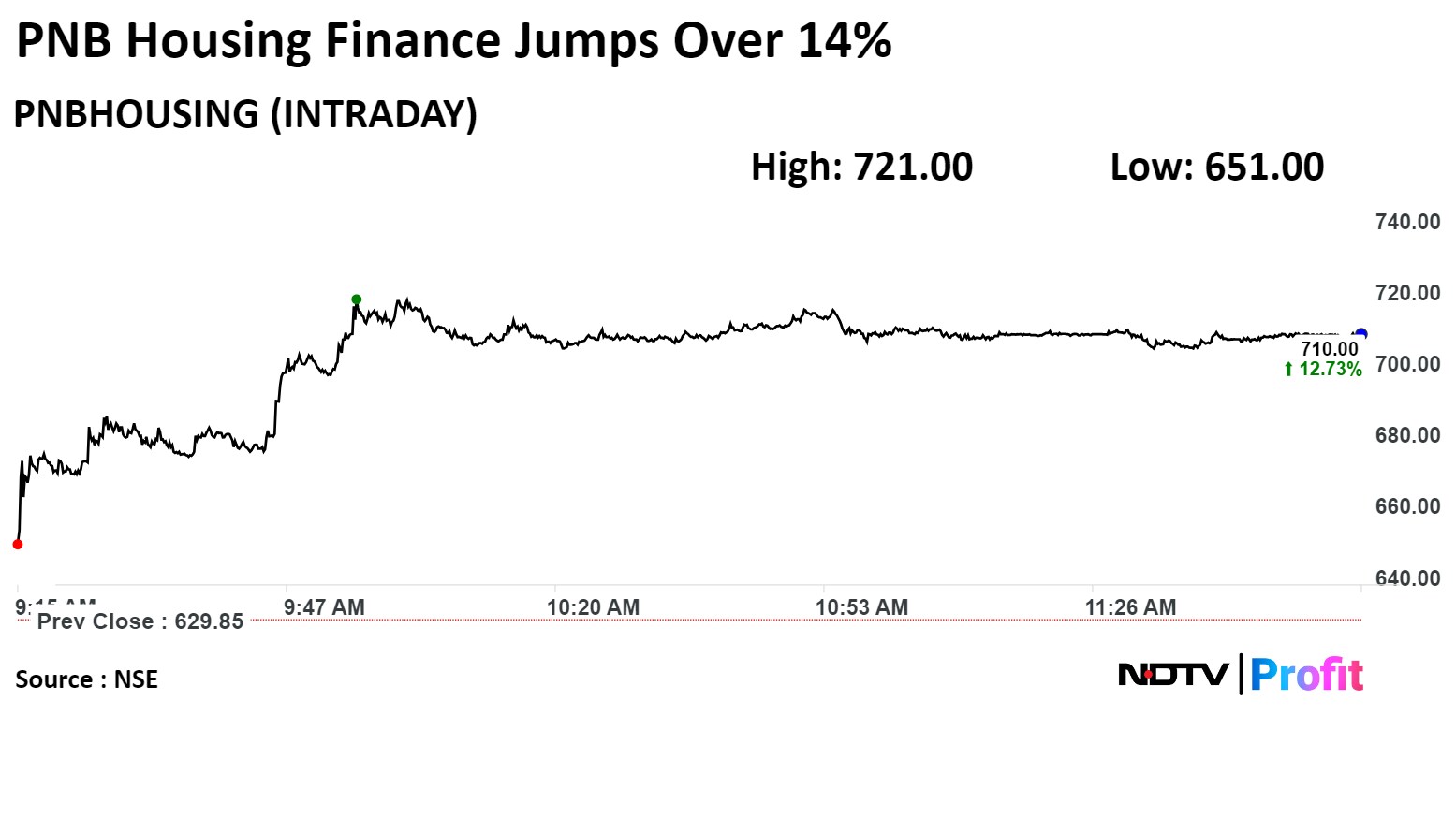

Shares of PNB Housing Finance Ltd. jumped over 14% after favourable outlook from Morgan Stanley and domestic rating agencies.

Last week, ICRA and CARE revised their credit rating for the non-banking finance company to AA+ (stable outlook) from AA (positive outlook) citing improved asset quality, strengthened capital position and diversified resource profile.

Morgan Stanley sees this as positive for growth and profitability for the housing finance company. "It could further help improve both availability and cost of borrowing, thereby benefiting loan spreads and loan growth over a period of time," the brokerage said in a note dated March 31.

It maintained its 'Overweight' rating and kept the target price for the scrip unchanged at Rs 970, which implies upside of 54% from Thursday's closing price.

Morgan Stanley

ICRA and Care Ratings have revised their ratings to AA+ from AA on improved positive growth and profitability. These upgrades came after India Ratings.

See positive growth momentum to improve both availability and cost of borrowing, thereby benefiting loan spreads and loan growth over a period of time.

Stock has underperformed in the past two months likely due to profit taking amid the mid-cap sell of, Morgan Stanley said on a note.

See a good entry point from a near and medium term perspective.

Care Ratings

Regular track record of support from the promoters and brand linkages with Punjab National Bank.

Housing finance has showcased a strong resource-raising capacity and diversified its source of funding via different instruments like commercial papers, non-convertible debentures, deposits, and external commercial borrowing.

PNB Housing Finance Ltd.'s asset quality has improved from 8.13% as of March 31, 2022, to 1.73% as of Dec. 31, 2023, driven by improved collection efficiency, write offs and resolution of its corporate accounts.

As per the asset liability maturity statement dated Dec. 31, the liquidity profile is strong, with no cumulative mismatches in any of the time buckets.

Shares of PNB Housing Finance rose 14.47% intraday, the highest level since Sept. 24, 2018. They pared gains to trade 13.24% higher as of 1:05 p.m., compared to 0.56% advance in the NSE Nifty 50.

The stock has risen 58.42% in 12 months. Total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 58.52.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.