(Bloomberg Opinion) -- So much for “the great corporate deleveraging.” This year was supposed to mark a return to balance-sheet prudence after U.S. companies piled on an unprecedented amount of cheap debt over the past 10 months to weather the Covid-19 pandemic. Instead, though, chief executives have greeted 2021 by indulging in mergers and acquisitions, pushing back timelines to reduce their companies’ debt loads.

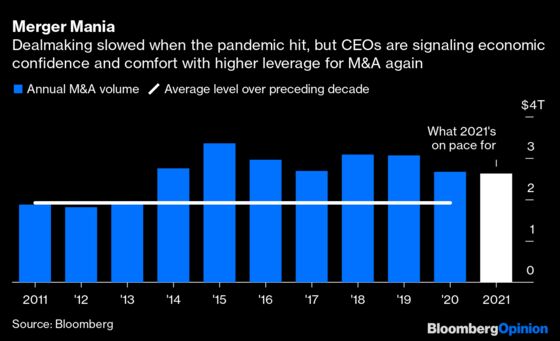

Just weeks into the new year, some $150 billion of M&A transactions have been announced globally, a more than 50% increase from the same period of 2020, according to data compiled by Bloomberg. U.S. deals alone are up by 43%. The overwhelming majority of them are being paid for at least partially with cash — that is to say, raising money through the debt markets or using funds that could otherwise be used to lessen liabilities.

There haven’t been any $80 billion or even $20 billion megamergers yet like the kind that punctuated the five years before the Covid-19 crisis, but those may be coming. Goldman Sachs Group Inc.’s investment-banking pipeline is close to an all-time high, the bank’s executives said on an earnings call last week. And analysts are already speculating about some astonishing potential combinations, from the possibility of JPMorgan Chase & Co. acquiring Target Corp. or Twitter Inc. to the prospect of Comcast Corp.’s NBCUniversal and AT&T Inc.’s WarnerMedia merging into a standalone entity.

Even in the telecommunications industry, which has exhausted its consolidation opportunities, other big-ticket purchases are underway as carriers expand their 5G networks. Bloomberg News reported Jan. 12 that AT&T was in discussions to raise $14 billion in new financing to amass more 5G airwaves through a 364-day delayed-draw term loan. This development came as the industry partook in the U.S. Federal Communications Commission’s auction of highly desirable mid-band spectrum, in which the bidding reached a record $81 billion. Before that, AT&T was in debt-reduction mode, with its sale of Crunchyroll and potential jettisoning of DirecTV part of those efforts. It’s still the world’s largest corporate borrower outside of financial institutions, and its credit rating — ranked two steps above junk status by Moody’s Investors Service and S&P Global Ratings — may draw further scrutiny. But as with all dealmaking, fear of missing out is a strong motivator, and wireless carriers don’t want to fall behind in next-generation technology.

While the pandemic is still raging in America and across the world, investors and economists generally agree that the worst of the economic damage may already be past. With more of the population getting vaccinated, the median expectation among economists surveyed by Bloomberg is for 4% annual growth in U.S. real gross domestic product in 2021, which would be the highest since 2000.

Ordinarily, a period after an economic downturn is when companies pare back their borrowing, as they did in the wake of the Great Recession. But deleveraging will be harder this time because companies are starting from a much more indebted place. In the fourth quarter of 2019, U.S. non-financial corporate debt relative to GDP stood at 74.6%. Six months later, as companies took on a stunning $1.34 trillion of obligations, that figure soared to 90.1% — a borrowing binge that lacks any historical comparison. As of September, U.S. companies had $17.9 trillion of debt, more than double the amount of 15 years ago, representing 88.2% of the nation’s GDP.

For every company that borrowed to stay afloat — such as casinos, cruise-ship operators and hotel chains — there were those that tapped the corporate-bond market simply because it was cheaper than ever to raise cash. “Companies didn’t only lever up; they also just have more liquidity,” Gene Tannuzzo, deputy global head of fixed income at Columbia Threadneedle Investments, told Molly Smith of Bloomberg News this month. “And so if they ultimately use that to pay down debt, we’re in a happy place. But the longer the optimism goes on with the economic momentum, we could start to see that cash being used for share buybacks and M&A.”

Take Marvell Technology Group Ltd. The chipmaker agreed in October to acquire Inphi Corp. for $8.9 billion (including debt), valuing Inphi at nearly 15 times trailing 12-month revenue. Moody’s analysts, citing the steep valuation, wrote that they view the “liberal use of debt to fund this acquisition as aggressive.” They expect Marvell’s debt to be nearly 5.5 times Ebitda at closing and to remain above 3.5 times for an extended period, calling that high for a Baa3 investment-grade issuer.

An exception to the lever-up trend can be found in an unlikely place. Netflix Inc., whose business model was predicated on debt, said last week in a milestone earnings report that it no longer needs to borrow money to finance its day-to-day operations. But the knock-on effect of that strengthened financial position may be to drive smaller rivals to pursue mergers.

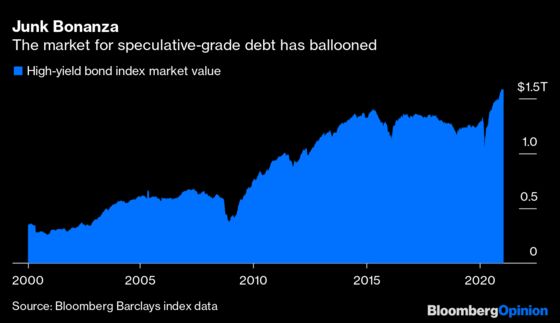

As long as corporate bond yields remain near record lows and credit-rating companies give borrowers a long leash before issuing downgrades, a rush of M&A shouldn’t do much harm. But it will put a definitive end to the facade that CEOs care about having a top credit rating or a pristine balance sheet. As it stands, more than half of the Bloomberg Barclays U.S. Corporate Bond Index is rated triple-B, up from 23% in 2000. Meanwhile, the size of the Bloomberg Barclays U.S. High Yield Index has grown to $1.59 trillion from about $257 billion two decades ago.

With borrowing costs this low, and with the Federal Reserve proving that it will step in to prevent a credit collapse, avoiding leverage is seen as a fool’s game. Until a damaging exogenous event occurs — Covid-19 apparently wasn’t it — investors also don’t seem too concerned about any giant borrowers facing solvency issues that could rattle the market. But it’s dangerous to bet that companies can go on an M&A spree so soon after the debt binge without suffering a hangover.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tara Lachapelle is a Bloomberg Opinion columnist covering the business of entertainment and telecommunications, as well as broader deals. She previously wrote an M&A column for Bloomberg News.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.

©2021 Bloomberg L.P.