Amid oil supply, rate and currency concerns, India's stocks appear to be “relatively calm”. Morgan Stanley analyses why.

India's "strong policy environment" and domestic institutions more than making up for the exodus by foreign portfolio investors are among the key factors for this "insulation" so far, according the financial services provider.

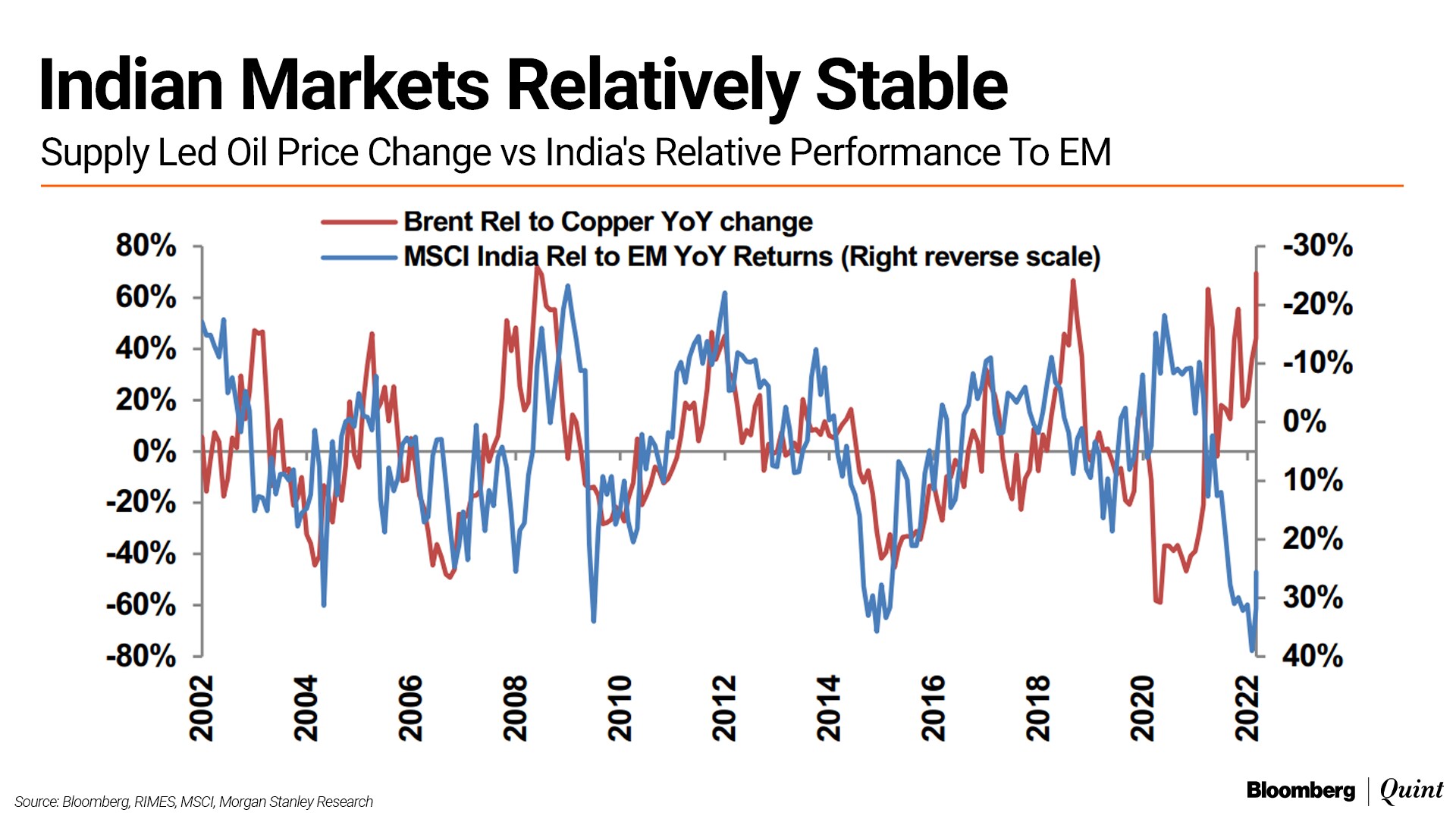

Supply-constrained oil price rises are bad for India as the current account deficit widens and inflation spikes, Morgan Stanley said in a March 4 note authored by equity strategists Ridham Desai and Nayant Parekh, and equity analyst Sheela Rathi. “Historically, India's relative stock prices to emerging markets have reacted poorly to oil price increases caused by supply outages.”

