(Bloomberg) -- Bond traders pulled forward expectations for the Federal Reserve's first full interest-rate cut by a month to November ahead of a key US jobs report on Friday.

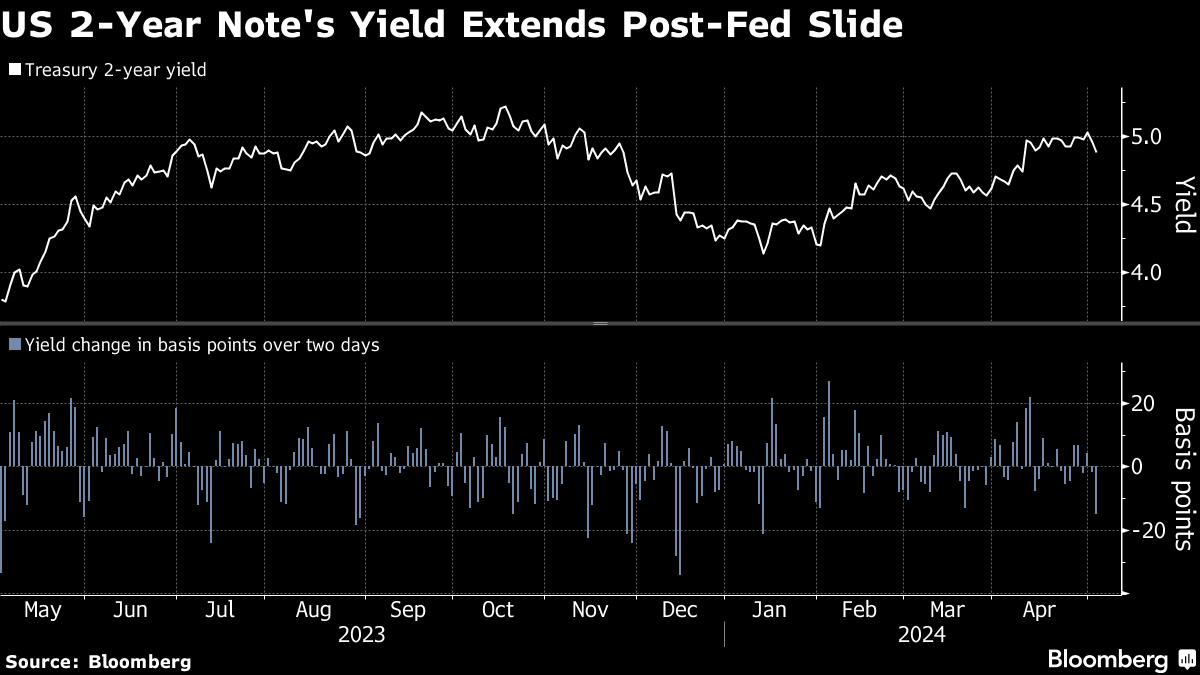

The recalibration came amid the best two-day rally for short-end Treasuries since January, following the central bank's latest policy meeting on Wednesday. Yields on two-year notes, among those most sensitive to interest rates, have tumbled 17 basis points to 4.87% from their high for the year of 5.04% on Tuesday.

The market took flight after Fed Chair Jerome Powell struck a less hawkish tone than feared, signaling a rate hike was unlikely and that cuts can be expected once economic data provides clear evidence that inflation is moving downward. Market-friendly data may come as soon Friday with the April jobs report — although Treasuries' capacity for further gains may be limited given the recent advance.

Treasury yields have experienced large swings in response to jobs data over the past year, and “I expect that historic volatility to hold if there's a large surprise,” said Angelo Manolatos, an interest-rate strategist at Wells Fargo Securities LLC. “But in order to get a sustained rally, we need inflation data to start coming in on the softer side.”

The bullish sentiment flowed into Asia, with the yields on Australian and New Zealand debt falling this week. The yield on policy-sensitive three-year Australian debt were three basis points lower at 4.04% in early trading Friday, while two-year New Zealand yields fell five basis points. Cash Treasuries are closed in Asia due to a holiday in Japan.

April employment data to be released Friday at 8:30 a.m. in Washington — though currently less critical than inflation readings in Fed deliberations on interest rates — still have the potential to alter investor expectations. Job creation has exceeded economist estimates for five straight months, and wage growth remains higher than pre-pandemic levels, creating upward pressure on inflation as the Fed tries to curb it.

That increases the potential for a weak report to make an impression, Manolatos said.

Another strong report — especially one that prompts more Wall Street banks to abandon forecasts for at least two Fed rate cuts this year — has the potential to induce traders to re-set short positions at better levels. The post-Fed rally was fueled in part by traders exiting bearish wagers, positioning data show.

Quarterly Treasury auctions totaling $125 billion are scheduled for next week, creating additional incentive to sell.

--With assistance from Matthew Burgess.

(Updates with Australia, NZ bond moves in third paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.