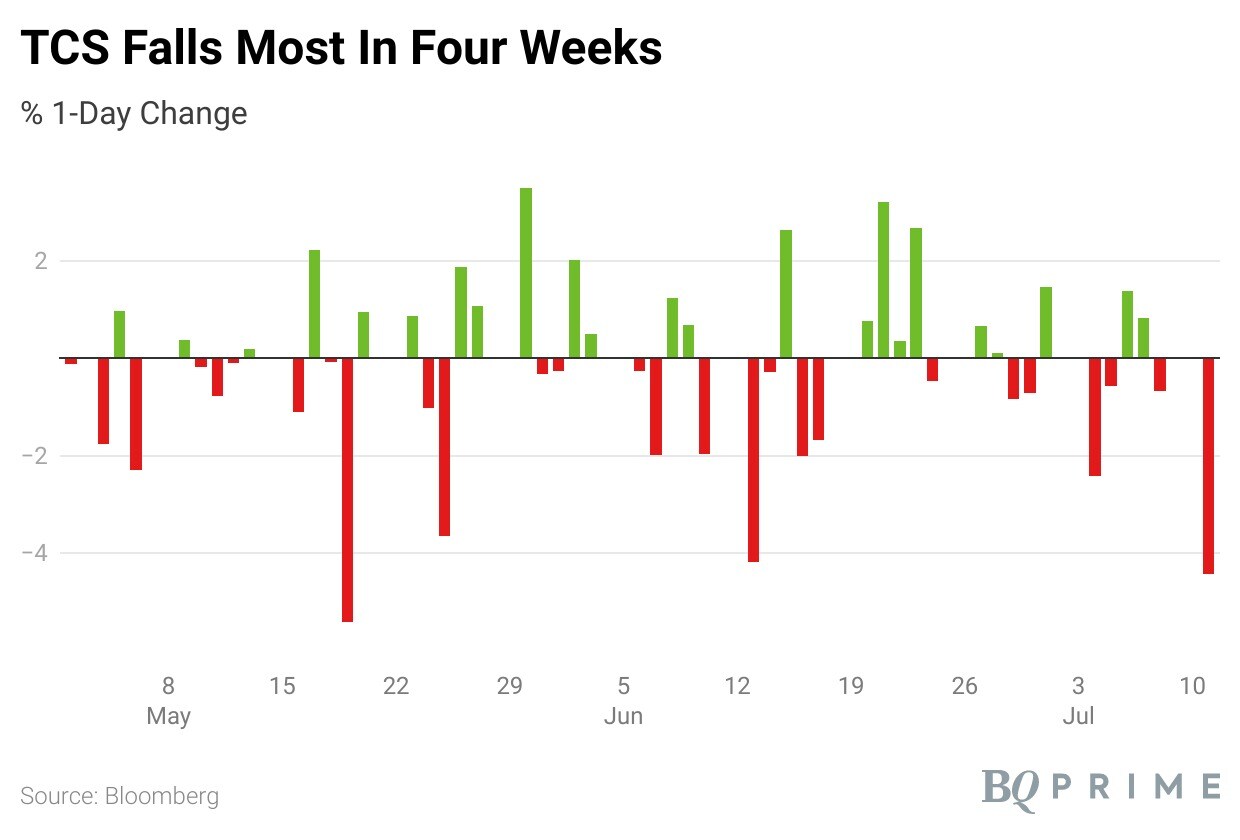

Shares of Tata Consultancy Services Ltd. fell the most in four weeks after analysts raised concerns over IT spends as an increase in interest rates, slow economic growth, and elevated geopolitical tensions impacted the macro environment.

While there has been no impact on actual spending as yet, India's largest software services exporter won new deals worth $8.2 billion in the quarter ended June, down from $11.3 billion in the preceding three months.

Its revenue rose for the eighth straight quarter, but net profit fell. The company's margin also contracted sequentially on rising attrition and salary hikes.

Credit Suisse, Incred Research and Reliance Securities have downgraded the stock after the results on Friday.

Key Q1 Highlights (QoQ)

Net profit fell 4.5% to Rs 9,478 crore.

Operating profit fell 3.5% to Rs 12,186 crore.

