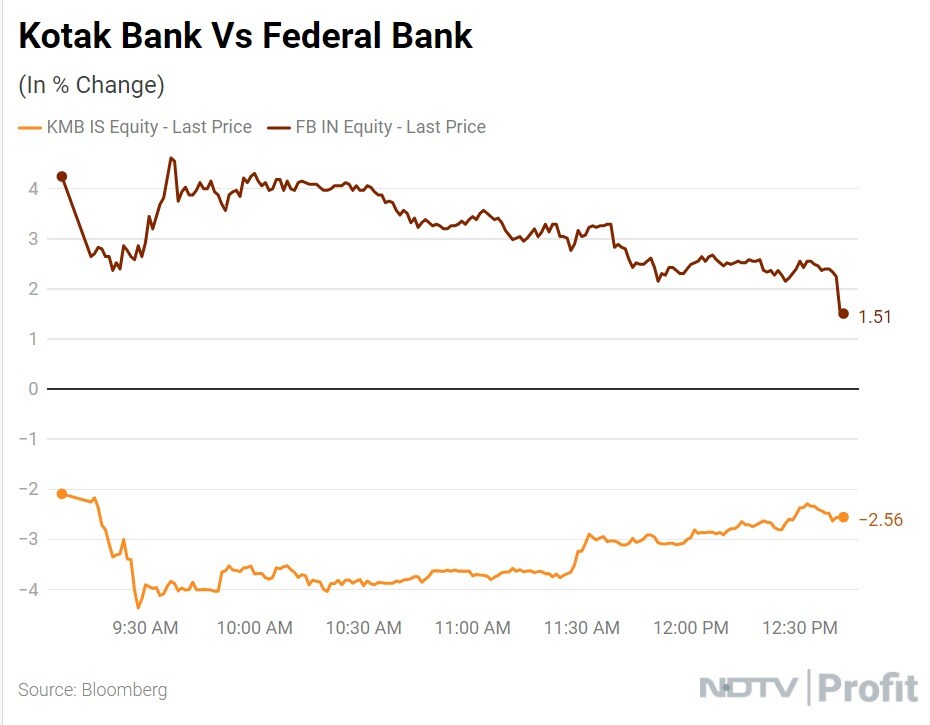

Kotak Mahindra Bank Ltd. shares cracked 2.6% on the exchanges at 12:30 p.m. on Thursday, as KVS Manian resigned from his role as joint managing director on Tuesday. Manian, who also served as a whole-time director on the bank's board, was relieved of his duties immediately, according to the resignation letter disclosed on the exchanges.

"I hereby tender my resignation from the services of Kotak Mahindra Bank for pursuing other opportunities in financial services, that I am exploring. Consequently, I would also step down from the Board of the bank," he said in the letter.

NDTV Profit had previously reported that Manian was being tapped for the managing director and chief executive officer role at Federal Bank. Though he is yet to accept the offer. Following the resignation, Federal Bank stock has seen an up-move on the bourses. On Thursday at 12:30 p.m., Federal Bank shares were up 1.5%.

Manian's exit from Kotak Mahindra Bank came as a surprise to most, as the bank had elevated him to joint managing director status only in February. He was previously a top contender for the managing director and chief executive officer roles at Kotak Mahindra Bank, after Founder and Chief Executive Officer Uday Kotak stepped down in September 2023.

Citi Research has maintained a 'neutral' rating on Kotak Mahindra Bank because it is concerned that management attrition will resurface among investors.

Nuvama downgraded the stock to 'reduce', saying that losing long-standing management and people from key managerial positions last year made the bank's growth outlook unpredictable.

Federal Bank shares rose further, after the lender announced its fourth quarter results, where net profit remained flat at Rs 906 crore and net interest income rose 15% year-on-year to Rs 2,195 crore. Profit growth was limited owing to a 40% rise in operating expenses.

Shyam Srinivasan, the current managing director and chief executive of Federal Bank, will need to step down in September 2024, after 14 years at the helm. While Srinivasan had sought an extension after the current term ends, Reserve Bank of India did not give him one.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.