The Reserve Bank of India unexpectedly cut its benchmark interest rate in Governor Shaktikanta Das's debut policy meeting, becoming the first in Asia to ease borrowing costs this year as inflation remains benign.

The repurchase rate was reduced by 25 basis points to 6.25 per cent, a decision predicted by just 11 of 43 economists surveyed by Bloomberg News, with the rest expecting no change. The six-member Monetary Policy Committee voted unanimously to switch its stance to neutral from 'calibrated tightening' adopted in October.

Emboldened by a slowdown in inflation, the MPC under the new governor showed more concern about economic growth risks, paving the way for more rate cuts.

"It is vital to act decisively and in a timely manner to address the objective of growth once price stability as defined in the Act is achieved," Mr Das told reporters in Mumbai, referring to the central bank's inflation targeting mandate. "The shift in stance from calibrated tightening to neutral provides flexibility to address, and the room to address, sustained growth of India's economy over the coming months as long as inflation remains benign."

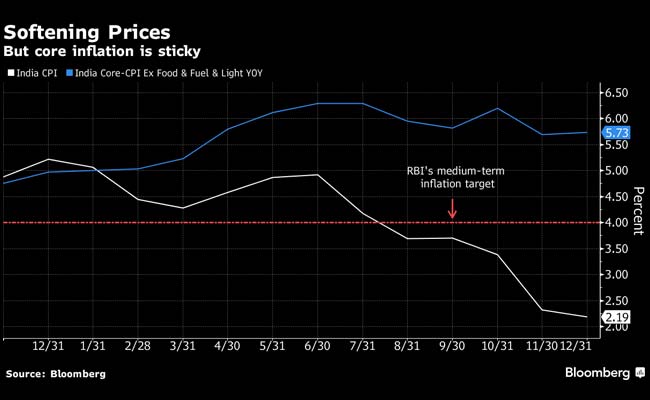

Inflation slowed to an 18-month low of 2.2 percent in December, remaining well below the Reserve Bank of India's medium-term target of 4 per cent.

"The MPC will now be looking at a balance of growth and inflation rather than just focusing on inflation alone," said Teresa John, an economist at Nirmal Bang Equities Pvt. in Mumbai. "The rate cut is also driven by the fact that inflation has significantly surprised on the downside."

With the US Federal Reserve signaling a pause in its rate-hike cycle, emerging markets from India to Indonesia are getting a breather as global risks mount. The Bank of Thailand kept its key rate unchanged on Wednesday after hiking in December, while the Philippines also held on Thursday.

Developed economies too are altering stance, with the Reserve Bank of Australia governor this week shifting to neutral.

RBI Autonomy

Bonds gained, and the rupee declined 0.2 per cent immediately after the rate move. The currency later reversed losses and was little changed at 71.5275 against the dollar as of 2:00 pm in Mumbai.

The policy decision was a tricky one for Mr Das, a career bureaucrat who was installed as governor after Urjit Patel quit in December amid a heated public battle with the state over the central bank's autonomy. Mr Patel had led the MPC to raise interest rates twice last year.

The new RBI chief -- one of four MPC members who voted for a cut, while two called for no change -- is seen as more willing to support the government's efforts to boost the economy. The surprise move also came after calls from a top adviser of Prime Minister Narendra Modi for rate cuts to fire up the economy.

Fiscal Stimulus

Sonal Varma, chief India economist at Nomura Holdings Inc. in Singapore, said the RBI's autonomy wasn't at issue this time around.

"Every monetary policy committee member can and should have an independent view," she said. "But there should be consistency in views over a period of time. The surprise this time was existing monetary policy committee members who voted for calibrated tightening stance in December and a cut in February."

The monetary stimulus is what PM Modi's government needs to stoke growth in an election year. Last week it unveiled an expansionary budget, which included $13 billion of consumer stimulus ahead of an election.

What Our Economists Say...

The decision "restores growth maximisation as a secondary objective of the RBI. It also signals a commitment to a symmetric policy to achieve its 4 per cent inflation target -- a departure from the RBI's previous one-sided, conservative stance that aimed to keep inflation below the target."-- Abhishek Gupta, Bloomberg Economics.

The central bank is forecasting gross domestic product growth of 7.4 per cent for the fiscal year starting April 1, the same as its estimate for the current year.

Falling food prices have been the main driver of the inflation slowdown, though the core measure -- which excludes food and fuel costs -- remains elevated at around 6 per cent. The central bank sees inflation at 2.8 per cent in the final quarter of the fiscal year ending March. Previously, it had projected inflation in a range of 2.7 per cent to 3.2 per cent in the six months to March.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.