Top brokerages are bullish on Bajaj Finance Ltd. after the non-banking lender reported robust assets under management in the fourth quarter of financial year 2024.

The AUM rose 35% year-on-year to Rs 3.3 lakh crore. The non-banking financial company's deposits grew 35% to Rs 60,100 crore, according to an exchange filing.

Bajaj Finance's consolidated AUM sustained robust traction, but margins could have declined with expensive borrowing, according to Citi Research.

The brokerage has a target price of Rs 8,975 per share, implying a potential upside of 23% from the previous closing price on the BSE.

The NBFC is one of the top picks for Jefferies India Pvt., which maintains a 'buy' rating with a target price of Rs 9,400 apiece, implying a potential upside of around 30%.

The robust AUM growth in the pre-quarter update is above the brokerage's estimates. It said the growth in customer base is healthy for the NBFC.

Bank borrowings would have become expensive, which increased the liquidity buffer. This will offset increased rates across all portfolios by 20–30 basis points and a moderation in wholesale rates, according to Citi.

Incremental commentary on issues and remedial measures for loans under ECom and Insta EMI Card will be keenly tracked, it noted. New loans booked during the fourth quarter fell 20% sequentially due to regulatory restrictions.

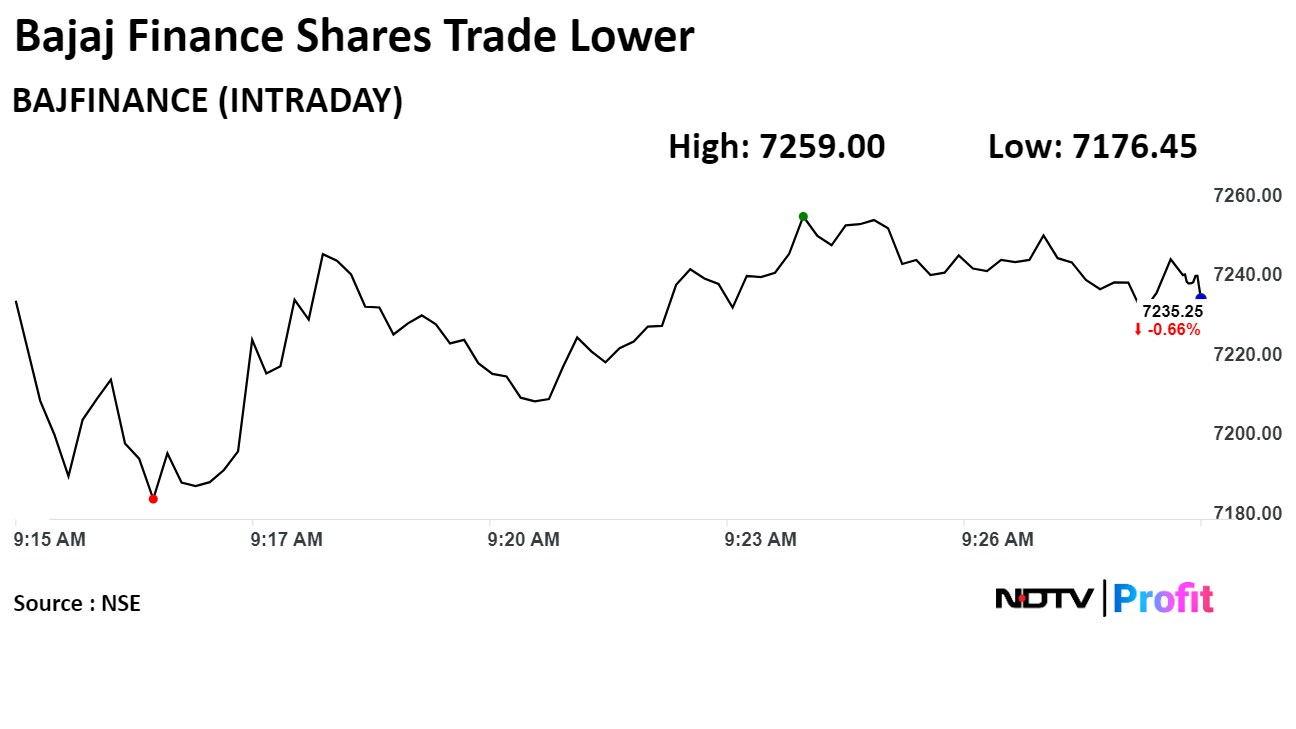

Bajaj Finance's stock fell as much as 1.47% during the day to Rs 7,176.45 apiece on the NSE. It was trading 0.68% lower at Rs 7,233.95 per share, compared to a 0.15% decline in the benchmark Nifty 50 as of 9:30 a.m.

The share price has risen 25.5% in the last 12 months. The relative strength index was at 69.

Twenty-nine out of the 36 analysts tracking the company have a 'buy' rating on the stock, four recommend 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 18.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.