Revenue in dollar terms rose 1.3% to $6,780 million.

Revenue growth in constant currency terms stood at 3.5% sequentially.

Shares of TCS ended 4.6% lower on Monday, the steepest intraday decline in four weeks.

Of the 48 analysts tracking the company, 21 maintain a ‘buy', 16 suggest a ‘hold' and 11 recommend a ‘sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 12.3%.

TCS is the top laggard on the Nifty IT index.

Here's what analysts made of TCS' Q1 FY23 results.

Phillip Capital

Maintains ‘buy' at a target price of Rs 4,150 apiece, implying a potential upside of 27%.

TCS reported mixed set of results—with revenue growth in line, while margins/PAT below expectations. Total contract value was stable and management commentary on demand environment also remained strong.

Client discussions on macro troubles have begun, but it has not led to any spending cuts, yet.

Overall, tech spending outlook remains very strong despite challenging macro environment. Management appeared confident of reaching 25% EBIT margins in FY23 and expects margin trajectory to improve from Q2.

TCS will be beneficiary of the robust demand environment continuing with its broad spectrum of services. Expects TCS to continue to command valuation premium to its large-cap peers, on the back of its strong diversified profile, superior return profile, management stability and market leadership position.

Maintain that all bottom-up data points and commentary continue to allude to a sustainable strong demand environment, while the top-down macro fears are putting pressure on the valuations.

A U.S./EU/global recession (if and when) will only boost the long-term growth potential of these companies, as it has historically. Makes minor tweaks to our FY23/24 estimates (less than 3%), primarily on tweaking USD/INR assumption, higher constant currency impact and slightly lower margin expectations.

Motilal Oswal

Maintains ‘buy' at a target price of Rs 3,730, implying a potential upside of 14%.

Management commentary on the demand environment and deal pipeline remained intact with no visible impact of weakening macro environment, although they remain watchful. Despite intact commentary, they indicated that the U.S. will do better than Europe, due to client concerns over the slowdown. This is an initial sign of industry commentary turning more realistic vs the current view of no impact on tech spends.

Increase in interest rates, slow economic growth, and elevated geopolitical tensions have impacted the macro environment and raised concerns over IT spends.

Given TCS' size, order book, and exposure to long duration orders, and portfolio, it is well positioned to withstand the weakening macro environment and ride on the anticipated industry growth.

TCS has consistently maintained its market leadership position and shown best-in-class execution. It allows the company to maintain its industry-leading margin and demonstrate superior return ratios.

Nirmal Bang

Maintains ‘sell' at a target price of Rs 2,469, implying a potential upside of 24.4%.

There have been no negative inputs from clients due to the challenging macroeconomic environment, but it was indicated that there are more conversations with clients' senior executives around a possible recession, but there is as yet no impact on actual spending.

There were no comments on outlook for FY24 and TCS is taking a cautious approach by saying that it is agile enough to move in either direction based on demand. However, from a supply constrained situation that we are currently in, we will move to a demand constrained one in FY24 with tighter spending across enterprise customers as macroeconomic conditions worsen, impacting clients' profitability and hence IT spending.

Current FY24 consensus estimates are ambitious and will see downside. Our estimates are 6% lower and even they have downside risk from lower pricing.

At 28x 12-month forward EPS, valuation is expensive at close to +1SD vs the five-year mean.

Yes Securities

Maintains ‘buy' at a target price of Rs 3,758, implying a potential upside of 15.1%.

Revenue was in line, but the operating margin was below expectation led by wage hike and increase in other expenses such as travel-related costs.

Remains positive on the stock as the near- to- medium-term demand environment remains robust. Deal booking remains strong across vertical led by multi‐year tech upcycle.

Employee addition has been robust over last few quarters and provides steady revenue growth visibility. Though, the employee attrition remains high, but the incremental attrition has started moderating.

Expects operating margin to increase sequentially over next three quarters, aided by positive operating leverage, improving employee pyramid and moderation in employee attrition.

Certain costs related to admin and travel have increased but these costs are not expected to reach pre-Covid level as IT companies are expected to move to hybrid model of work.

Reduces target multiple from 32x to 28x to account for higher cost of capital and potential risk from macroeconomic concerns.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.