India's benchmark stock indices fell to their lowest level in over a month on Tuesday, dragged by losses in the shares of IT companies.

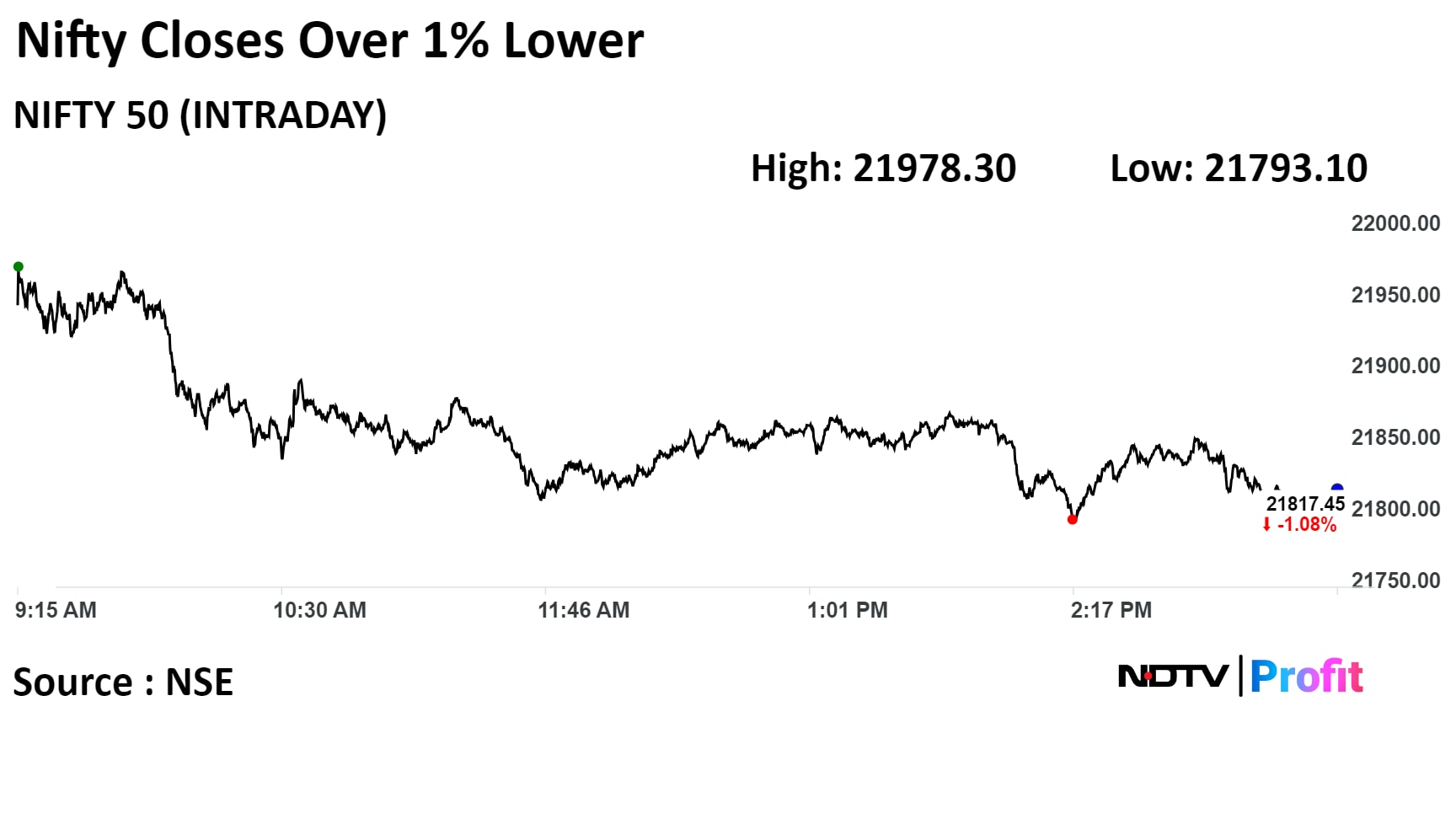

The Nifty closed 238.25 points or 1.08% lower at 21,817.45—the lowest level since Feb. 13—while the Sensex fell 736.37 points or 1.01% to end at 72,012.05—the lowest since Feb. 14.

"After violating its immediate support of 21,900, the (Nifty 50) index is about to form an advanced harmonic pattern known as the bullish cypher at 21,740," said Aditya Gaggar, director at Progressive Shares. "Post the pattern reversal confirmation, one can expect the target of 22,000 followed by 22,200."

Nifty Bank fell for the eighth day in a row, recording its longest losing streak since Jan. 21, 2022.

Shares of Tata Consultancy Services Ltd., Infosys Ltd., Reliance Industries Ltd., ITC Ltd., and Larsen & Toubro Ltd. weighed on the Nifty.

Meanwhile, those of Bajaj Finance Ltd., HDFC Bank Ltd., Kotak Mahindra Bank Ltd., ICICI Bank Ltd., and Bajaj Auto cushioned the fall.

All sectoral indices ended lower, with Nifty IT losing nearly 3%.

Broader markets ended lower in line with the benchmark indices. The S&P BSE Midcap ended with a 1.36% loss and the S&P BSE Smallcap closed 1.04% lower on Tuesday.

On BSE, all 20 sectors ended in red, with the S&P BSE IT index emerging as the top loser. The S&P BSE Bankex was the top performer among sectoral indices.

Market breadth was skewed in favour of the sellers. Around 2,572 stocks declined, 1,244 stocks rose, and 112 stocks remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.