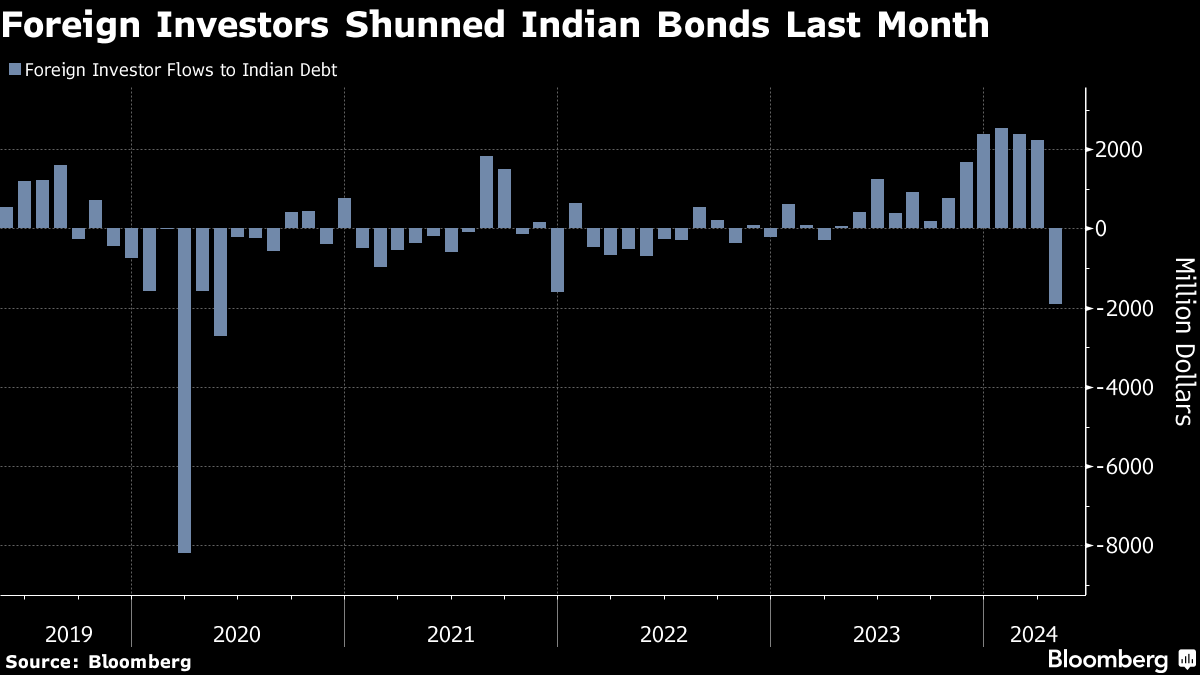

(Bloomberg) -- Foreign funds dumped the most amount of Indian bonds in April since the Covid pandemic as concern on higher-for-longer Federal Reserve interest rates prompted traders to dial down their fervor over inclusion of the debt in global indexes.

They sold nearly $2 billion of Indian sovereign and corporate bonds in April, a pace unmatched since May 2020 and the first month of net sales since March last year. That's after Asia's third-largest economy drew more than $12 billion of debt inflows since JPMorgan Chase & Co. announced it would add the nation's sovereign bonds to its flagship EM gauge in September.

While index-tracking flows are set to kick in from June, many active investors had placed their bets ahead of time, which helped India's benchmark 10-year yield drop to the lowest in nine months in March. But that's before yields surged to 7.25% in April, the highest this year, as strong US data prompted traders to price in fewer Fed rate cuts in 2024.

“Until there is clarity on Fed policy, we will trade in this range,” said Debendra Dash, trader at AU Small Finance Bank Ltd. India's ongoing elections are giving investors another reason to stay on the sidelines, he said.

“Nobody would want to take the event risk, and people would rather wait,” Dash said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.