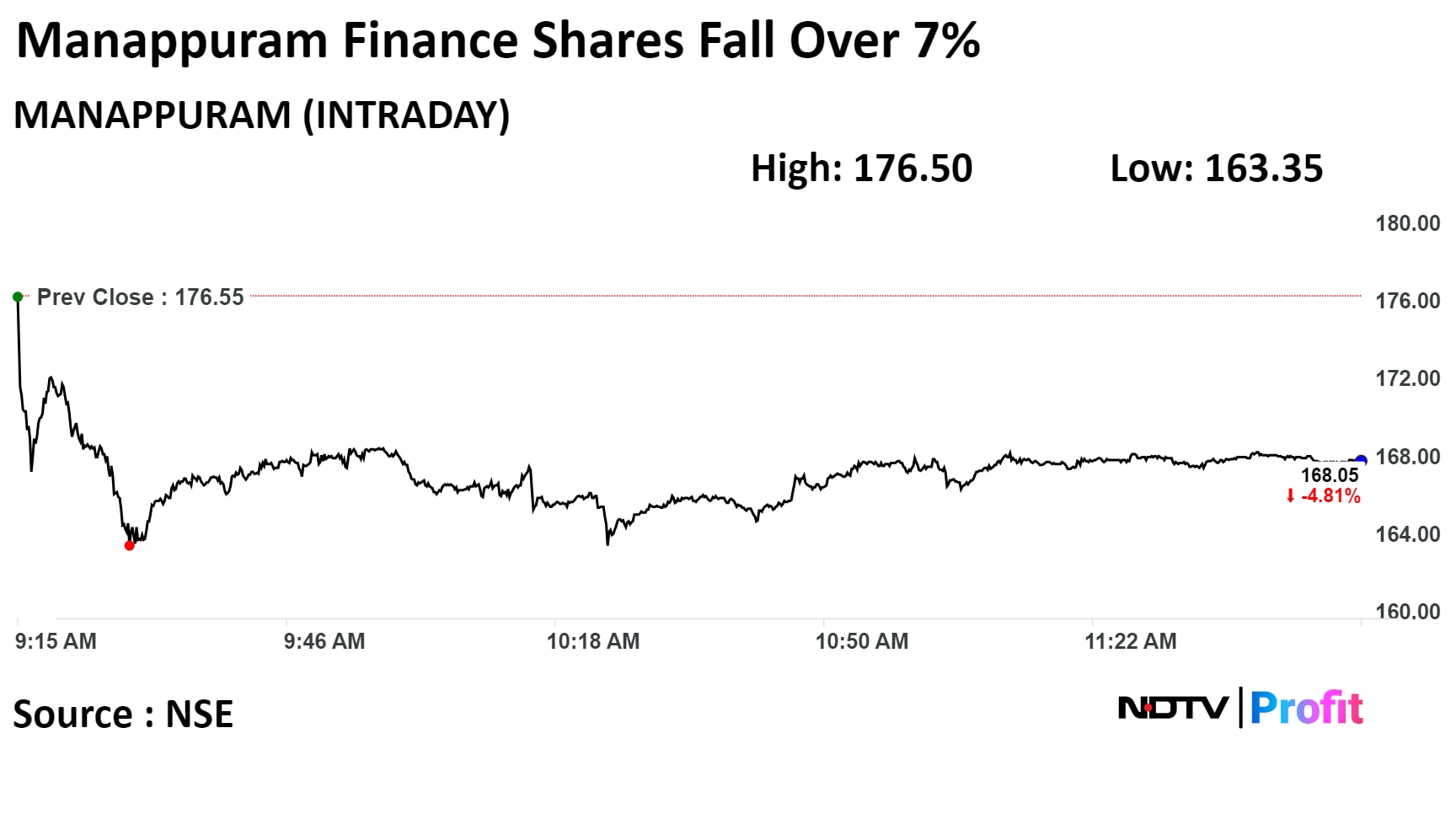

Shares of Manappuram Finance Ltd. tumbled over 7% on Wednesday after the Securities and Exchange Board of India posted on its website that it has kept the IPO of the company's arm, Asirvad Micro Finance, in abeyance.

Asirvad Micro Finance had filed a Draft Red Herring Prospectus with the market regulator on Oct. 5, with a proposed initial public offering of equity shares worth up to Rs 1,500 crore with a face value of Rs 10 each.

Manappuram Finance raised a stake in the microfinance company in June 2022 as part of its diversifying strategy. The postponement of the IPO issue would greatly imped this strategy.

Shares of the company tumbled 7.48%, the lowest since Dec. 20, before paring loss to trade 4.42% lower as of 12:00 p.m. This compares to a 0.05% decline in the NSE Nifty 50.

The stock has risen 39.36% in the last 12 months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 49.36.

Of the 20 analysts tracking the company, 17 maintain a 'buy' rating, one recommends a 'hold,' and two suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 11.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.