Shares of Tata Motors Ltd. fell after the automaker reported a wider-than-expected loss in the third quarter as supply issues and high input costs hurt production.

Analysts, too, said a delay in reviving production due to semiconductor shortage, luxury demand contraction and a slower macro recovery are key risks facing the company. Besides, a prolonged delay in Jaguar Land Rover's deleveraging plan could adversely impact the parent's aggressive electric vehicle strategy.

Tata Motors' revenue and operating profit fell over the year earlier in the quarter ended December, and its operating margin contracted. Sequentially, however, Ebitda and margin improved.

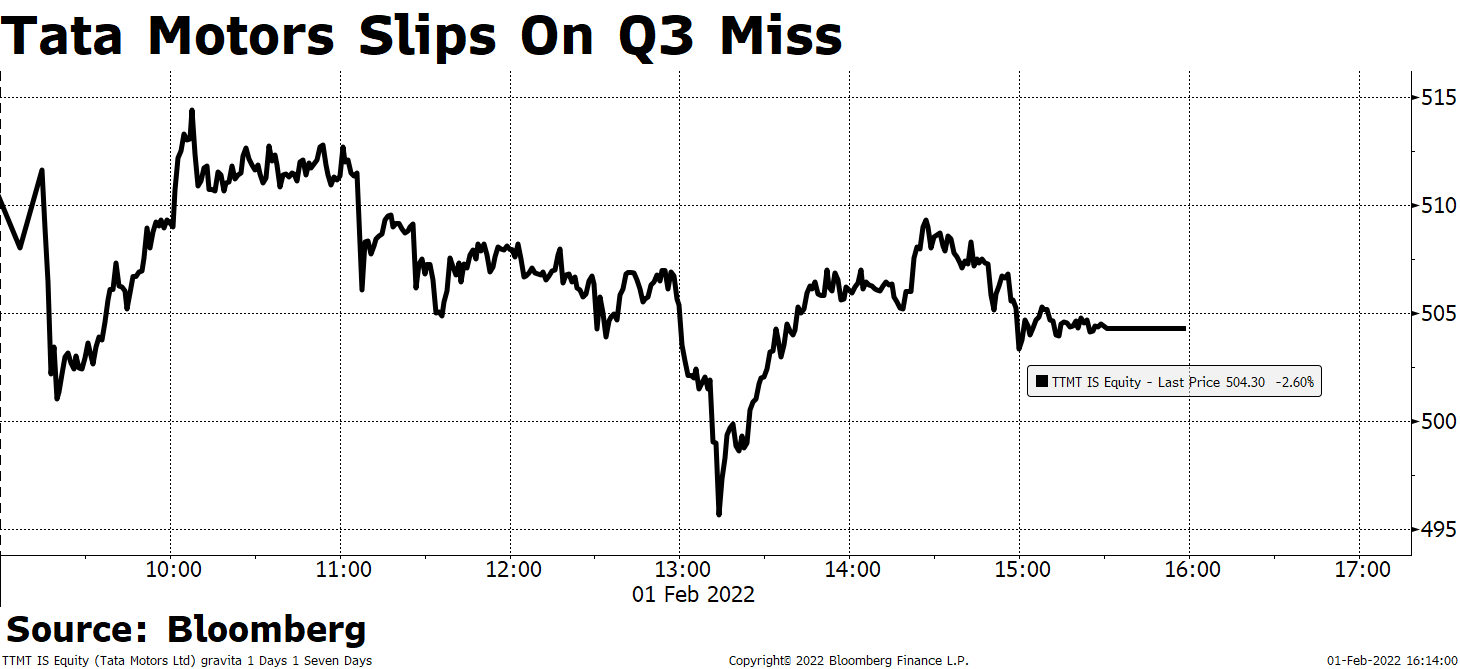

Shares of the automaker fell as much as 4.8%, the steepest intraday decline in more than a week and closed with 2.6% losses at Rs 504.3 apiece on Tuesday.

Of the 33 analysts tracking Tata Motors, 25 maintain a 'buy' and four each suggest a 'hold' and 'sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 12.3%.

The stock's trading volume was nearly three times the 30-day average volume at the time .

Tata Motors was among the top losers in the NSE Nifty Auto index.

Here's what analysts have to say about Tata Motors' Q3 FY22 results:

Nirmal Bang

Maintains 'sell' with a target price at Rs 369—an implied downside of 27.46%.

Better-than-estimate margin at JLR in Q3 was offset by lower-than-expected margin in the standalone business due to raw material cost pressure in commercial vehicle business and one-off costs related to subsidiarization of the passenger vehicle business.

The company expects uncertainty in semiconductor shortage to persist.

A prolonged delay in JLR's deleveraging plan is likely to restrict its aggressive EV strategy.

Expects profitability trends to improve on account of easing raw material cost pressures.

Remains constructive on the India business, but reduces earnings estimates for JLR to factor in lower volume due to chip shortages.

Emkay Global

Reiterates 'buy' and raises target to Rs 575 from Rs 550; an implied return of 11.1%.

Delay in reviving production due to supply issues for semiconductors, luxury demand contraction and slower macro recovery are some of the key risks facing the company.

Strong JLR performance driven by healthy model mix, higher realisations and better share of the China region.

Expects volume to surge across divisions between FY22E and FY24E.

Expects strong margin performance across divisions.

ICICI Securities

Reiterates 'buy' with the target price raised to Rs 703 from Rs 653 earlier.

JLR managed a good performance despite limited wholesale volume of 69,000 units due to chip shortage.

Expects product mix to normalise with production improving, which is likely to result in rationalisation of gross margin.

CV margin in domestic business was severely impacted by higher commodity cost despite improving scale.

In India PV segment, EV mix is expected to reach nearly 20% over the next five years from 6-8% now.

Industry is unable to take steep price hikes despite freight rates firming up.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.