

Entry into paints business is likely to have an overall return on capital employed-dilutive impact in the initial years.

Key Risks: Weak demand/pricing and sharp cost escalations.

Emkay Global

Reiterates 'hold' with the target price unchanged at Rs 3,150; an implied upside of 19.3%.

Not incorporating the paints business into the company's estimates as of now.

Creation of subsidiary for paint business should enable singular focus on the business.

Management's plans to invest up to Rs 600 crore over the next five years look aggressive given that land acquisition and various regulatory clearances are still pending.

Establishment of a management team, creation of strong brand equity and investment in tinting machines remain key challenges.

Company could potentially add 5% to the market capitalisation of JK Cement if it manages to achieve its guidance for the paints business.

Kotak Institutional Equities

Maintains 'sell' with the target price at Rs 2,600; an implied return of -15.62% (rating not updated since Feb. 16).

New entrants have historically struggled to scale up in the paints business due to high entry-level barriers.

JK Cement's foray into paints is unlikely to pose any risk to Asian Paints Ltd.'s market share.

Rise in competitive intensity could weight on industry profitability.

Company's capex commitment indicates growth aspiration similar to that of JSW Paints Ltd. but not as ambitious as the Rs 5,000 crore investment by Grasim Ltd.

It won't be easy for JK Cement to establish itself in decorative paints due to rising competitive intensity.

Infrequent purchase cycle and preference for existing brands make it difficult for new entrants to gain share in the mid-to-premium emulsions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.