India's benchmark stock indices rebounded from Friday's drop to close nearly 1% higher on Monday, led by a rally in the banking, power and oil & gas sectors.

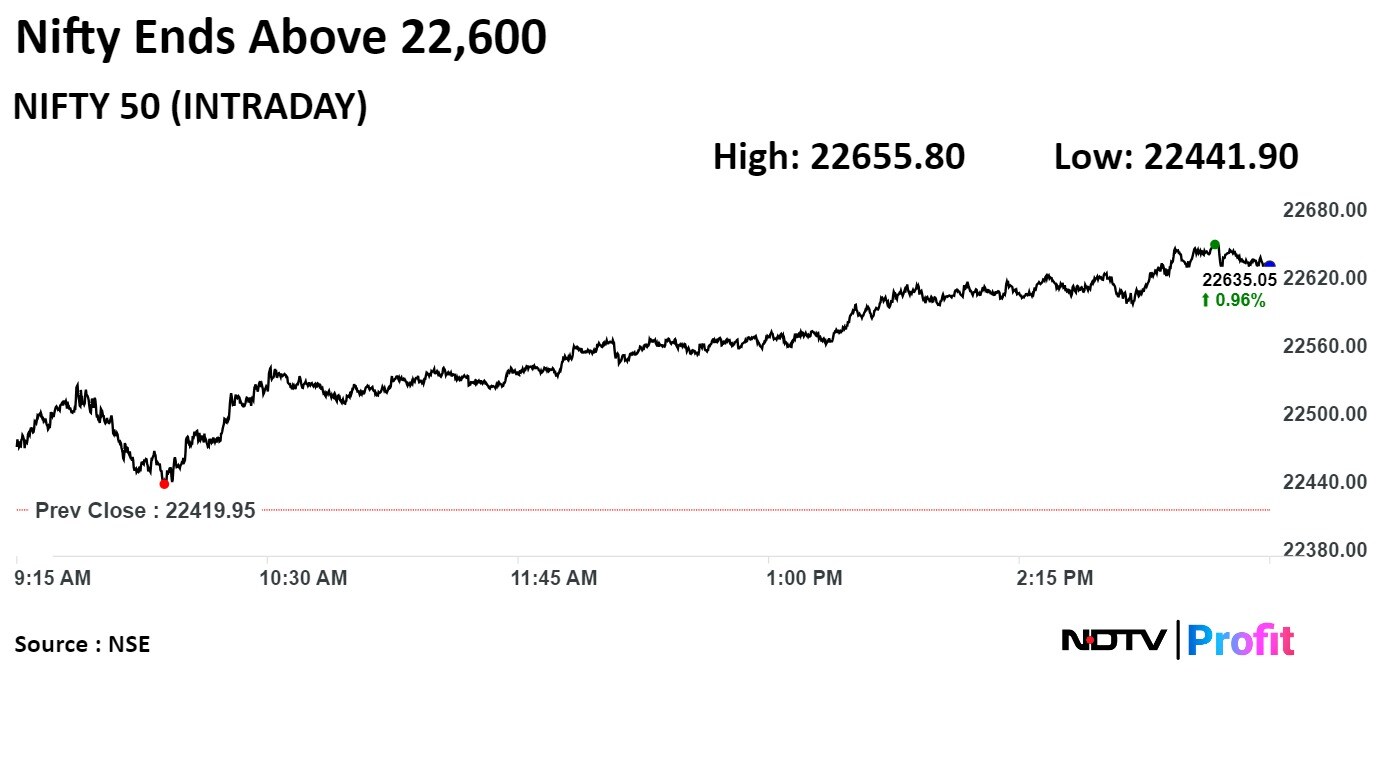

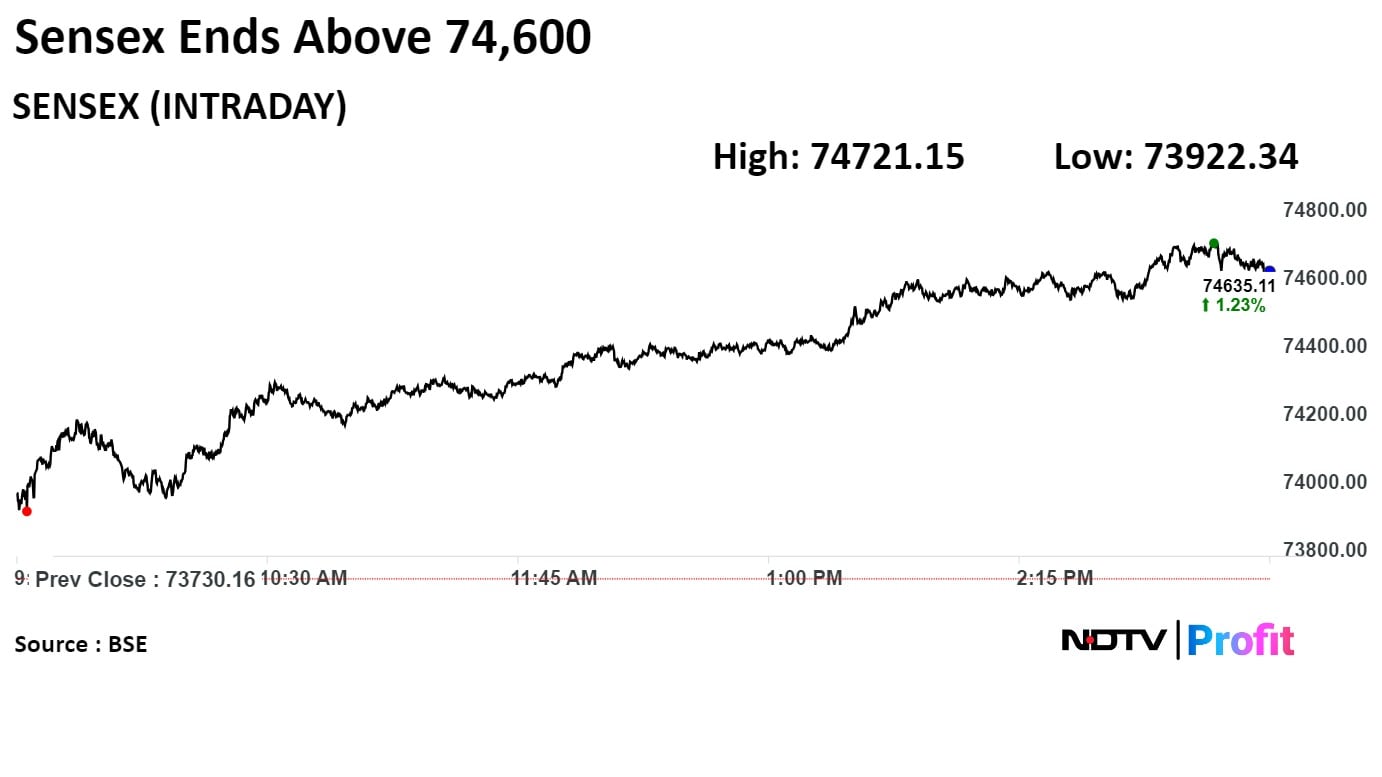

The Nifty settled 215.10 points, or 0.96%, higher at 22,635.05, and the Sensex rose 941.12 points, or 1.28%, to end at 74,671.28.

"An ease in Middle East tensions, coupled with stable earnings, is expected to maintain positive market sentiment. Moving forward, Fed policy and US non-farm payroll data will dictate the overall market dynamics," said Vinod Nair, head of research at Geojit Financial Services.

