India Inc. has reported better-than-expected earnings so far this season, led by financials and material firms, even as higher costs continue to weigh on margins.

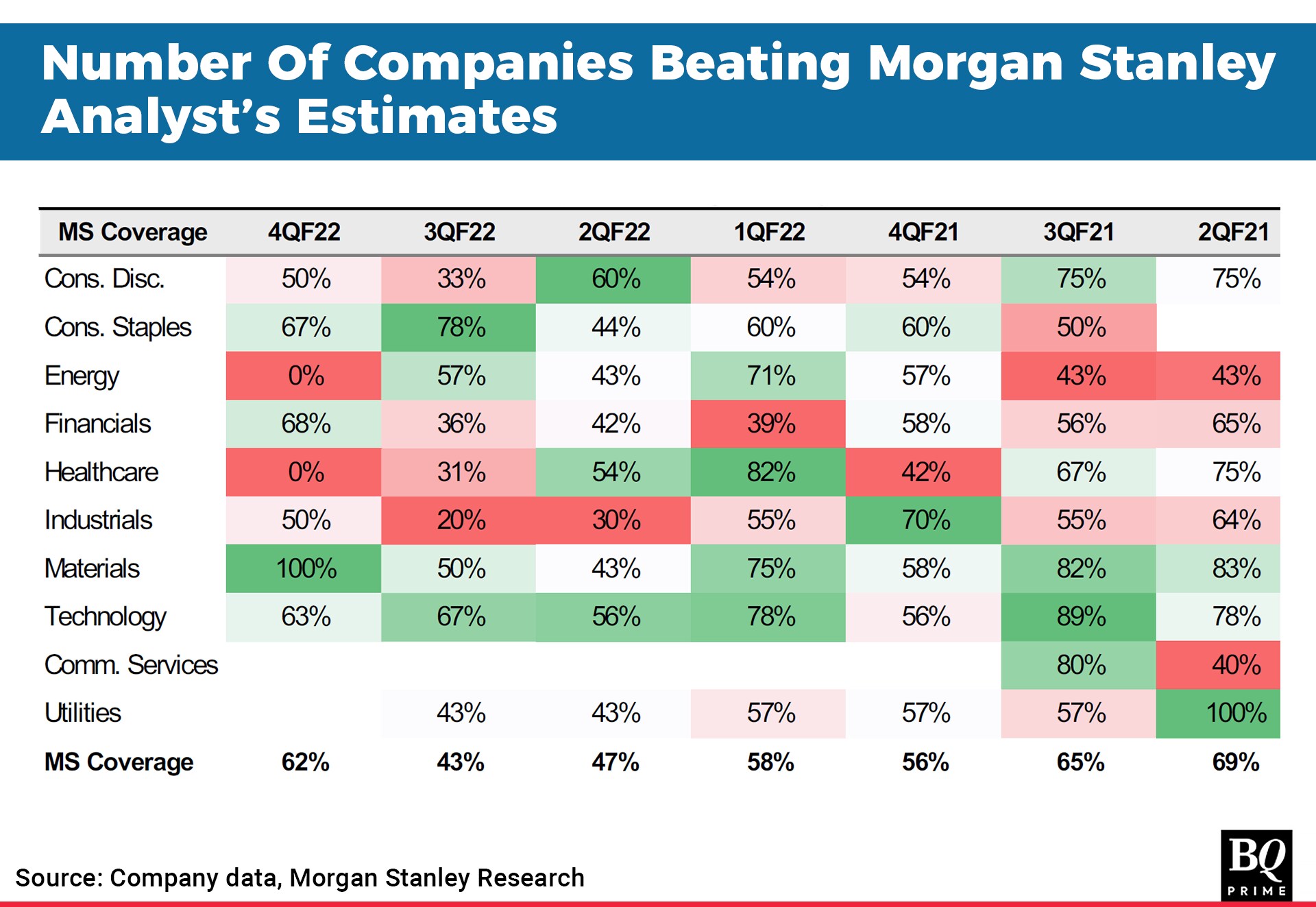

The companies beating analyst estimates have outnumbered the firms that have underperformed, according to mid-season review for results till May 11 by Morgan Stanley and Jefferies. IT, pharma, healthcare, cement and industrials have been laggards, they said.

Revenue, Ebitda and net profit of the 22 Nifty firms in Morgan Stanley's universe rose 25%, 13% and 26% over a year earlier. The numbers beat revenue and net profit forecasts by 2 percentage points and 5 percentage points, respectively, it said.

Of the 61 companies in Jefferies coverage universe that have reported earnings, numbers of 35 were above estimates, while 19 missed forecasts.

