Shares of Indiamart Intermesh Ltd. surged to their highest in over two months on Thursday after its profit beat analysts' estimates. The company's net profit rose 78.49% year-on-year to Rs 100 crore in the quarter ended March 2024, according to an exchange filing. This compares with the Rs 80.8 crore consensus estimates of analysts polled by Bloomberg.

Indiamart Intermesh (Consolidated, YoY)

Revenue up 17.07% at Rs 315 crore. (Bloomberg estimate: Rs 316 crore).

Ebitda up 33.73% at Rs 88.4 crore. (Bloomberg estimate: Rs 83.29 crore).

Margin up 349 bps at 28.09% (Bloomberg estimate: 26.3%).

Net profit up 78.49% at Rs 100 crore. (Bloomberg estimate: Rs 80.8 crore).

Board recommends final dividend of Rs 20 per share.

The subscriber addition was weak, but sustained ARPU improvement and strong lead indicators reiterate the brokerage's positive stance, according to DART Research. "We lower our FY25E/FY26E earnings estimate by 5.1%/3.2% and maintain a ‘buy' rating with a DCF-based target price of Rs 3,400 apiece," it said.

A one-off revaluation gain of Rs 29 crore in an investment company contributed to the company's fourth-quarter net profit.

"We value IndiaMart's core business at 30x FY26F P/E (unchanged), a 25% discount to InfoEdge's core business, and continue to assign 1x book value to its recent investments," said Nomura in a report, adding that it retains a "neutral" rating on the stock with a marginally lower target of Rs 2,520 apiece from Rs 2,530 apiece earlier.

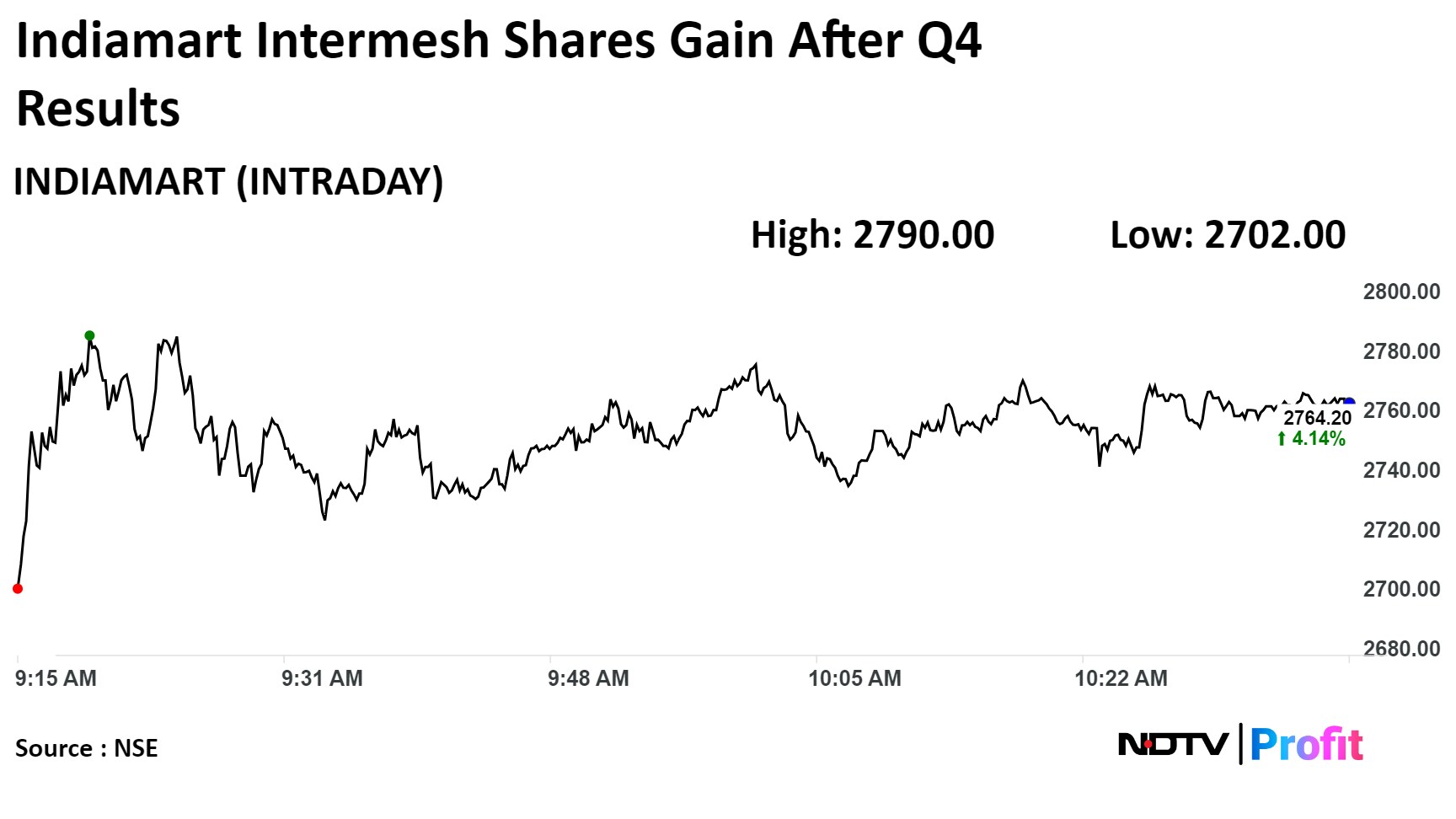

Shares of the company rose as much as 7.73% to Rs 2,848.20 apiece, the highest level since Feb. 20. It pared gains to trade 7.5% higher at Rs 2,839.40 apiece as of 10:58 a.m. This compares to a 0.34% advance in the NSE Nifty 50 Index.

The stock has risen 3.83% on a year-to-date basis and 1.42% in the last 12 months. Total traded volume so far in the day stood at 6.97 times its 30-day average. The relative strength index was at 70.65.

Out of the 24 analysts tracking the company, 16 maintain a 'buy' rating, two recommend a 'hold,' and six suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.