Morgan Stanley lowered price target and earnings estimate for the nation's biggest two-wheeler maker citing weaker-than-expected volumes.

“The two-wheeler industry has passed on all cost pressures to date, but in an ongoing inflationary environment, spot prices imply that the industry will need another price hike of 1.5%/2%, which could delay demand recovery, especially for the entry-level segment that Hero MotoCorp Ltd. is exposed to,” the financial services provider said in a March 7 report. “We lower EPS estimates by 12% each for FY22, FY23 and FY24.”

Morgan Stanley remains ‘underweight' on the stock, and cut target price to Rs 1,937 from Rs 2,400 earlier, a potential downside of 11.90%.

That, it said, is because though Indian two-wheeler volumes are “close to a trough”, the next cycle will be driven by electric and premium two-wheelers. “Hero has strong collaborations in the premium (Harley) and electric (Ather and Gogoro) spaces, but limited presence in those segments currently.”

Also, the company's market share declined from 45% in FY11 to 37% in FY21. It plans to launch electric two-wheelers in July 2022, but “given the significant shift in the competitive scenario, we think it might not be able to command a market share similar to ICE (internal combustion engine) two-wheelers in EV two-wheelers”.

Morgan Stanley lowered its volume assumptions for Hero MotoCorp for FY22 by 13%.

Amid recent geopolitical uncertainty, raw material prices are increasing once again. At current levels, two-wheeler original equipment makers would require another Rs 1,000-1,500 in price hikes to offset commodity headwinds.

High exposure to mass-market two-wheelers makes it relatively difficult for OEMs such as Hero MotoCorp to pass on commodity headwinds, and hence margins could remain under pressure in the near term.

Expects industry shifts toward electric vehicles to continue.

A 10% hike in fuel prices is likely to lead to a 3% reduction in total cost of ownership for EVs compared to ICEs.

Morgan Stanley's views concurs with Goldman Sachs', who initiated coverage on Hero MotoCorp with a ‘sell' and a target price of Rs 2,080 apiece—implying a potential downside of 10%.

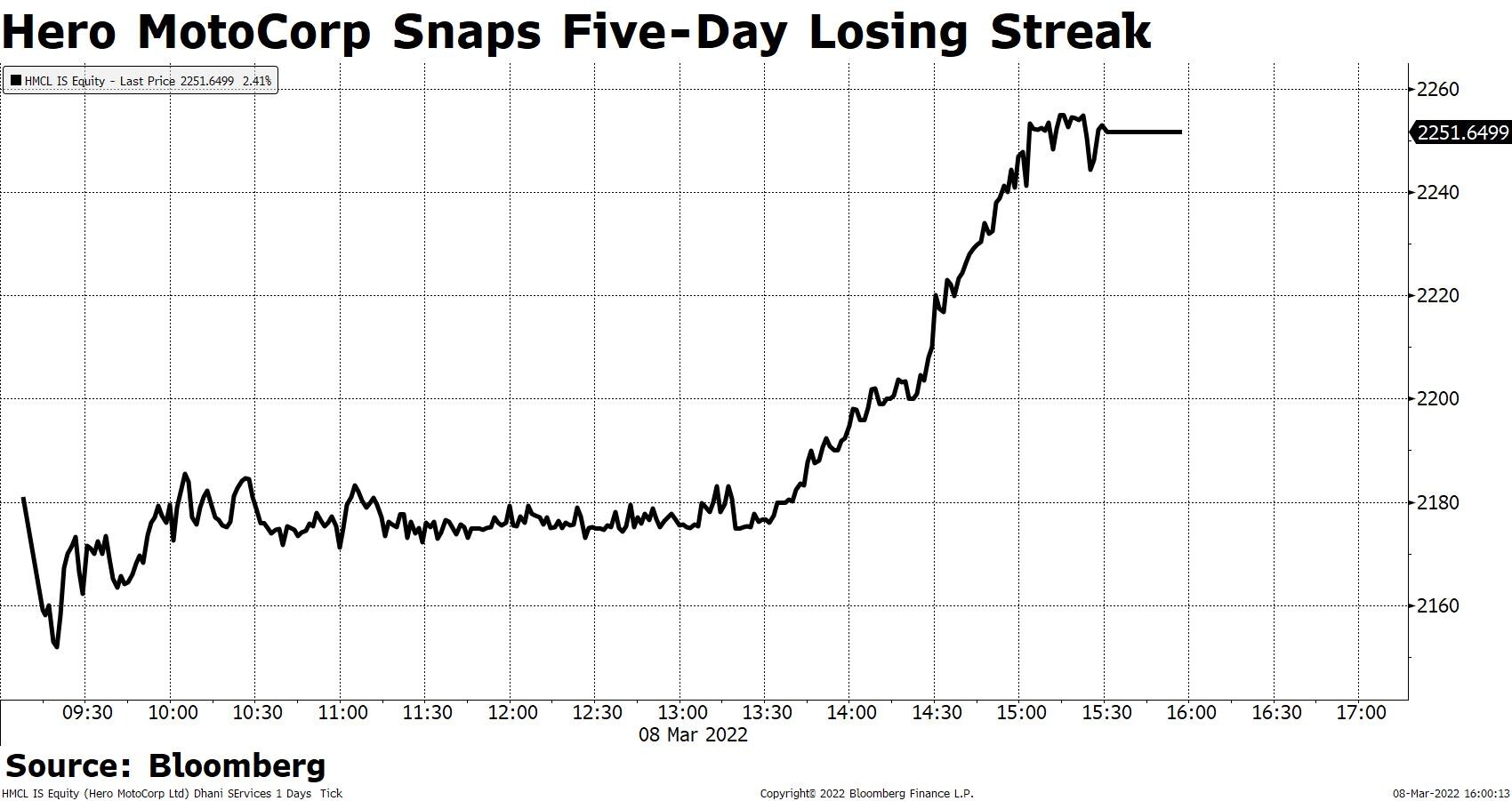

Shares of Hero MotoCorp declined as much as 2% intraday on Tuesday before reversing the losses to close with 2.41% gains. The stock snapped a five-day losing streak.

Of the 51 analysts tracking the company, 33 say ‘buy', 13 recommend a ‘hold' and five suggest a ‘sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 35.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.