Shares of Avenue Supermarts Ltd., the parent of the DMart chain of stores, fell the most in over eight months after the company's third-quarter revenue missed estimates.

The Radhakishan Damani-led firm reported a revenue of Rs 11,569 crore in the December quarter, up 25% over the same period last year, against a consensus estimate of Rs 11,632.1 crore made by analysts tracked by Bloomberg.

Sequentially, it rose 9% from Rs 10,638.33 crore.

Avenue Supermarts Q3 FY23 Key Highlights (YoY)

Net profit rose 7% to Rs 589.6 crore, missing analysts' estimates of Rs 699.3 crore and falling 14% sequentially.

Operating profit rose 11% to Rs 965.26 crore against an estimated Rs 1,073.7 crore. It rose 8% over the September quarter.

The margin came in at 8.3% versus 9.4% due to higher expenses. It was lower than 8.4% in Q2 of FY23.

Total expenses rose 27% to Rs 10,788.86 crore. Expenses were up 9% over the previous quarter.

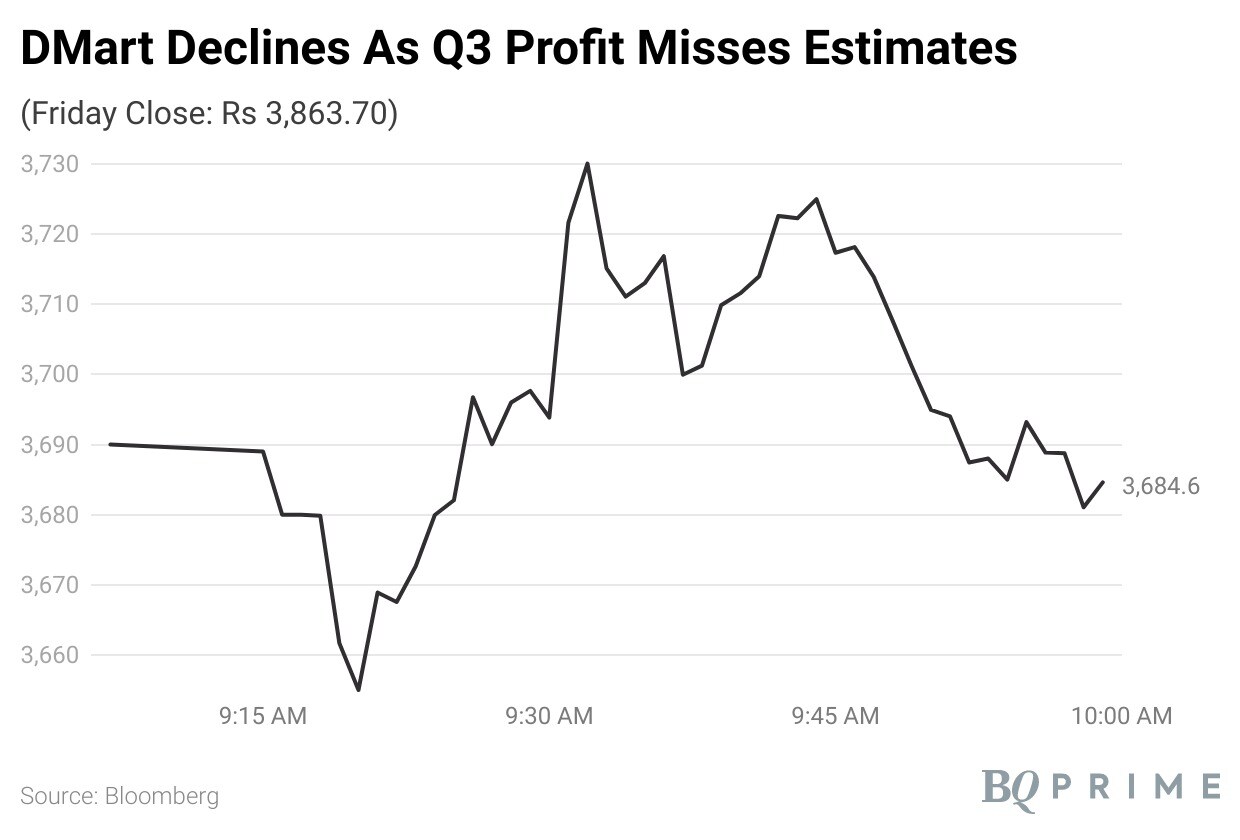

Though the results were announced on Saturday—a market holiday—the company's shares fell as much as 6.1% to Rs 3,627 apiece. That's the most since May 6. This is also the stock's lowest level since July 5.