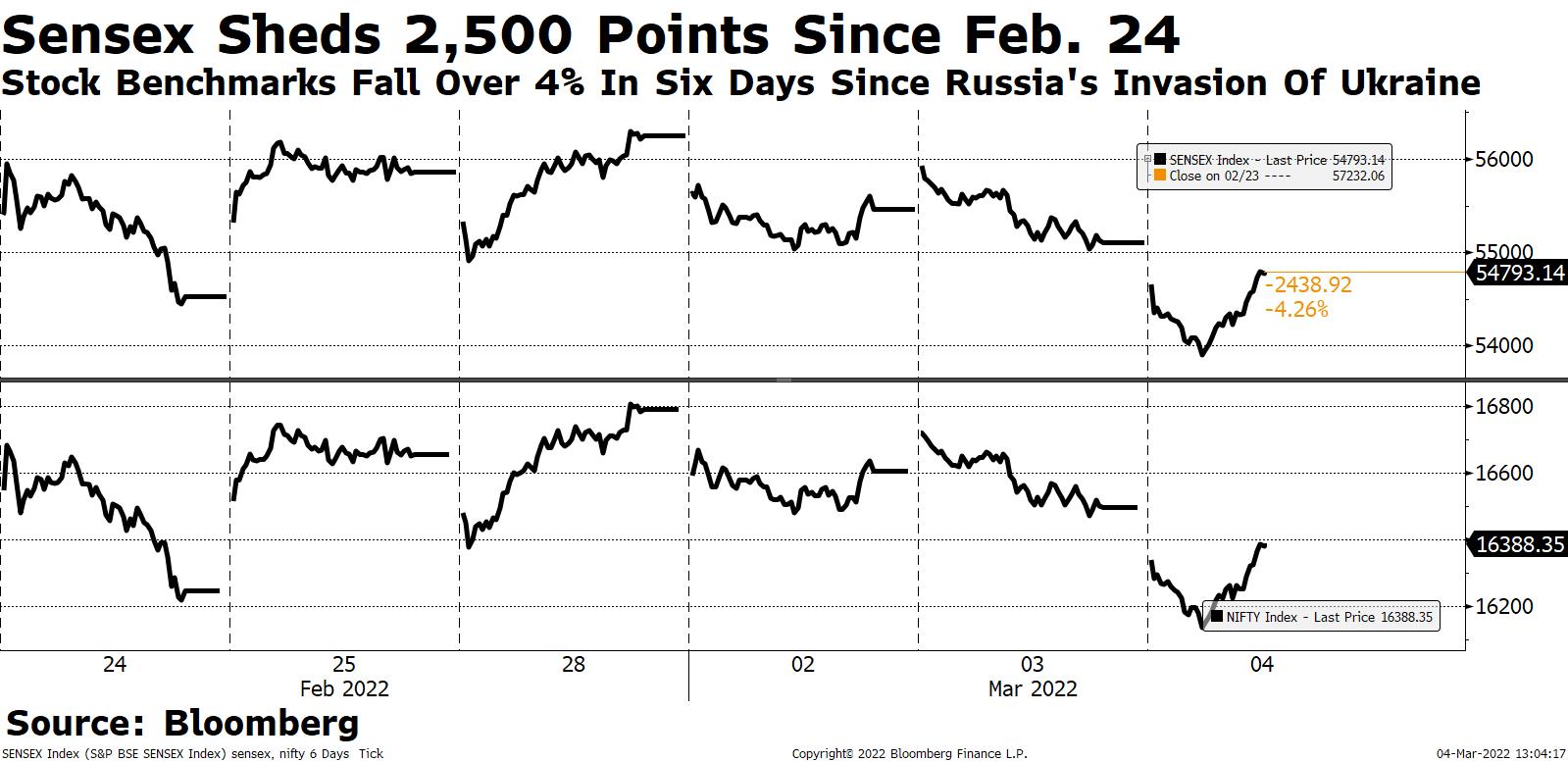

India's stock benchmarks have dropped 11% from their record over the past four months. Russia's invasion of Ukraine that caused crude and commodity prices to surge, too, contributed to the decline.

Still, according to Morgan Stanley, India has fared better during the supply-led oil price rise than in the past.

Morgan Stanley measured India's relative stock prices to other emerging markets using oil price relative to copper and New York Fed's oil price dynamics report. “The tight association between these indicators and India's relative performance to EM appears to be breaking down in recent years.”

Morgan Stanley cited the reasons in detail:

Policy certainty: India's policy environment is among the strongest in the world driving the nation's idiosyncratic growth story and, more importantly, likely creating a new profit cycle. The rise in oil price is a threat but not strong enough in the context of the policy environment.

Declining oil intensity in GDP: Oil consumption as a share of GDP has fallen from nearly 1.8% to just over 0.6% in 2020. That's at all-time lows and is steadily declining, especially since 2014.

High relative real policy rate: India's relative real policy rate to the U.S. is at all time high. Monetary policy looks much better placed to handle the inflationary impact from an oil price rise, especially compared to history.

Rising share of FDI to FPI: India used to rely primarily on foreign portfolio flows to fund its current account deficit. FPI flows tend to react more aggressively to the effect of oil prices on shares. But since 2014, external funding has shifted dramatically to FDI, which is more stable and less sensitive to oil price fluctuations.

Domestic bid: The rising domestic bid on stocks since 2014 also means that FPI selling is now offset, unlike the past.

Calm in rupee and rates: The above factors probably explain why the rate and currency markets have been relatively stable compared to previous oil shocks. Thus, stocks have also reacted less violently.

Morgan Stanley, however, isn't sure if this relative insulation of stocks from oil prices is structural or just the market's assumption of a quick reversal.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.