Shares of ICICI Securities Ltd. fell over 4% on Thursday to an over two-month low as the institutional investors voted in favour of delisting and merging it with the ICICI Bank Ltd.

Results of shareholders vote showed 71.89% of them voted to delist the company and go merging after the delisting process. To the favour of the proposal 83.8% public institutional shareholders voted, and only 32% non-institutional shareholders voted.

The arrangement is indicating that shareholders of ICICI Securities will get 67 shares of ICICI Bank against every 100 shares held.

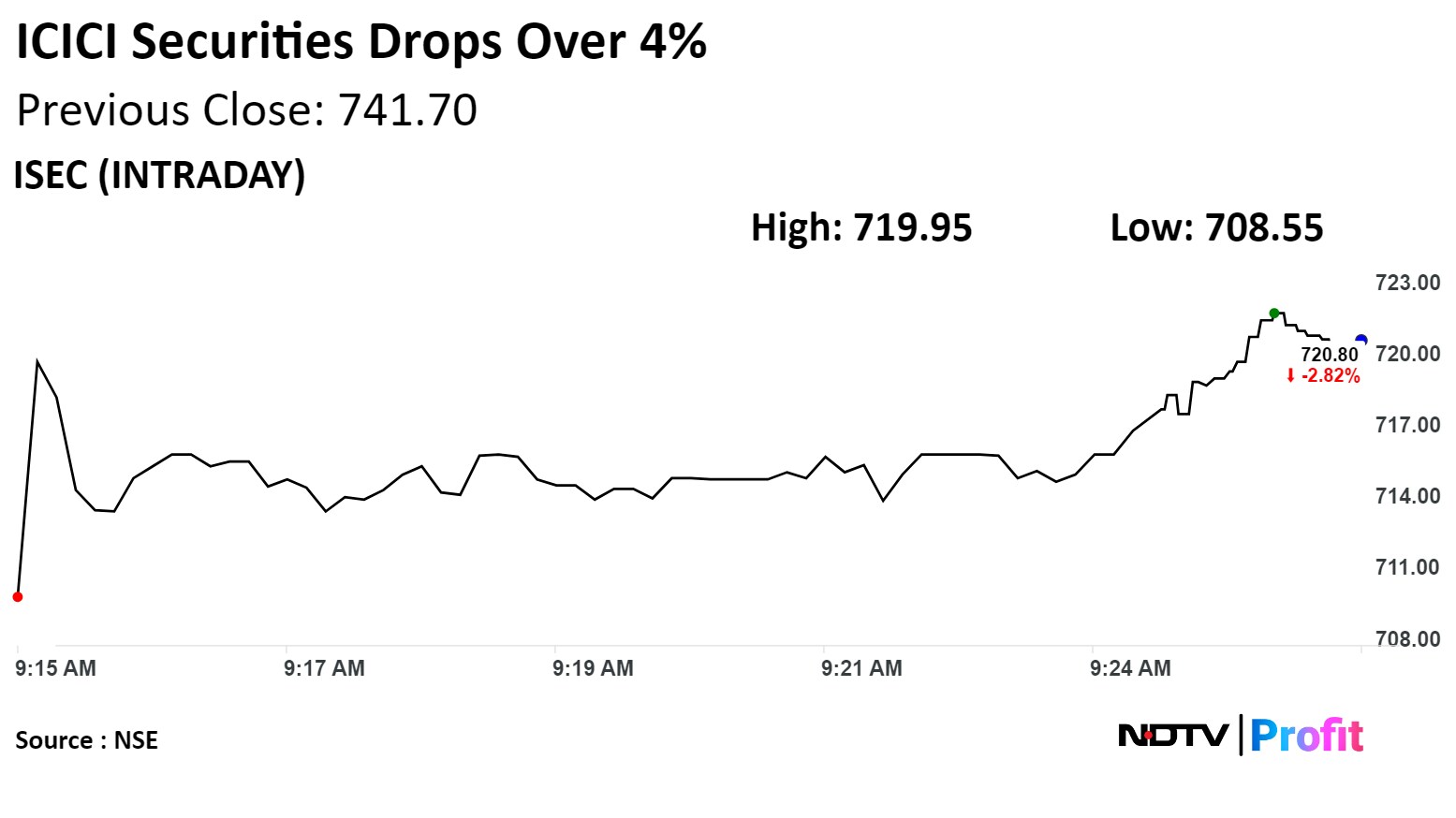

On the NSE, ICICI Securities' stock fell as much as 4.47% during the day to Rs 708.55 apiece, the lowest since Jan. 3. It was trading 2.74% lower at Rs 721 per share, compared to a 0.41% advance in the benchmark Nifty 50 as of 09:28 a.m.