It ended 4.8% lower at Rs 2,678.35 apiece on Monday.

Of the 27 analysts tracking the company, eight maintain 'buy,' nine suggest 'hold,' and 10 recommend 'sell,' according to Bloomberg data. The return potential of the stock implies a upside of 8.9%.

Here's what brokerages made of DMart's Q3 performance:

Kotak Institutional Equities

Maintains a 'sell' rating at a fair value of Rs 3,550, implying a potential downside of 8.1%.

Weaker gross margin print of 14.3% was driven by an inferior mix of general merchandise and apparel segments despite favorable seasonality. Lower-than-expected gross margin and higher-than-anticipated operational expenses drove an 8% Ebitda miss.

Cuts FY23–25 EPS estimates by 4–11% as it aligns FY23 to nine-month performance, assumes lower same-store sales growth over FY24–25, and bakes in higher operating expenses.

Typically, low-cost retailers benefit in high inflationary environments, but surprisingly, this has not panned for Dmart.

Phillip Capital

Maintains a 'neutral' rating at a target price of Rs 3,654, implying a potential downside of 5%.

Inflationary pressure on staples and essential categories impacts wallet share for discretionary spends, especially in mass categories. On the back of an unfavourable sales mix, the company expects near-term pain to persist and gross margin to remain under pressure.

Believes that the overall throughput is dragged down by newer stores while older, more mature stores are operating at healthy levels that are above the company average.

Revises revenue/Ebitda estimates downward for FY24 by 0.9%/3.4% led by impact of slow recovery in discretionary categories on gross margins.

Valuations are expected to remain soft, despite time corrections witnessed in the stock, as margins are under stress from an unfavourable revenue mix and higher operating de-leverage led by other expenses.

Believes revenue recovery from the general merchandise category is still a couple of quarters away given the impact of inflation on low- and middle-income households.

JM Financial

Maintains a 'buy' rating at a target price of Rs 4,440, implying a potential upside of 15%.

DMart's earnings were lacklustre and below an already toned-down expectation. Earlier expectations that the business could use the excess margin to enhance throughput as seen during CY18 did not play out, and the margin has also tapered off since.

Discretionary revenue needs to necessarily pick up, and we suspect that, apart from macro, the 'crowd' at the stores needs to build up more to drive this.

The strategy to sweat existing assets by piloting pharmacy shop-in-shops is interesting.

Continues to like DMart - businesses with such long growth runways are rare and one should not get too carried away by short-term weaknesses. Reckons the stock can easily deliver double-digit compounding over the coming five years even if the PE ratio—currently 85x FY24E—compresses significantly over that time frame.

Jefferies

Maintains 'hold' rating, cuts target price to Rs 3,550 from Rs 4,100, implying a potential downside of 8%.

General merchandise and apparel continued to underperform FMCG and grocery, resulting in a weaker product mix.

Lowers our FY23-25 earnings by 6-8% factoring in softer store adds and lower margins.

Growth pick-up, especially in general merchandise, is a must for share price performance.

Nuvama Institutional Equities

Maintains a 'hold' rating at a target price of Rs 4,193, implying a potential upside of 8.5%.

Avenue Supermarts posted a weak Q3 FY23 performance on both counts: revenue growth and gross margins.

The key question, assuming this is affecting DMart's customer base more than others, is the time frame of recovery or, potentially, if this is a structural shift.

Muted recovery; adverse mix impacts margins for the second quarter in a row.

Motilal Oswal

Maintains a 'neutral' rating at a target price of Rs 4,050, implying a potential upside of 5%.

Lower footfall and weak demand in the discretionary non-FMCG segment, along with a 20% increase in the store size, affected store productivity, which may take a few quarters to recover.

Cognizant of the prominence of new-age grocery models, their rich valuations, and weak management commentary on the non-food category, as well as lower revenue per square foot in the last few quarters.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.