Shares of Indiamart Intermesh Ltd. rose on Tuesday after Jefferies said it foresees paid subscriptions to double in the next fiscal, supporting the valuation of the company.

"Indiamart to deliver a strong 19%/25% revenue/EPS CAGR over FY24–26E," said Jefferies after attending the company's investors meet. The research firm maintained a 'buy' rating on the stock with the price target at Rs 3,400 apiece, implying an upside of 30%.

The research firm expects the addition of paid subscribers to pick up from 3,000 per quarter in FY24E to 6,000 per quarter in FY25E. The rise will be due to normalisation of gross adds post-price hikes, reduction in renewal churn, optimised subs acquisition and tenured service teams.

The subscriber addition will be steady despite the low-tech knowledge among SMEs, it said. Looking at the consistent repeat rate, robust buyer inquiries and high buyer-supplier overlap, concerns about the relevance of Indiamart may not be necessary, Jefferies said.

Jefferies expects SaaS investments to drive the next leg of growth, as seen in the case of China's 1688.com.

Looking at the long term, Jefferies sees that the current valuations are justified given the market opportunity and that the company is well placed against competition due to strong moats.

However, execution concerns, slow subscriber addition and SaaS investment were the risks to the above outlook, Jefferies said.

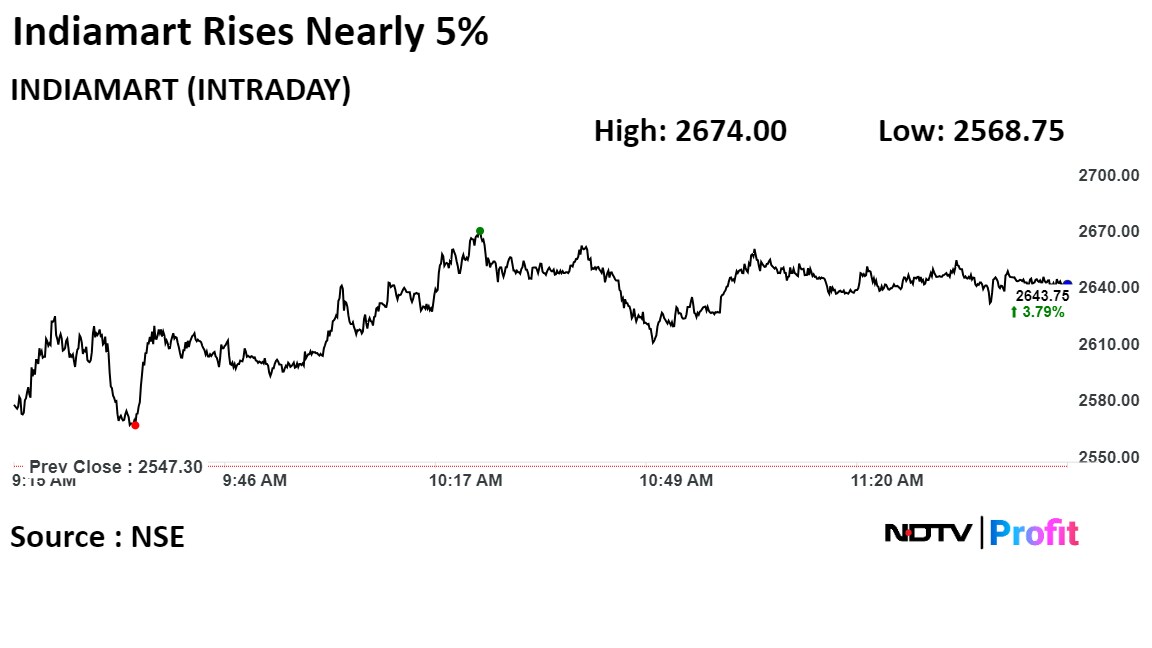

Shares of the company rose as much as 4.97% to Rs 2,674 apiece, the highest level since March 4. It pared gains to trade 3.84% higher at Rs 2,645 apiece as of 11:48 a.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen 13.49% in the past 12 months. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 49.68.

Out of 24 analysts tracking the company, 17 maintain a 'buy', two recommend a 'hold', and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.