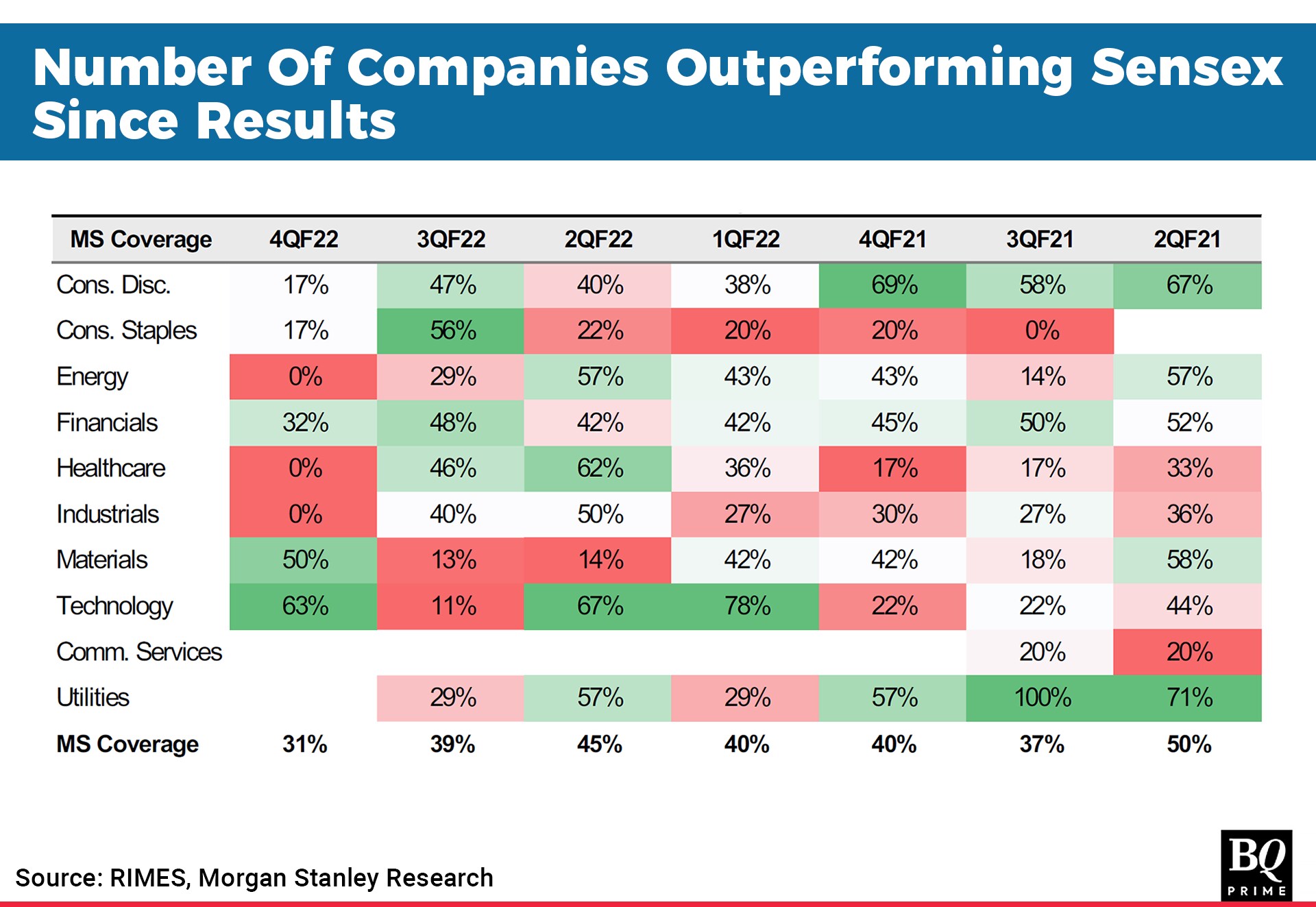

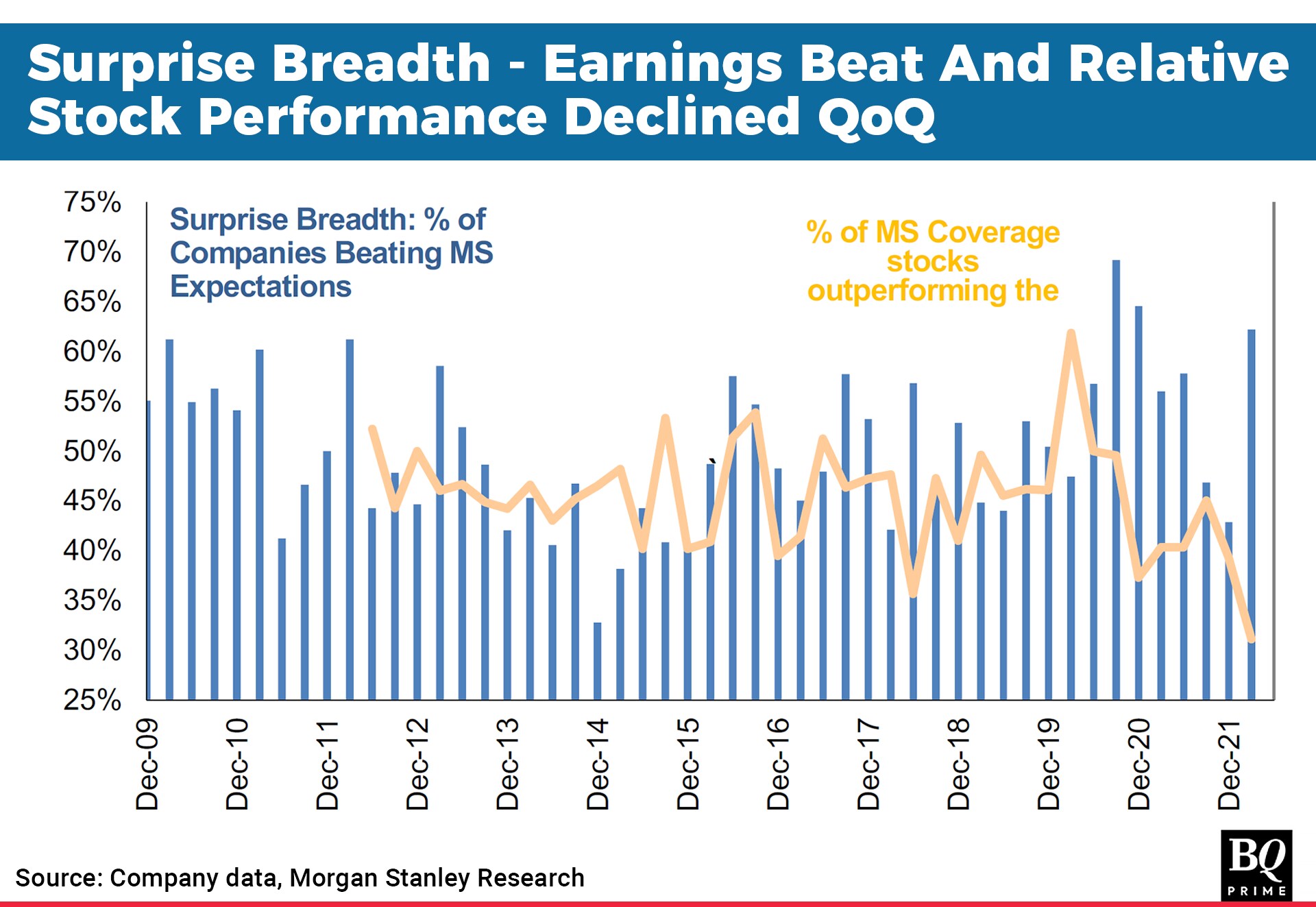

Earnings beat, however, has not sparked a commensurate reaction on the stock market. Morgan Stanley and Jefferies cited supply snags, rate hike worries, volatile crude and commodity prices due to Russia's war in Ukraine and fears of a global growth slowdown as the reasons.

Here's how the two research firms have analysed the earnings so far:

Morgan Stanley

Morgan Stanley has upgraded FY23 earnings estimates of three firms in its coverage so far. It downgraded the forecasts for eight.

Early trends signal beats across the board, contrary to expectations.

Excluding financials, firms in Morgan Stanley coverage universe reported revenue, Ebitda, profit before tax and net profit growth of 26%, 13%, 16%, 17% year-on-year, respectively. They beat revenue and net profit by 3 percentage points and 6 percentage points.

Margins were lower by 241 basis points.

Earnings beat ratio rose to 65%, a five-quarter high, the relative stock performance was at all all-time of 31%.

Materials and financials firms posted strong profit beat, while the biggest misses were mostly in healthcare and industrials.

Jefferies

Jefferies said the results season has trended better so far with earnings beat outnumbering misses.

Volatility in commodity costs during the quarter led to price hikes across sectors like consumer staples, automobiles, houses, paints and QSR firms, the research house said, adding more such increases are likely as companies protect margins.

Jefferies noticed a weakness in rural demand but expects better farm produce prices and a normal monsoon to offset the impact.

Analysts at Jefferies upgraded earnings estimates of 30 of the 61 companies (41%) in its coverage universe that have reported numbers so far, while 29 saw downgrades.

Results season has trended better quarter-on-quarter so far, a positive outcome given the macro concerns.

Strong results from financials and relatively resilient earnings from auto and consumer firms have been positive factors, while IT, pharma and cement stocks witnessed cuts.

The number of earnings downgrades are fewer than in the quarter-ended December.

Pass-through of input cost pressures will continue into the June quarter.

Commodity prices saw significant volatility during the quarter.

Price hike has happened across consumer staples, durables, autos, houses, paints and QSR with firms highlighting need for further price hikes.

Rural demand remains a worry, but outlook is improving an better agricultural produce prices and normal monsoon forecast.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.