(Bloomberg) -- Global bond markets have declared that the steepest global monetary tightening campaign in a generation is as good as done.

Benchmark short-end bond yields have crashed below their economy's cash rates across most of the developed world in the few sessions since the collapse of Silicon Valley Bank. German two-year bund yields tumbled 22 basis points on Tuesday to 2.47%, becoming the latest major bond market with yields under the relevant central bank benchmark.

“Two-year yields below cash rates tell you that the hiking cycle will end, it just doesn't tell you when,” said Amy Xie Patrick, head of income strategies at Pendal Group Ltd. in Sydney. “At the system level, SVB's collapse highlights that when easy money ends, pain points are going to appear.”

Treasury 10-year yields may end up dropping as low as 1% if a recession does eventuate, Patrick said.

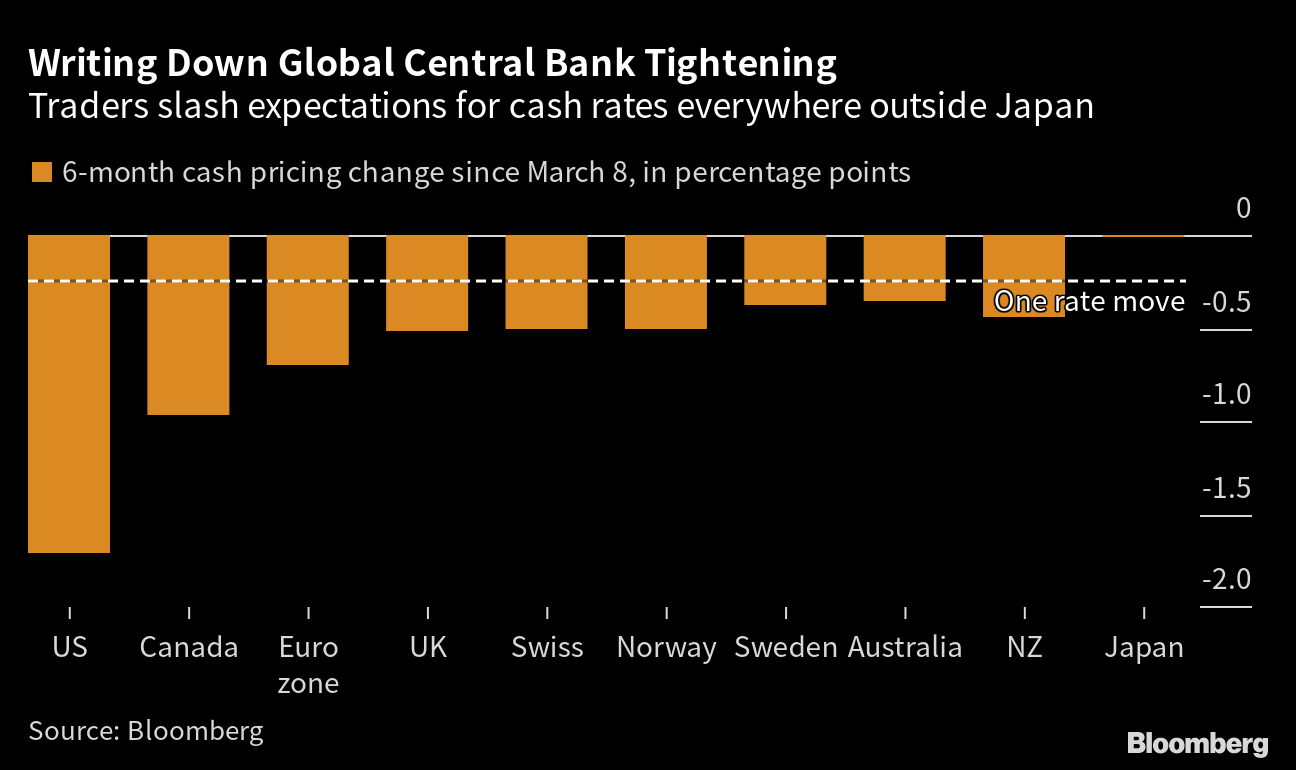

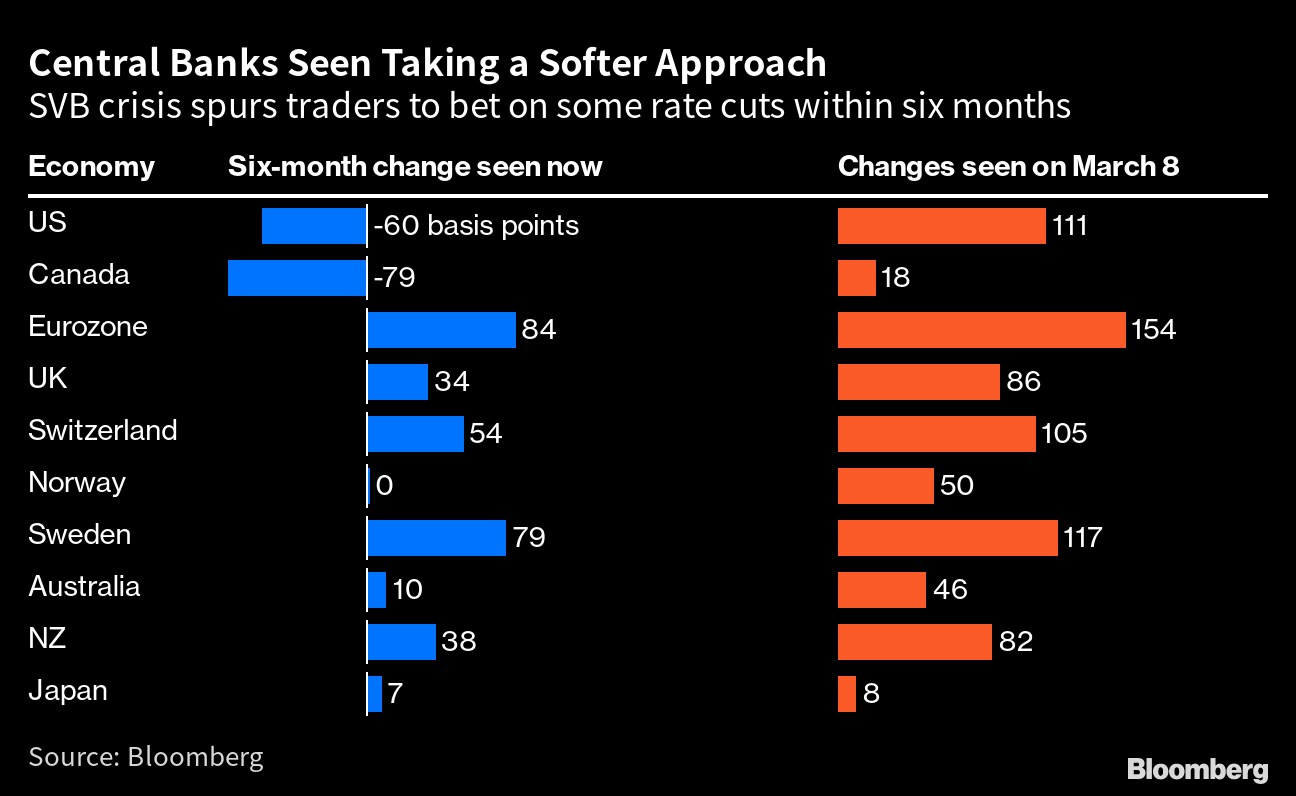

US two-year yields have led the way this week with their biggest decline since the 1980s, tumbling more than a percentage point in the space of three days as traders moved to price in two Federal Reserve rate cuts within six months. Similar-dated yields across every developed-market economy outside Japan all dropped at least 39 basis points.

The first US bank failure since 2008 has turbocharged concern that policymakers' efforts to quash inflation — led by the Fed's 4.5 percentage points of rate hikes in the space of a year — will tip economies into recession. The collapse of SVB has also scuttled bets on next week's Fed meeting, which had been seen as a sure-fire hike of at least 25 basis points just days ago.

Divided Opinions

Goldman Sachs Group Inc. now expects the Fed to keep rates on hold at its March 21-22 meeting, while Nomura Securities has gone a step further and forecasts a cut and a halt to bond sales. The BlackRock Investment Institute in contrast, says the Fed will press on with its hiking campaign to combat inflation.

Swaps traders are still betting on a rate increase in either March or May, followed by a reversal in June. The central bank target rate is expected to come down to about 3.9% by year-end, from its current range of 4.5% to 4.75%, the contracts show.

