Analysts expect Vodafone Idea Ltd. to witness a churn among postpaid subscribers on account of new plans launched by Reliance Jio Infocomm Ltd. and poor connectivity, at a time the cash-strapped telecom operator rebranded itself to take on rivals in India's fiercely competitive wireless market.

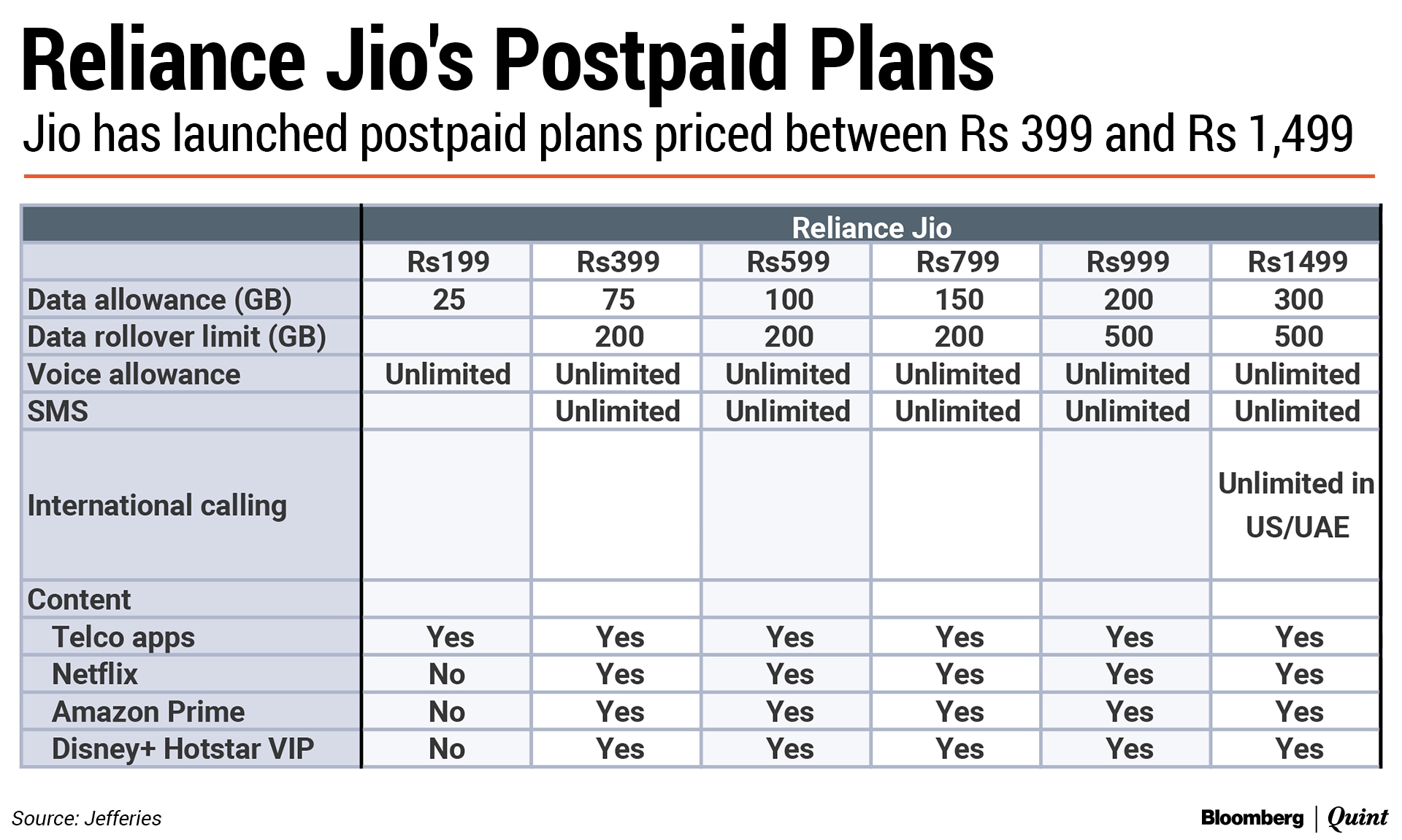

Reliance Jio has launched new postpaid plans that offer unlimited voice, SMS, and bundled subscription to streaming apps like Disney+ Hotstar, Netflix and Amazon Prime. The Postpaid Plus pack will have monthly tariffs ranging from Rs 399 to Rs 1,499. Apart from benefits like data rollover and family packs, there is international roaming (U.S./UAE) in the Rs 1,499 plan.

The Mukesh Ambani-led telecom venture's first attempt at the postpaid market came in May 2018, with the launch of its Rs 199 plan, much cheaper than peers. Still, that saw limited uptake due to a lack of content offerings.

Reliance Jio's new postpaid plus plans, however, offer more content options than both Bharti Airtel Ltd. and Vodafone Idea across price points.

Reliance Jio's Rs 399 plan offers nearly double the data compared to Vodafone Idea's same price pack, Jefferies said in a note. While Vodafone Idea's plans start at Rs 299, the research firm expects the carrier's 23 million postpaid subscribers to churn as its service quality gap widens. “Reliance Jio's refreshed postpaid offering is well timed to leverage this opportunity.”

