(Bloomberg) -- US factory activity contracted in April on declining demand while input prices rose at the fastest pace since inflation peaked in 2022.

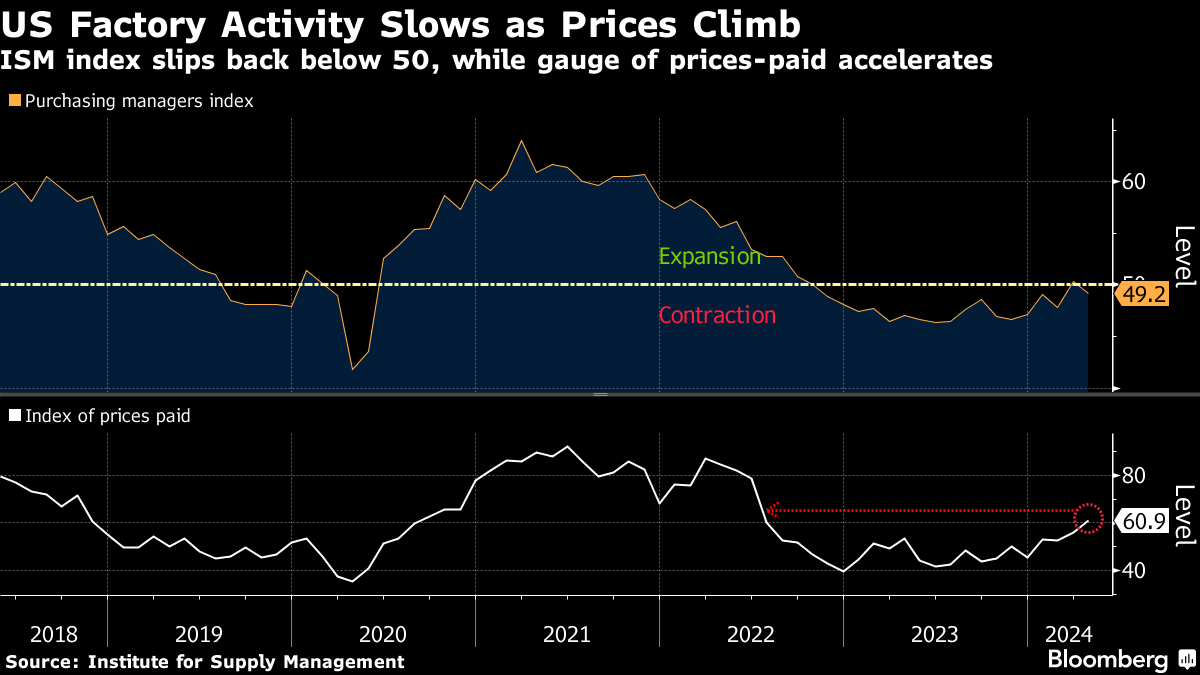

The Institute for Supply Management's manufacturing gauge fell 1.1 points to 49.2, after expanding a month earlier for the first time since 2022, data out Wednesday showed. Readings less than 50 indicate contraction and the April figure was weaker than the median estimate in a Bloomberg survey of economists.

A measure of costs for materials and other inputs rose for the second straight month, suggesting stubborn inflationary pressures. The group's gauge of prices paid increased by 5.1 points to 60.9, the highest since June 2022.

At the same time, a gauge of production fell 3.3 points in April after a large gain a month earlier, while a measure of new orders slipped back into contraction territory.

The readings indicate US manufacturing is struggling for traction after some optimistic signs earlier this year for the industry's outlook. Producers continue to battle headwinds of higher interest rates, elevated input costs and sluggish overseas markets.

“Demand remains at the early stages of recovery, with continuing signs of improving conditions,” Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee, said in a statement. “Suppliers continue to have capacity but work to improve lead times, due to their raw material supply chain disruptions.”

Seven industries contracted in April, including machinery, furniture and wood products, while nine reported expansion.

Select ISM Industry Comments

“Conditions are improving as demand is starting to recover. Costs continue to be a major concern as suppliers that rapidly increased prices in the follow-up from Covid-19 are slow to return to pre-pandemic levels.” - Chemical Products

“Sales continue to exceed expectations in 2024. The forecasted dip in commercial vehicle production volumes appears to be avoided.” - Transportation Equipment

“Order flow has stabilized....Order rates are expected to remain stable through August.” - Food, Beverage & Tobacco Products

“Some small indications of market improvement in China for our instruments and technology. Recovery is still slower than we had hoped, and macroeconomic uncertainty remains in Europe and the Middle East, as well as domestically in the U.S. with ongoing inflationary pressures and anticipation for the (upcoming) election.” - Computer & Electronic Products

“Market conditions have definitely softened. Thankfully, our backlog is strong and will get us through the year.” - Machinery

“Business is slowing down — it has been a gradual decline for the last several months. We are not seeing new orders at last year's level, or at this year's budgeted levels.” - Fabricated Metals

“There has been a lot of volatility in sales. On average, our sales look flat, but the volatility is concerning.” - Electrical Equipment, Appliances & Components

“The major factor affecting our business is the uncertainty of the Federal Reserve's handling of interest rates, which will affect our customers' businesses, thereby affecting ours.” - Plastics & Rubber Products

“Business is stable, and orders have been consistent. We're quoting new business for the factory, and automotive builds continue at averages but not near maximum outputs. Workforce is stable, with the turnover ratio dropping considerably. Salaries and hourly rates increasing to meet inflationary pressures.” - Primary Metals

Among commodities noted in the report, producers reported paying higher prices for crude, gasoline, aluminum, copper, corrugated boxes, plastic resins and steel. Thirty-one percent of companies reported paying higher prices in April, up from 24% a month earlier.

Orders from overseas customers shrank for the first time in three months, while order backlogs contracted at a faster rate, according to the ISM.

The data also showed the measure of customer inventories shrank at a slower pace and factory stockpiles were unchanged from March.

The ISM index of employment contracted for a seventh month, though at a slower pace.

--With assistance from Kristy Scheuble.

(Adds details on input prices)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.