Investing opportunities lie in spaces like urban infrastructure and railways due to recovery in the investment cycle and government-aided capital expansion, according to Neelkanth Mishra, managing director and India equity strategist of Credit Suisse.

Credit Suisse said there is a shift among investors to chase capital-intensive sectors than “overpriced” consumer discretionary and staples space. “Consumption (based-stocks) is slowing and will continue to slow in the foreseeable future and that is not what markets are geared up to,” Mishra told BloombergQuint. “Sustenance of gross capital formation recovery in the last six months is much longer than market pricing and that is where the investment opportunities lie.”

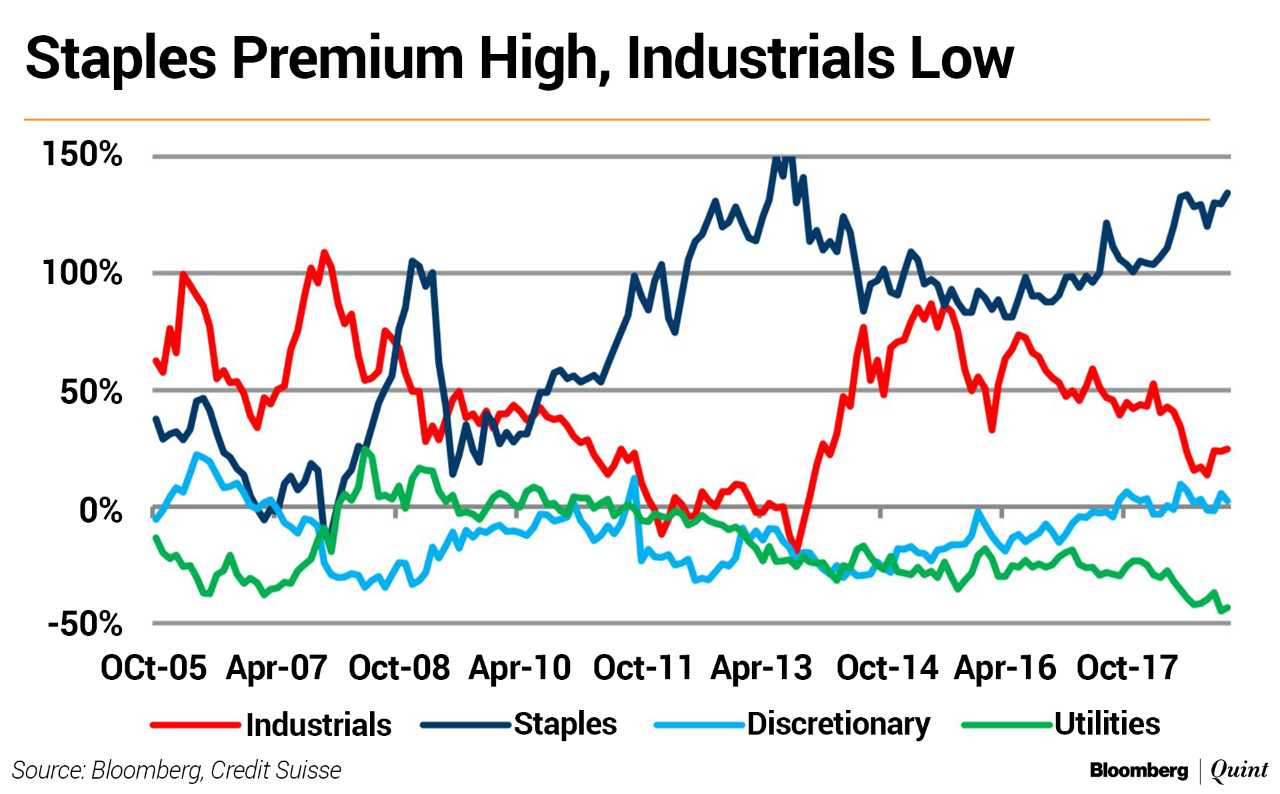

The industrial sector comprising stocks such as Larsen & Toubro Ltd. and Bharat Heavy Electricals Ltd. have underperformed by 48 percent in this decade, said Credit Suisse in a research report. Improvement in the price-to-earning ratios and confidence in the investment cycle, however, should drive significant outperformance, it said.

Also, the non-government income has to catch up with pay commission-induced government salaries in order to support the automobile and two-wheeler industries, Mishra said.

Watch the full conversation here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.