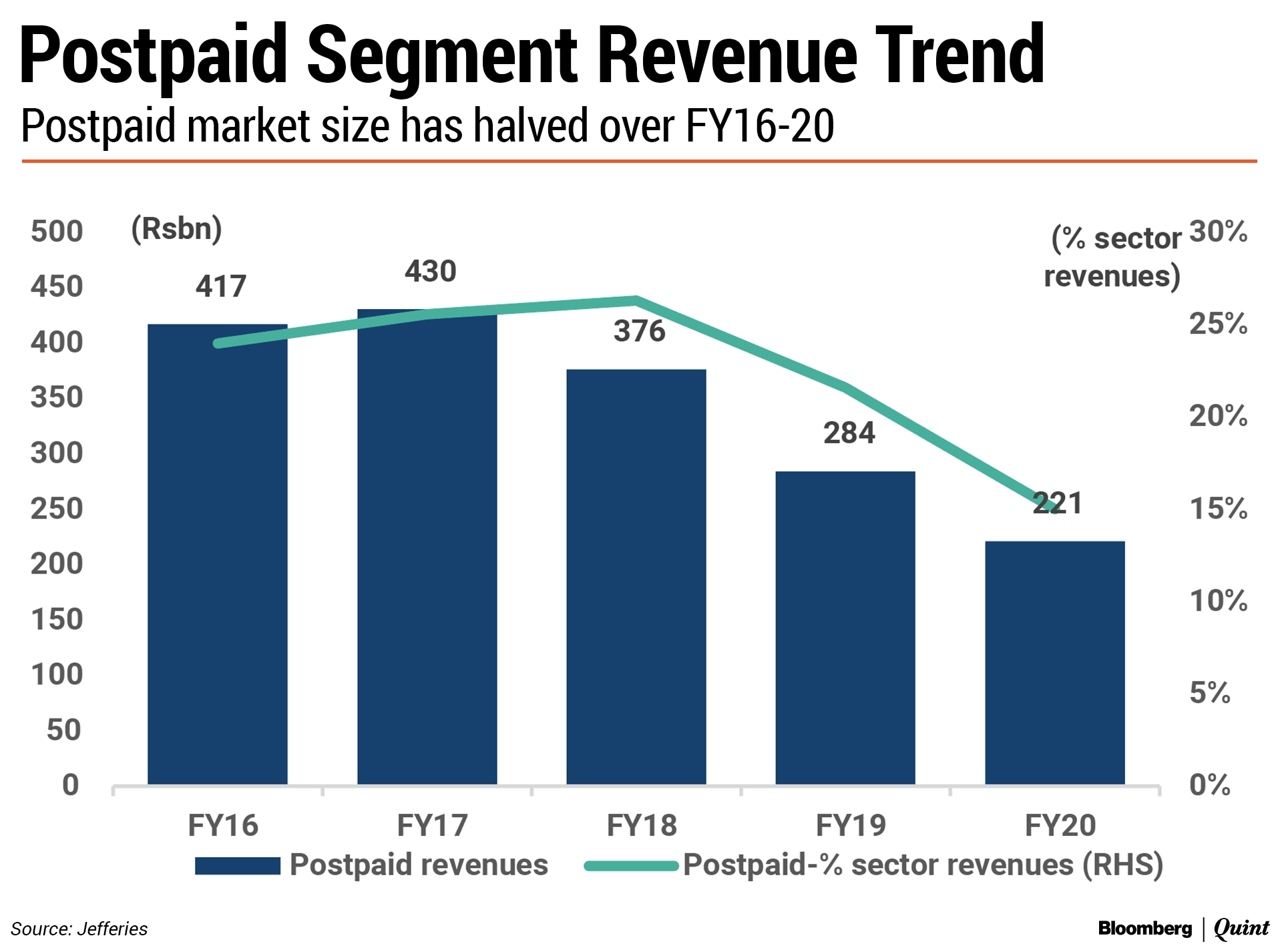

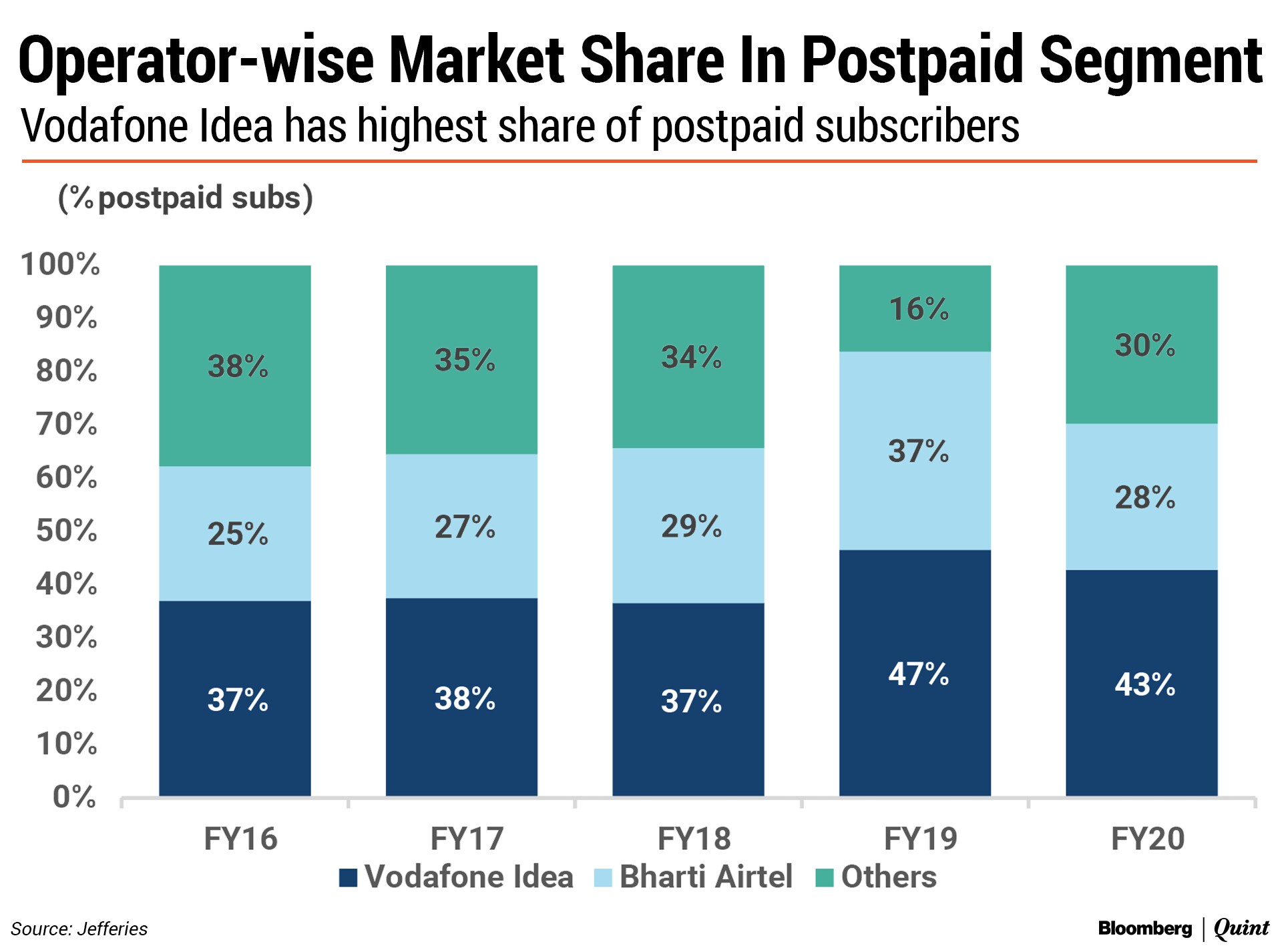

India's postpaid market, according to Jefferies, has halved between FY16 and FY20 because of a sharp fall in prepaid pricing. Vodafone Idea has the highest 43% market share in the postpaid segment, followed by Bharti Airtel at 28%.

But analysts see limited risks from these new plans for the Sunil Mittal-owned carrier.

That, according to Jefferies, is because Bharti Airtel's 50-60% subscribers are enterprise customers and their focus is less on pricing and more on the sustained track record of service delivery. Also, with the carrier maintaining 8-25% premium pricing in prepaid and managing churn well, lower postpaid pricing by Reliance Jio is unlikely to drive churn materially, the research firm said in the note. That's despite Reliance Jio pricing its comparable offerings at a 20% discount to Bharti Airtel.

Credit Suisse, too, does not see much subscriber churn risk to Bharti Airtel, given its premium brand positioning in the segment. Vodafone Idea, on the other hand, may witness higher churn as the ongoing network integration exercise has caused bad experience in some key service areas.

