(Bloomberg) -- In a market that's captured the attention of global finance for allegedly making $1 billion for Jane Street Group, many trading firms are employing a relatively simple strategy: short volatility.

The trade, or variations of it, revolves around a bet that Indian stock indices will move within relatively small ranges, according to five participants familiar with the strategy, who asked not to be identified discussing private information. Significant amounts of capital are deployed to scale the derivatives bets in the world's largest market by number of options contracts traded, the people said.

While the high-speed traders sell options, long-only funds and retail investors buy contracts to make speculative bets or protect themselves against sudden market drops and are often on the other side of the trade, the people said.

There is no indication that Jane Street's billion-dollar strategy, which it has been ordered to detail to a US District Judge by May 23, employed any of these trades. An external spokesperson for Jane Street declined to comment.

The wager has been lucrative so far as India's rising wealth and a shift by global asset managers away from China has steadily lifted the South Asian nation's equities. The country's stock benchmark has moved 2% or more in only nine out of the previous 500 trading sessions, data compiled by Bloomberg shows.

Still, the strategies can be risky, leaving firms open to massive losses in the event of sudden, large moves. In the US, such trades contributed to the so-called Volmageddon of February 2018, when investors who had piled into low-volatility strategies were caught flat-footed by a sudden spike after years of calm.

India's options market entered the spotlight last month after Jane Street filed a lawsuit against two former employees alleging they took a secret strategy involving Indian options to their new jobs at Millennium Management, sparking interest in how they might have amassed the profits. Risky bets around the derivatives also led to a pair of traders in Hong Kong exiting Societe Generale SA, people familiar with the matter have said.

Read More: India's $6 Trillion Derivatives Frenzy Has Government Worried

While none of the trading firms have disclosed their strategies, Optiver, Citadel Securities LLC, IMC Trading BV and Jump Trading have all been expanding in India, alongside a bevy of hedge funds and other players.

A common strategy has been to sell puts and calls, either at the same strike or at different strikes. In both cases, the sellers of these so-called straddles and strangles bet that the premium they pocket more than offsets any loss from a move in the index.

Aside from shorting volatility, trading firms also profit from continuously offering to buy and sell on a range of options, hoping to profit on the spread between bid and ask, one of the people said.

“Shorting volatility, writing puts, writing calls is their mainstay,” said Abhilash Pagaria, a quant strategist at Nuvama Wealth Management, which handles trades for some high-frequency firms.

Read More: Jane Street Ordered to Detail Secret India Trading Strategy (1)

Retail investors make up about 35% of index option trades in India, with the market regulator estimating that 90% of active retail traders lose money on derivatives.

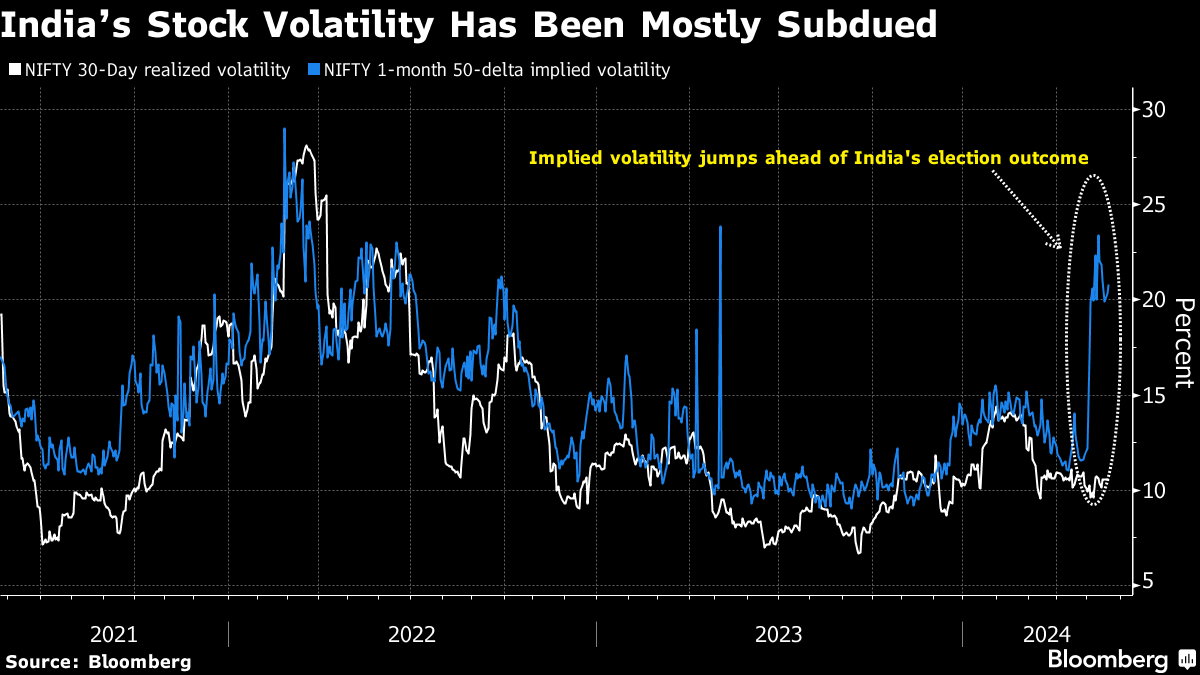

Volatility in Indian equities has been subdued over the past year, compared to US and Hong Kong stocks, but traders are bracing for potential swings around parliamentary election results due in early June.

Large spikes in volatility are bad news for algorithmic traders, who generally trade derivatives of India's benchmark Nifty 50 or Nifty Bank Index, said Amit Kumar Gupta, founder of New Delhi-based money manager Fintrekk. “Gap ups and gap downs can kill high-frequency traders,” he said.

--With assistance from David Marino, Abhishek Vishnoi, Ambereen Choudhury and Joanna Ossinger.

(Adds context on US volatility trading in sixth paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.