China’s 2025 Trade Surplus Hits Record $1.2 Trillion Despite US Tariffs

Imports also rose more than expected with a jump of 5.7%, leaving a surplus of $114 billion — the most in six months.

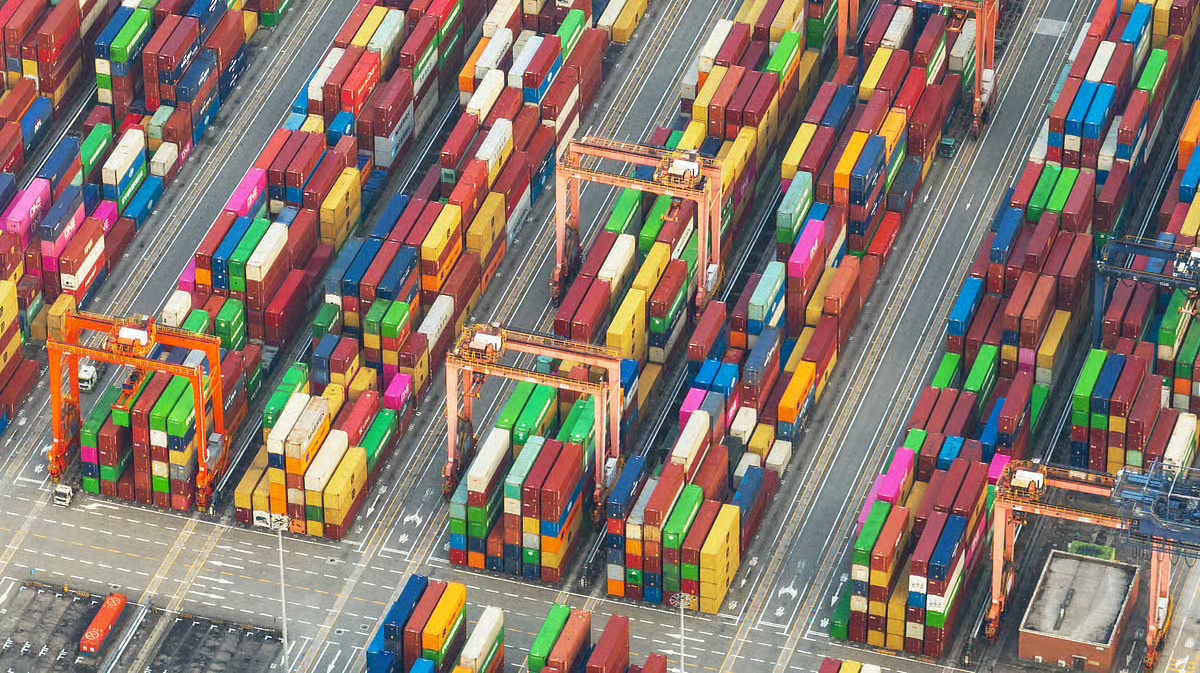

China’s trade surplus climbed to $1.2 trillion in 2025, extending a record run as the tariff war started by President Donald Trump sent exporters in search of markets beyond the US.

Shipments to regions like Southeast Asia and Europe made up for a deepening plunge in sales to the US in December, with overall exports increasing 6.6% from a year earlier. That was the quickest growth in three months and faster than any forecast in a Bloomberg survey of economists, whose median was for a 3.1% gain.

Imports also rose more than expected with a jump of 5.7%, leaving a surplus of $114 billion — the most in six months, according to data from China’s General Administration of Customs on Wednesday. The US share of China’s total exports fell to a historic low of 11% in 2025, according to Bloomberg Economics, a drop of eight percentage points since Trump’s first term.

Shipments overseas have boomed through much of the trade war and after the recent de-escalation of tensions with the Trump administration. But as China navigates tariffs and growing economic protectionism around the world, it’s stirring anxiety abroad as it pours exports into Africa, Latin America and beyond.

The swelling surplus also underscores the imbalance between China’s manufacturing strength and stubbornly weak domestic consumption. While exports have powered the world’s second-biggest economy, its years-long property slump and falling investment are restraining the country’s appetite for foreign goods.

Despite a global backlash, Chinese companies aggressively sought out customers in other markets when shipments to the US plunged after Trump hiked tariffs. Exports to the US slumped more than 30% in December, among their worst declines this year.

For the full year of 2025, exports to Africa saw the fastest growth among major regions with a 26% gain from a year ago. Shipments to the Southeast Asian nations in the Asean group expanded 13%, and those to the European Union and Latin America rose 8% and 7% respectively. Exports to the US plunged 20%.

What Bloomberg Economics Says...

“China’s stronger-than-expected export growth in December shows its export engine continued to support the economy in the final quarter of 2025 when domestic drivers weakened. Higher shipments to non-US markets again more than offset the tariff-driven slump in exports to the US. Looking ahead, export resilience is likely to extend into 2026.”

— Eric Zhu. For full analysis, click here

Looking ahead, global demand for China’s goods and the competitiveness of its exports will likely keep foreign shipments on the rise in 2026, especially if the trade ceasefire with the US holds.

This week, Trump announced new tariffs on goods from countries trading with Iran, threatening to derail his one-year truce with China, the world’s top buyer of Iranian oil.

Other risks abound. Tensions over the influx of goods are building with major partners such as Europe. And a high base of comparison last year means export growth will probably moderate in the months ahead.

“The external environment for China’s trade development is still grim and complex” in 2026 due to slower global economic growth and geopolitical fragmentation, Wang Jun, deputy head of the customs authority, said during a briefing in Beijing Wednesday. But “with more diversified trading partners and strengthened resilience, the fundamentals of China’s trade remain solid,” he said.

The Chinese government has also moved to rein in the exports of some goods to ease trade tensions and as part of an effort to address excess capacity in several industries that’s adding deflationary pressure on the economy.

Authorities will cancel the export tax rebates on hundreds of products including solar cells and batteries from April, according to an official announcement on Friday.

Exports of higher-value goods surged in 2025, with products including semiconductors, cars and ships recording gains of more than 20% from a year ago. Meanwhile, some lower-end exports such as toys, shoes and clothing contracted.

Lynn Song, chief economist for Greater China at ING Groep NV, warned China is facing “some pushback” as its higher-end products become more competitive globally.

“The key to continuing win-win cooperation is to boost China’s domestic demand and support imports,” he said. Overall, the stronger-than-forecast figures are “an encouraging sign for China as well as trading partners, given we were looking at a potential deceleration due to last year’s frontloading effect.”