After Kotak Mahindra Bank's KVS Manian resigned from the post of joint managing director, analysts have expressed concern that recent key managerial personnel changes could weigh on the private lender's growth outlook.

Citi Research has maintained a 'neutral' rating on the stock because it is concerned that management attrition will resurface among investors.

Nuvama downgraded the stock to 'reduce', saying that losing long-standing management and people from key managerial positions last year made the bank's growth outlook unpredictable.

Alteration and attrition in the management segment, coupled with a recent ban by the Reserve Bank of India, will hurt growth for the upcoming 12–18 months, the brokerage said in a note on Wednesday.

Kotak Mahindra Bank has seen Uday Kotak and its CFO and CDOs exit in the last one year. This proves its attrition rate is higher than its peers, Nuvama said.

The Reserve Bank of India directed Kotak Mahindra Bank to cease and desist the issue of fresh credit cards and the onboarding of new customers through its online and mobile banking channels on April 24. The bank had been found lacking in IT risk and information security governance for two consecutive years.

Since the curb, shares of the lender have declined 15.22% on NSE.

Brokerages' Take

Citi Research

The brokerage maintained a 'neutral' rating on Kotak Mahindra Bank, and kept the target price unchanged at Rs 2,040 apiece, implying a 25.62% upside from Tuesday's closing price.

Investors monitoring management strategy, execution, and management changes.

Resignation of KVS Manian is set to bring back focus on management attrition.

Resignation is unlikely due to RBI action.

Manian was instrumental in transforming many businesses during his tenure.

Manian has been spearheading corporate since April 2014, also looked at private banking and had oversight on investment banking.

Nuvama

Nuvama downgraded Kotak Mahindra Bank to 'reduce', and cut its target price to Rs 1,530 from Rs 2,095 earlier, which implied 5.8% downside from Tuesday's closing price.

Negative events and high attrition make the outlook for Kotak unpredictable.

Recent changes shall hurt growth and profit at least for 12–18 months.

Losing a long standing key management personnel is a negative amid many such exits in the last year.

Digital prowess flagged off as a key strength is lacking as viewed by the regulator.

RBI's digital ban shall put the bank one–two years behind aggressive peers.

Recommend switching to ICICI Bank Ltd., Axis Bank Ltd., IIB, HDFC Bank Ltd. (for a one year-plus horizon) and Shriram.

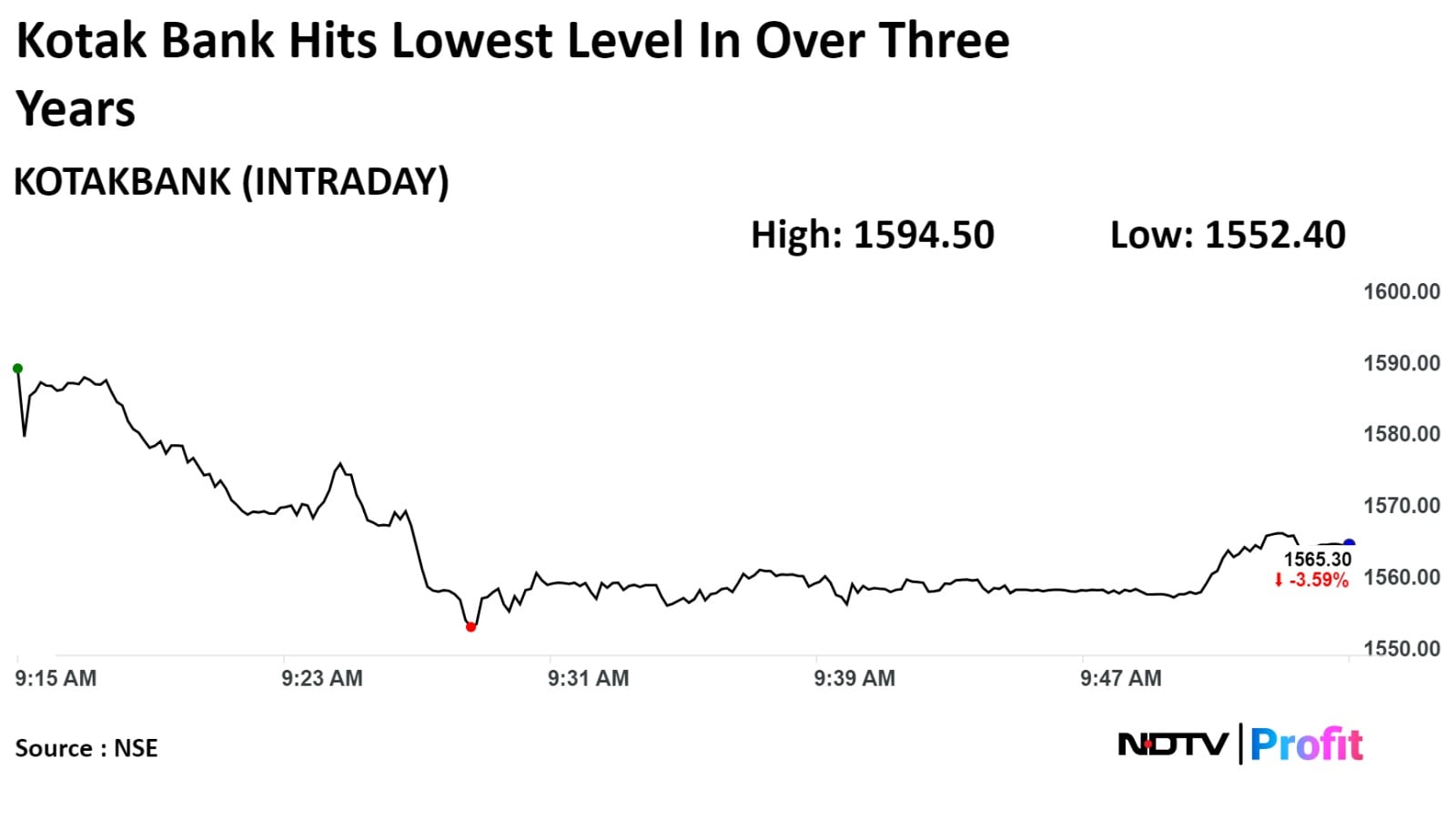

Shares of Kotak declined as much as 4.41% intraday, the lowest level since Nov. 20, 2020. They pared loss to trade 3.80% lower at 10:49 a.m. This compares to 0.32% advance in the NSE Nifty 50.

The stock has declined 18.68% in 12 months and 18.01% year-to-date. Total traded volume so far in the day stood at 7.6 times its 30-day average. The relative strength index was at 28.94, implying the stock was oversold.

Of the 43 analysts tracking the company, 22 maintain a 'buy' rating, 14 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 28.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.