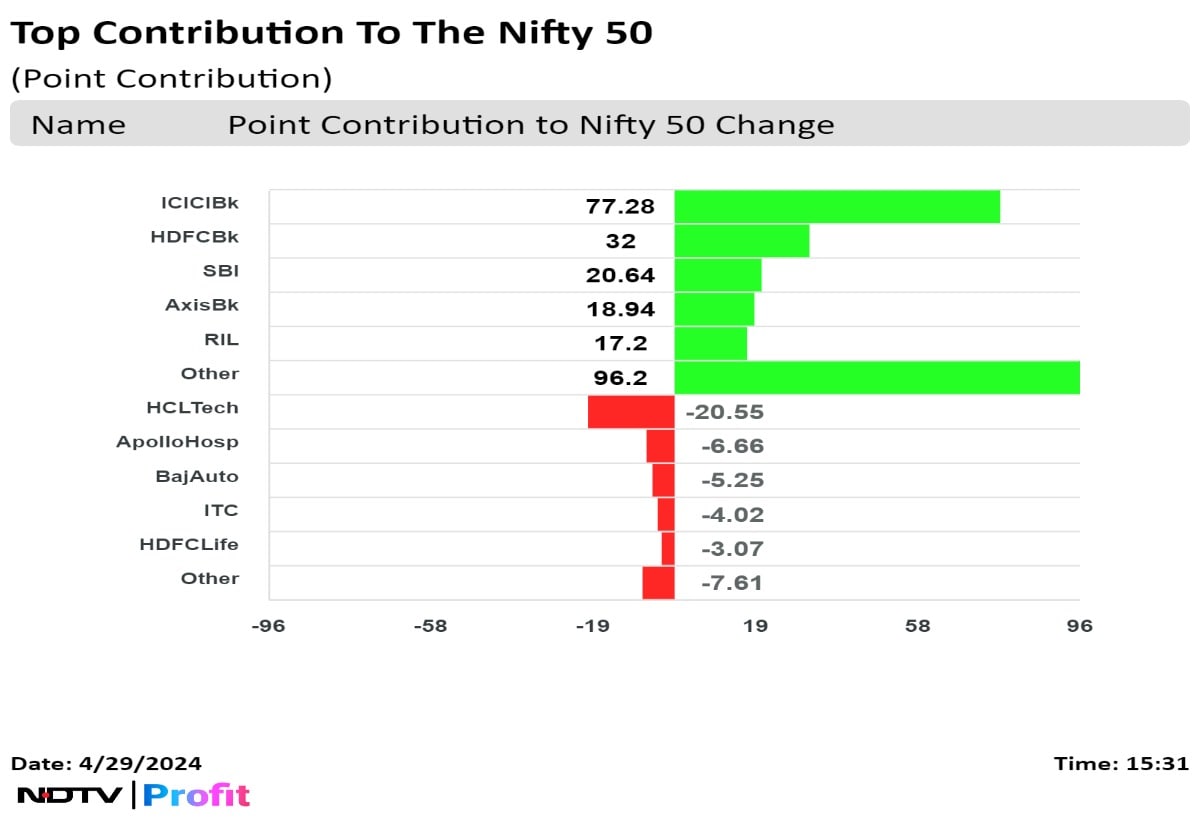

Shares of ICICI Bank Ltd., HDFC Bank Ltd., State Bank Of India, and Axis Bank Ltd., and Reliance Industries Ltd. contributed the most to the Nifty.

While those of HCLTech Ltd., Apollo Hospitals Enterprise Ltd., Bajaj Auto Ltd., ITC Ltd., and HDFC Life Insurance Co. Ltd. weighed on the index.

