The Nifty FMCG index is down 5.7% on a year-to-date basis and has been the second-worst performer after the Nifty Media.

But this is not necessarily the worst start since 2012 as the Nifty FMCG started in a negative or a flat note in nine out of the 13 times during the period. However, it has ended in the green in 10 out of the last 12 years by the end of a calendar year.

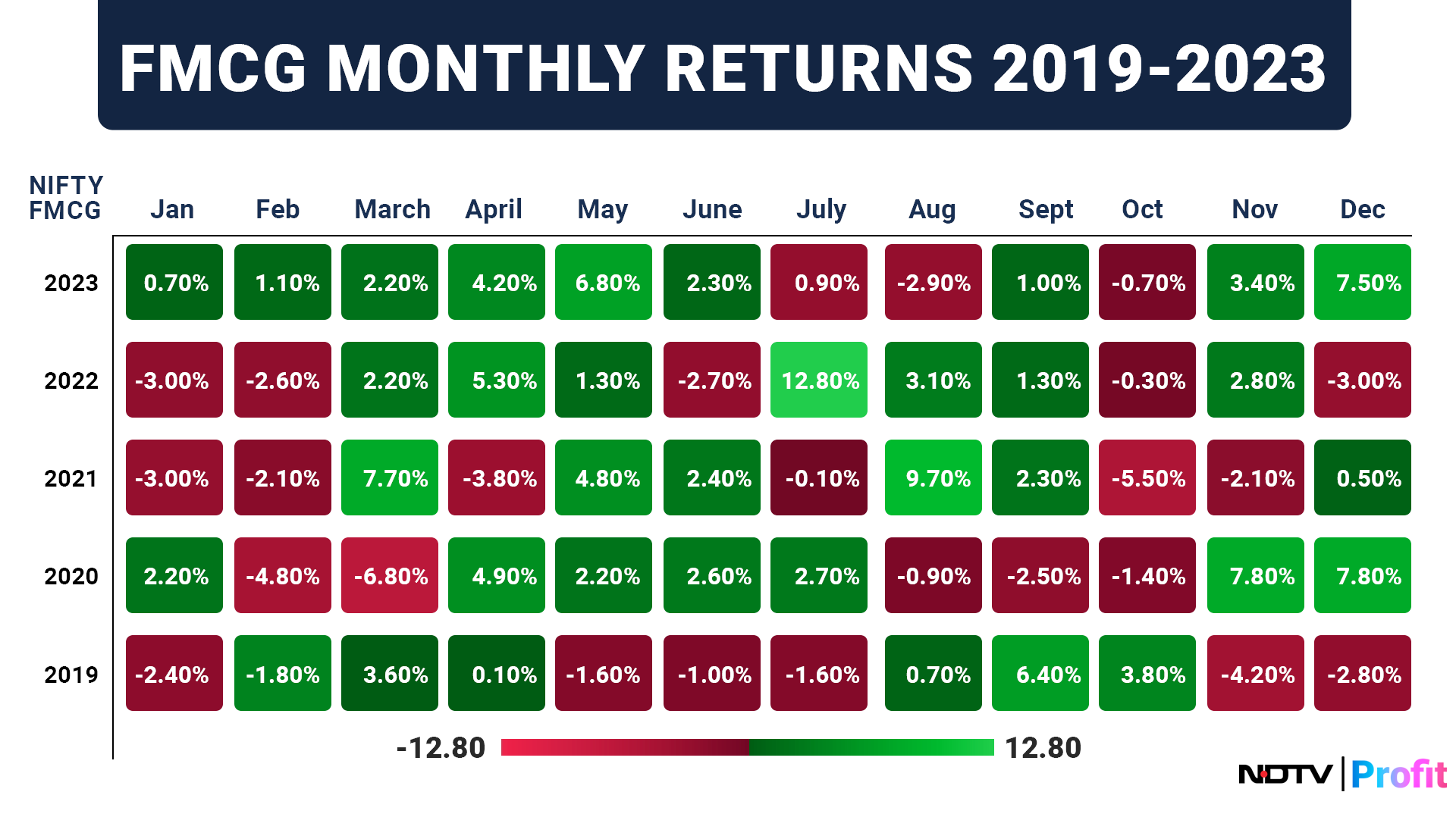

Nifty FMCG Monthly Returns For Last Five Years

The Nifty FMCG has started gaining momentum after March in the last five years. There is not a guaranteed surge in FMCG stocks specifically after March, but there are some factors that could influence increased investor interest in FMCG companies following the first quarter:

Post-holiday spending surge after the festive season.

Summer stocking up for beverages, personal care.

Dividend potential after FMCG companies' year-end.

Rise in rural demand post-harvest season.

Valuations Look Attractive

The price-to-earnings for the Nifty FMCG in 2023 has surged to 53 times, marking a substantial increase from the 39.8 times recorded in 2019. Despite this, projections indicate a downward trend in valuations for the sector in the upcoming years. As of March 14, the PE of Nifty FMCG is at 42.06 times.

At present, the Nifty FMCG sector's EV/Ebitda ratio is at 31.65 times. Since 2020, valuations based on EV/Ebitda for the Nifty FMCG have been steadily increasing.

However, forecasts indicate a forthcoming decrease in these valuations. Estimates of 2024 and 2025 suggest an EV/Ebitda of 27.8 and 24.3 times respectively, which is 16% and 27% lower than EV/Ebitda of 2023 at 33.3.

FMCG Valuations

Valuations for stocks like Emami Ltd. and ITC Ltd. look attractive and are the only two stocks that are undervalued when compared to the Nifty FMCG Index.

The table below suggests all FMCG stocks that are overvalued are set to correct themselves and witness a downward trend in valuations as per Bloomberg estimates for 2024 and 2025.

FMCG Sector: Analysts Fairly Bullish

Analysts at Bloomberg are highly optimistic about Varun Beverages Ltd., Tata Consumer Products Ltd., Dabur India Ltd. and ITC Ltd., recommending them as potential buys. This suggests strong growth expectations for these companies.

Conversely, analysts are more cautious regarding Colgate Palmolive (India) Ltd. and Nestle India Ltd. This could indicate concerns about future performance or potential for overvaluation.

In terms of return potential for the next 12 months, analysts' view suggests that stocks like Emami, ITC, Hindustan Unilever Ltd., Dabur and Marico Ltd. look the most attractive. Stocks like Colgate is poised for a downside potential of 13%.

FMCG Stocks Long-Term Outlook

The FMCG sector has had a sluggish start to 2024, but historically this has not stopped it from recovering by year-end. While valuations are currently high, analysts predict a downward trend in the coming years.

Emami and ITC appear undervalued compared to the Nifty FMCG Index, while analysts favour Varun Beverages, TCPL, and Dabur for their growth potential. Overall, the FMCG sector may present some attractive buying opportunities, particularly for investors with a long-term outlook.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.