The share price has risen 75.40% in the last 12 months. The relative strength index was at 36.21.

Out of six analysts tracking the company, three have a 'buy' rating on the stock, two recommend 'hold' and one suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 19.1%.

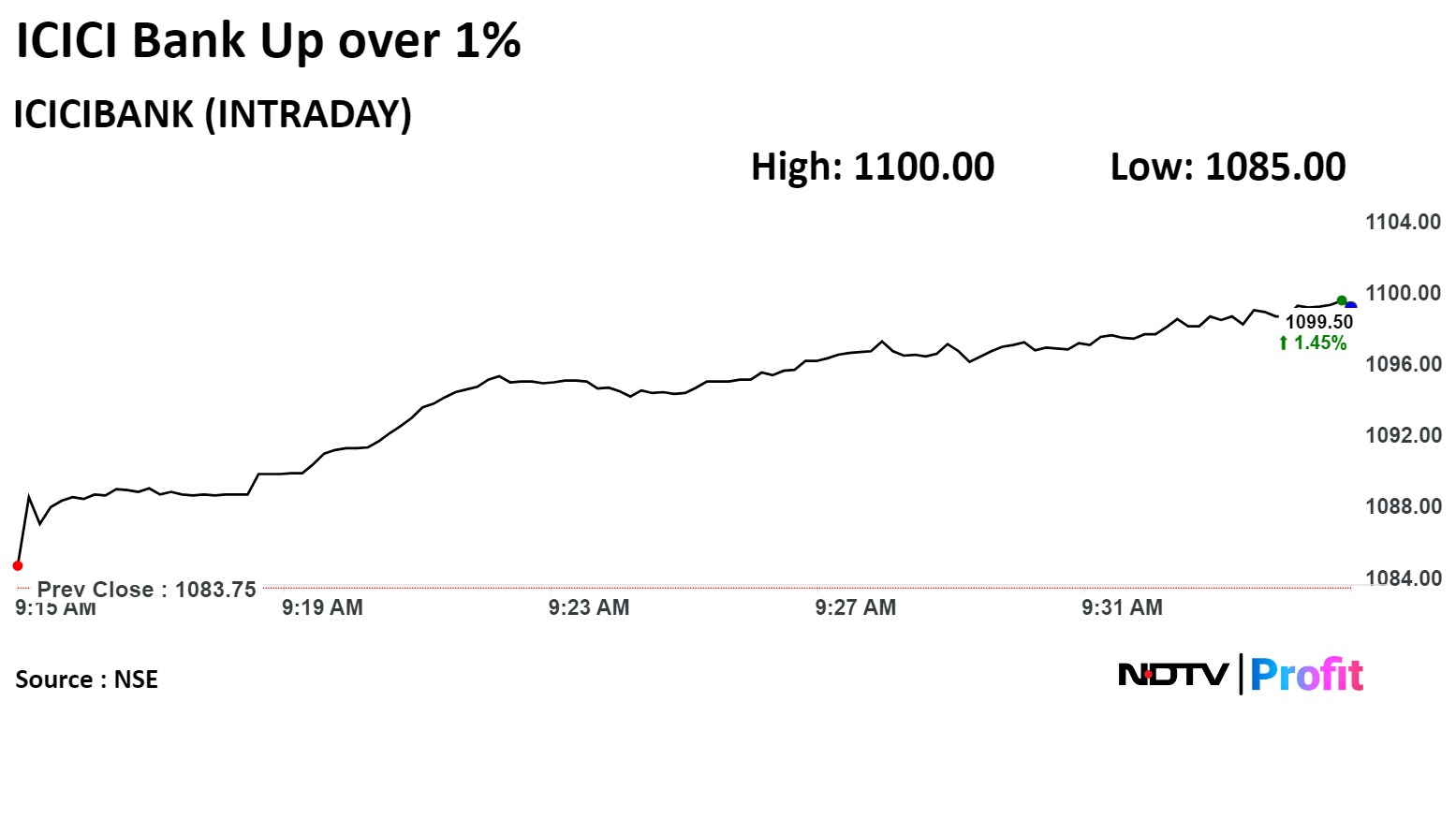

ICICI Bank Ltd.'s stock rose as much as 1.5% during the day to 1,100 apiece, the highest since March 21. It was trading 1.48% higher at Rs 1,099.75 per share, compared to a 0.43% advance in the Nifty as of 9:36 a.m.

The stock has risen 28.66% in the last 12 months. The total traded volume so far in the day stood at 0.10 times its 30-day average. The relative strength index was at 65.34.

Out of 52 analysts tracking the company, 49 have a 'buy' rating and three recommend 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 12.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.