According to Emkay Global, postpaid subscribers constitute 5-8% of the active user base of Bharti Airtel and Vodafone Idea, and contribute 13-16% to their wireless revenue. While the brokerage does not expect the carriers to undercut headline tariffs to compete with Reliance Jio, they will have to match its content offerings, leading to an increase in operating expenditures.

Vodafone Idea's weak financial position and a higher proportion of postpaid subscriber base make it more vulnerable to losses, Emkay said. Bharti Airtel, however, will follow Reliance Jio on content offerings, limiting subscriber losses and impact on revenues, the report stated.

Vodafone Idea hasn't reported an annual profit since Vodafone Group Plc's India unit and Aditya Birla Group's Idea Cellular announced their merger in 2017, driven by a brutal tariff war unleashed by Ambani's telecom unit. The merged entity lost subscribers and was weighed down by a massive debt.

Also Read: After Mobile, Reliance Jio, Bharti Airtel Unleash Broadband Tariff War

According to ICICI Direct, response of the non-corporate segment will be important as more than two-thirds of the postpaid category is driven by corporate connections in India. Matching Reliance Jio's offering will result in additional annual costs for Bharti Airtel and Vodafone Idea. The impact on Vodafone Idea, however, could be significant as it will have to weather churn through cost increase and raise tariffs for survival, the brokerage said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.