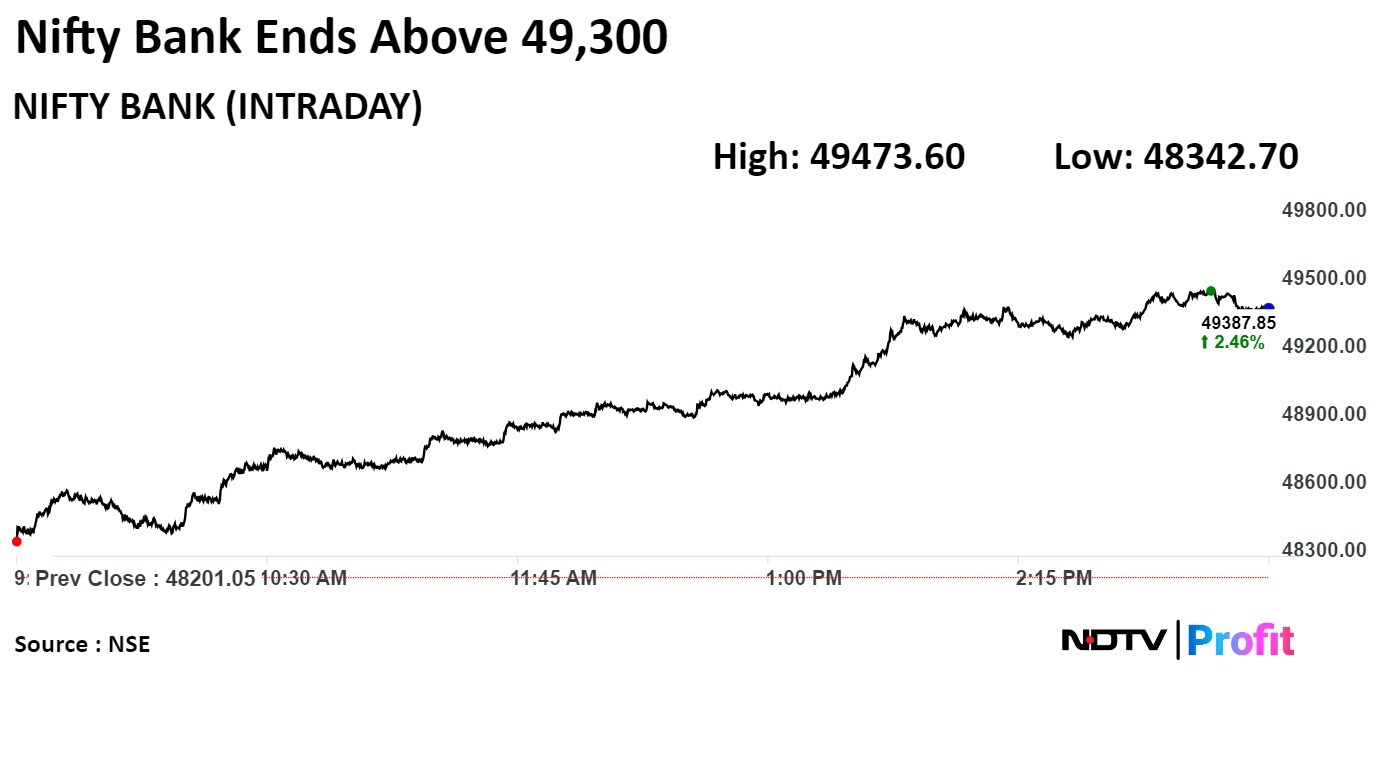

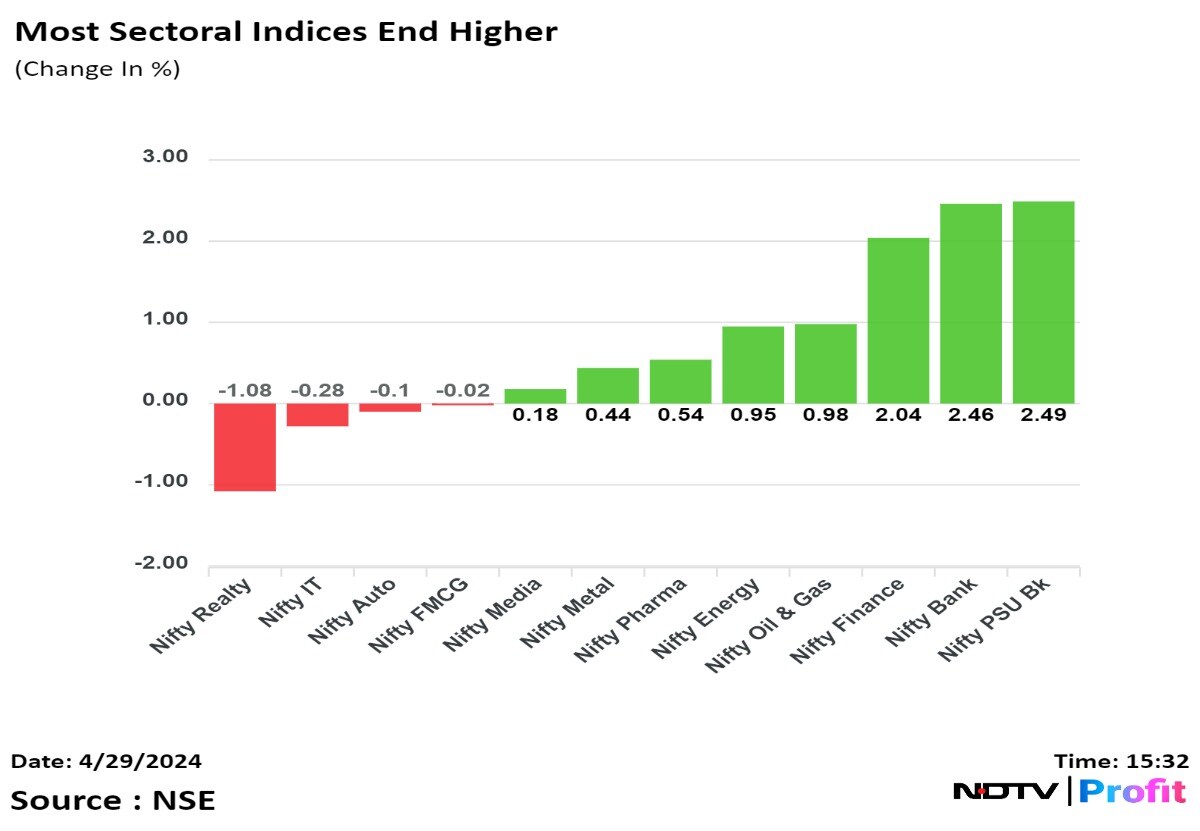

Most sectoral indices ended higher with Nifty PSU Bank, Nifty Bank and Nifty Finance gaining the most while Nifty Realty fell 1%.

Broader markets ended higher on BSE. The S&P BSE Midcap settled 0.77% up, and the S&P BSE Smallcap ended 0.10% higher.

On BSE, 17 sectors advanced, and three declined out of 20. The S&P BSE Financial Services was the top gainer, while the S&P BSE Realty was the top loser of the day.

Market breadth was skewed in favour of the buyers. Around, 2,038 stocks rose, 1,875 stocks declined, and 175 stocks remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.