Over the last 2 months, share prices of tyre companies have been riding on the correction in rubber prices and on the bullish view on auto companies.

Rubber is the main raw material for tyre companies, and forms about 50-55 percent of their operating cost, and hence is the key variable in determining operating margins.

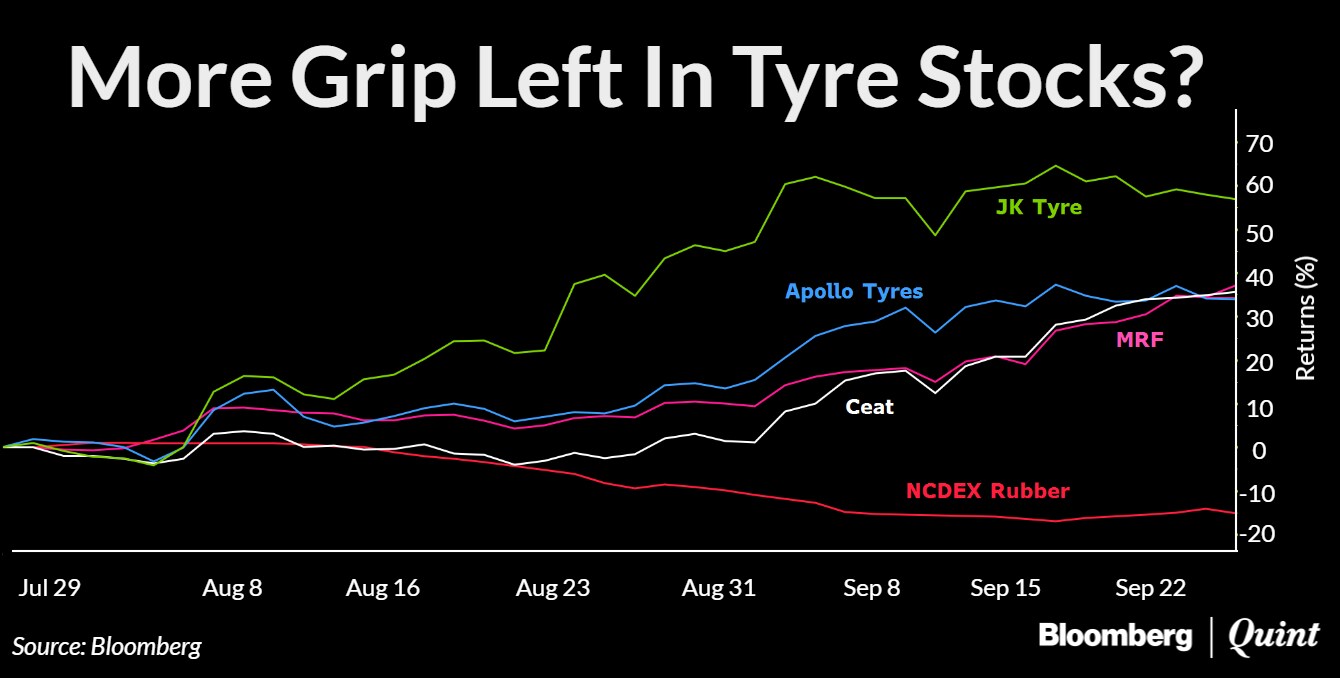

Domestic rubber prices on NCDEX have seen a sharp 15 percent drop since July 27, 2016. International rubber futures on Tokyo Commodity Exchange have also corrected, losing 6.2 percent in this period.

As a result, share prices of tyre companies, JK Tyre, Apollo Tyres, MRF and CEAT have rallied between 35-58 percent in the last 2 months.

But is there room for a further rally in Indian tyre stocks? Analysts seem to be bearish on domestic rubber prices given the start of the peak production phase in India which is expected to put downside pressure on rubber prices. Broadly, the trend in international rubber prices is also said to be on the weaker side. Weak price trends and adequate supply of raw material for tyre companies indicate there could be more steam left in the tyre companies stock prices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.