Shares of Macrotech Developers Ltd. gained after the real estate company reported its best-ever quarterly pre-sales, and a fall in debt.

The developer's pre-sales stood at Rs 3,456 crore in India in the quarter ended March, up 37% over the year earlier, according to its business update released on the bourses after market hours on Wednesday. That, it said, was despite a strong base of previous year—sales in Q4 FY21 were supported by the stamp duty waiver in Maharashtra.

U.K. pre-sales in the quarter were at £173 million or Rs 1,700 crore.

Q4 collections stood at Rs 2,843 crore, up 36% over the year ago.

Net debt for India business fell to Rs 9,310 crore in Q4 FY22 from Rs 16,075 crore a year ago and Rs 9,896 crore in the preceding three months.

For FY22, the company reported pre-sales in India of Rs 9,024 crore, its best annual sales ever, up 51% over the year earlier. “Thus, we have met our guidance of Rs 9,000 crore in spite of the external challenges faced during the financial year, including the Delta and Omicron Covid waves leading to lockdowns of about three months,” the filing said. “In FY22, our U.K. investments had pre-sales of £531 million (Rs 5,300 crore).”

Analysts at ICICI Securities and Jefferies see the incremental sales in U.K. projects as a positive for the company, and expect debt to fall further.

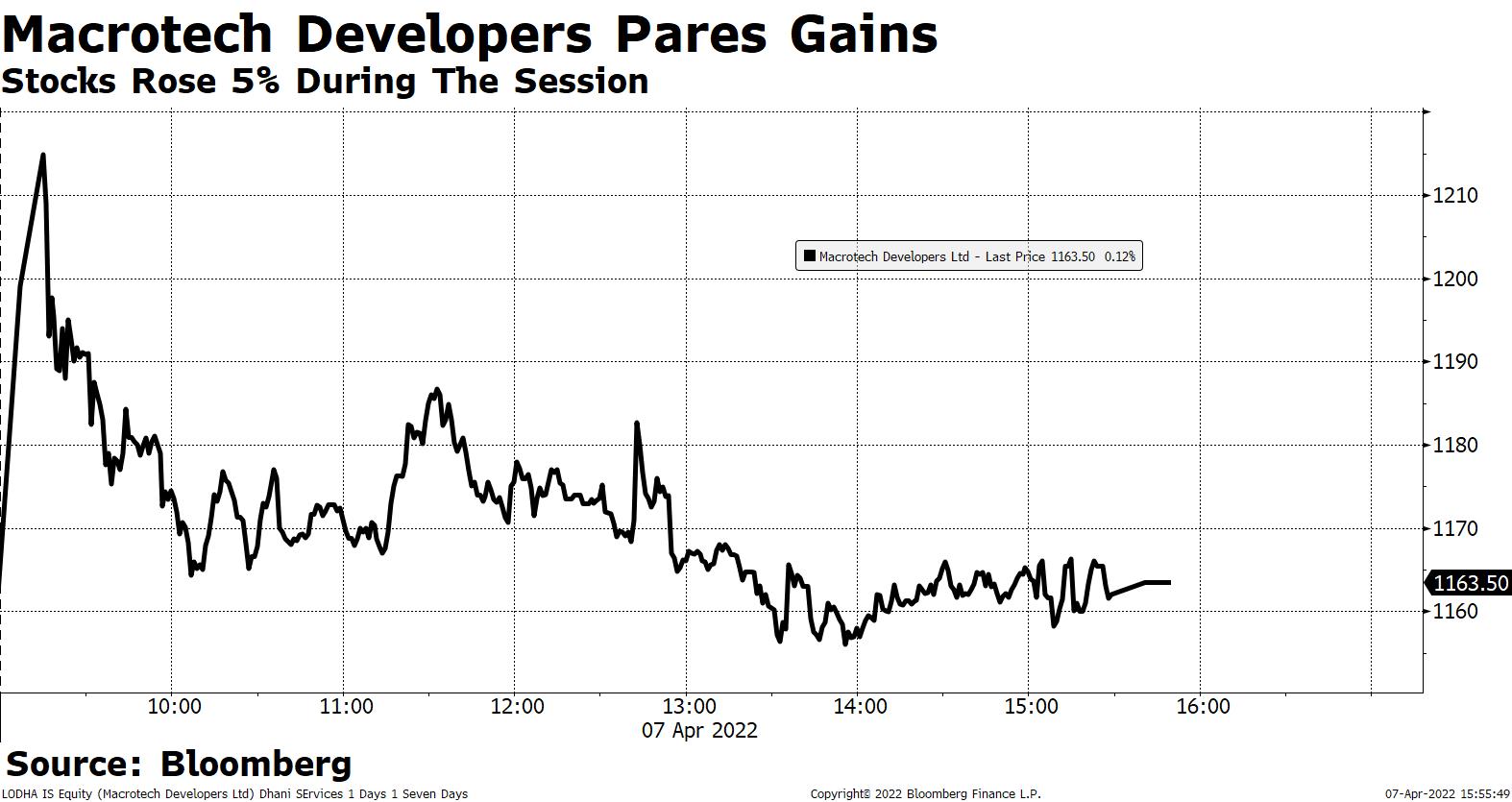

Shares of Macrotech rose more than 5%, the most this week, to Rs 1,221.9 apiece in early trade before paring the gains on Thursday.

Of the 15 analysts tracking the company, 11 maintain a ‘buy' and two each suggest a ‘hold' and a ‘sell', according to Bloomberg data. The 12-month consensus price targets implies an upside of 16.3%. The stock's trading volume is nearly five times the 30-day average at this time of the day.

Here's what analysts have to say about Macrotech Developers...

ICICI Securities

Upgrades to ‘buy' from ‘hold' with target price at Rs 1,348, an implied return of 12.43%.

Q4 launches were largely limited to extended eastern suburbs of Mumbai.

Record sales booking in Q4 and FY22 have been largely sustenance-driven.

Estimates sales bookings of Rs 11,010 crore in FY23 and Rs 11,900 crore in FY24.

Achievement of Rs 1,700 crore (£173 million) of sales in its London projects in Q4 is a major positive.

The debt reduction is driven by improved collections.

Expects further debt reduction over FY23-24E.

Jefferies

Reiterates ‘buy' with a target price at Rs 1,475, an implied return of 26.93%.

Record surge in pre-sales helps the firm meet its target of Rs 9,000 crore for the year.

Strong housing demand and new project acquisitions are likely to help drive double-digit sales growth.

Q4 performance is indicative of its own strong project pipeline.

Significant upgrades to FY23 sales are possible.

The company's U.K. projects witnessed incremental sales of Rs 1,700 crore during Q4.

Deleveraging continues with the net debt falling by Rs 590 crore sequentially to Rs 9,310 crore.

Expects a further decline in net debt in FY23, while the company continues on its project addition path.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.