Investors risk another painful unwind similar to February's rout by restoring bets on a rapid pivot from central banks, according to PGIM Ltd. The SVB crisis may end up being much like last year's UK pension rout, which prompted intervention from the Bank of England, but didn't stop UK policymakers from hiking rates, he said.

“Markets believe that central banks will pivot before a recession, whereas my view is the central banks will tighten until they've got control of inflation,” said Jonathan Butler, co-head of global high yield at PGIM, a company with $1.2 trillion of assets under management. “Central banks are going to be more hawkish than the market believes.”

The bond market repricing continued Tuesday, with Australian three-year yields dropping 16 basis points to 3.05%, some 55 basis points below the Reserve Bank of Australia's cash-rate target. That's the widest discount since 2015, when the RBA was busy cutting interest rates.

Swaps traders have now priced out further hikes for the RBA, after last week seeing two more hikes in 2023.

The European Central Bank now stands as the leading hawk among global policymakers, according to swaps traders, who see it raising rates by 75 basis points within six months. Still that's about half the hiking pace seen last week.

But there too, the path isn't certain. The ECB's plans for more big rate hikes are set to meet stronger opposition this week after the collapse of SVB, according to officials with knowledge of the matter.

At the same time, it won't be a one-way move. US two-year yields climbed back 17 basis points to 4.15% in Asian trade after tumbling 61 basis points Monday.

The rally in US short-dated debt Monday meant a dramatic re-steepening in the yield curve — a phenomenon widely regarded as signaling a recession is imminent. The spread between US two- and 10-year yields is still inverted, but it jumped by 48 basis points on Monday, the most since January 2001, just two months before the official start of a recession that lasted through November of that year.

(Adds German two-year yields falling below ECB rate in second paragraph, comment from PGIM in ninth-10th paragraph. An earlier version of this story was corrected to say decline instead of rally in the fifth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.